You might be interested in

Coinhead

Where to for crypto in 2025?

| Kraken

Coinhead

If Bitcoin’s good enough for AMP then should you get into it?

Coinhead

Coinhead

Tap, tap, tap. Bitcoin is still trapped just under the $25k-level ice. Will it break out? That’s the question. Meanwhile, Hong Kong regulators have provided the market with a hefty hit of hopium.

While US regulators, okay – namely Gary “I AM the Law Round These Parts” Gensler – seem to be on a crypto-innovation-stifling mission at the moment, it appears Hong Kong is looking to embrace digital asset trading with comparatively open arms.

Overnight, AEDT, Hong Kong’s regulators the SFC proposed a set of rules that would let retail investors – in other words plebs like you and me – trade certain “large-cap tokens” on licensed exchanges.

Sorry, DogeBonk fans, but you’ll probably have to look elsewhere for now, as the tokens alluded to probably mean the likes of Bitcoin and Ethereum.

Still, this is potentially great news for further global expansion of the asset class considering Hong Kong’s power as a financial centre throughout Asia and its obvs close ties with a rather large and influential mainland superpower just near it.

Animoca Brands CEO Yat Siu likes it…

#hongkong plans to let retail trade #crypto in a newly released consultation paper. Excited about how #hk #asia will drive broader #web3 #NFTs and #blockchain #digitalpropertyrights adoption https://t.co/ULJ7MN0ho3

— Yat Siu (@ysiu) February 20, 2023

And this news follows revelations earlier in February that the finance powerhouse would soon be allowing accredited institutional investors to obtain crypto licences.

There are even reports and rumours that the move to relax crypto-trading laws in Hong Kong could be a harbinger for things to come in China, with the island nation potentially acting as something of a blockchain/crypto testing ground for the CCP.

That‘s probably a hopium hit too far for the moment. But, as TechCrunch noted, with money and talent pouring into the Web3 space, “it’s hard to imagine Beijing sitting still while the rest of the world works on the building blocks that some argue would spark a new wave of innovation as big as the current internet itself.”

In any case, it’s part of what appears to have sparked a new mini-narrative – “Chinese coins”, as we mentioned yesterday.

How are some of those going? Filecoin (FIL) has actually pulled back a tad but is still up roughly 70% over the past week. Conflux (CFX), meanwhile, which is China’s only public blockchain and recently signed a big partnership with China Telecom, is up close to 1,000% over the past month.

It was probs a wise choice for Conflux to avoid the CON ticker, by the way. Which reminds me of the time a, erm, friend invested in something called Confido back in 2017. Yep, $200 well spent. The founders rug pulled with a dick pic on Telegram or Reddit from memory. Valuable due-diligence lesson learnt.

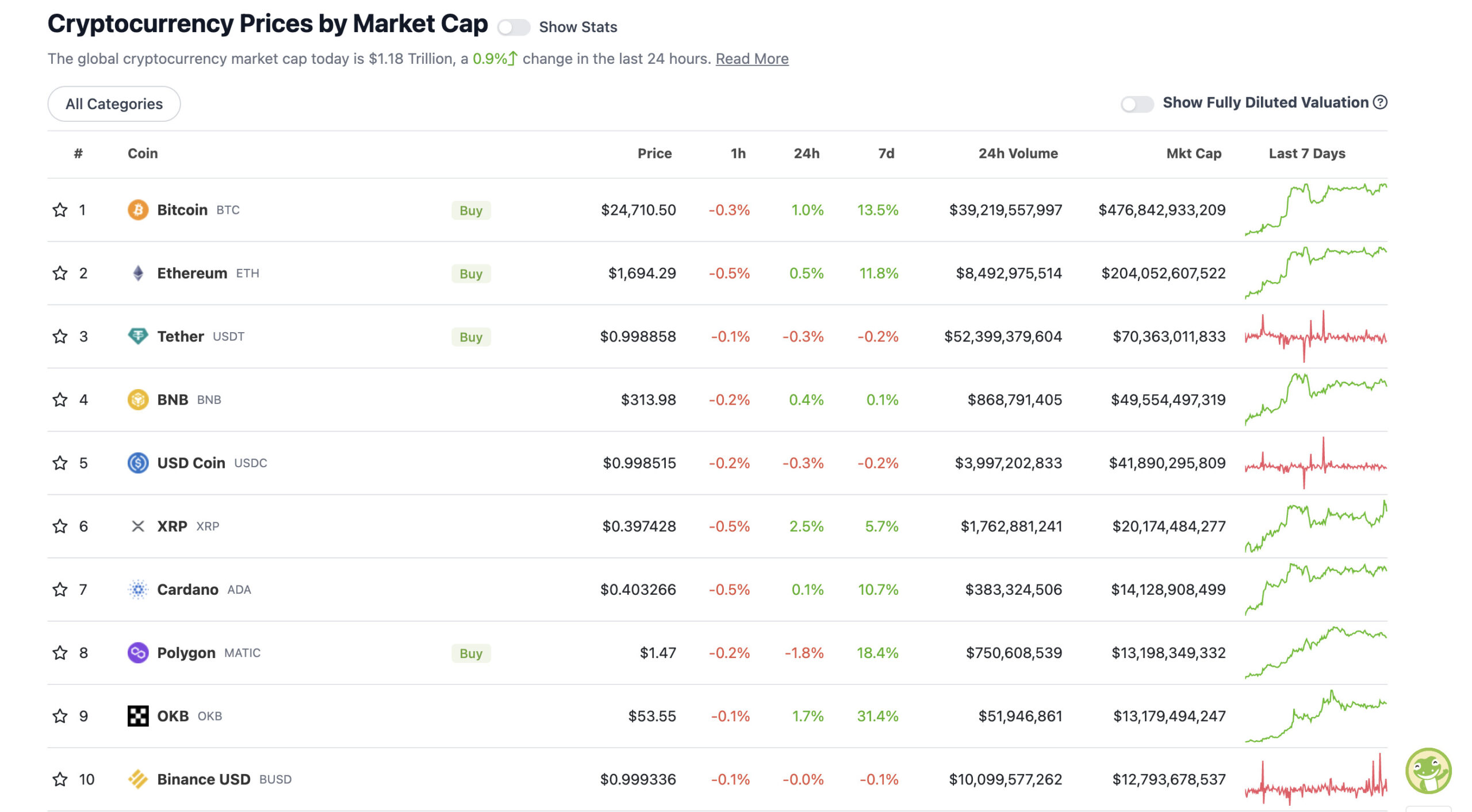

With the overall crypto market cap at US$1.18 trillion, up about a percentage point since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Well, Bitcoin (BTC) did poke its head, AGAIN, very briefly above the fabled US$25k mark last night, only to sink back down into teaser territory. Guess it’s just biding its time.

Look, no rush, BTC, but if you wouldn’t mind engaging one of your trademark mega-pumps so all these speculative altcoins we’ve invested in can 10x… that’d be great. (Definitely not anything remotely resembling financial advice.)

That US$25k mark, though. Just above it, according to various chartists and analysts, lies a rather important level – the 200-week simple moving average – which, in much of Bitcoin’s history has acted as a level of strong support, but is currently proving to be resistance.

It’s crucial to reclaim that level, according to the likes of Rekt Capital, Lark Davis and others, and then maybe, just maybe… nope, not even going to jinx it.

Sweeping a market-cap range of about US$12 billion to about US$493 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• NEO (NEO), (market cap: US$1.02 billion) +38%

• Conflux (CFX), (mc: US$614 million) +33%

• WEMIX (WEMIX), (mc: US$587 million) +23%

• Huobi (HT), (mc: US$1 billion) +18%

• VeChain (VET), (mc: US$2.3 billion) +9%

Guess where most of the main pumpers today have ties to? That’s right, China. Or at least, in WEMIX’s case, Asia. And here’s the Justin Sun-invested Huobi exchange, with news that it’s “stoked” about Hong Kong potentially becoming a crypto hub…

Exciting news! Huobi is stoked about Hong Kong's pro-crypto policies & we're working hard to secure our crypto license there. Our aim is to be one of the first fully compliant exchanges in HK & collaborate with our Asia-Pacific users to drive digital asset growth! #Huobi #Crypto pic.twitter.com/ktZw1WE2cs

— HTX (@HTX_Global) February 20, 2023

DAILY SLUMPERS

• Filecoin (FIL), (market cap: US$3.3 billion) -3%

• Rocket Pool (RPL), (mc: US$956 million) -3%

• Klaytn (KLAY), (mc: US$1 billion) -3%

• Fantom (FTM), (mc: US$1.42 billion) -2%

• Litecoin (LTC), (mc: US$6.9 billion) -2%

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Dutch crypto trader and chart watcher Michaël van de Poppe has an ambitious plan for the months ahead…

Corrections remain to be relatively shallow.

I think that we'll continue the run towards $35-40K before we'll have a harsh correction, maybe even to $20-25K.

Maximize profits, start allocating towards $USDT the higher we come, buy on the correction in second half of 2023.

— Michaël van de Poppe (@CryptoMichNL) February 20, 2023

Meanehile, “Dave the Wave” reckons if we’re not looking, BTC can get big, fast…

A #btc risk to the upside. Number can get big fast… pic.twitter.com/QADPx6UtL6

— dave the wave🌊🌓 (@davthewave) February 18, 2023

Lastly, a bit more speculation for you based around the Chinese economy-opening narrative. Here’s Gemini twin Cameron Winklevoss…

My working thesis atm is that the next bull run is going to start in the East. It will be a humbling reminder that crypto is a global asset class and that the West, really the US, always only ever had two options: embrace it or be left behind. It can't be stopped. That we know.

— Cameron Winklevoss (@cameron) February 19, 2023

And Coinbase CEO Brian Armstrong talking up crypto as a global hub. Got that, Americans?

America risks losing it's status as a financial hub long term, with no clear regs on crypto, and a hostile environment from regulators.

Congress should act soon to pass clear legislation. Crypto is open to everyone in the world and others are leading. The EU, the UK, and now HK. https://t.co/i9WeUZ7K6H

— Brian Armstrong (@brian_armstrong) February 16, 2023

For more:https://t.co/J5JnKx9oGw

— ted (@tedtalksmacro) February 20, 2023

Maybe what America needs is a bit of Dutch courage, Churchill style.

https://twitter.com/fasc1nate/status/1627466674235473921