Mooners and Shakers: Bitcoin stirs above $20k; Ethereum and Cardano lead crypto majors charge

Coinhead

Coinhead

As George Costanza said in that episode of Seinfeld, “It moved.” Bitcoin and the crypto market are up, but whether they’ve recovered sustained potency remains to be seen.

Four months of inactivity and sideways movement for Bitcoin. Did that just end? Is BTC “back, baby”? It’s back above US$20k at least. Meanwhile Ethereum (ETH) surged more than 12% overnight (AEDT) and the entire crypto market cap is poking its head above US$1 trillion again.

Best not count chickens before they hatch – the woeful global macro climate still shows grey skies, but we’ll enjoy taking in a patch of green and euphoria (real or mock) on Crypto Twitter regardless.

https://twitter.com/cobie/status/1585026683161440256

It’s almost been a year of downtrending price action for #BTC

History suggests the Bear Market is close to ending$BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) October 25, 2022

THE BULL MARKET IS BACK

— LilMoonLambo (@LilMoonLambo) October 25, 2022

Okay, let’s bring it back down a notch or two. Here’s US trader Gareth Soloway reminding about potentially significant tech-stock earnings calls today, plus the strong likelihood of another 0.75 rate hike from the Fed next week.

Earnings releases from $GOOGL, $MSFT, $TXN + housing data today it is clear the economy is collapsing toward recession. Keep in mind, the last two 0.75 rate hikes have not filtered in, let alone the next one coming next week. Like 'transitory' the Fed will be way off again.

— Gareth Soloway (@GarethSoloway) October 25, 2022

And Roman Trading never likes a pump on low volume.

$BTC 1D

“Low volume breakouts often lead to fakeouts”.

I’ve said this numerous times on Twitter and within my trading class. We’ve seen these hundreds of times over the last year.

Don’t be liquidation bait.#bitcoin #cryptocurrency #cryptotrading #cryptonews pic.twitter.com/uaniNgWNZN

— Roman (@Roman_Trading) October 25, 2022

Still, the US Dollar has been showing weakness and potential signs of topping out, so as long as that’s in play, there’s a chance for some decent relief right here. Dutch chart guy Michaël van de Poppe thinks so.

#Bitcoin breaks to $20K. #Ethereum up 10% on the day.

Big move, as Yields have been falling down and $DXY showing weakness.

Tables are turning, it's definitely time for significant relief across markets for #crypto.

Staying long.

— Michaël van de Poppe (@CryptoMichNL) October 25, 2022

Onto some daily price action.

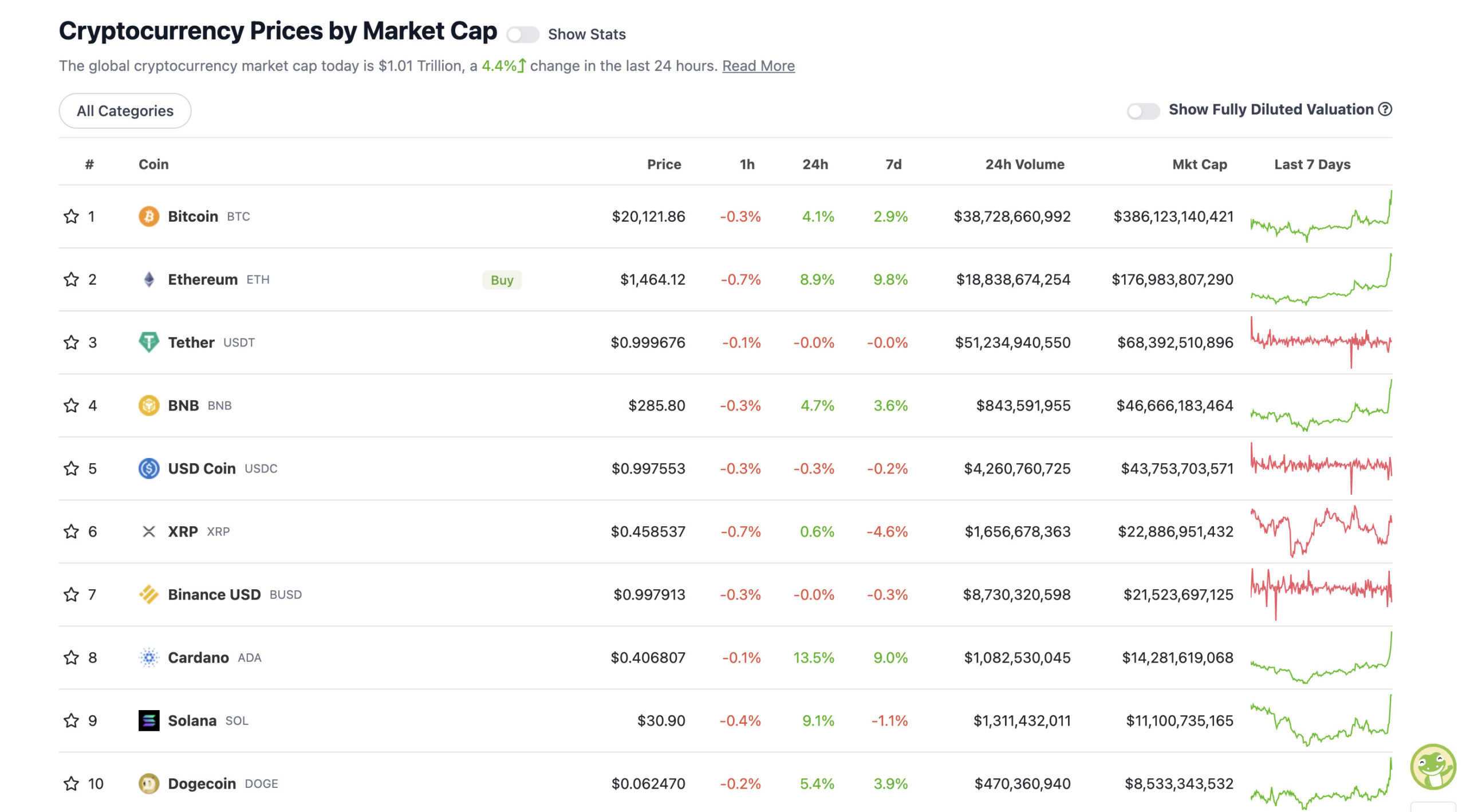

With the overall crypto market cap at US$1.01 trillion, up roughly 4.4% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

So yes, bull goose cryptocurrency Bitcoin (BTC) is up 4%, which is obviously significant, but it’s the layer 1 smart contract platforms in the top 10 and just outside that are stealing the gainz show.

Ethereum, Cardano and Solana in particular surged overnight. (Polkadot, too, at no. 11.)

Blockchain data analytics firm Santiment noted that Ethereum’s surge in particular correlated tightly with a bounce in the S&P 500.

It also wrote that the dollar value’s drop and “growth coming to an end (or at least a pause) would be a key component to the next breakout of cryptocurrency market caps”.

The firm also pointed to some particular ETH whale activity showing signs of life for the first time in six years:

🐳😲 An #Ethereum whale wallet that had not been active for 6+ years woke up today & moved $22.2M worth of $ETH to an empty wallet. $ETH's price is +8.1% since this transaction, briefly jumping over $1,500 for the 1st time since the #merge 6 weeks ago. https://t.co/bLwZZwhJSa pic.twitter.com/L78mAfJHq2

— Santiment (@santimentfeed) October 25, 2022

Sweeping a market-cap range of about US$7.5 billion to about US$412 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Token XChange (TKX), (market cap: US$1.49 billion) +17%

• Polkadot (DOT), (mc: US$7.5 billion) +8%

• Lido Staked Ether (STETH), (mc: US$6.57 billion) +8%

• Ethereum Classic (ETC), (mc: US$3.39 billion) +8%

• Evmos (EVMOS), (mc: US$780 million) +7%

DAILY SLUMPERS

• Klayton (KLAY), (market cap: US$583 million) -15%

• Aptos (APT), (mc: US$1.14 billion) -9%

• Aave (AAVE), (mc: US$1.16 billion) -3%

• Elrond (EGLD), (mc: US$1.34 billion) -2%

• Quant (QNT), (mc: US$2.55 billion) -1%

DAILY PUMPERS

• Hegic (HEGIC), (market cap: US$23.3 million) +195%

• Rari Governance (RGT), (mc: US$18 million) +30%

• Tokemak (TOKE), (mc: US$29 million) +20%

• Clearpool (CPOOL), (mc: US$29 million) +17%

• Gods Unchained (GODS), (mc: US$50 million) +15%

DAILY SLUMPERS

• Crypto Legions V3 (BLV3), (market cap: US$5 million) -25%

• Hop Protocol (HOP), (mc: US$5 million) -21%

• Nuls (NULS), (mc: US$26 million) -16%

• Morpheus Network (MNW), (mc: US$61 million) -16%

• Dogechain (DC), (mc: US$48 million) -6%

A selection of randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

So here’s something. A day into Rishi Sunak’s new job as the richest British PM in history and the UK government has voted to recognise Bitcoin and crypto as regulated financial instruments.

JUST IN: 🇬🇧 UK votes in favor of recognizing #Bitcoin and #crypto as regulated financial instruments.

— Watcher.Guru (@WatcherGuru) October 25, 2022

Per a CoinDesk report, the lower house of British Parliament voted in favour of adding crypto to the scope of activities to be regulated via the proposed Financial Services and Markets Bill.

That’s a bill that was partly drafted by Sunak and which already seeks to extend payments rules to stablecoins. Regularity clarity is often cited as a potential catalyst for the next bull run.

And, although some are sceptical about his CBDC motives, it’s well known that the new PM has shown positive intent towards making Britain an innovation-friendly “global hub for crypto asset technology“.

The UK’s new PM prefers Bored Apes to CryptoPunks and prefers a basket of different coins (dabbles in shitcoins?)

(Clip from leadership race a couple months ago) pic.twitter.com/3FwMgAPA0s

— db (@tier10k) October 24, 2022

One day you wake up and see #bitcoin at $21K, without any important news or event. The next week BTC $24K .. and $30K. Some will say it's a bull trap, others realize the bear market is over and the next bull market has started. pic.twitter.com/otJGOo4F1S

— PlanB (@100trillionUSD) October 25, 2022

NEW: Bank of America: Investors “may view #bitcoin as a relative safe haven” amid macro uncertainty.

— Bitcoin Magazine (@BitcoinMagazine) October 24, 2022

JUST IN: Twitter is reportedly developing its own wallet with support for #crypto deposits and withdrawals.

— Watcher.Guru (@WatcherGuru) October 24, 2022

We just had to change the name 🤦♂️ pic.twitter.com/Q2HsOv2rsp

— Alan Carroll (@alancarroII) October 24, 2022