Mooners and Shakers: Bitcoin simmers as analysts predict big move; SBF behind bars ahead of trial

Pic via Getty Images

Another week in crypto another seven days of sideways chop ahead? Maybe, although several crypto analysts are predicting something’s gotta give and a big move either way is imminent.

It certainly feels like the calm before some sorta storm, as it has done now for a good month or so. We’ve been here before, though, with pretty much those exact same words.

But let’s see who’s saying what in the world of crypto chart watching…

Popular analyst TechDev, for instance, has been looking at Bitcoin’s 20-period moving average on a three-week timeframe and is noticing “compression levels” that appear to be coiling up for a potential move upwards.

CrediBull Crypto chimed in with: “Historic compression leads to historic expansion.”

Historic compression leads to historic expansion…imagine looking at this chart and thinking "yea, 10k incoming".

A ticking time-bomb till bear extinction. $BTC https://t.co/xyAwqyC0X4

— CrediBULL Crypto (@CredibleCrypto) August 11, 2023

Meanwhile, Dutch trader/analyst Michaël van de Poppe notes that the “volatility on Bitcoin is getting lower and lower. A matter of 1-2 weeks before we’ll be having a big move on the markets.”

The volatility on #Bitcoin is getting lower and lower.

A matter of 1-2 weeks before we'll be having a big move on the markets.

— Michaël van de Poppe (@CryptoMichNL) August 13, 2023

Pseudonymous trader Inmortal, however, thinks Bitcoin could well dip to about US$26,000 by the end of August, which he feels could send a bit of panic into the market, before prices move higher.

“Look, in the next dip people will panic. But it will only be another macro higher low,” he noted.

Meanwhile, in other news

• Sam “SBF” Bankman-Fried, the clown-haired FTX founder and former CEO of the embattled FTX crypto exchange, is in jail after a judge revoked his bond.

This is ahead of his trial in October, in which he will face seven different charges related to the FTX implosion, including wire, commodities and securities fraud.

According to a CoinDesk report, the reason the former crypto mogul’s bond has been revoked is because he has allegedly tried to “tamper with witnesses”, which, er, doesn’t sound good on any level.

[Bankman-Fried is willing] “to risk crossing the line in an effort to get right up to [the line], wherever it is,” said Judge Lewis Kaplan, of the US District Court for the Southern District of New York, adding: “All things considered I’m going to revoke bail.”

The judge further clarified: “My conclusion is there is probable cause to believe the defendant has attempted to tamper with witnesses at least twice. … There is a rebuttable presumption that there is no set of conditions that will ensure Bankman-Fried will not be a danger.”

🚨BREAKING: FTX's Sam Bankman-Fried TO BE JAILED | Bail Revoked

SBF is being incarcerated for tampering with at least 2 witnesses.

He will be in jail prior to his October trial, facing a range of fraud and conspiracy charges.

He may have access to a laptop with an internet… pic.twitter.com/1sj8fMm8cO

— Mario Nawfal (@MarioNawfal) August 11, 2023

SBF will reportedly still have access to a laptop and internet connection during this bout of jail time. Presumably also a hot tub, champagne (or strawberry milk or whatever he drinks) and bowls of amphetamines mixed in with M&Ms (orange ones removed).

• SEC delay’s Ark Invest’s spot Bitcoin ETF filing. Look, this one wasn’t a shocker, but we’ll mention it anyway.

It happened late on Friday, US time, with the Cathie Wood-led Ark 21Shares Bitcoin ETF just the latest in a lengthening roadblock from the regulator, largely orchestrated by its chair, good ol’ Gary Gensler.

The SEC has kicked the can down the road on this one, noting in a filing that it is seeking public comment on one of the amendments in the application for the exchange-traded fund.

It’s a process that will probably now stretch into 2024 and that will likely be the case, too, for all other BTC spot ETF hopefuls – yep, even BlackRock’s. Although, we’ll see – some other decisions from the SEC are due in October.

First time you see a delayed Bitcoin ETF?

You're welcome, we will see more delays before approval.

It's a game. pic.twitter.com/zG0cjAdSyJ

— Inmortal (@inmortalcrypto) August 11, 2023

• Meanwhile, the crypto investment firm Grayscale is awaiting a court decision in its legal tussle with the SEC after the latter repeatedly rejected Grayscale’s proposal to convert the Grayscale Bitcoin Trust into an ETF.

• And John Reed Stark, the former SEC Office of Internet Enforcement chief, has (while being no fan of crypto) mooted a scenario in which the SEC could reverse its current stance on the digital assets industry.

That scenario is essentially a pro-crypto Republican president taking power next year. Although he also notes that an SEC regime change, with SEC Commissioner Hester Peirce taking the reins, would also bring the SEC-related crypto disruption “to a screeching halt”.

Will the SEC Approve Any Of The Recent Bitcoin Spot ETF Applications?

People often ask for my opinion on whether the SEC will approve any of the recent spate of bitcoin spot ETF applications, which is an interesting and important question.

My take is that the current SEC will… pic.twitter.com/lPXebl03Y4

— John Reed Stark (@JohnReedStark) August 13, 2023

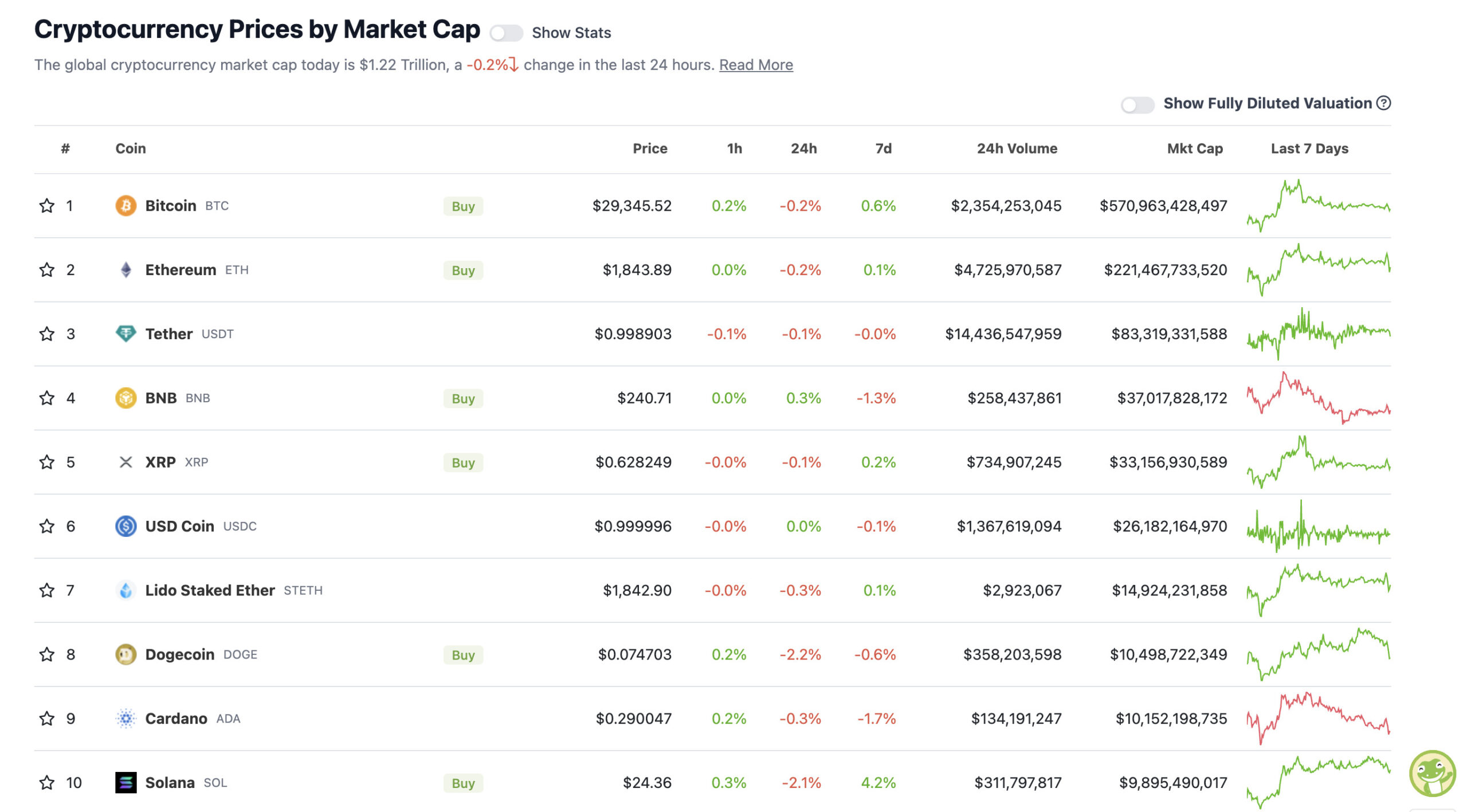

Top 10 overview

With the overall crypto market cap at US$1.22 trillion, down a fraction of a fraction since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Hedera (HBAR), (market cap: US$2.14 billion) +14%

• THORChain (RUNE), (market cap: US$423 million) +5%

• ApeCoin (APE), (market cap: US$768 million) +5%

• Maker (MKR), (market cap: US$1.14 billion) +3%

• The Graph (GRT), (market cap: US$987 million) +2%

SLUMPERS (11-100 market cap position)

• Rollbit Coin (RLB), (market cap: US$567 million) -9%

• Shiba Inu (SHIB), (market cap: US$6 billion) -4%

• Kaspa (KAS), (market cap: US$885 million) -4%

• FLEX Coin (FLEX), (market cap: US$624 million) -3%

• Aptos (APT), (market cap: US$1.58 billion) -2%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

🇺🇸 SEC delayed decision on Cathie Wood's spot #Bitcoin ETF.

They approved:

– Bitcoin Futures ETF

– Bitcoin Leveraged ETF

– Bitcoin SHORT ETFBut they won't approve a SPOT Bitcoin ETF!

"Arbitrary, Capricious and Discriminatory"

— Bitcoin Archive (@BTC_Archive) August 12, 2023

All you ever needed to hear to understand the mind of these people. https://t.co/rCrnoR5wO4

— John E Deaton (@JohnEDeaton1) August 13, 2023

JUST IN: Elon Musk texted Mark Zuckerberg about their upcoming fight.

Zuck: "I don’t want to keep hyping something that will never happen."@ElonMusk: "I will be in Palo Alto on Monday. Let’s fight in your Octagon.." pic.twitter.com/aLBr7gXLdZ

— Watcher.Guru (@WatcherGuru) August 13, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.