Mooners and Shakers: Bitcoin resilient; Chinese banks support Hong Kong crypto firms; XRP pumps further

Yep, that's a honey badger. (Pic: Getty Images)

Bitcoin appears to be showing some strength in the face of further regulatory uncertainty for crypto in the US this week. Meanwhile, the Hong Kong crypto hub narrative is alive and XRP has pumped again.

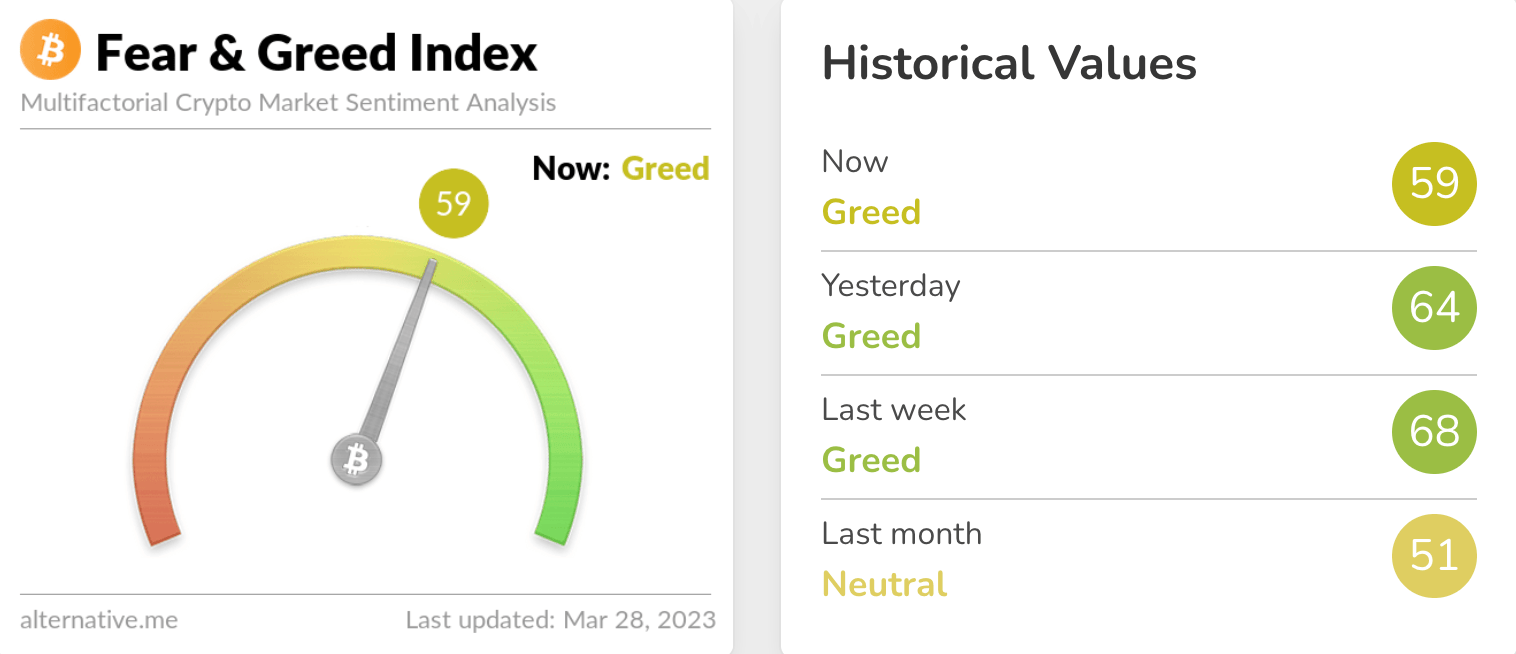

The crypto Fear & Greed Index market sentiment tracker may have pulled back a tad (although it’s still in the Greed zone, just) but Bitcoin has clawed its way back up above from under US$27k at the time of writing.

China looks to bank crypto in Hong Kong

And here’s something. While elements of the US government seem hell-bent on stifling the crypto industry in its country via a banking on-ramp/off-ramp chokepoint and through other enforcement methods, it seems China could be moving ahead to help enable Hong Kong as a genuine crypto-innovation hub.

A Bloomberg report reveals that Hong Kong regulators are planning to host a meeting in April between local crypto firms and top Chinese bankers with a view to establishing financing for the industry as the region aims to emerge as global digital asset hotspot.

The report notes that the Hong Kong Monetary Authority and the Securities and Futures Commission plan “to facilitate direct dialog” between local crypto entities and banking institutions to “share practical experiences and perspectives in opening and maintaining bank accounts.”

In fact, the Bank of China, the Bank of Communications and the Shanghai Pudong Development Bank have already begun offering their services to Hong Kong’s crypto industry.

JUST IN: 🇭🇰 Hong Kong regulators to assist #crypto firms with banking in effort to become a digital asset hub.

— Watcher.Guru (@WatcherGuru) March 28, 2023

All this may come as a big surprise to the casual observer, considering China’s strong stance against crypto mining and crypto-related activities in general for its regular citizens over the past couple of years. It begs the question – is China spying a potentially massive economic opportunity slipping through the fingers of Biden and co?

Former Goldman Sachs exec Raoul Pal, now CEO of the Real Vision financial media firm, predicts a future for the crypto industry in which it’s controlled by highly regulated “TradFi” operators in the US, and in China/Asia, overseen by a “global regulatory arbitrage regime” that connects the two, which is how he says the existing financial system basically works.

“Capital finds a way. Always,” notes Pal.

My best current guess of the global future of the crypto industry…

A US regime of highly regulated and TradFi -integrated major players, small in number and oligopolistic in nature over time.

An Asian regime of one or two key players, CCP approved and global South in nature.…

— Raoul Pal (@RaoulGMI) March 28, 2023

Top 10 overview

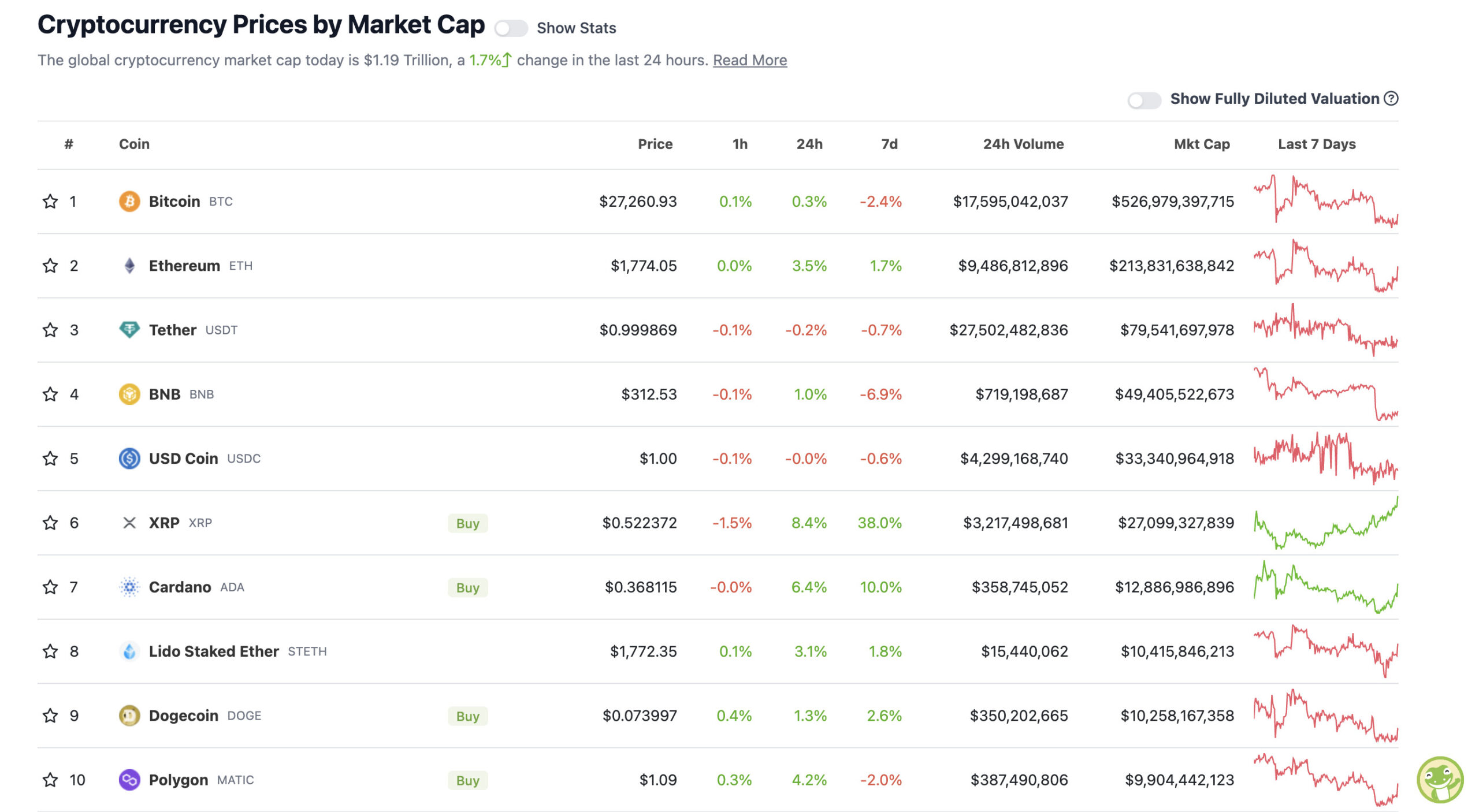

With the overall crypto market cap at US$1.19 trillion, up about 1.7% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Bitcoin (BTC), having dipped as low as roughly US$26,600 yesterday, has clawed its way back above $27,200 at the time of writing, while the other major crypto major, Ethereum (ETH), is also showing strength.

“Bitcoin is displaying such unbelievable resilience to what is happening around it, even in the crypto industry, that you have to wonder just how sustainable that can be,” wrote Craig Erlam, senior market analyst at foreign exchange market maker Oanda, wrote in a note overnight (AEDT).

Erlam added, however, that the dip, which occurred after the CFTC lawsuit against Binance came to light, “doesn’t feel particularly significant”.

Meanwhile, XRP continues to rip and outperform other top cryptos this week. In fact, it’s currently up 38% over the past seven days and reaching a five-month high.

There have been several rumours lately that XRP founder Ripple Labs’ legal stoush with the US SEC is winding down and coming to a potential settlement soon. The SEC certainly has a few other big fish it seems to be hoping to fry, for example Coinbase.

XRP seems, for the moment, relatively unscathed from wider regulatory pressures on the crypto industry in the US.

Uppers and downers: 11–100

Sweeping a market-cap range of about US$7.88 billion to about US$412 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS

• Mask Network (MASK), (market cap: US$494 million) +14%

• Rocket Pool (RPL), (mc: US$883 million) +14%

• Flare (FLR), (mc: US$521 million) +14%

• Lido DAO (LDO), (mc: US$2 billion) +11%

• Conflux (CFX), (mc: US$747 million) +11%

SLUMPERS

• Radix (XRD), (market cap: US$412 million) -1%

• WhiteBIT Token (WBT), (mc: US$729 million) -1%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

#Bitcoin price predictions after a 5% pump. 📈 pic.twitter.com/bQgJ20jHVC

— Altcoin Daily (@AltcoinDailyio) March 28, 2023

People in Hong Kong will be allowed to buy large cap #crypto coins from June 1st.

I guess that is the day the real pump starts as Chinese money floods crypto

— Lark Davis (@TheCryptoLark) March 27, 2023

– CFTC sues Binance because ETH is a commodity

– SEC sues Kraken because ETH is a securityCorrect?

— CTO Larsson (@ctoLarsson) March 27, 2023

Oh, and just in… yikes…

BREAKING: Safemoon has just been hacked for $8.9M 😢

— MASON VERSLUIS (@MasonVersluis) March 28, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.