Mooners and Shakers: Bitcoin opens week below $30k; PlanB thinks April 2021 was peak of bull market

Getty Images

It’d be fine if this ages like milk but it’s not an overly solid opening to the week for Bitcoin. If things keep tracking this way, BTC might be resembling Marcus Harris’s Test batting average pretty soon. (Caveat: but literally times 1,000.)

Meanwhile, altcoins are bathed in more blood than 11 seasons of The Walking Dead plus spin-offs, and another algorithmic stablecoin has just lost its US dollar pegging.

Any reasons to be crypto cheerful? Of course there are. Although it all depends on which timeframe you’re working towards.

How about the short term? Here’s an interesting Bitcoin trader’s take just now, which sounds pretty dicey if you’re an overexposed HODLer with a heart condition…

Probably 1 candle to 39/40 k

Then resumé the doom#btc https://t.co/05YURwqjv0

— WIZZ🥷 ( beware scammers ) (@CryptoWizardd) May 16, 2022

Let’s dive into today’s action…

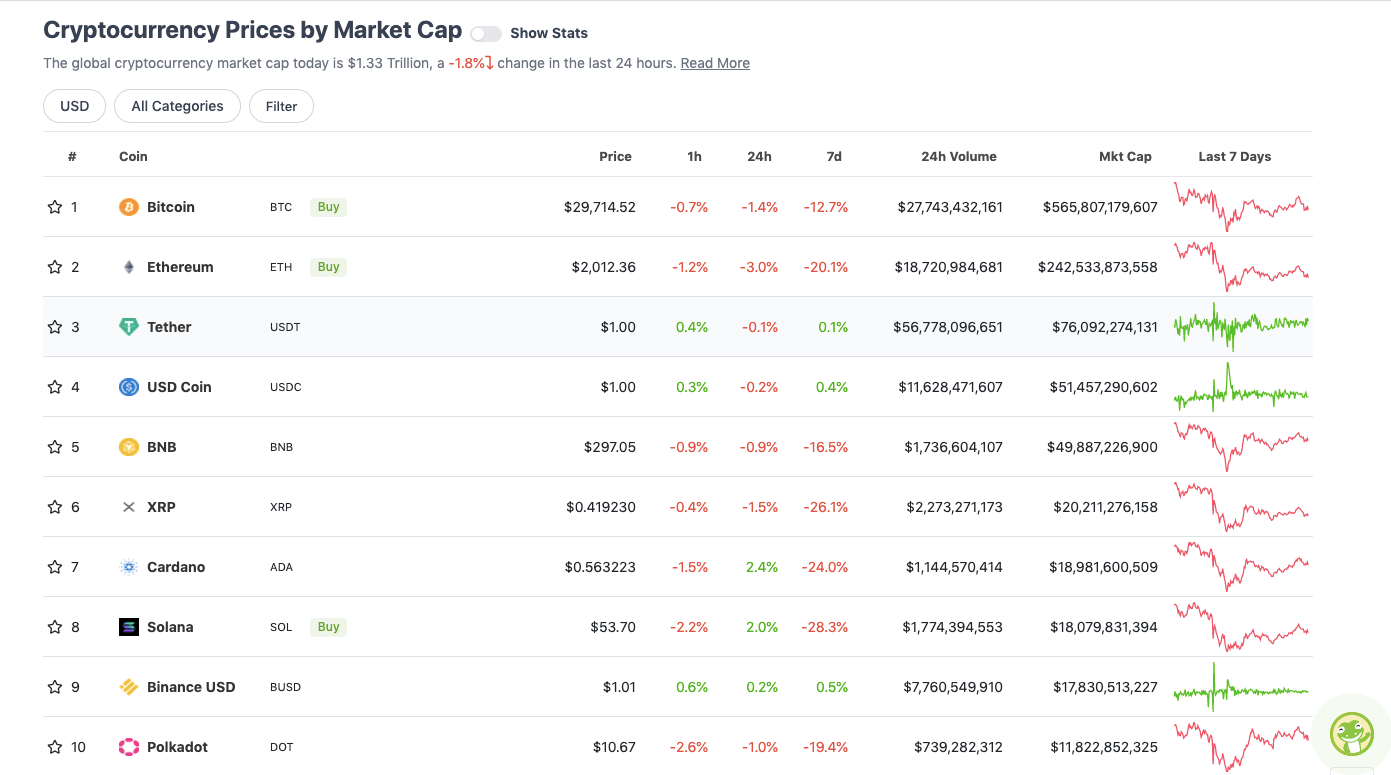

Top 10 overview

With the overall crypto market cap at roughly US$1.33 trillion, down 1.8% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

After a relatively brief frisson above US$31k on Sunday to close out the week, Bitcoin has currently lost its $30k “peg” again, to borrow the most overused word in crypto at the moment.

And that’s a level proving pretty hard to crack and sustain right now. Still, according to PlanB, one of the most famous anonymous analysts in the crypto space, the Bitcoin-led bull run is in the middle of “creating a bottom”.

The creator of the now much-maligned Bitcoin Stock to Flow (s2F) model is of the belief we are a lot further into the bear market than perhaps a lot of people realise, suggesting the peak of the most recent bull run was actually more than a year ago, back in April 2021.

And that’s despite the BTC price actually reaching an all-time high of about US$69k in November.

Dec 2021 I was still hoping for a 2nd leg of the bull market. But in Q1 2022 it became clear that this bitcoin bull market was over. We entered a bear market since Apr 2021 peak (yes ATH was Nov 2021). Now we are creating a bottom. Then a new bull market will start. BTC cycles. pic.twitter.com/cPpAnNCklx

— PlanB (@100trillionUSD) May 16, 2022

It’s a theory that on-chain and Bitcoin cycle analyst “The Rational Root” agrees with, broken down in depth in a tweet thread (see below). A few of his points…

• The first peak of 2021 has “an enormous increase in short-term holder supply while the second has none”.

• The RSI (relative strength index) peaked in April 2021, and is now reaching what might be considered lows – a sign of potentially bottoming out.

• Bitcoin has been showing clear signs of consolidation for more than a year, “increasing our chances that a bottom is near”.

2/8 I've been posting charts comparing the #Bitcoin cycles aligned by ATH's using the April 2021 top and get obviously many comments saying that "November is the ATH".

Although a case could be made to use November, in this thread I'll explain why I believe April might be better. pic.twitter.com/XZeHWHzkNq— Root 🥕 (@therationalroot) May 13, 2022

Still, a timely reminder below, from nuclear-engineer-turned-crypto-head Benjamin Cowen. Take any calls that predict the exact BTC bottom… with more grains of salt than the Dead Sea.

Do not get suckered into thinking you know (or anyone else for that matter) knows where the exact bottom is for #Bitcoin.

— Benjamin Cowen (@intocryptoverse) May 16, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$11.6 billion to about US$576 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Chain (XCN), (market cap: US$1.73 billion) 12%

• Kusama (KSM), (market cap: US$704 million) 9%

• eCash (XEC), (market cap: US$889 million) 7%

• Synthetix (SNX), (market cap: US$641 million) 5%

• Monero (XMR), (market cap: US$3 billion) 3%

DAILY SLUMPERS

• TerraUSD (UST), (mc: US$664 million) -62% ($0.06)

• Terra (LUNA), (mc: US$877 million) -45%

• Arweave (AR), (mc: US$817 million) -11%

• The Graph (GRT), (mc: US$1.23 billion) -11%

• Dash (DASH), (mc: US$604 million) -7%

Uppers and downers: lower caps

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• Beefy.Finance (BIFI), (market cap: US$64 million) +72%

• Gains Network (GNS), (mc: US$26m) +44%

• Ampleforth Gevernance Token (FORTH), (mc: US$36m) +34%

• Clover Finance (CLV), (mc: US$49m) +28%

• Orchid Protocol (OXT), (mc: US$97m) +24%

DAILY SLUMPERS

• DEI (DEI), (mc: US$58m) -33%

• Anchor Protocol (ANC), (mc: US$43m) -33%

• Efinity (EFI), (mc: US$72m) -18%

• DEUS Finance (DEUS), (mc: US$22m) -12%

• Wilder World (WILD), (mc: US$30m) -11%

Another “stable”coin, Deus Finance’s DEI, has lost its peg to the US dollar, as of Sunday. It seems Terra’s UST has begun an unfortunate trend.

DEI, is a Fantom-ecosystem stablecoin that maintains its peg in a system that adjusts its collateral ratio via arbitrage bots that continually trade US$1 worth of underlying tokens for 1 DEI.

It’s another interesting idea, and that’s nowhere near the half of it. You’ll get a better idea of it here… before likely thanking yourself for keeping your powder dry in a centralised, fiat-backed stablecoin such as USDC instead.

Now algorithmic stablecoin $DEI is depegging. Stay safe guyz pic.twitter.com/pYC2j66TKG

— Ash Crypto (@Ashcryptoreal) May 16, 2022

Around the blocks

As charts watcher/analyst Justin Bennett notes, Bitcoin is now on a seven-week losing streak. That’s apparently a record for the most sustained week-by-week downtrend. What goes down, must go up?

$BTC has had seven 7 consecutive red weeks.

6 was a record, and 7 broke that record.

But 8…?

Shorts are asking to get burned. 🔥 pic.twitter.com/df48gxAirV

— Justin Bennett (@JustinBennettFX) May 16, 2022

U.S. MARKETS COULD IMPROVE "SIGNIFICANTLY" IN THE SUMMER, AFTER FED'S QT HAS STARTED – BLACKROCK'S RIEDER

AT LEAST 90% OF THIS YEAR'S MOVE IN U.S. RATES ALREADY HAPPENED – RIEDER

— FTX Access (@FTX_Access) May 16, 2022

I will ensure this tweet ages terribly. See you in 6 months.

— Kieran.eth (@KieranWarwick) May 16, 2022

There’s been a bit of a furore (when isn’t there in crypto?) around a few comments made by a prominent figure in the space. The CEO and founder of the FTX crypto exchange, Sam Bankman-Fried told the Financial Times on Monday that he believes Bitcoin is not a suitable payments network, or an effective scaling network.

More specifically, “SBF” thinks Bitcoin’s mining-based Proof of Work network isn’t set up to handle millions of transactions.

Naturally, this went down like an algo stablecoin in an NFT of a lead zeppelin with certain sections of the Bitcoin faithful… particularly those building BTC Lightning Network payments solutions. Such as Jack Dorsey’s CashApp, for example…

and you didn't bring up Lightning because…?

— jack (@jack) May 16, 2022

I asked him on stage at the Bitcoin conference in El Salvador last year and he refused to say the words ‘bitcoin’ or ‘Lightning’ and would instead answer with ‘crypto’ every time pic.twitter.com/ZEtJ34wUyb

— Stacy Herbert 🇸🇻🚀 (@stacyherbert) May 16, 2022

Just sort it out would ya, crypto? There’s surely still room for all – Bitcoin maxis, Solana-spruiking billionaires and risky AF algo stablecoins alike… right?

Do kwon to all the $LUNA holders pic.twitter.com/YIeA3LsbeQ

— Ash Crypto (@Ashcryptoreal) May 16, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.