Mooners and Shakers: Bitcoin in danger of losing $20k on hump day as whales send coins to exchanges

Humpback day for the crypto market. (Getty Images)

Mooners and Shakers is sponsored by Dacxi, the world’s first purpose-built Crypto Wealth platform.

Bitcoin and most altcoins have cooled again since yesterday’s small bounce, but the crypto market is generally plodding along okay for the moment. If you think BTC barely clinging to US$20k is “okay”, that is.

To quote Marsellus Wallace in Pulp Fiction, this level was feeling “pretty f**kin’ far from okay” about a week ago.

What next, then? Unfortunately our crystal ball’s busted, but we can at least give you a bit of a mix from various analytical minds on Crypto Twitter and beyond.

Tbh, though, not seeing a whole lot of confidence out there, still. And that’s probably fair enough given the contagion risk of over-leveraged crypto firms still offering an unclear and present danger – despite the best efforts of SBF to bail them all out of deep doo-doo.

Also, as “Roman Trading” points out, a bunch of Bitcoin miners are apparently sending “thousands of Bitcoin to exchanges” right now. “Not a good indication for bullishness” indeed.

I’m actively watching $BTC miners send thousands of #bitcoin to exchanges.

This is not a good indication for bullishness as miner capitulation could send price another large leg down.

The bottom isn’t in.#cryptocurrency #cryptotrading

— Roman (@Roman_Trading) June 22, 2022

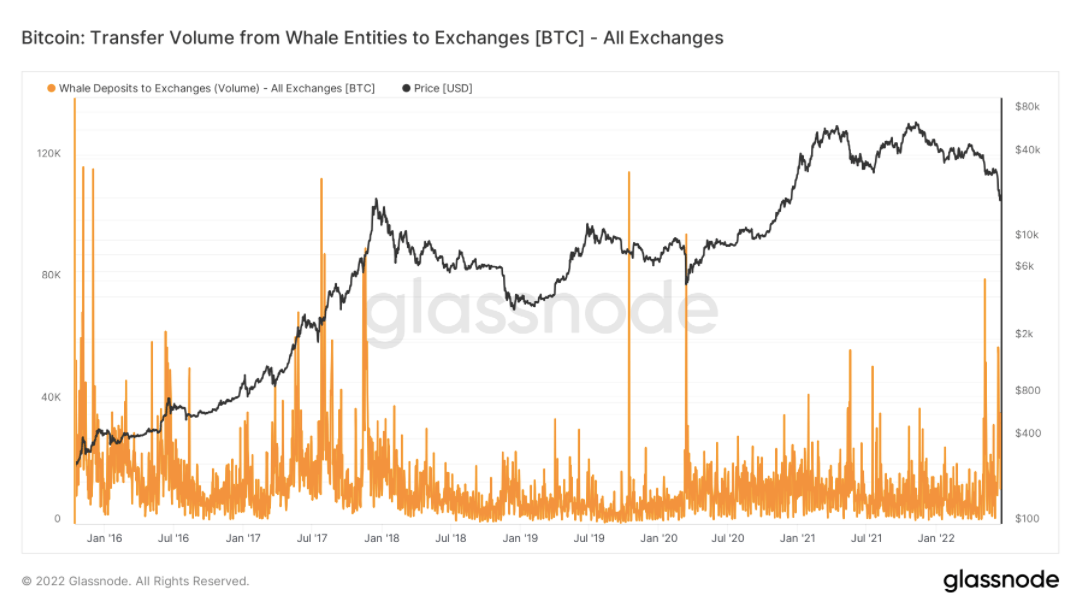

Add to this the fact Bitcoin whales already sent at least 50,000 BTC to exchanges on June 20 and 21 (according to on-chain analytics firm Glassnode), and it might not be a bad idea to take an extremely cautious approach for the moment. Not financial advi… ah, you know.

One thing, though, and this is mere speculation, but whales tend to dig games, coordinated faking out… If you examine those orange-line-spiking whale deposits on the Glassnode chart below, it doesn’t always hold true that exchange inflows correspond with BTC price dumps. But again, caution… etc, etc.

Meanwhile, the analyst Rekt Capital has been pointing out something else to be wary about, and we’re pretty sure Roman would agree. There was some pretty low trading volume on that market bounce yesterday…

The volume on this recent #BTC rebound is very low and seller-dominated

This is not the kind of volume $BTC experiences at Bear Market bottoms#Crypto #Bitcoin

— Rekt Capital (@rektcapital) June 22, 2022

Still, this attempted thread from “Plan E” is a little more upbeat in tone. Zooming out on the crypto market a bit usually brings a sunnier perspective…

let’s start a chain of obvious reasons to be long term bullish:

~$70T are expected to be transfered to millennials from baby boomers over the next 25 yrs for demographical reasons alone. millennials are overindexed to crypto vs. boomers. crypto will grow from this reason alone. https://t.co/fMTA5u6xVI

— Eric Wall | BIP-420😺 (@ercwl) June 22, 2022

Top 10 overview

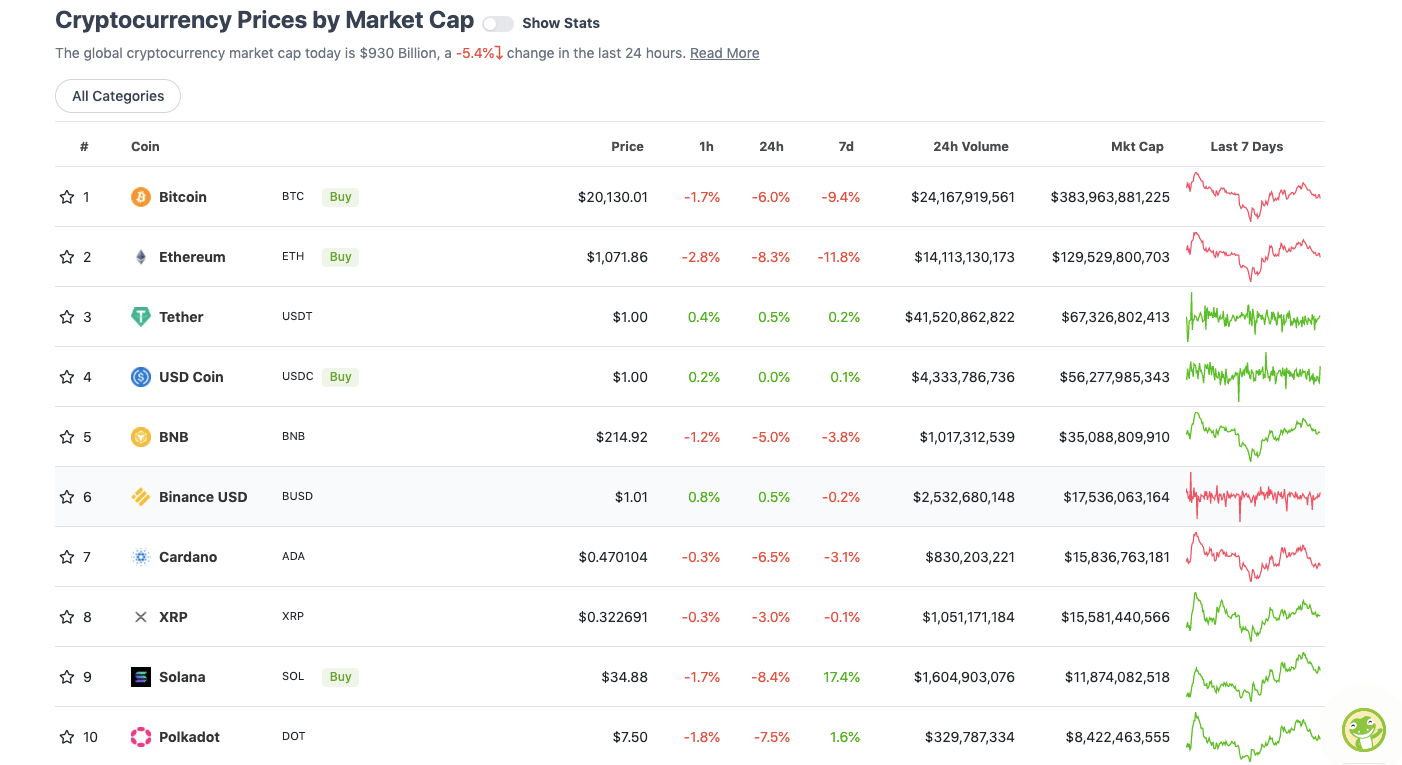

With the overall crypto market cap at roughly US$930 billion, down 5.4% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Must be nice to be a (hopefully) secure and fully backed stablecoin on days like these. Because everything else in the majors aside from USDT, USDC and BUSD is looking a bit depressed again on the 24-hour timeframe.

Uppers and downers: 11–100

Sweeping a market-cap range of about US$8.2 billion to about US$379 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• LEO Token (LEO), (market cap: US$5.4 billion) +8%

• Synthetix Network (SNX), (mc: US$716 million) +7%

• Uniswap (UNI), (mc: US$2.3 billion) +2%

• Chain (XCN), (mc: US$1.88 billion) +2%

• Tenset (10SET), (mc: US$626 million) +1%

DAILY SLUMPERS

• Celsius Network (CEL), (market cap: US$389 million) -19%

• Aave (AAVE), (mc: US$877 million) -13%

• Theta Network (THETA), (mc: US$1.23 billion) -11%

• THORChain (RUNE), (mc: US$536 million) -10%

• ApeCoin (APE), (mc: US$1.24 billion) -10%

Around the blocks

To finish, a selection of randomness that stuck with us on our daily journey through the Crypto Twitterverse.

Something positive here – a couple of new world leaders appear to be fans of Bitcoin…

NEW: Former Thai Prime Minister spotted on TV with #Bitcoin block clock in the background 💥 pic.twitter.com/mFz3akZ3WJ

— Bitcoin Magazine (@BitcoinMagazine) June 22, 2022

The newly elected president of Colombia 🇨🇴, Gustavo Petro, is pro #Bitcoin 🙀

"It takes power away from the banks" #btc #bullish #petro pic.twitter.com/jcCO8sC7qs

— Crypto Profit 💎 (@_Crypto_Profit_) June 21, 2022

Meanwhile, there’s a pretty damn large NFT conference happening in New York this week – NFT.NYC. Find out more about that, plus an NFT market update from Balthazar, here.

And here are some mixed vibes from the event…

NFT lovers literally falling for dude wearing a nametag that says Doop Snogg pic.twitter.com/BeBVOT61nE

— Stephen Langton (@StephenMLangton) June 21, 2022

Will the real Snoop stand up? Here he is…

CryptoArt interest is up only 🕊 Love to see it @curatedxyz https://t.co/shdsjtWaWr

— Cozomo de’ Medici (@CozomoMedici) June 22, 2022

🔥@steveaoki taking over @goblintownwtf right now… absolutely wilddddddd! pic.twitter.com/reAPE9N44b

— Ja’dan Johnson (@jdanjohnson) June 22, 2022

Just heard someone at the Moonbirds line, which hasn’t moved for the last hour, pronounce Tame Impala “Ta-mae Impalea.”

Couldn’t be having a worse time

— Rogue Itachi (@TheRogueItachi) June 22, 2022

Those NFT protestors blocked the entrance 🤣https://t.co/rdq2WXaDL4

— Marek | Celo ℓ2 🦛 (@marek_) June 22, 2022

In NYC for @NFT_NYC? "Australian Blockchain Going Global Networking Event"

Tomorrow – Thu, Jun 23 • 5:30 PM EDThttps://t.co/yjjOdF7FCP— Steve Vallas (@stevevallas) June 22, 2022

Lastly… wish we could un-see these two goblintown.wtf fans… but this one’s been going Crypto Twitter viral. And not in a good way…

Wtf just happened?!? @goblintownwtf pic.twitter.com/8SkJH6BpbJ

— dealer (@dealer1943) June 21, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.