Mooners and Shakers: Bitcoin stuck in the mud near $28k; Frothy meme coin PEPE still in the green

Getty Images

You’ve almost made it to the weekend – when hopefully you’re relaxing and not checking your portfolio of highly speculative risk assets quite as much. But how are Bitcoin and Ethereum and pals tracking? Bit iffy at the moment – you’re playing the long game, right?

Bull goose crypto BTC is, at the time of writing, struggling to hold onto support levels. In fact, it’s lost a couple more since we last checked in here, but seems to be holding on around about US$28.2k for the moment.

Various Twittering chart watchers have their various views, but the OG orange digital asset will need to show some strength tout suite if it’s to avoid the told-you-so bears taking hold of the short-term narrative.

US forex/crypto trader/analyst Justin Bennett is one of those.

What happened to everyone from last week telling me I was an idiot for being bearish at resistance?

The comments have gone quiet without them.

Kinda miss their blind optimism and general disregard for all things technical.

— Justin Bennett (@JustinBennettFX) April 20, 2023

Bennett is foreseeing some pretty heavy retracement in the crypto market if Bitcoin and the total crypto market cap can’t reclaim levels above at least US$28,400 quick smart and notes: “It isn’t looking good for stocks and crypto, barring a significant recovery from SPX today.”

— Justin Bennett (@JustinBennettFX) April 20, 2023

Let’s look for a counter point of view…

Here’s another US chart soothsayer, Roman Trading, who’s not been backwards in coming forwards about Bitcoin going, er, backwards in the past. He’s been looking at the “Bitcoin dominance” chart this week, though, and is spotting a “head and shoulders pattern”, which, if it continues to play out, signals movement of funds into altcoins.

This, he notes, is generally “bullish for the entire space”. Roman is also keeping an eye on the US Dollar Index, the DXY, which, on the whole has been trending lower for the past month – an also not-terrible situation for risk assets IF that continues.

$BTC 1D

Price looking to close under support. Normally id say I’m looking for short opportunities, however, I discussed that a pullback is likely in the crypto space. How far? I’m unsure.

The $DXY is continuing lower & I’m still seeing $BTC.D acting bearish.

Still looking for… pic.twitter.com/CpvjtGBqj8

— Roman (@Roman_Trading) April 20, 2023

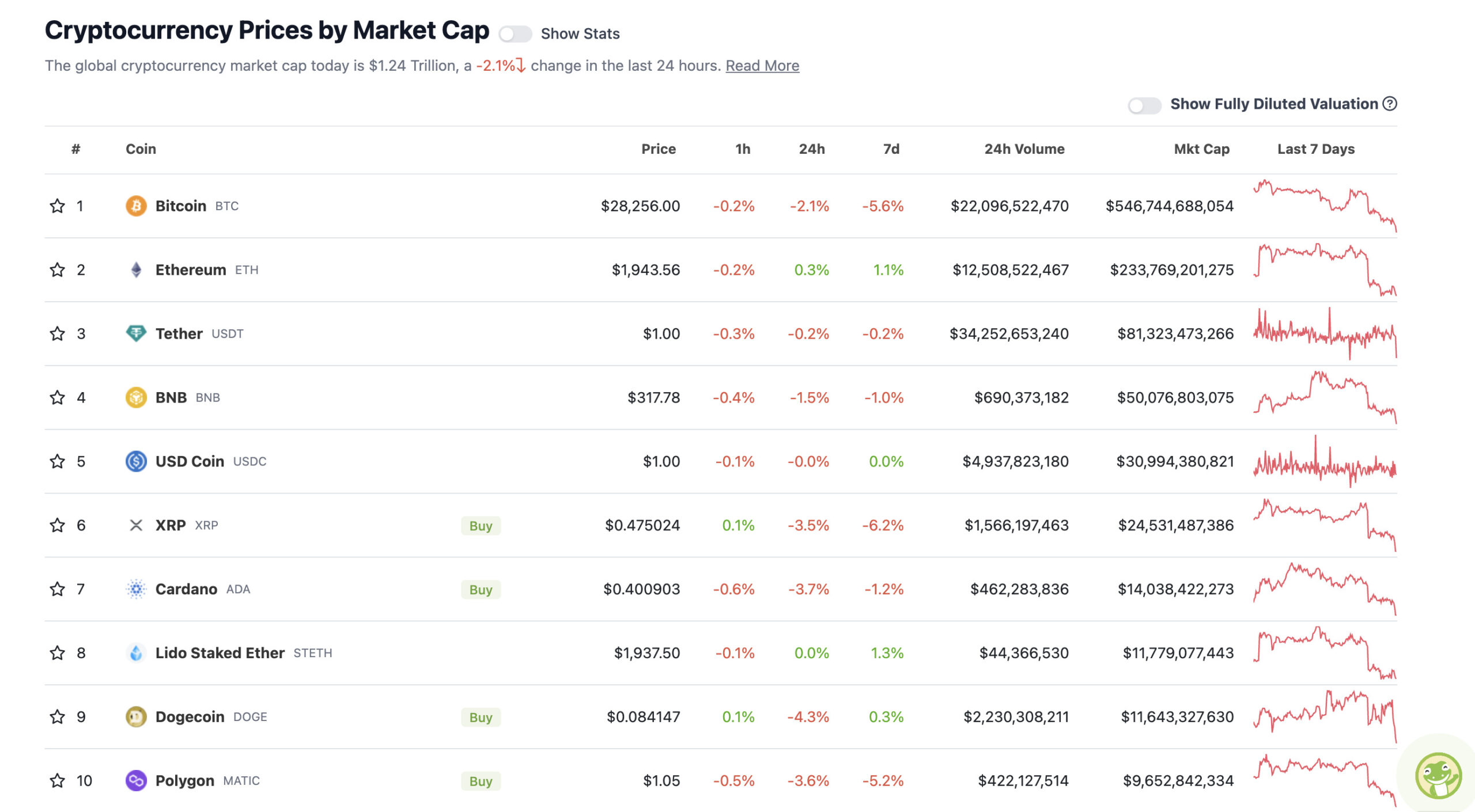

Top 10 overview

With the overall crypto market cap at US$1.24 trillion, down 2.1% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Well, that’s all a little bleak today. Let’s swiftly move on…

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Kaspa (KAS), (market cap: US$472 million) +9%

• Conflux (CFX), (market cap: US$689 million) +2%

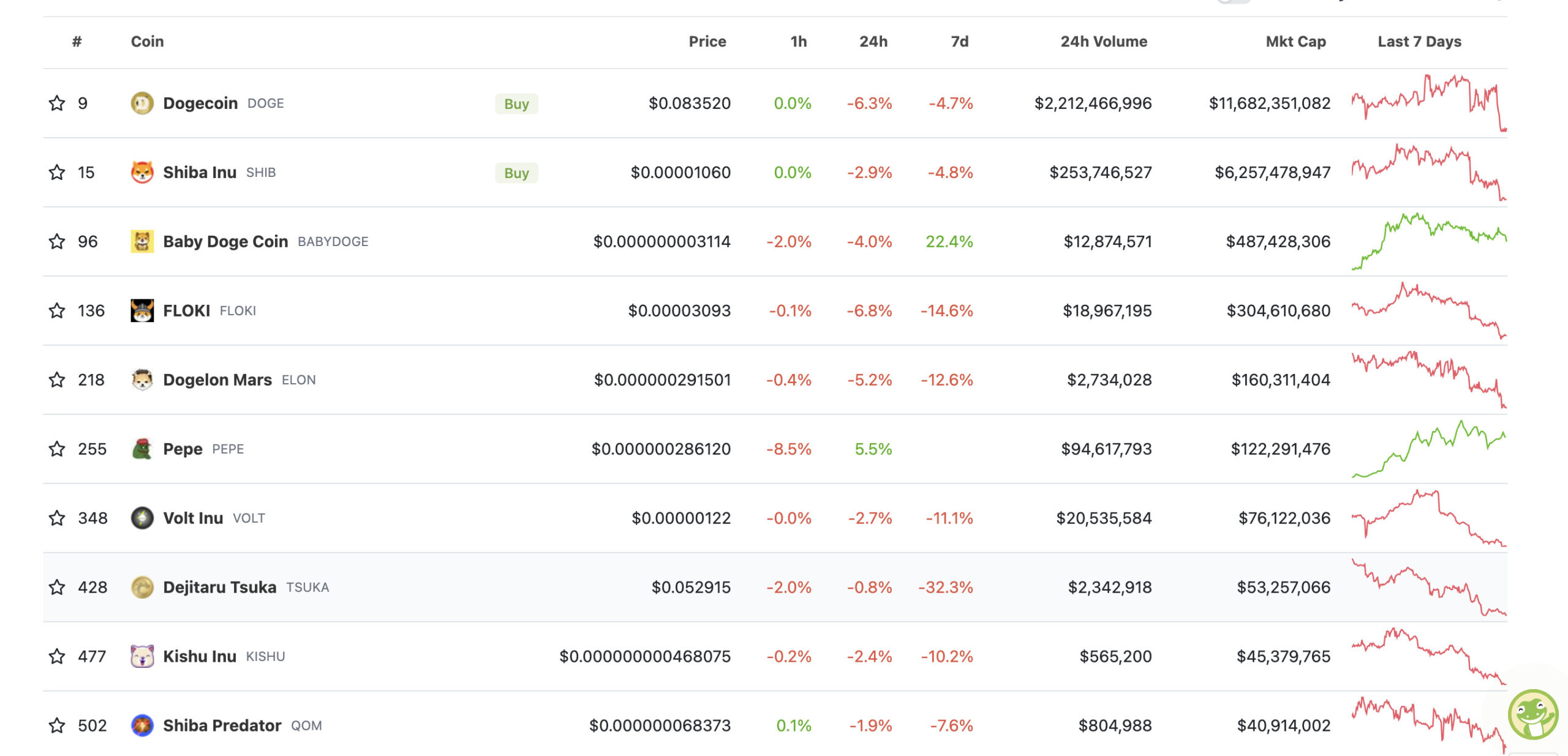

PUMPERS (lower caps)

• Polymath (POLY), (market cap: US$220 million) +33%

• Pepe (PEPE), (market cap: US$123 million) +5%

PEPE is a frothy-as-hell meme coin named after Pepe the Frog, the famous/infamous meme, and cartoon character created by Matt Furie.

It has nothing to do with the original meme’s creator, however, and entered the market less than a week ago by persons unknown, undoxxed. It’s certainly been in the crypto spotlight this week, fuelled by social media hype, quickly propelling it to the status of sixth-largest meme coin by market cap (see below).

And anyone whose ever done stupendously well, okay, or stupendously badly from tokens such as Dogecoin, Shiba Inu and Floki and the like, will know how these things can go.

You usually need to be lucky enough to get in super-duper early on these sorts of “projects” to make any kind of decent profit, and then likely get the hell out at the right time, too. Not always, mind.

Pepe self describes as the “the most memeable memecoin in existence”.

https://twitter.com/Pauly0x/status/1649198124949225472

Extreme buyer beware – be extra cautious when tooling around in this end of the crypto casino, there are a lot of scammers trying to take advantage. And you may, or may not, be way too late on the Pepe “Frog Nation” ride. Several Johnnies on the spot have already, on paper at least, made millions of dollars from this thing. Whether the liquidity has been there for to them to actually cash out is another question, and something worth investigating.

Also, just a reminder, that if you’re looking to buy any crypto on a DEX (decentralised exchange, such as Uniswap), always make sure you’re using the official contract code of the official project. You generally can’t go wrong if you’re sourcing those directly from CoinGecko.com or CoinMarketcap.com.

SLUMPERS

• Radix (XRD), (market cap: US$982 million) -20%

• Zilliqa (ZIL), (mc: US$495 million) -9%

• Rocket Pool (RPL), (mc: US$911 million) -7%

• Casper (CSPR), (mc: US$546 million) -6%

• ImmutableX (IMX), (mc: US$935 million) -6%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

If the following is true (and it’s completely unconfirmed and may just be a silly rumour), then the disgraced, and recently arrested, Terra Luna founder Do Kwon may have found the perfect place to dump his sh*tcoins…

You are telling me Do Kwon got arrested

& they found a hardware wallet inside his body? pic.twitter.com/mQHocU9Spq

— Paulo (@TycoonPal) April 20, 2023

Spent the day in DC meeting with members of congress. We need regulatory clarity in the U.S. for the centralized players in crypto for many reasons – consumer protection, national security, economic growth, etc.

The SEC has caused untold harm to America with its policy of… pic.twitter.com/eV13Ny66db

— Brian Armstrong (@brian_armstrong) April 20, 2023

It’s a great question https://t.co/6vT53IXjBU

— Brian Armstrong (@brian_armstrong) April 20, 2023

life summarized in one 7 second clip pic.twitter.com/TzbnpkCxz8

— Shibetoshi Nakamoto (@BillyM2k) April 18, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.