Mooners and Shakers: Bitcoin rides above $42k again as Germany’s Commerzbank pushes adoption

Today's Bitcoin undulating-ride metaphor is brought to you by Getty Images

There’s no shortage of bullish news doing the rounds for crypto this week, and Bitcoin and other crypto majors are digging the vibe, responding with a three-day upswing on the charts.

Germany and Bahamas adopt; Australian crypto ETFs gather pace

Here are a few of the main news bites feeding the blockchain-based hopium today/this week…

• Big news out of Germany. The country’s second-largest bank has reportedly applied for a crypto custody licence. Commerzbank is partly government owned and provides services to nearly 28,000 corporate client groups and close to 11 million private and entrepreneurial clients.

According to a CoinDesk report today, one of the bank’s spokespeople said Commerzbank wants to “help shape emerging digital ecosystems”, especially with regard to custody and trading in non-physical assets.

Let the frothy, “mass adoption” Crypto Twitter posts ensue…

⚡️BREAKING NEWS:

German Commerzbank applies for #crypto License!!!

Massadoption is coming 🔥— AMCrypto (@AMCryptoAlex) April 21, 2022

• You might not know this but the Bahamas has had a central bank digital currency (CBDC) up and running since late October. It’s called the Sand Dollar (not to be confused with The Sandbox’s SAND metaverse token).

Anyway, that’s not the news here… the increasingly crypto-friendly country has today announced that its citizens will be able to pay their taxes using digital assets, according to a newly released white paper detailing the nation’s digital strategy until 2026.

“We have a vision to transform the Bahamas into the leading digital asset hub in the Caribbean,” said Prime Minister Philip Davis.

• And speaking of the Bahamas… according to the Financial Times, an interesting meeting went down there recently – between Goldman Sachs boss David Soloman and the CEO of crypto exchange giant FTX, Sam Bankman-Fried…

Goldman boss DJ D-Sol met crypto billionaire Sam Bankman-Fried in a secret meeting in the sunny Bahamas last month to discuss regulatory collaboration between the Wall Street giant and the $32bn crypto exchange FTX 🏝️🍹

Scoop with @eva_szalay https://t.co/DH5MKRZRqV

— Tabby Kinder (@Tabby_Kinder) April 21, 2022

A potential high-powered collaboration there, then? Over a Bahama Mama cocktail with a Kalik chaser (possibly), the two CEOs apparently discussed the prospect of Goldman advising FTX on future funding rounds and a potential IPO, according to that most classic of sources: Unnamed.

• And we’ll aim to cover this more soon, but just quickly, the market for major crypto investment vehicles Down Under is heating up. Earlier this week, exchange-traded fund (ETF) issuer 21Shares announced it’s launching two spot-traded ETFs next week – one in BTC and the other in ETH.

#Bitcoin & #Ethereum ETF in Australia next week has me super bullish. This could start the rally & throw Grayscale in the picture and it could very interesting.!!

— ₿ᴜʟʟʀᴜɴɴer77 (@BullRunnner77) April 21, 2022

It’s significant because these will be Australia’s first spot-exchange-traded crypto products. And that news is currently leaving the US institutional crypto market a sickly shade of green as it sideways glances at its futures-backed Bitcoin ETFs with mild disdain.

The 21Shares update follows the news that Cosmos Asset Management will be launching the country’s first Bitcoin ETF – also landing next week. That one is slightly different, as it’s expected to invest through Purpose Investments’ Bitcoin ETF, which launched on Canada’s Toronto Stock Exchange in February 2021.

It’s still potentially a big deal for institutional-grade BTC exposure, though.

21Shares’ product joins a similar fund from Cosmos Asset Management that will start trading on the same day. However, 21Shares’ fund will be the first ETF in Australia to invest directly into #Bitcoin. @namcios covers the news:https://t.co/WEbRXrcvzD

— Bitcoin Magazine (@BitcoinMagazine) April 20, 2022

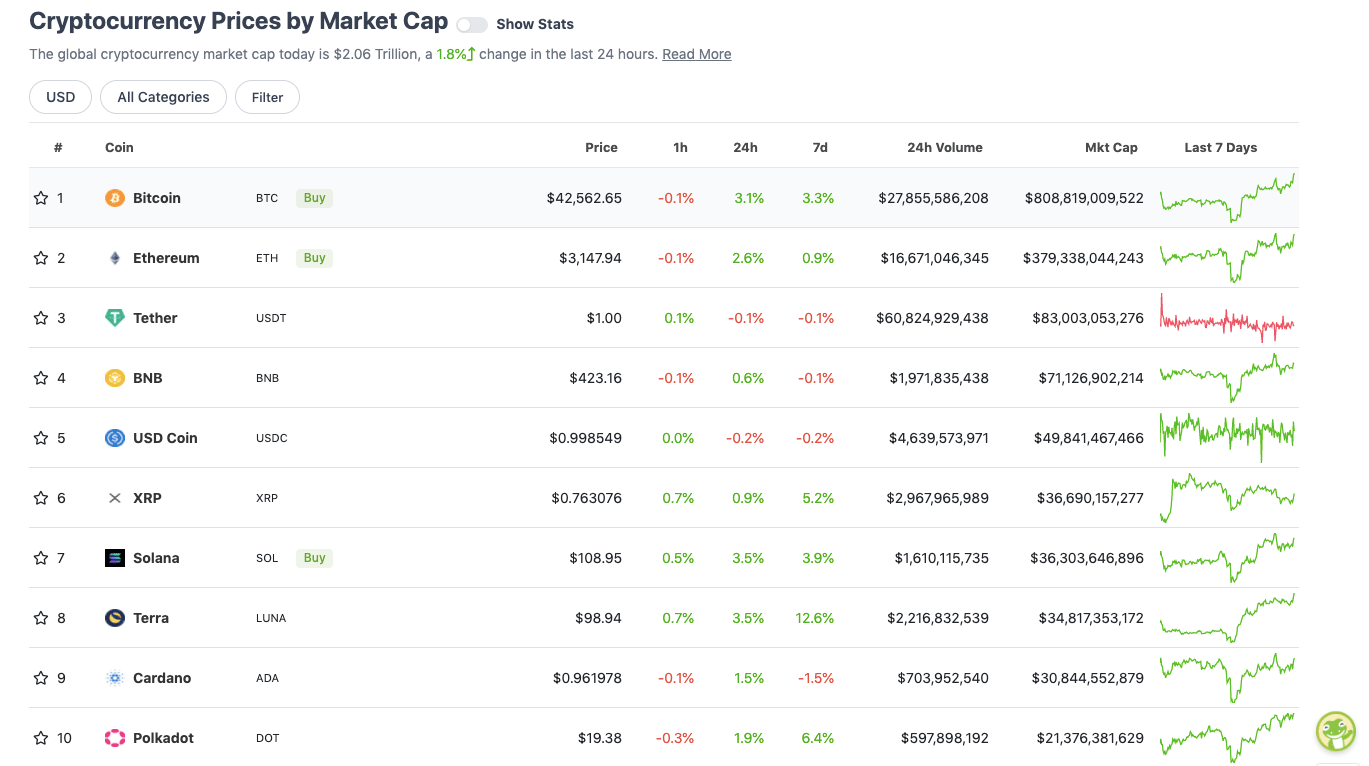

Top 10 overview

With the overall crypto market cap a bit over US$2.06 trillion, up about 1.8% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

As indicated earlier, it’s a green day so far for the crypto majors. At least one prominent analyst is calling the bottom for Bitcoin. His words, definitely not ours…

#BITCOIN COMPLETE AND ACCURATE TOPS AND BOTTOMS DETECTOR.

The bottom seems to have been reached, according to my research.

At @xorstrategy we have been working hard for months.

Time to join our trading robot → https://t.co/kgZrXJqjLw before the next bull run. 👊#BTC #Crypto pic.twitter.com/XjOxSFmsBU— AO (@AurelienOhayon) April 21, 2022

Is there enough trading volume to support this thesis and truly become bullish here? That’s probably at least one thing to remain cautious about.

Uppers and downers: 11–100

Sweeping a market-cap range of about US$21.1 billion to about US$995 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• TRON (TRX), (mc: US$7.26 billion) +15%

• Theta Network (THETA), (market cap: US$3.4 billion) 12%

• Monero (XMR), (mc: US$5 billion) +9%

• The Graph (GRT), (mc: US$2.6 billion) +7%

• Basic Attention Token (BAT), (mc: US$1.2 billion) +5%

The TRON blockchain was born by copying Ethereum, plagiarizing the Ethereum whitepaper word for word.

Now TRON is copying Luna's decentralized dollar. and faithful to its roots, the stages of the TRON stablecoin will be named Moon and Mars. Very original.

— Alex Krüger (@krugermacro) April 21, 2022

DAILY SLUMPERS

• STEPN (GMT), (mc: US$1.89 billion) -10%

• ApeCoin (APE), (mc: US$4.3 billion) -7%

• Loopring (LRC), (mc: US$1.2 billion) -4%

• EOS (EOS), (mc: US$2.7 billion) -3%

• NEAR Protocol (NEAR), (mc: US$11.3 billion) -2%

Uppers and downers: lower caps

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• Exeedme (XED), (market cap: US$29 million) +119%

• Steem (STEEM), (mc: US$224m) +60%

• Trustswap (SWAP), (mc: US$84m) +45%

• 0x (ZRX), (mc: US$841m) +37%

• Mantra DAO (OM), (mc: US$50m) +22%

🥁 And now… 🥁 Exeedme Introduces

The WEB3 Gaming Launchpad… XPADA launchpad where you can play the Games and enter Esports competitions

Can’t wait to read all about it? 👀 You don’t have to!

Discover it below and let's take this step together 👇https://t.co/xoFU9MusJ9 pic.twitter.com/xvtUNJhJ2S

— Exeedme (@Exeedme) April 20, 2022

DAILY SLUMPERS

• ICHI (ICHI), (mc: US$29m) -17%

• Lyra Finance (LYRA), (mc: US$27m) -16%

• Metal (MTL), (mc: US$167m) -15%

• Tokamak Network (TON), (mc: US$175m) -10%

• Linear (LINA), (mc: US$101m) -10%

Around the blocks

Always look on the bright side of life

— Elon Musk (@elonmusk) April 21, 2022

https://twitter.com/cobie/status/1517180202904080385

— BitcastTR 🇹🇷 (@BitcastTR) April 21, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.