Mooners and Shakers: Bitcoin investment products see outflows, but beware the crypto ‘bottom vultures’

Pic via Getty Images

So then, how did Bitcoin fare on the dreaded weekly close? Are we all DOOMED? Actually, it’s holding up pretty… okay just for the moment.

Are the bears right, though, is a dip to US$20k or worse inevitable? The hawkish Fed and China’s economic wobbles are hardly helping matters much.

Then there’s the news Ethereum co-founder Vitalik Buterin has sent US$1m of his ETH to the exchange Coinbase, causing the odd tremor, plus data from CoinShares detailing hefty digital asset product outflows all of a sudden.

On the latter point, CoinShares, a prominent European-based digital investment manager, sent Stockhead its latest Digital Asset Fund Flows Report this morning, and its takeaway is that disappointment from the SEC’s delays on BTC ETFs have impacted sentiment.

This week in Fund Flows by @CoinSharesCo Head of Research @jbutterfill:

Digital asset investment products saw outflows totalling US$55m — we believe this is in reaction to recent media highlighting that a decision by the US Securities & Exchange Commission to authorise a US… pic.twitter.com/Ecxx3GeZkR

— CoinShares (@CoinSharesCo) August 21, 2023

Clarifying further, the following highlights from the CoinShares report, which tracks the previous week’s data, show that:

- Digital asset investment products saw outflows totalling US$55m.

- Bitcoin saw outflows totalling US$42m, reversing the inflows seen the prior week, while short-bitcoin saw outflows for almost the 17th consecutive week.

- Ethereum saw US$9m outflows, while Polygon, Litecoin and Polkadot also saw outflows of US$0.9m, US$0.6m and US$0.5m respectively.

Vitalik sends ETH to Coinbase, sending cryptoverse into panic

Well, the Vitalik Buterin-induced “panic” aspect is an overstatement, but it made for an eye-grabbing subhead, right?

The crypto analyst and influencer known as “Wendy O” actually had the best non-panicky take on the alien-like Ethereum co-founding genius’s transaction of 600 ETH to the Coinbase exchange – something that might be construed as a bearish, “sell, sell, sell!” sign.

Wendy O told Coindesk in a panel discussion on the subject that Buterin’s transaction “was literally just $1 million, it’s really not a lot of money, especially when you’re looking at crypto whale wallets… I don’t think it’s a big deal that he’s moved this amount… and maybe he wanted to bridge the funds over to Base [the exchange’s new layer 2 platform].”

Vitalik Buterin Just Sent $1M #ethereum to Coinbase

STEADY LADS WE ARE GOING TO ZERO https://t.co/JJWUavtvRl

— Wendy O (@CryptoWendyO) August 21, 2023

Meanwhile… ‘be wary of bottom vultures’

With all the bearish sentiment suddenly flooding the crypto social space again, the following take –from notable VC investor Chris Burniske – stood out to us…

While 2019 is useful context, I don’t think $BTC, $ETH and $SOL make new lows in ‘23 — 2022 was the low imo.

That doesn’t mean we don’t take a punch, but if right, it means the long term uptrend will continue into ‘24 & ‘25 — be wary of bottom vultures that’ll never buy.

— Chris Burniske (@cburniske) August 21, 2023

Major crypto assets Bitcoin, Ethereum and Solana have gone about as low as they’re going to this year, in the former ARK Invest exec’s opinion.

He also noted this, in a separate post…

To pull us from the depths of last bear, DeFi games were built to get the apes aping. It follows that social games, like FT, are the catalyst for the apes this cycle.

Apes always ape first — then, the rest of society comes later as follower apps clean up the experience.

— Chris Burniske (@cburniske) August 21, 2023

With “FT” he’s referencing the buzzy Friend.Tech web3 social application built on Coinbase’s Ethereum layer-2 chain Base, citing it as potential bullish spark, or at least an example of a possible catalyst.

Incoming: Another thread @friendtech 🫨

Instead of writing the 34214th explainer thread, I want to share 4 lesser-known things about Friend Tech.

This will help you better understand how it works, what to expect, and why it has generated so much buzz 👇 pic.twitter.com/QzzRhzZfES

— Matt Willemsen (@matt_willemsen) August 22, 2023

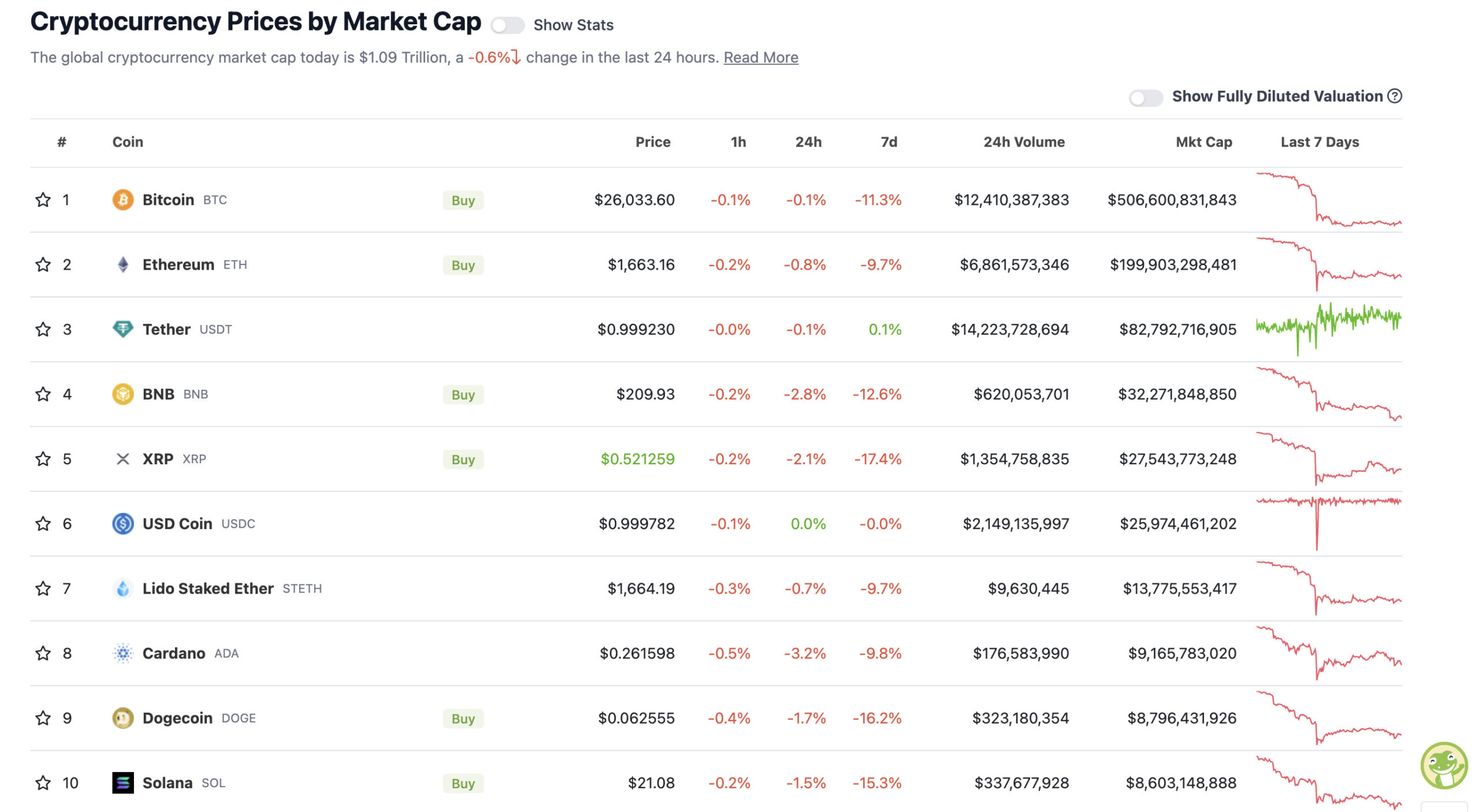

Top 10 overview

With the overall crypto market cap at US$1.09 trillion, pretty flat since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Some potentially encouraging thoughts here from a couple of popular crypto traders on Bitcoin’s price action and ability to hang in there (for now)…

New #BTC Weekly Close has occurred above ~$26,000

Which means that the $BTC Double Top has NOT confirmed breakdown continuation#Crypto #Bitcoin

— Rekt Capital (@rektcapital) August 21, 2023

$BTC H4

More or less the same as yesterdays update. Bear flagging for a bit lower before potential reversal.

The area I’m looking for longs would be 24.5-25.5. Again LOOKING does not mean TAKING.

We wait for setups. Patience#bitcoin #cryptocurrency #cryptotrading #cryptonews pic.twitter.com/uMhlS8nJHQ

— Roman (@Roman_Trading) August 21, 2023

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Rollbit Coin (RLB), (market cap: US$517 million) +11%

• Optimism (OP), (market cap: US$1.09 billion) +5%

• Litecoin (LTC), (market cap: US$4.92 billion) +2%

• Monero (XMR), (market cap: US$2.71 billion) +2%

• Ethereum Classic (ETC), (market cap: US$2.24 billion) +2%

SLUMPERS

• FLEX Coin (FLEX), (market cap: US$555 million) -7%

• XDC Network (XDC), (market cap: US$773 million) -6%

• Sui (SUI), (market cap: US$372 million) -5%

• Avalanche (AVAX), (market cap: US$3.46 billion) -4%

• Shiba Inu (SHIB), (market cap: US$4.68 billion) -4%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

#Bitcoin Daily RSI is now the most oversold since the Covid Crash in March 2020. pic.twitter.com/OULTwMFl2A

— Bitcoin Archive (@BTC_Archive) August 21, 2023

Printers will go brrrr again… pic.twitter.com/t1k27MJcfz

— Lark Davis (@TheCryptoLark) August 21, 2023

NEW – Leading Argentine presidential candidate Javier Milei spotted with The Philosophy of #Bitcoin book 👀

We are winning 🇦🇷 pic.twitter.com/Pug1y2HFER

— Bitcoin Magazine (@BitcoinMagazine) August 21, 2023

Finally, “better off embracing it”, eh, Pomp? Not so sure about this specific case…

Better, cheaper haircuts are coming to a barber shop near you.

Fighting technological progress is a losing strategy, so you are better off embracing it.pic.twitter.com/8bYVnlR6HG

— Anthony Pompliano 🌪 (@APompliano) August 20, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.