Mooners and Shakers: Bitcoin rally stalls as tech earnings calls wobble markets

Getty Images

Bitcoin and the crypto market at large have curbed their enthusiasm today (aside from a few notables including Dogecoin). Tight correlation with tech stocks? Damn right.

There are probably a few other reasons besides – such as some not exactly thrilling news circulating regarding the world’s biggest Bitcoin mining operation. However, all may not be lost, as we’ll discuss in a sec.

On the earnings season news, major tech firms Amazon and Apple published their reports overnight (AEDT), and the survey says? Ba-bowwww. Along with Meta, Google and Facebook, the companies didn’t exactly meet market expectations.

This has generally sent tech stocks a bit lower, as you’d expect, and the correlated crypto market has hitched a ride south, too.

Still, because we don’t mind the odd hopium hit here at Coinhead, we quite like this reply to one of economist and financial analyst Sven Henrich’s tweets. The Fed pivot narrative is still alive ahead of the US central bank’s FOMC meeting next week.

https://twitter.com/DanShephardN7/status/1585730735272607745

While still very small a notable jump in 50bp rate hike odds for next week from 3.8% yesterday to 10.7% now. pic.twitter.com/oaklFpAHlr

— Sven Henrich (@NorthmanTrader) October 26, 2022

Bitcoin miner Core Scientific

This might also be affecting crypto-market sentiment today.

Huge, publicly listed Bitcoin miner Core Scientific (CORZ) is making news today for the wrong reasons. Its stock has plummeted by about 70% as it reportedly could be facing bankruptcy, according to an announcement made in a filing to the US Securities and Exchange Commission (SEC).

The company noted that it is “very difficult to estimate our future liquidity requirements” and it could “potentially seek relief under the applicable bankruptcy or insolvency laws”.

The Texas-based Bitcoin-mining firm’s liquidity crisis is being put down to the ongoing crypto bear market, low BTC prices and high electricity costs, all of which have been affecting profitability for Bitcoin miners.

“The Company anticipates that existing cash resources will be depleted by the end of 2022 or sooner,” it added. “Given the uncertainty regarding the Company’s financial condition, substantial doubt exists about the Company’s ability to continue as a going concern for a reasonable period of time.”

The world's biggest Bitcoin miner is going bust. This is what happens when Bitcoin trades below its production cost for too long. pic.twitter.com/Ri0yXqZIPs

— Charles Edwards (@caprioleio) October 27, 2022

Onto some daily price action.

Top 10 overview

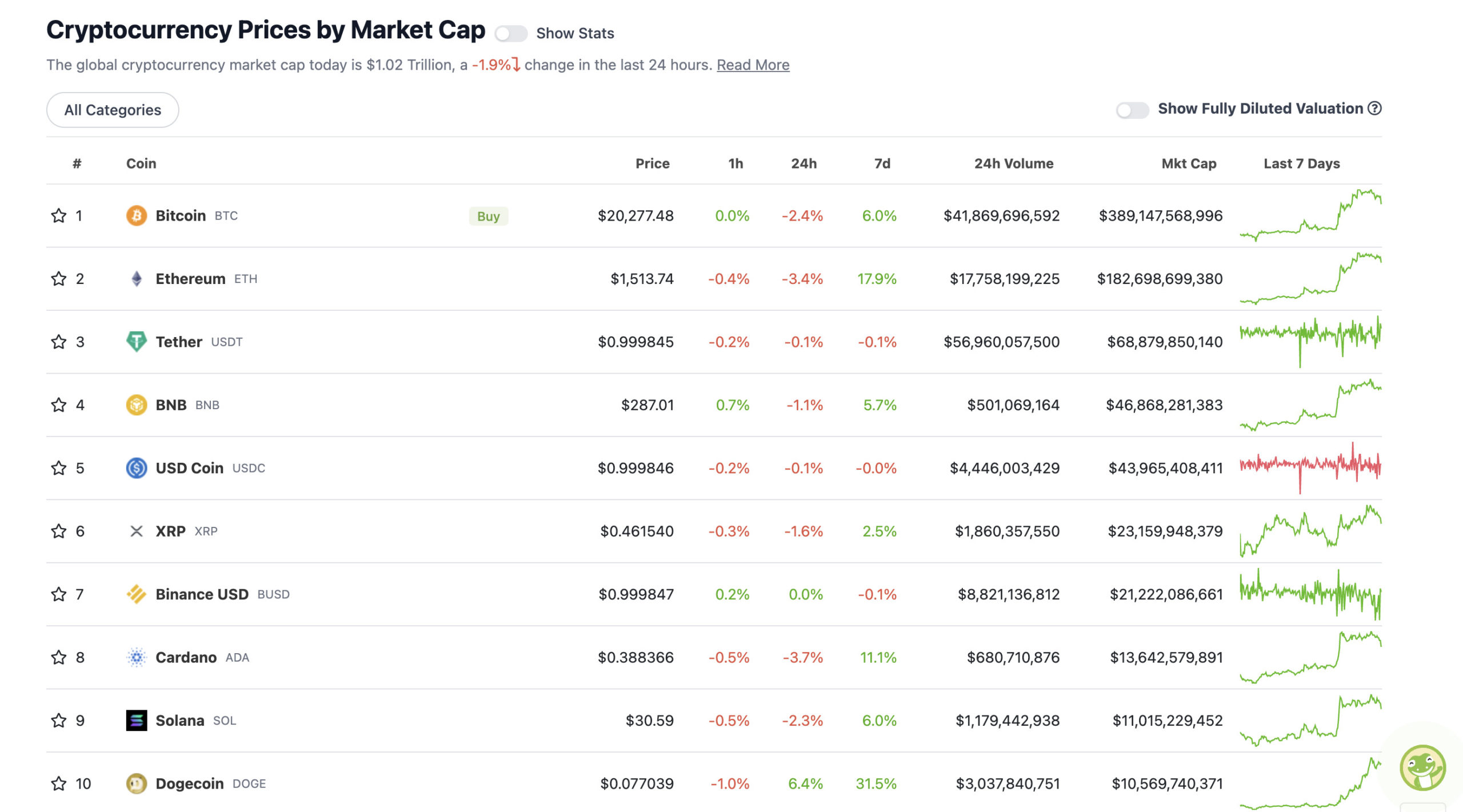

With the overall crypto market cap at US$1.02 trillion, down roughly 2% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

While Bitcoin (BTC) looks in peril of losing its US$20k footing again, Ethereum (ETH) is still doing well to hold the US$1,500 mark it breached for the first time in yonks the other day. It’s up close to 18% for the week.

$BTC $20,400 is the must-hold level for bulls. Lose that on the higher time frames, and we probably see much lower levels for #Bitcoin.

I'm not ruling out one more flush up to $21,400 while above $20,400. pic.twitter.com/jcnu2snJcZ

— Justin Bennett (@JustinBennettFX) October 27, 2022

It’s largely redness on the crypto major daily price chart, though – aside from Dogecoin (DOGE), which is still riding high on the Elon Musk Twitter-buy excitement. Perhaps DOGE fans just love a really crap dad joke (see Musk’s “let that sink in” tweet from yesterday.)

— BTC⚡️ (@vBKEVLH1GlEzkK6) October 27, 2022

There’s also a rumour that Twitter might be developing its own crypto wallet. If so, that’d almost certainly be a Dogecoin-enabled crypto wallet, along with probably at least Bitcoin and Ethereum we’d hazard a guess.

Here’s trader Bluntz again, throwing his analytical backing behind the leading meme coin.

contemplating simply putting the rest of my #btc into $doge f or the next few months atleast.

this doge/btc chart most crazy bullish thing ive seen in a long time.

Almost a year long IHS breakout that barely any people are even talking about pic.twitter.com/vE1fOsyRgq

— Bluntz (@Bluntz_Capital) October 27, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$8 billion to about US$425 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Klaytn (KLAY), (market cap: US$774 million) +17%

• WhiteBIT Token (WBT), (mc: US$1.63 billion) +9%

• Cosmos Hub (ATOM), (mc: US$3.7 billion) +3%

• Osmosis (OSMO), (mc: US$613 million) +3%

• Uniswap (UNI), (mc: US$5.1 billion) +1%

DAILY SLUMPERS

• Evmos (EVMOS), (market cap: US$646 million) -14%

• EthereumPoW (ETHW), (mc: US$717 million) -10%

• Casper Network (CSPR), (mc: US$465 million) -6%

• Quant (QNT), (mc: US$2.39 billion) -6%

• Chiliz (CHZ), (mc: US$1 billion) -6%

Around the blocks

A selection of randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

Looks like all this “Inverse Cramer” ETF stuff is actually really getting to CNBC financial analyst Jim Cramer.

Jim Cramer begins to cry and apologizes on being wrong on $META pic.twitter.com/c8qoB8iv3m

— unusual_whales (@unusual_whales) October 27, 2022

#Investors loved when $AAPL $AMZN $MSFT $META $TSLA $GOOGL made up basically 50% of the #NASDAQ100 and carried the market higher for years. Now it is time to pay the piper. Live by the sword, die by the sword.

— Gareth Soloway (@GarethSoloway) October 27, 2022

#Bitcoin Disbelief Rally Coming 🚨 pic.twitter.com/MTsoZiawib

— Kevin Svenson (@KevinSvenson_) October 26, 2022

XRP sentiment right now…

Arch rivals $XRP and the SEC are set for an epic showdown. The SEC (who may have bribed the refs) awaits the game with undeserved confidence… when all of the sudden, a faint chant can be heard from the distance… it’s the #XRParmy and they don’t sound afraid one bit. 😤 pic.twitter.com/PDZf7slcKG

— NotFinancialAdvice.Crypto (@NFAdotcrypto) October 26, 2022

— Solemlyswear ⭕🅧 (@solemly_swear) October 27, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.