Mooners and Shakers: Bitcoin touches $38k as crypto market takes brief hopium hit

Photo: Getty Images

“Rebellions are built on hope.” Jyn Erso could’ve been talking about the sentiment-driven crypto market, which grabbed the hopium pipe today as Bitcoin briefly pulled above US$38k.

With all of crypto’s fate seemingly in Wall Street’s (and Vladimir Putin’s) hands lately, the general expectation was a volatile opening to stonks trading in New York after a US public holiday yesterday.

Things began quite tamely, but at the time of writing it looks like that particular rickety ride is on its gut-churning way once again.

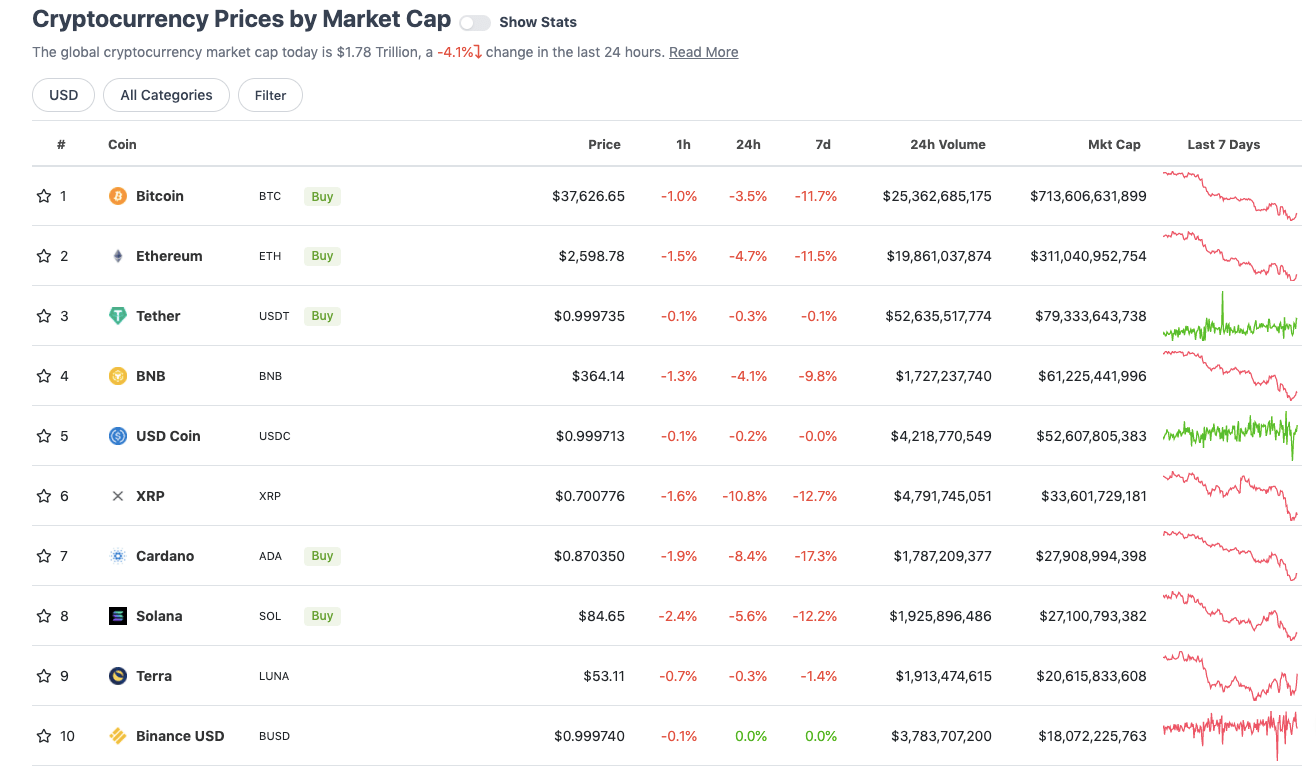

Top 10 overview

With the overall crypto market cap sitting at about US$1.78 trillion and down about 4% over the past 24 hours, here’s the state of play in the top 10 tokens right now – according to CoinGecko.

Things to note here… With a -7% plunge in the past 24 hours, Layer 1 protocol Avalanche (AVAX) has dropped back off this list, leapfrogged by the Binance USD stablecoin.

But the two top-10 coins really taking a battering are XRP and Cardano (ADA), dropping 10.8% and 8.4% respectively.

Cardano, much like XRP, seems to have become one of those polarising love-or-hate blockchains. The reasons for this are varied, but one thing’s for sure, crypto is way too tribal for its own good sometimes.

https://twitter.com/Shaughnessy119/status/1496149704928858117

#Cardano is building. As it always has, and continues to do. pic.twitter.com/03TwdAnHuO

— Ed n' Stuff (@EdnStuff) February 22, 2022

Meanwhile, courtesy of pseudonymous full-time options trader “John Wick”, here’s an example of the more hopeful outlook we were talking about, but backed up with some technical analysis…

You can count on me to bring the hopium!

We have a possible double bottom, with possible confirmation coming from a Reversal bar (Turquoise)

See your Alpha Confirmation Suite for reversal confirmation.

Indicators by https://t.co/c5WtFtKTRV pic.twitter.com/6c3Tk3tonl

— Wick (@ZeroHedge_) February 22, 2022

Something to cling to perhaps, but the crucial word to note in that reversal scenario is “possible”.

Uppers and downers: 11–100

Sweeping a market-cap range of about US$17.9 billion to about US$865 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY… MEH…

• Hedera (HBAR), (market cap: US$4.3 billion) +1.4%

• Maker (MKR), (mc: US$1.6b) +1%

• Leo Token (MANA), (mc: US$5.4b) +0.5%

DAILY SLUMPERS

• Frax Share (FXS), (market cap: US$1.1 billion) -11%

• Harmony (ONE), (mc: US$1.58b) -10.5%

• ECOMI (OMI), (mc: US$2.6b) -10%

• Convex Finance (CVX), (mc: US$1.1b) -10%

• Stacks (STX), (mc: US$1.2b) -10%

Uppers and downers: lower cap

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• Lido DAO (LDO), (market cap: US$185.5m) +37%

• Guild of Guardians (GOG), (mc: US$17.2m) +13%

• Injective Protocol (INJ), (mc: US$143m) +10%

• PolySwarm (NCT), (mc: US$78m) +9.7%

• Anchor Protocol (ANC), (mc: US$674m) +8%

DAILY SLUMPERS

• Alpine F1 Team Fan Token (ALPINE), (market cap: US$58 million) -20%

• Epik Protocol (EPIK), (mc: US$22m) -19.5%

• Scream (SCREAM), (mc: US$13.5m) -19%

• Spookyswap (BOO), (mc: US$127.5m) -19%

• Gains Network (GNS), (mc: US$47m) -18%

Gains Network… with a name like that it’s possibly setting itself up for failure. That said, now that we’ve taken the time to make that flippant comment, let’s find out what it actually is…

It’s a new leverage-trading and stop-loss enabling suite of DeFi products based on the Polygon “layer 2” blockchain, which sits on top of Ethereum.

Leverage trading… this particular crypto degen is steering clear of that risky business for the moment. But hey, “you do you”…

🎉 v6 is up on the #Polygon mainnet! 🚀

– Guaranteed stop losses (cryptos)

– 35% less gas fees

– Optimized limit/stop orders

– Higher max collateral (75k DAI)

– Lower min collateral (10 DAI)

– …🔎 Full changelog: https://t.co/SbaQEvgciJ

📊 Trade: https://t.co/xhVOvb4uzI

— gTrade | Gains Network 🍏 (@GainsNetwork_io) February 16, 2022

Final words

Barry Silbert, CEO of Digital Currency Group and Grayscale Bitcoin Trust, is calling for market-saving intervention from an odd source. Not sure Matt Damon making another widely ridiculed Crypto.com ad is going to help matters much…

https://twitter.com/BarrySilbert/status/1495947102018547713

But here’s a more useful tweet, probably – serving as another zoom-out reminder…

If you’re selling #Bitcoin here because of fears of war and civil unrest, you have absolutely no idea what you own and why it is so vitally important for the world at this very moment.

— James Lavish (@jameslavish) February 21, 2022

And here’s a word of caution, too, for anyone tempted to hit that sweet hopium a bit too hard on the back of the slightest of pumps…

#Alts can get much worse, resist the temptation!

— Benjamin Cowen (@intocryptoverse) February 22, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.