Mooners and Shakers: Bitcoin struggles to hold $27k; Coinbase gets boost from US Chamber of Commerce

Getty Images

As Bitcoin and pals limp towards another weekend of open-all-hours unreliable trading, at least one of the world’s most influential crypto exchanges has some decent news.

The US Chamber of Commerce – a pretty big deal in the world of business – has essentially thrown its weight behind Coinbase in the exchange’s tussles with the United States Securities Commission (SEC).

According to a report from Blockworks among others, and this Twitter thread (below) from pro-web3 lawyer James A. Murphy, aka “MetaLawMan”, the US Chamber of Commerce has called out the SEC for acting “unlawfully” with regards to the digital assets space.

2/ The U.S. Chamber is a highly influential organization representing companies in all industries across the U.S.–not just crypto.

The brief opens with:

"As it stands today, nobody knows for certain which digital assets, if any, are 'securities' under federal law."

Exactly!

— MetaLawMan (@MetaLawMan) May 11, 2023

The Chamber has filed an amicus brief in support of the crypto exchange, which made the bold move to take the SEC to court in April. Coinbase is attempting to force the SEC to respond to its “petition for rulemaking” filed in July 2022. The petition seeks greater clarity from the SEC with regards to regulation for the crypto industry in the US.

The SEC, in case you haven’t been following has been cracking down on various sectors of the crypto industry, adopting a punitive approach on what the industry believes to be an unfair, unclear regulatory playing field.

As MetaLawMan notes, the Chamber has three main arguments against the SEC’s approach…

4/ The Chamber declares:

"The SEC's actions are not just harmful policy; they are unlawful…" pic.twitter.com/Fgxc5ak0Vp

— MetaLawMan (@MetaLawMan) May 11, 2023

And, just quickly, before we eyeball some of the latest price action in the crypto charts, Coinbase has also been in the news regarding the attention-grabbing memecoin PEPE.

As we noted briefly yesterday, Coinbase drew some heat from prominent holders of the memecoin when it came to light that the exchange had described the Pepe image as an alt-right “hate symbol”.

The “Pepe community” responded strongly, sending the hashtag #deletecoinbase somewhat viral, calling out the exchange for its lack of knowledge on the full story arc.

In short, yes, Pepe the frog’s image was adopted by alt-right groups a few years ago, but has since been, for the most part, successfully “reclaimed” as a laidback cartoon character by the original creator Matt Furie. The crypto space has also “reclaimed” the image as a meme, which it’s been using avidly for a few years now.

Think you should list $PEPE on Coinbase as an apology

— Caff (@ChadCaff) May 11, 2023

This hasn’t, however, arrested the PEPE coin’s quite dramatic slide over the past few days. In fact, it’s currently down another 26% over the past 24 hours (see further below).

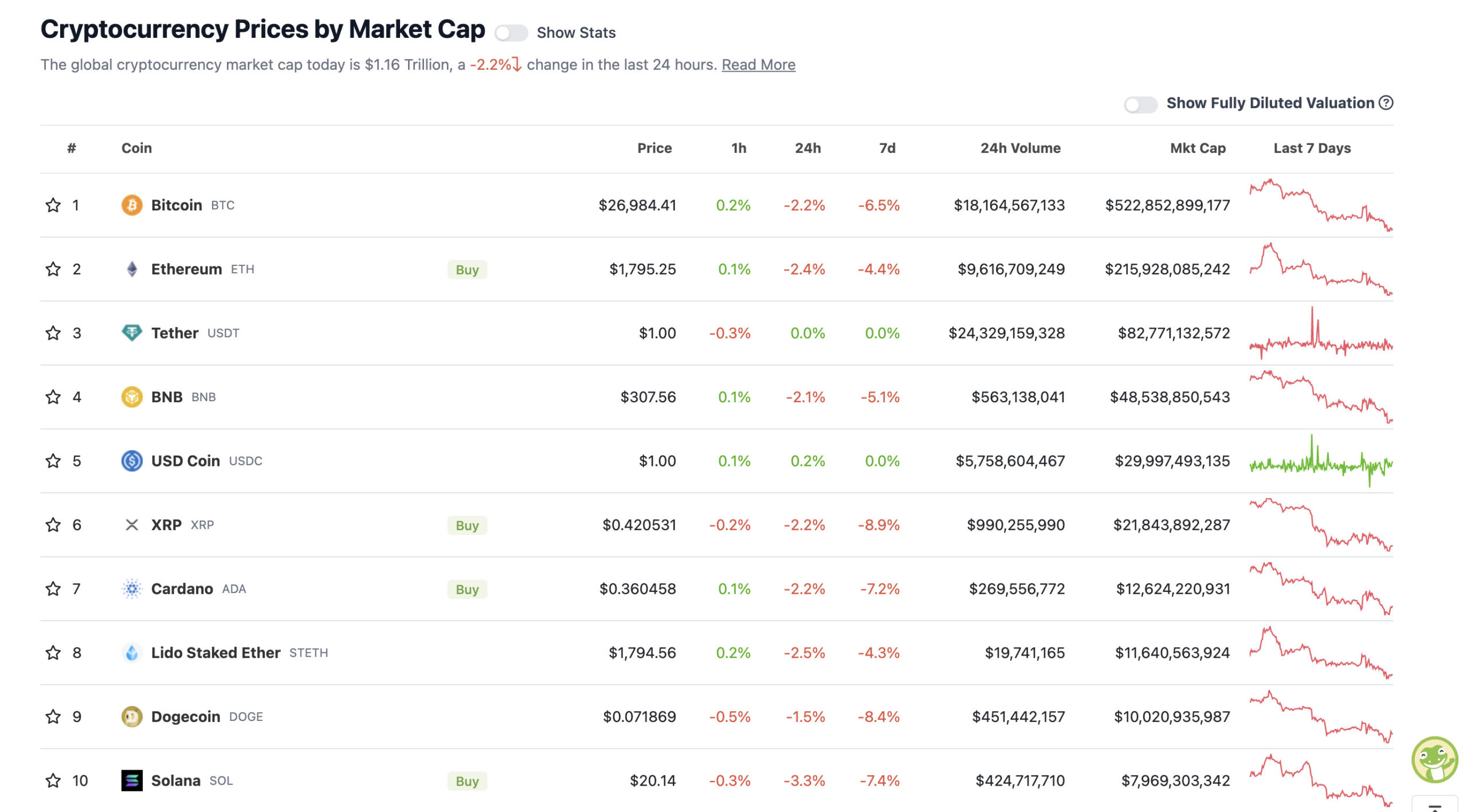

Top 10 overview

With the overall crypto market cap at US$1.16 trillion, down about 2.2% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

A couple of round-number levels of support lost there from the two leading cryptos, with Bitcoin (BTC) falling below US$27k just now, and Ethereum (ETH), losing US$1,800.

Still, as the blockchain and crypto analytics firm Santiment has been noting, there is a metric for both coins that’s trending in a direction that could be deemed positive.

And that’s the fact that exchanges are seeing levels of both BTC and ETH dip dramatically over the past few months.

In fact, ETH is at an “all-time high for non-exchange holdings”. This is a good thing, why? Because it suggests there are fewer looking to sell their BTC and ETH and more looking to HODL and keep in cold storage as longer-term investments.

👛 As #Ethereum has dipped to $1,780 today, we've seen exchange supply continue to decrease. The percentage of $ETH on exchanges is at its lowest (10.1%) since public trading began in 2015. This is essentially the #AllTimeHigh for non-exchange holdings. https://t.co/WVmeAJhhMM pic.twitter.com/eMXoRh9R76

— Santiment (@santimentfeed) May 11, 2023

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Bitget Token (BGB), (market cap: US$683 million) +4%

• Cosmos Hub (ATOM), (market cap: US$3.2 billion) +2%

• Litecoin (LTC), (market cap: US$5.9 billion) +1%

• Injective (INJ), (market cap: US$527 million) +5%

• Conflux (CFX), (market cap: US$568 million) +4%

PUMPERS (lower, lower caps)

• Milady Meme Coin (LADYS), (market cap: US$75 million) +144%

• Optimus AI (OPTI), (market cap: US$19 million) +39%

• Serum (SRM), (market cap: US$30 million) +13%

SLUMPERS

• Pepe (PEPE), (market cap: US$584 million) -26%

• Lido DAO (LDO), (mc: US$1.44 billion) -11%

• Injective (INJ), (mc: US$461 million) -10%

• Frax Share (FXS), (mc: US$430 million) -9%

• Optimism (OP), (mc: US$488 million) -8%

SLUMPERS (lower, lower caps)

• FourCoin (FOUR), (market cap: US$14 million) -44%

• ORDI (ORDI), (market cap: US$255 million) -34%

• Turbo (TURBO), (market cap: US$49 million) -30%

• Ben (BEN), (market cap: US$40 million) -27%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

When will the Fed start cutting rates? Based on historical precedent of time between last rate hike & first rate cut… probably within a year

Which means the #Bitcoin halving (and subsequent bull market) will be during a QE environment 🚀 pic.twitter.com/raabmEzgfo

— Jesse Myers (Croesus 🔴) (@Croesus_BTC) May 11, 2023

Sickening to see the amount of predatory behaviour from “influencers” this week.

If you’re a creator, and you pump and dump meme coins (or any project for that matter) undisclosed, you should be jailed. Simple.

Your job is to educate, not defraud your audience.

— Miles Deutscher (@milesdeutscher) May 11, 2023

The new CEO: pic.twitter.com/aq3DxWlY0V

— Inverse Cramer (@CramerTracker) May 11, 2023

BREAKING‼️ 🇺🇸 Texas lawmakers voted in favour of including use of digital currencies like #Bitcoin on the Bill of Rights! 🔥 pic.twitter.com/rUX8cWHJEe

— Bitcoin Archive (@BTC_Archive) May 11, 2023

The author of this piece holds various cryptos including BTC, ETH as longer-term investments and even a small amount of PEPE – the latter being a highly speculative “degen” play, which he probably should’ve sold by now.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.