Mooners and Shakers: Bitcoin meets resistance at US$45k; Avalanche leads top coin gainers

Pic: Getty

Bitcoin powered to nearly US$45k earlier, before running out of gas and retreating to a plateau around US$43.5k, where it’s been hanging out for much of the past 24 hours.

It would seem US$45k (although some analysts are saying $45.5k) is a crucial barrier to bust to take a shot at sustained upwards momentum.

All the while, Moscow’s invasion of Ukraine and noose tightening around Kyiv provides a particularly sobering background to the world of trading and investing, crypto included.

How that story plays out will surely continue to shape the direction of the financial markets, especially as it has the potential to inform the US Federal Reserve’s interest-rate-hike moves.

While its run up may be showing signs of cooling at the time of writing, Bitcoin is still up about 18 per cent from where it was this time last week. Popular (per Twitter followers) US traders “Cantering Clark” and “John Wick” shared these bull-case tweets earlier…

Bitcoin since weaponized finance began with Russia.

Compared to the S&P ($ES), Crude, Dollar, and Gold. pic.twitter.com/zXTHaAUByR

— HORSE (@TheFlowHorse) March 1, 2022

Wouldn’t*

— Wick (@ZeroHedge_) March 1, 2022

While Dutch trader Michaël van de Poppe was circumspect…

Slightly favoring the odds of a correction on #Bitcoin here after this fake-out up and a pretty deep wick.

If $43.5-43.7K is lost, I think we'll see $42K.

— Michaël van de Poppe (@CryptoMichNL) March 1, 2022

… as was CryptoCapo, who highlighted a sharp spike in crypto market sentiment over the past day…

From 20 to 51 in one day. Why so bullish below resistance? pic.twitter.com/RfavRm61Up

— il Capo Of Crypto (@CryptoCapo_) March 1, 2022

The forthright trader/analyst “Roman”, however, was leaning bearish once again a few hours back, citing low momentum on price action…

$BTC Daily

Something I've been paying attention to is Price Action. The Daily is not showing momentum strength as price action is leaning bearish.

Looking to take profits today if 45k isn't broken.#bitcoin #cryptocurrency #cryptotrading #cryptonews pic.twitter.com/dyxwnUPbN0

— Roman (@Roman_Trading) March 1, 2022

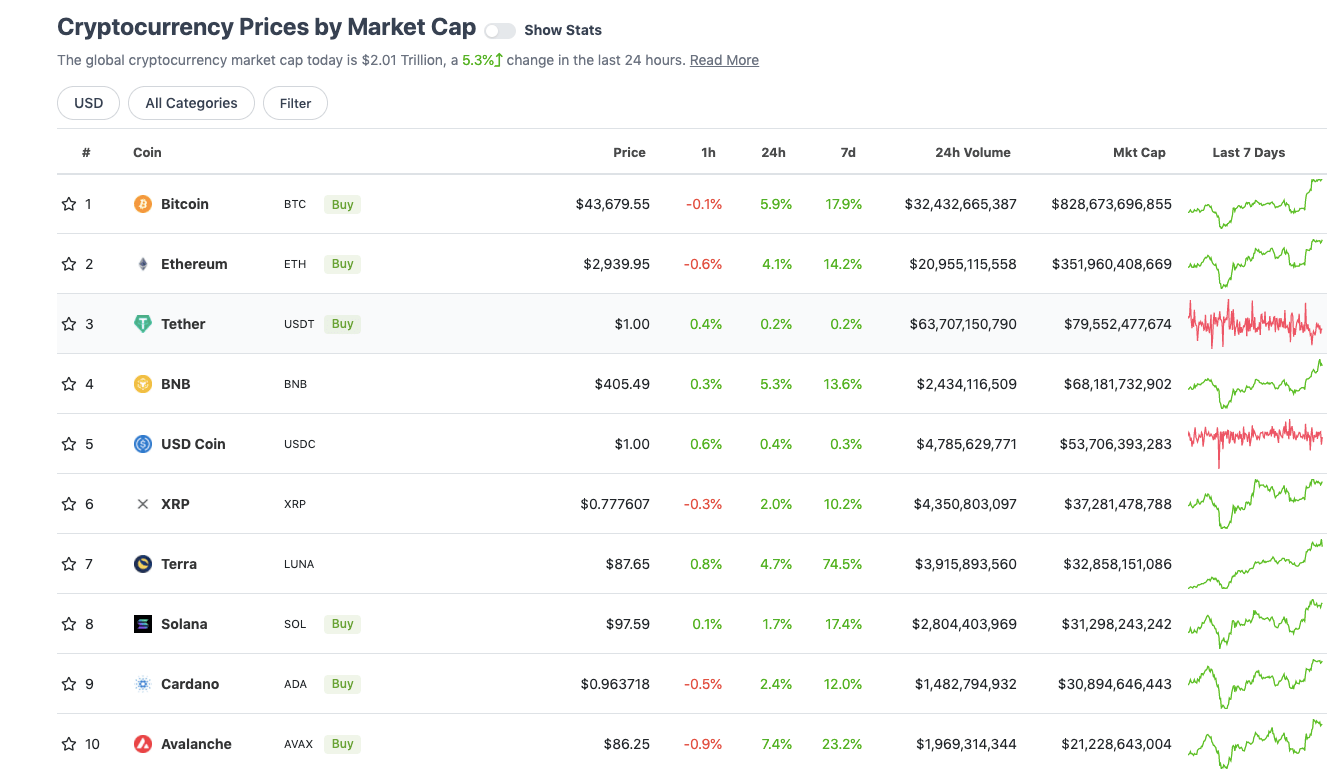

Top 10 overview

With the overall crypto market cap just cracking US$2 trillion and up 5.3% over the past day, here’s the state of play in the top 10 tokens right now – according to CoinGecko.

Aside from layer 1 protocol Avalanche (AVAX) in the 10th position (+7.4%), Bitcoin (BTC) is showing the way among the leading market-cap daily gainers.

Avalanche gained no small amount of traction in the crypto industry last year, fuelled by its mission of empowering an ecosystem of DeFi and gaming projects with high speed and scalability. It’s a similar narrative to the one most Ethereum competitors are pushing, including the Solana (SOL) blockchain.

The upcoming open-world RPG Ascenders, built on Avalanche, looks like it might be another crypto “triple-A” contender to watch. Admittedly, that comment is completely based on the gameplay footage below and very little else at this stage. But perhaps we’ll look into it more deeply when we next dive into an ever-widening pool of promising GameFi projects.

Will you… ascend? 🚀https://t.co/jjVrsIOmEG pic.twitter.com/HQvJOp9KSM

— Ascenders ⚔️ (@PlayAscenders) February 28, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$20.3 billion to about US$952 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Waves (WAVES), (market cap: US$1.8 billion) +43%

• THORChain (RUNE), (mc: US$1.45b) +30%

• Near (NEAR), (mc: US$7.35b) +26%

• NEO (NEO), (mc: US$1.7b) +14%

• Axie Infinity (AXS), (mc: US$4.15b) +13%

DAILY SLUMPERS

• Radix (XRD), (market cap: US$1.46 billion) -4%

• LEO Token (LEO), (mc: US$5.6m) -2%

• Filecoin (FIL), (mc: US$3.5b) -1%

• Uniswap (UNI), (mc: US$4.6b) -0.5%

• Bitcoin Cash (BCH), (mc: US$6.5b) -0.5%

Uppers and downers: lower cap

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• UMA (UMA), (market cap: US$740m) +125%

• Bitcoin Standard Hashrate Token (BTCST), (mc: US$170m) +54%

• Silo Finance (SILO), (mc: US$38m) +33%

• Lisk (LSK), (mc: US$305m) +26%

• ShibaDoge (SHIBDOGE), (mc: US$19m) +24%

DAILY SLUMPERS

• Tracer DAO (TCR), (market cap: US$30 million) -16%

• BlockWallet (BLANK), (mc: US$14m) -12%

• Dock (DOCK), (mc: US$70m) -12%

• Songbird (SGB), (mc: US$662m) -11%

• Victoria VR (VR), (mc: US$132m) -11%

Final words

Predictably, the Democratic US senator Elizabeth Warren today tweeted about crypto being a possible way for Putin and pals to get around the financial sanctions imposed by several leading nations. The only surprise there is that it’s taken this long for the serial crypto sceptic to convey those thoughts.

Several Bitcoin and crypto advocates quickly responded to the senator, including US lawyer Jason Gottlieb…

Dear @SenWarren: I am generally a fan of yours. I am a liberal progressive and support many of the same things you do. But you are absolutely wrong on crypto, and specifically wrong about this issue. Please let me explain: (1/) https://t.co/hHETWO2zan

— Jason Gottlieb (@ohaiom) March 1, 2022

“Crypto – for all its flaws and issues – lets people maintain their own independent stores of value,” wrote Gottlieb. “Yes, it’s susceptible to market see-sawing. But it’s not affected by the rouble collapse, or closing of (say) Sberbank ATMs …

“Fundamentally, crypto frees people from corrupt, evil, or incompetent intermediaries who can cancel their money at any time. It puts financial power back into the hands of individuals, and out of the hands of the elites and banks…

“Isn’t that one of the big goals of progressive financial policy? That, in a nutshell, is the progressive case for crypto.”

The Human Rights Foundation’s Alex Gladstein also weighed in with the following…

No, Bitcoin *undermines* Putin’s plans to isolate, repress, and plunder the Russian people.

It gives them a way out.

Do not allow confused, pro-surveillance and control politicians to tell you otherwise. https://t.co/qjYya7nJ3t

— Alex Gladstein 🌋 ⚡ (@gladstein) February 28, 2022

For everyone darkly muttering about Russia and Bitcoin, I'll remind you that according to Chainalysis, Ukraine had the 4th-highest per-capita crypto adoption in the world in 2021https://t.co/qsLxKWokTG pic.twitter.com/TkKdVBmE5o

— nic carter (@nic__carter) March 1, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.