Mooners and Shakers: Bitcoin rides higher on US debt ceiling deal; Shaq cops crypto heat

Getty Images

Morning Coinheads. The riskiest component of your risky portfolio of spray-and-pray risk assets should be looking in better shape this morning. That’d be crypto.

And that’s because of two Yanks, one of who goes by the title and name of POTUS Joe Biden, the other House Republican Speaker Kevin McCarthy.

Debt Ceiling Crisis number 79 (since 1917) looks like being MIRACULOUSLY averted (jeez, phew, eh?) thanks to Democrats and Republicans reaching some sort of begrudging “You Can’t Always Get What You Want” tentative deal. Erm, in principle.

Anyway, the markets have responded favourably to this news for now, with Wall Street surging higher late, late Friday (AEST) and the ASX looking like it’s about to have a decent day, too.

“Under the expected deal, the debt limit increase will last 2 years, with defence and renewable energy to get the most funding,” reports Eddy “Catches the Worm” Sunarto in his morning Market Highlights wrap.

Let’s check in with the price action in the crypto majors and minors, then…

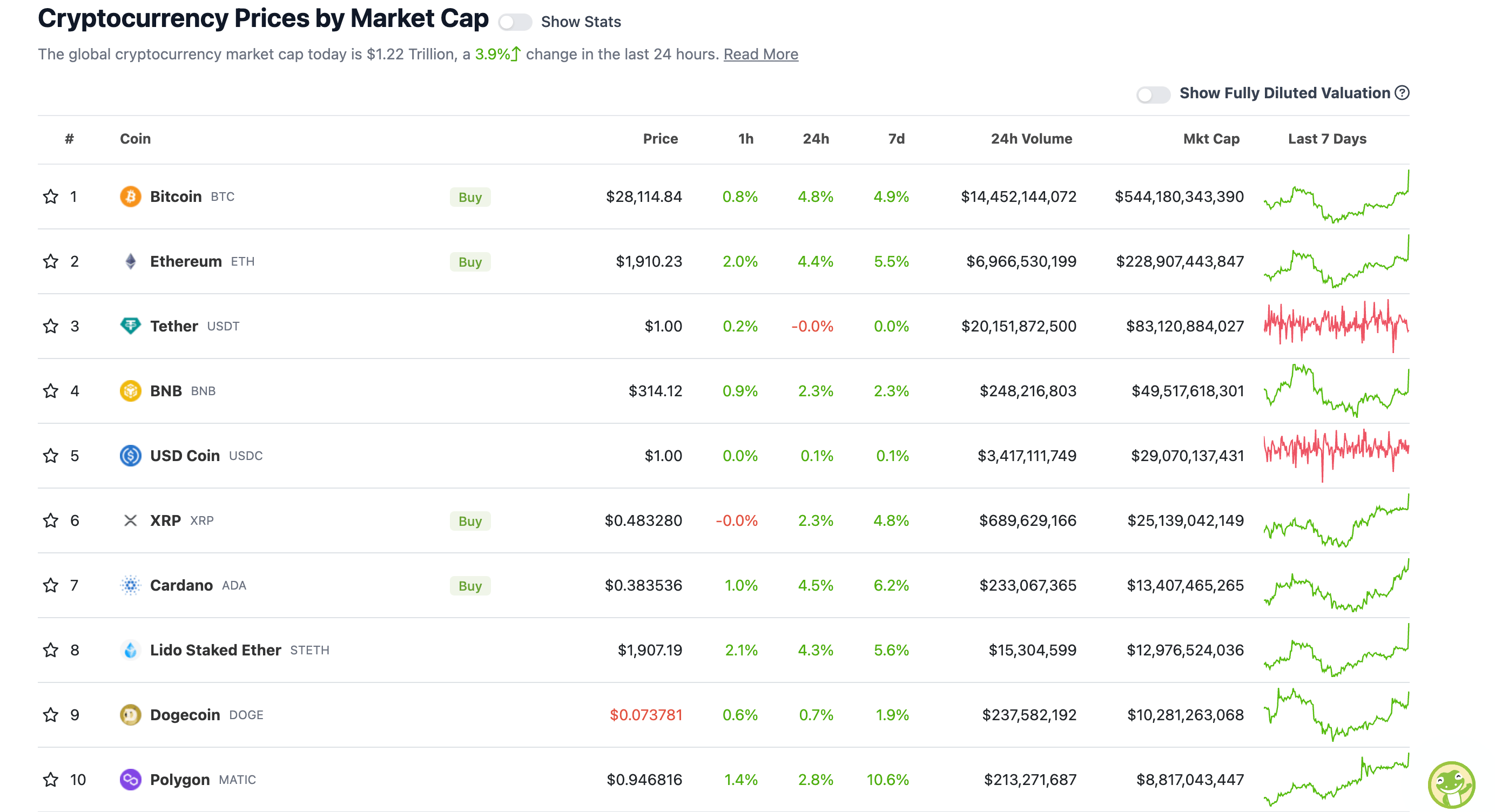

Top 10 overview

With the overall crypto market cap at US$1.22 trillion, up about 4% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Sea of green. Let the “god candles commence?” Well, let’s not get too far ahead of ourselves, as it remains to be seen what ramifications this could have on market liquidity longer term, never mind the US inflation-combatting narrative, but the bulls are happy right now…

That’s a really good weekly candle on #Bitcoin.

— Michaël van de Poppe (@CryptoMichNL) May 28, 2023

I’d pray for the bears but I gave warnings all week.

Nothing about this consolidation is bearish.

Ultimately expecting much higher.#bitcoin #cryptocurrency #cryptotrading https://t.co/kMaZ0gWhwp

— Roman (@Roman_Trading) May 28, 2023

So far, so good for the #BTC Bulls

If $BTC Daily Closes below the red box top, there is scope for a retest of red downtrending channel BTC broke out from

Overall, the goal for the bulls is for BTC to reclaim the red box top to move towards the black trendline#Crypto #Bitcoin https://t.co/txOCI8T3c6 pic.twitter.com/Ak0OCfRSI5

— Rekt Capital (@rektcapital) May 28, 2023

It’s not just #Bitcoin which suggests an early parabolic move.#Altcoin cap / $BTC appears at an inflection point. pic.twitter.com/N7eWeB9vji

— TechDev (@TechDev_52) May 28, 2023

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Injective (INJ), (market cap: US$577 million) +13%

• Axie Infinity (AXS), (market cap: US$733 million) +11%

• GGTKN (GGTKN), (market cap: US$1.33 billion) +8%

• Lido DAO (LDO), (market cap: US$1.85 billion) +7%

• GMX (GMX), (market cap: US$508 million) +6%

PUMPERS (lower, lower caps)

• Lybra Finance (LBR), (market cap: US$27 million) +48%

• Multichain (MULTI), (market cap: US$91 million) +42%

• TomoChain (TOMO), (market cap: US$162 million) +27%

• ORDI (ORDI), (market cap: US$209 million) +26%

• Akash Network (AKT), (market cap: US$129 million) +25%

SLUMPERS

• Pepe (PEPE), (market cap: US$632 million) -2%

• Toncoin (TON), (mc: US$2.83 billion) -1%

SLUMPERS (lower, lower caps)

• Firmachain (FCT), (market cap: US$31 million) -14%

• Efinity (EFI), (market cap: US$33 million) -13%

• Samoyedcoin (SAMO), (market cap: US$18 million) -8%

Around the blocks: Shaq is dunked on

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Legal reps for a group of investors who seem to think they’ve been slam dunked by NBA legend Shaquille O’Neal’s involvement as a promoter of the FTX crypto exchange and a failed NFT project Astrals, have finally tracked down and served their lawsuits to the big bloke.

Shaq had managed to avoid them for months in an unlikely game of tiny cat and gigantic, 7ft 1 mouse. The legal process servers had reportedly literally thrown their papers at his presumably oversized car a few weeks ago, as he sped away.

Shaq got sued today in a class action lawsuit for his Astrals NFT.

Why? Plaintiffs claim the Astrals tokens and NFTs (allegedly Shaq’s “brainchild”) were unregistered securities.

It’s truly never a dull day in crypto land.

— Ariel Givner, Esq. (@GivnerAriel) May 24, 2023

But, during Game 4 of the Boston Celtics v Miami Heat playoff series, the eager legal beavers managed to sneak their way into where the Lakers and Heat legend was broadcasting for ESPN and film themselves deftly passing him the documents through a sea of defenders.

All this perhaps partly explains why the big fella came down to Australia not so long ago to appear in a series of commercials for a betting company, featuring the line: “Shaqodile Dundee”. Not that he’s exactly struggling, but perhaps he needed the extra funding to help fend/block this pesky legal crypto layup.

Shaq is now embroiled in two separate lawsuits: one related to his involvement in FTX and the other due to his association with NFT project, Astrals.https://t.co/C0My43D4L0

— nft now (@nftnow) May 25, 2023

Meanwhile, is this jammy bloke the living embodiment of still-not-dead Bitcoin? Or just someone who’s really, really fizzing for a pint? Answer: both.

Simon Smith — on his way to pub in Reading — bus hits him, he picks himself up, walks into the pub and orders a drink. Respect.pic.twitter.com/IRXFgzo0TC

— Jeremy Vine | thejeremyvine.bsky.social (@theJeremyVine) May 28, 2023

https://twitter.com/naiivememe/status/1662796312360939521

Another trip around the monopoly board

— Peter McCormack 🏴☠️ (@PeterMcCormack) May 28, 2023

Now that a deal on the debt ceiling has been reached, the worst outcome may be averted.

However, what it does mean is that the Treasury will start issuing T-bills again which could drain liquidity from the market.

GS estimates them to issue c. $700bn in the coming weeks 🤔

— Coin Bureau (@coinbureau) May 28, 2023

except this news pic.twitter.com/wDsrdFmssa

— naiive (@naiivememe) May 28, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.