Mooners and Shakers: Bitcoin rises (a tad) on tepid Fed speech; Sui dumps onto crypto market

The Fed's new, improved Nothingburger, now with extra air. (Getty Images)

The Fed’s FOMC meeting went basically to script, albeit a pretty unexciting one, and consequently Bitcoin and pals (although not Sui) have perked up a little bit.

That said, don’t dust off the astronaut suit just yet – it’s not as if the US Federal Reserve has given investors the signal to go absolutely nuts aping in to every memecoin with the numbers 69 and 420 in its total supply. Oh wait, that’s already been happening.

But here, in some sort of a nutshell, is what the Fed and its tight-lipped, mealy mouthed boss Jerome Powell has done and basically said this time around:

• 25bps rate hike? Check. And that makes the 10th consecutive interest rate hike from the central bank.

• Talk of “work to do”? Check. Talk of the likelihood of a “mild recession”? Check.

• Further vague language that essentially lies somewhere in the middle on the scale of two extreme possibilities? Check. With pivoting to a pause or rate cuts at one happy-investing end, and continued rate hiking for the forseeable at the other.

In other words, it’s still a bet each way. But hope/hopium is still on the menu, hence the little rise after the initial little dip post FOMC meeting.

Do you want some JPow quotes? You don’t? Fair enough, but he did at least hint at the possibility of a pause in the Fed’s streak of rate hiking, noted Eddy Sunarto in this morning’s highly informative Market Highlights. Although he did also say this:

Powell: “We, on the committee, have a view, that inflation is going to come down not so quickly, and that it would take some time. And in that world, if that forecast is broadly right, we would not cut rates, and we won’t cut rates.”

<In response if they would cut this year>

— Benjamin Cowen (@intocryptoverse) May 3, 2023

Got to hand it to him, though (Powell, not Eddy or Benjamin Cowen) – he’s possibly the best deadpan comedian we’ve seen since Steven Wright, or that Elliott Goblet bloke…

JUST IN – 🇺🇸 Fed Chair: "US banking system is sound and resilient" pic.twitter.com/QaDdPtbKFd

— Bitcoin Magazine (@BitcoinMagazine) May 3, 2023

Nothing special in todays presentation with Powell, aside from slight adjustments.

Banking system is sound and resilient, according to Jerome.

Hiking process getting to the end, most likely only 1 more hike and we're done.

That's a period of strength for #Bitcoin.

— Michaël van de Poppe (@CryptoMichNL) May 3, 2023

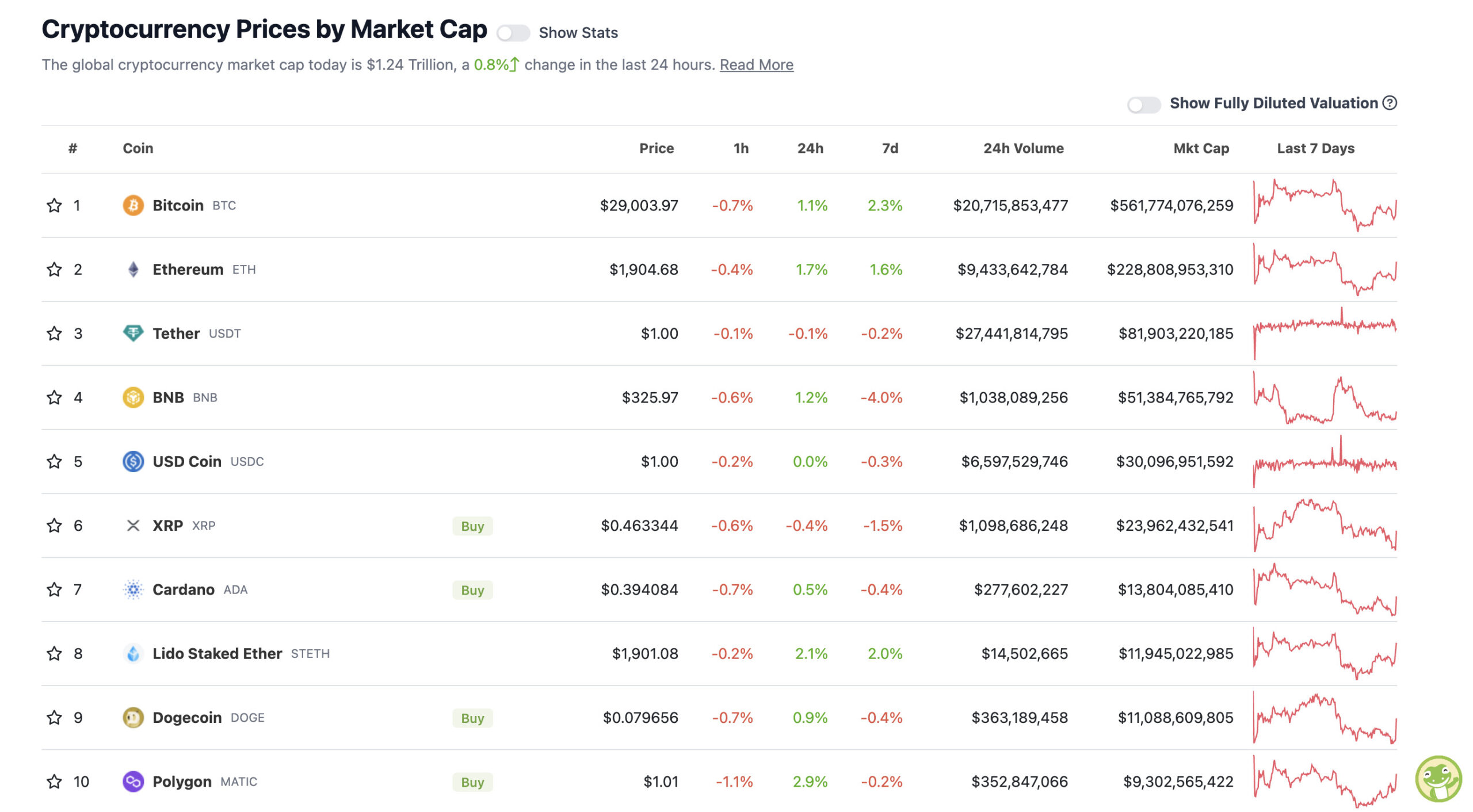

Top 10 overview

With the overall crypto market cap at US$1.23 trillion, up about 0.8% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

There you have it. Bitcoin has just breached the US$29k level again, but for how long this time?

So, no it’s not a spectacular boost for the crypto majors but it’s better than a kick in the Tether region. (Fully aware how terrible that joke is and yet we’ve left it in here anyway, unless the editor has better ideas. We’ve got our coat handy and will be out of here presently.)

(Ed: Rob Badman, ladies and gentlemen!)

Before we do that, let’s take a look at further down the charts…

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Render (RNDR), (market cap: US$828 million) +11%

• WOO Network (WOO), (market cap: US$477 million) +9%

• Curve DAO (CRV), (market cap: US$785 million) +7%

• Rocket Pool (RPL), (market cap: US$1 billion) +7%

• Stacks (STX), (market cap: US$1.08 billion) +7%

PUMPERS (lower, lower caps)

• IDEX (IDEX), (market cap: US$85 million) +18%

• Orion Protocol (ORN), (market cap: US$35 million) +13%

SLUMPERS

• Sui (SUI), (market cap: US$766 million) -33%

• Pepe (PEPE), (mc: US$453 million) -4%

• Toncoin (TON), (mc: US$3.01 billion) -3%

• Radix (XRD), (mc: US$908 million) -3%

• Huobi (HT), (mc: US$530 million) -2%

SLUMPERS (lower, lower caps)

• Wojak (WOJAK), (market cap: US$46 million) -28%

• Cult DAO (CULT), (market cap: US$20 million) -26%

The reasonably hyped new layer 1 blockchain (yep, another one) Sui (SUI) has landed on major exchanges, and it’s had a pretty swift dump.

And that’s very likely due to the ye olde practice of whitelisted tokens bought at a fraction of the market-launch price immediately dumping for a 45x gain. The lucky sods.

A reminder, I guess, that it can pay to keep the ear to the ground on potentially top projects (such as Aptos late last year) whitelisting and doing your best to try to get involved at a pre-market stage.

Max available to be purchased at $0.03 → 1500 SUI (45 USD)

• These users are ~2000 USD in profitMax available to be purchased at $0.10 → 10,000 SUI (1000 USD)

• These users are ~12,000 USD in profitNot an airdrop, but profitable for lucky users who got in 🎯

— olimpio (@OlimpioCrypto) May 3, 2023

Is SUI a “buy” now that it’s immediately dumped 33%? Hmm, not so sure. As savvy young Aussie crypto analyst Miles Deutscher points out, it has a helluva token release schedule coming up. Potentially inflationary token environments are something to obviously be aware of when looking at individual crypto investments.

Look at the $SUI token release schedule.

That’s a crazy amount of early supply hitting the market. 😳 pic.twitter.com/tVbe961pEz

— Miles Deutscher (@milesdeutscher) May 3, 2023

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Backing up some other recent commentary, outspoken presidential candidate (which is probably tautological) Robert F. Kennedy Jr has gone into bat for crypto, on Twitter, again. Here he is talking it up, while the Biden admin attempts to instil a crippling 30% tax measure on crypto mining…

Yes, energy use is a concern (though somewhat overstated), but bitcoin mining uses about the same as video games and no one is calling for a ban on those. The environmental argument is a selective pretext to suppress anything that threatens elite power structures. Bitcoin, for…

— Robert F. Kennedy Jr (@RobertKennedyJr) May 3, 2023

Just as a biodiverse ecosystem is a resilient ecosystem, so too will our economy be more resilient if it has a diverse ecology of currencies, not just a single, centrally controlled one. We are seeing today how fragile our over-centralized system is.

— Robert F. Kennedy Jr (@RobertKennedyJr) May 3, 2023

"The United States can pay any debt it has because we can always print money to do that. So there is zero probability of default."

— Former Federal Reserve Chair Alan Greenspan in 2011 pic.twitter.com/Rp1P9mSAtO

— Balaji (@balajis) May 3, 2023

JUST IN: Running a bank comes with a lot of "temptations to do the wrong thing" – Charlie Munger

Yes, that's why we buy #Bitcoin 😎 pic.twitter.com/KVjUWhEm6t

— Bitcoin Archive (@BTC_Archive) May 2, 2023

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.