Mooners and Shakers: Bitcoin unsteady amid murky conditions; IMX surges

Getty Images

It’s so far been an unsettling and difficult-to-read opening to the week in the financial markets. But at least Bitcoin seems to have largely arrested its latest slide. Hang on, it’s dipping again…

Bitcoin updates tend to age like milk, so it might well be mooning by the time you read this. Or not.

At the time of writing, gold has slowed its recent pump, US stocks are down (S&P 500 is negative 2% over the past 24 hours), and the surging price of oil has reversed some of its recent gains, too.

The latter development is reportedly due to newly stated opposition from Germany to the US push for banning Russian oil imports.

Well, equities are down, Gold is also a little, Bitcoin is up a little, while Oil is dropping.

Good luck analyzing that.

— Michaël van de Poppe (@CryptoMichNL) March 7, 2022

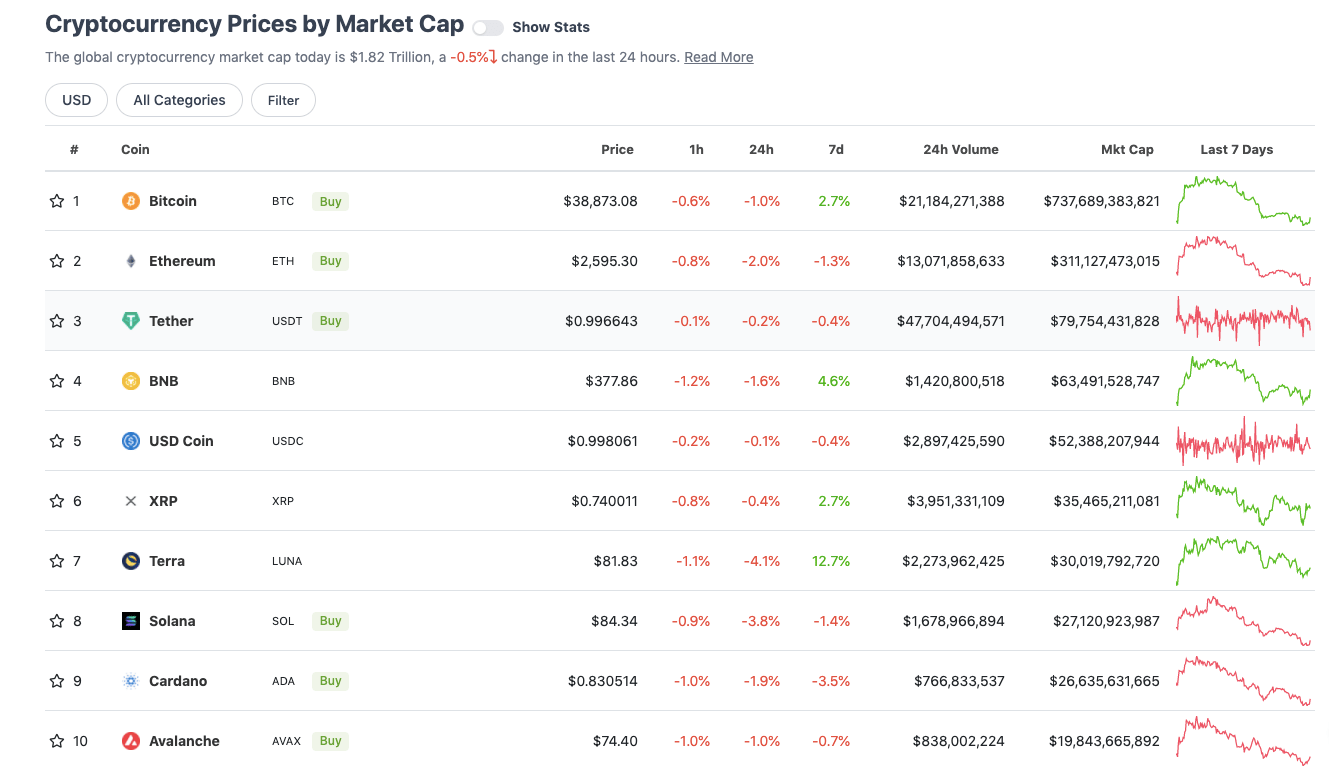

Top 10 overview

With the overall crypto market cap at about US$1.82 trillion, down 0.6% from this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Proving just how volatile and unpredictable this market is right now, Bitcoin (BTC) has lost about US$600 in value since the first key was struck typing this article. About 15 minutes ago the asset was changing hands for US$39,400, but has now dropped back to the high US$38ks.

Checking in with technical analysis almost seems futile at the moment, given the substantial macro/geopolitical influence on all markets for the forseeable. Nevertheless, here’s a grab from the trader and analyst Rekt Capital, who’s spied a potentially bullish chart pattern. Hey, it’s something…

Very early-stage #BTC Ascending Triangle forming?

Time will tell$BTC #Crypto #Bitcoin pic.twitter.com/oWy70p85B6

— Rekt Capital (@rektcapital) February 25, 2022

Keeping an open mind about crypto, but given the inflating US dollar and the stark reminder that governments can and will under certain circumstances freeze accounts and block payments, wouldn’t you think crypto would be having a moment now? Not seeing it in the price, so far….

— Lloyd Blankfein (@lloydblankfein) March 7, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$18.4 billion to about US$813 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Waves (WAVES), (market cap: US$2.15 billion) +17%

• Arweave (AR), (mc: US$1.52b) +5%

• Celo (CELO), (mc: US$1.18b) +4.5%

• Flow (FLOW), (mc: US$1.93b) +2%

• Leo Token (LEO), (mc: US$5.1b) +2%

Founded in 2016 by Ukrainian Sasha Ivanov, Waves is a permissionless platform for easily creating tokens. You can read a bit about why it’s trending up right now here.

DAILY SLUMPERS

• Convex Finance (CVX), (market cap: US$861 million) -9%

• Kadena (KDA), (mc: US$1.1m) -8%

• THORChain (RUNE), (mc: US$1.36b) -8%

• Frax Share (FXS), (mc: US$1.14b) -7%

• Chiliz (CHZ), (mc: US$1.1b) -7%

Uppers and downers: lower caps

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• veDAO (WEVE), (market cap: US$236m) +85%

• Troy (TROY), (mc: US$18m) +68%

• MovieBloc (MBL), (mc: US$36m) +66%

• ZKSpace (ZKS), (mc: US$27m) +26%

• Immutable X (IMX), (mc: US$353m) +26%

IMX is surging today on the back of US$200 million of fresh funding for the Sydney-based NFT startup Immutable, which is the developer of hot blockchain gaming projects Gods Unchained and Guild of Guardians. You can read further on Stockhead here for more details on the raise.

DAILY SLUMPERS

• BarnBridge (BOND), (market cap: US$46.5 million) -24%

• Redacted Cartel (BTRFLY), (mc: US$60m) -21%

• Orion Protocol (ORN), (mc: US$115m) -19%

• Pegaxy Stone (PGX), (mc: US$10m) -17%

• Mirror Protocol (MIR), (mc: US$223m) -15%

Final words

If you don't fear inflation, regulation, war, famine, complexity, competition, corruption, coercion, confiscation, or chaos, then you don't need #bitcoin.

— Michael Saylor⚡️ (@saylor) March 7, 2022

https://twitter.com/NorthmanTrader/status/1500887549388242953

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.