Mooners and Shakers: Bitcoin kicks off week in green as relief rally whispers do the rounds

HODLing onto that green feeling (Getty Images)

After closing out Sunday as a record nine-week loser, Bitcoin’s had a cortisone injection and is back on the paddock, running the ball up the guts and pretending everything’s just fine.

Prevailing macro conditions (Fed’s rate hiking, war, potential recession) would suggest things are far from fine, but zooming in, what we’re seeing today is a fair amount of chatter regarding an impending relief rally.

And while citing crypto YouTubers needs a grain of salt, various prominent ones – Benjamin Cowen, Lark Davis and Crypto Zombie, for example – have posted videos today pointing to the possibility of a relieving run for the market, with somewhere between US$37k and US$38k seen as a potential checkpoint but likely strong area of resistance.

All three note the RSI (relative-strength index momentum indicator) is sitting extremely low right now, lower than where it touched during the Covid crash of March 2020 and “screaming for a bounce”.

#Bitcoin finally bouncing! Can we trust it?

THIS could be the absolute key for $BTC right now…

BEWARE! It could be as short as three months until THIS breaks!! Will FED back down and cause #BTC to surge?! 🚀

***WATCH NOW***

📺👉 https://t.co/QCAUYcsbcS 👈👀

***NEW VIDEO*** pic.twitter.com/FSTQfPesgJ— Crypto Zombie (@TheCryptoZombie) May 30, 2022

As Zombie points out, it’s a public holiday in the US today (Memorial Day), so slick-haired traders are enjoying quality time throwing cash off yachts, returning some videotapes and other Wall Street film-based tropes.

Friday, though – the last time they were in action – saw a nice daily bounce on the S&P 500 (2.47%) and Nasdaq (3.3%), while the US Dollar (DXY) slumped a little further. These are conditions conducive to better crypto prices – so perhaps today we’re seeing a delayed, positively correlated reaction to the mini surge in stocks.

Top 10 overview

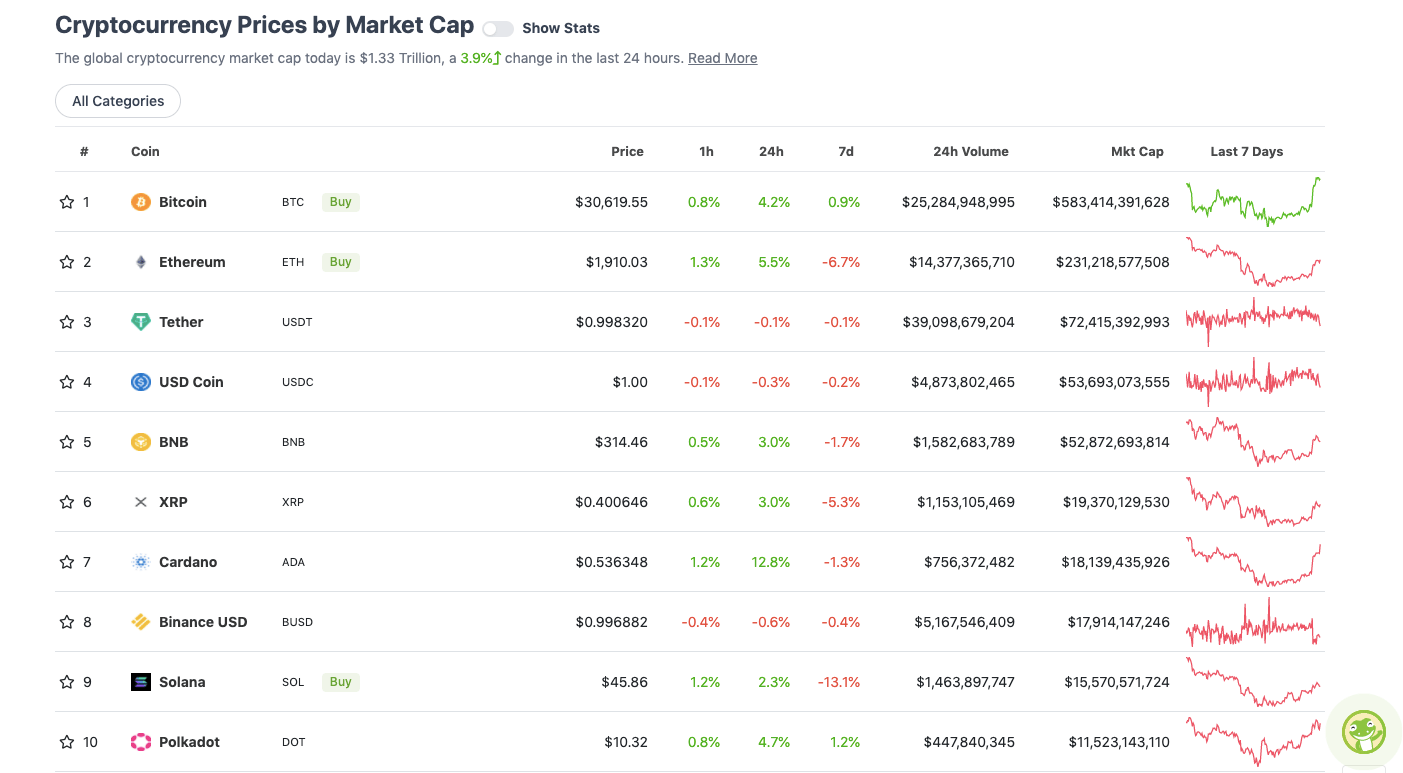

With the overall crypto market cap at roughly US$1.33 trillion, up 3.9% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Crypto “blue chips” Bitcoin (BTC) and Ethereum (ETH) are showing the way in the top 10 today, although Ethereum layer 1 rival Cardano (ADA), which has been punished recently, is taking that ball and running with it (+12.8%).

ADA is still down 11% over the past fortnight and 33% over the past month, so some say it was due a bounce.

$ADA is Bottomed out & Ready to Bounce Back..!!#Crypto #ADA #Cardano #CardanoADA pic.twitter.com/ASap6fxIpG

— Captain Faibik 🐺 (@CryptoFaibik) May 30, 2022

As for Bitcoin, popular Twitter-based analyst Rekt Capital has a thought or two in his latest newsletter about where to buy the OG asset. TLDR: kinda now, really, with caveats.

By his calculations, and based on historical precedents, BTC might not be truly bottoming out until later in the year, perhaps between August and November. That said, while it remains below its 20-month moving average, which is at about US$41k, he says Bitcoin is of interest to him as a buying opportunity, to layer into over time.

“Whatever BTC does below the 20-Month MA is of interest to me in terms of my dollar-cost-averaging strategy but I’m not interested in catching the absolute bottom,” wrote the analyst, adding:

“Bitcoin is already in a period that has historically produced outsized ROI for long-term investors.”

I've just published "Where Am I Buying #BTC?"

Checkout my recent newsletter to learn more about my personal buying strategy for #Bitcoin

Read here:https://t.co/XuCrhItY2v$BTC #Crypto

— Rekt Capital (@rektcapital) May 30, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$11.3 billion to about US$539 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Terra Luna Classic (LUNC), (mc: US$814 million) +69%

• Waves (WAVES), (market cap: US$573 million) +34%

• Helium (HNT), (mc: US$868 million) 24%

• THORChain (RUNE), (mc: US$934.5 million) 16%

• Synthetix (SNX), (mc: US$655 million) 15%

DAILY SLUMPERS

• Everdome (DOME), (mc: US$609 million) -10%

• Chain (XCN), (mc: US$2.8 billion) -4%

• NEXO (NEXO), (market cap: US$688 million) -1%

Uppers and downers: lower caps

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• Kripto (KRIPTO), (market cap: US$20.8 million) +121%

• Bella Protocol (BEL), (mc: US$65m) +66%

• Reserve Rights (RSR), (mc: US$145m) +53%

• OriginTrail (TRAC), (mc: US$124m) +20%

• Immutable X (IMX), (mc: US$265m) +20%

DAILY SLUMPERS

• Kylin (KYL), (market cap: US$6.7m) -12%

• XCAD (XCAD), (mc: US$90m) -7%

• Augur (REP), (mc: US$84.5m) -5%

• Persistence (XPRT), (mc: US$151.7m) -4%

• Orion Protocol (ORN), (mc: US$50m) -3%

Around the blocks

Blockchain Australia’s Steve Vallas, who earlier gave Stockhead his perspective on the crypto-regulation state of play under the new Labor government, thinks Twitter is “the firehose” of information in the crypto space.

ngmi

— chloe white (@ChloeWhiteAus) May 30, 2022

And seeing as that’s exactly where we source most of our info for this little segment, we tend to agree.

JPMorgan in 2017: "#Bitcoin is a fraud that will eventually blow up"

JPMorgan in 2022: "#Bitcoin is now our preferred alternative asset"

— Kyle Chassé / DD🐸 (@kyle_chasse) May 30, 2022

https://twitter.com/timoshisuen/status/1531167254746120193

— Toon (@ToonCrypto) May 30, 2022

One for the Bitcoin maxis here…

#Bitcoin will recover.

Everything else though… 😂 pic.twitter.com/2GQy1LM8hb— Bitcoin Archive (@BTC_Archive) May 29, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.