Mooners and Shakers: Bitcoin rejected at $45k; Wells Fargo compares crypto adoption to internet’s growth

Pic: Getty

Bitcoin felt it had the all clear for a bold move up past US$45k today, only to then cop a humiliating, face-slapping $2,500 rejection. Guess it misread the signals.

At the time of writing, the orange one is playing out a tense battle on the charts and inside your portfolio, trying to stake its claim on US$43k as a new base of support.

In reality, a rejection wasn’t unexpected – not by the full-time chart watchers we’ve been following, anyway. In fact, a retest or two while establishing support somewhere around US$42-$43k might be what’s shaping up here for the moment. At least that’s the hope.

Dutch trader Michaël van de Poppe this afternoon was describing Bitcoin as facing some “crucial resistance” around that US$45k level.

My view on the markets is described in the chart.#Bitcoin faces a crucial resistance, which is different than the run we've experienced in September 2021.

In that regard, I'm assuming we won't break in one go and have a correction -> ending up bad for #altcoins. pic.twitter.com/7RKynM1dBW

— Michaël van de Poppe (@CryptoMichNL) February 8, 2022

Break that red box on his chart and Van de Poppe thinks we’re heading to all-time highs. He did hint, however, that a further correction would likely see altcoins bleed out pretty badly.

Well then, as usual, no pressure, Bitcoin…

Despite a fantastic recovery as of late, #BTC is still down -36% in total since the ~$69000 All Time Highs$BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) February 8, 2022

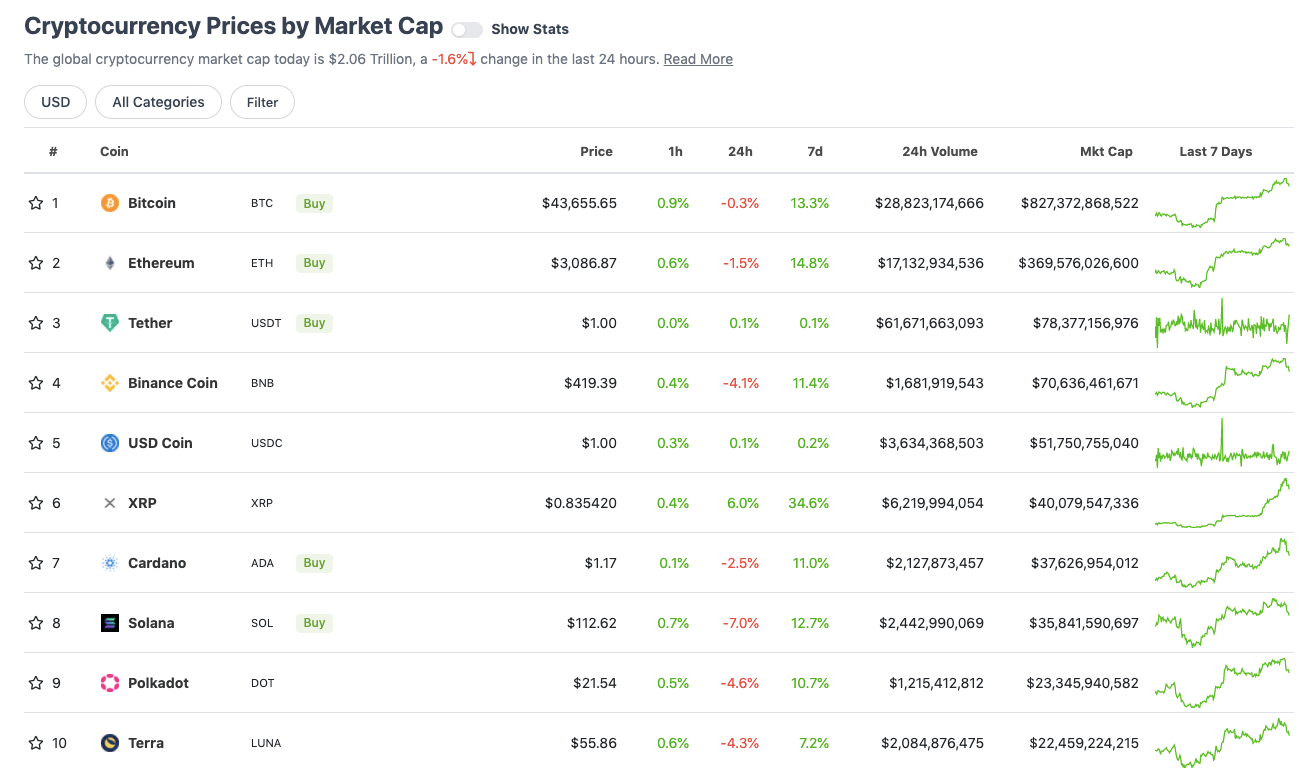

Top 10 overview

With the overall crypto market cap down about 1.6% over the past 24 hours, here’s the state of play in the top 10 by market cap right now – according to CoinGecko data.

We’ve spoken about Bitcoin, Ethereum’s in similar territory, while Solana, Polkadot and Terra are all taking a few shots to the midriff.

But what’s going on with XRP and why’s it currently bucking the daily trend with a 6% gain?

Confidence has been building for quite a while now about a positive outcome for XRP developer Ripple Labs’ much-publicised court battle with the dastardly US Securities and Exchange Commission.

#XRP is going to shock the world!🚀 pic.twitter.com/665ouQ039M

— JackTheRippler ©️ (@RippleXrpie) February 2, 2022

This is a disagreement (based around the SEC’s belief XRP was issued as an unregistered security) which has been playing out since September 2020 and is taking longer to resolve than the filming and editing of Better Call Saul season 6. If only this guy could help out with the Ripple defence… pretty sure one way or another it’d all be over a lot sooner.

That said, judging by this tweet and accompanying Reuters story, it appears some key evidence that could work in Ripple Labs’ favour is set to be revealed. Maybe Jimmy McGill’s on the case after all…

#xrpcommunity

👇😎

It’s “baffling,” @s_alderoty said, that it took the SEC eight years, while XRP traded globally, to declare its contrary view.@Reuters

Ripple lawyers' advice on digital tokens set for unsealing in key SEC case | Reuters https://t.co/tk3mn98k9r— James Rule XRP 👊😎 (@RuleXRP) February 8, 2022

Winners and losers: 11–100

Sweeping a market-cap range of about US$20.8 billion to about US$1 billion in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• IoTex (IOTX), (market cap: US$1b) +20%

• Leo Token (LEO), (mc: US$4.65b) +15.5%

• Radix (XRD), (mc: US$1.99b) +14%

• Kadena (KDA), (mc: US$1.4b) +8%

• Tezos (XTZ), (mc: US$3.8b) +6.5%

DAILY SLUMPERS

• Arweave (AR), (market cap: US$1.8b) -12%

• Shiba Inu (SHIB), (mc: US$16.75b) -11%

• Quant (QNT), (mc: US$1.88b) -11%

• Helium (HNT), (mc: US$2.8b) -10%

• JUNO (JUNO), (mc: US$1.1b) -9.5%

Lower-cap winners and losers

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• Dinger Token (DINGER), (market cap: US$17.3m) +124%

• ApolloX (APX), (mc: US$46.5m) +46%

• Smooth Love Potion (SLP), (mc: US$676m) +30%

• Revain (REV), (mc: US$3.8m) +20%

• Popsicle Finance (ICE), (mc: US$10m) +19%

DAILY SLUMPERS

• QI DAO (QI), (market cap: US$40m) -42%

• Tomb Shares (TSHARE), (mc: US$266m) -30%

• Paint Swap (BRUSH), (mc: US$23.6m) -24%

• Star Atlas (ATLAS), (mc: US$112.6m) -18%

• Step Finance (STEP), (mc: US$30.6m) -18%

Final words

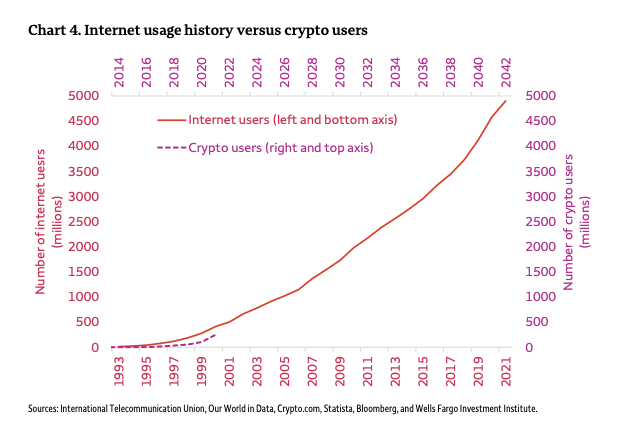

American multinational financial services and banking giant Wells Fargo has told its investors that it believes crypto is “early, but not too early” when it comes to the asset class’s investment stage.

The institution also noted in a report from its Global Investment Strategy Team that crypto appears to be nearing a “hyper-inflection point” of global adoption, comparable to what the internet went through in the mid-to-late 1990s.

“We believe that cryptocurrencies are viable investments today,” reads the report, “even though they remain in the early stages of their investment evolution.”

Two major, major narrative violations that are rapidly being recognized by sharp policymakers:

– Bitcoin mining enhances the resiliency and capacity of the grid

– Stablecoins support the proliferation of the dollar globally and create new demand for US Treasuries— nic carter (@nic__carter) February 8, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.