Mooners and Shakers: Bitcoin holds above US$42k for now; Dubai introduces authority to boost crypto

Getty Images

Bitcoin is currently maintaining gains made over the past 24 hours on the back of what’s being interpreted as an innovation-friendly executive order on crypto from the Biden administration.

Meanwhile, as long as war rages in Ukraine, its various knock-on effects will keep markets on overworked toes. And on that, here’s an interesting tweet from NorthmanTrader’s Sven Heinrich…

Imagine the Ukraine crisis having just marked the peak in inflation.

Time will tell. pic.twitter.com/a5bfl9AjkN

— Sven Henrich (@NorthmanTrader) March 9, 2022

But, in terms of the crypto market, there are other global happenings of some interest aside from Biden’s signature and Eastern European conflict. And that includes news out of the United Arab Emirates.

The ruler of Dubai, Sheikh Mohammed bin Rashid Al Maktoum, today announced the creation of a regulatory and licensing authority in the emirate. The aim is reportedly for Dubai to become a “major player” globally in digital assets – a move that’s been slowly brewing within the UAE for some time.

“The future belongs to whoever designs it,” posted the sheikh in a tweet, adding:

“Today, through the virtual assets law, we seek to participate in the design of this new and rapidly growing global sector. Our step is a leap towards the future aimed at developing this sector and protecting all investors in it. And the future is more beautiful… comprehensive… and better, God willing.”

Today, we approved the virtual assets law and established the Dubai Virtual Assets Regulatory Authority. A step that establishes the UAE’s position in this sector. The Authority will cooperate with all related entities to ensure maximum transparency and security for investors. pic.twitter.com/LuNtuIW8FM

— HH Sheikh Mohammed (@HHShkMohd) March 9, 2022

The independent authority, he continued, will “oversee the development of the best business environment in the world for virtual assets in terms of regulation, licensing, governance, and in line with local and global financial systems.”

Top 10 overview

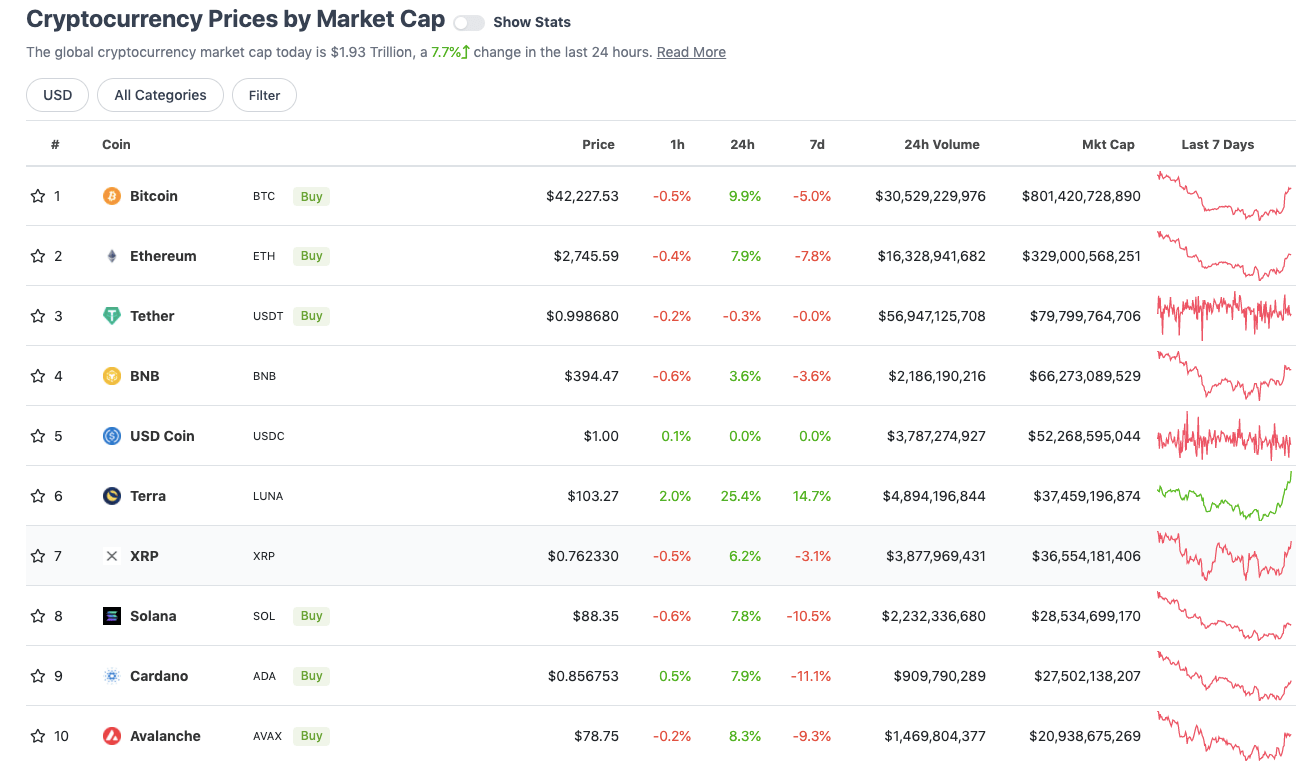

With the overall crypto market cap at about US$1.93 trillion, up 7.7% from this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Aside from Terra (LUNA), which has been on a fairly sustained moon mission lately, Bitcoin (BTC) has been leading the way in the top 10 over the past 24 hours. Everything else in the top 10 appears to be riding on its coattails at the time of writing.

Uppers and downers: 11–100

Sweeping a market-cap range of about US$19.6 billion to about US$909 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Synthetix (SNX), (market cap: US$992 million) +23%

• Anchor Protocol (ANC), (mc: US$1.14b) +21%

• Near (NEAR), (mc: US$7.4b) +19%

• Waves (WAVES), (mc: US$2.7b) +18%

• eCASH (XEC), (mc: US$1.55 billion) +17%

DAILY SLUMPERS

• Humans.ai (HEART), (market cap: US$1.33 billion) -3%

• Huobi Token (HT), (mc: US$1.42b) -0.1%

Uppers and downers: lower caps

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• Deus Finance (DEUS), (market cap: US$25m) +64%

• Alpine F1 Team Fan Token (ALPINE), (mc: US$64m) +60%

• Mirror Protocol (MIR), (mc: US$299m) +43%

• Xido Finance (XIDO), (mc: US$553m) +39%

• Verge (XVG), (mc: US$184m) +25%

DAILY SLUMPERS

• Fio Protocol (FIO), (market cap: US$44 million) -14%

• Plex (PLEX), (mc: US$187m) -10%

• Zignaly (ZIG), (mc: US$42m) -7%

• PolySwarm (NCT), (mc: US$60m) -6%

• Tornado Cash (TORN), (mc: US$113m) -5%

Final words

To finish up, here’s a bit more reaction to President Joe Biden’s executive crypto order revelations today…

Anyone worried that President Biden’s executive order would spell doom & gloom for crypto can fully relax now.

The main concern was that the EO might force rushed rulemaking or impose new & bad restrictions, but there’s nothing like that here. It’s about as good as we could ask.

— Jake Chervinsky (@jchervinsky) March 9, 2022

“The United States must maintain technological leadership in this rapidly growing space [crypto], supporting innovation while mitigating the risks for consumers, businesses, the broader financial system, and the climate.” – White House Executive Order

— Pomp (@APompliano) March 9, 2022

The US wants to be the leader in #Bitcoin and crypto

Buckle up

— Bitcoin Magazine (@BitcoinMagazine) March 9, 2022

The Executive Order on crypto seems dovish, but don’t let them shill you their CBDC sh*tcoin #Bitcoin

— Natalie Brunell (@natbrunell) March 9, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.