Mooners and Shakers: Bitcoin hangs under $24k as bulls and bears eye each other up; NEM jumps for no good reason

The new iEchoChamber, out now. (Getty Images)

Where are we at, bulls and bears? It’s tense. Bitcoin is hanging in there as regulatory FUD (fear, uncertainty and doubt) intensifies. The US dollar meanwhile dipped a fraction overnight while US stocks rose a bit.

One thing to note, despite the increasing regulatory scrutiny and negative narratives being pushed here and there (looking at you SEC boss Gary Gensler, and IMF managing director Kristalina Georgieva), BTC is actually up close to 5% over the past few days.

And there was some positive US inflation-data news yesterday, which may have flown under the radar. The US Commerce Department reported durable goods orders being down 4.5% in January versus the previous month.

Look, it’s something, and is just another number for the inflation bingo card. It’s still anyone’s guess regarding when an interest-rate-hike cool-off from the US Fed may occur in earnest.

So, that’s notsobad, in the very, very short term. But, as usual, we’ll grab a selection of analytical thoughts on this and that a bit further below to see what else we can lean on and ascertain.

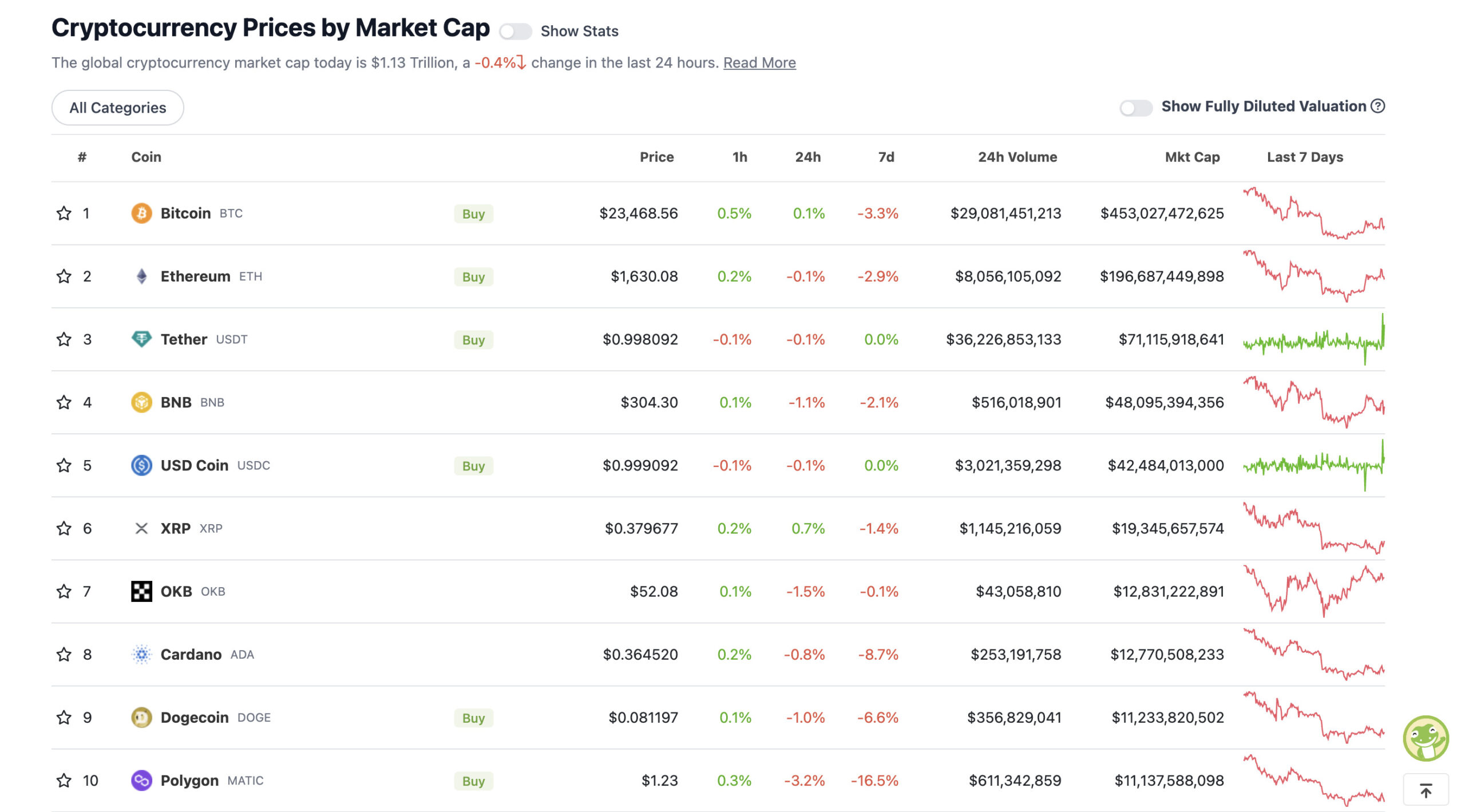

Top 10 overview

With the overall crypto market cap at US$1.13 trillion, down about 0.4% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Flat City, for the most part in the majors today, although top L2 Ethereum scaler and popular gaming blockchain Polygon (MATIC) is down a tad more than the rest.

It’s not moved on any specific news we can immediately see, although on a brighter note, there are potential positive catalysts for MATIC coming up. Namely, the launch and integration of its much-awaited zk rollups scaling integration – Polygon zkEVM.

Next week, there will be an audit-upgraded testnet for Polygon #zkEVM. The coming testnet will feature:

🗂️Support for Etherscan

𝒇 FFLONKFor more on the upgrades and an update on finality time, click 👇🏼https://t.co/ZUwQrECMPb

— Polygon Foundation (@0xPolygonFdn) February 24, 2023

Polygon’s network growth and partnerships continue to surge, meanwhile, and MATIC is an increasingly popular coin with crypto whales (large holders) – which can be a good thing, but also a volatility thing in both directions.

https://twitter.com/WhaleStats/status/1628855062800867334?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1628855062800867334%7Ctwgr%5Eaa215491c60ca5f16d92ef1c9e1e12d56c012547%7Ctwcon%5Es1_&ref_url=https%3A%2F%2Fambcrypto.com%2Fpolygon-makes-major-announcements-here-is-what-you-need-to-know%2F

Meanwhile, the Binance USD stablecoin (BUSD) continues to slip (right out of the top 10 cryptos by market cap). It’s just had some further crap news – a Coinbase delisting.

We regularly monitor the assets on our exchange to ensure they meet our listing standards. Based on our most recent reviews, Coinbase will suspend trading for Binance USD (BUSD) on March 13, 2023, on or around 12pm ET.

— Coinbase Assets 🛡️ (@CoinbaseAssets) February 27, 2023

But onto the crypto market pacesetter in chief – Bitcoin (BTC).

The OG crypto asset is, for now, remaining there, or thereabouts, slightly above a supposedly critical level for potential bullish momentum. And yes, that is a ridiculously vague sentence.

But we’re basing it on the analysis we see from a few Crypto Twitter-housed traders, such as the popular, largely excellent chartist Rekt Capital, who has pinpointed the US$23,400 mark as a good monthly close-out figure to hit.

A failed #BTC Weekly retest of ~$23400 as support would mean that price remains inside the Monthly Macro Range

Let's see how the Monthly Closes

1M Close above ~$23400 -> likely range breakout

1M Close below -> $BTC stays in & range & could dip lower in range#Crypto #Bitcoin pic.twitter.com/xTAqH7pVlm

— Rekt Capital (@rektcapital) February 24, 2023

Rekt, which admittedly isn’t the most inspiring pseudonym, also says the following: “March is just around the corner Historically, BTC has broken out past its Macro Downtrend around 366-396 days before the Halving. This March, it will be ~396 days before the Halving.”

Meanwhile, here’s something else for the positivity pipe. Some data from analytics gurus (via young analyst Will Clemente) that proves the Bitcoin HODLing faithful is as strong as ever.

There is now more Bitcoin that hasn't moved in at least 10 years than there is on exchanges. Wild stat.

(h/t @jimmyvs24) pic.twitter.com/8IWMnDO9bk

— Will (@WClementeIII) February 27, 2023

Uppers and downers: 11–100

Sweeping a market-cap range of about US$10.6 billion to about US$471 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• NEM (XEM), (market cap: US$545 million) +46%

• Stacks (STX), (mc: US$1.25 billion) +16%

• SingularityNet (AGIX), (mc: US$534 million) +7%

• NEO (NEO), (mc: US$932 million) +6%

• Lido DAO (LDO), (mc: US$2.8 billion) +5%

Okay, here’s another wild pump based on no news. NEM (XEM), once a highly touted layer 1 blockchain back in the 2017/early ’18 bull run days of yore, has surged 46% over the past several hours.

And yet, like Defigram yesterday, there appears to be no fundamental reasons for this. In fact, a quick scour of the project’s Twitter account tells us that, unless you’re bullish on “Merry Christmas” tweets, there’s not a lot going on that’s sounding particularly pump worthy.

There is news of a “chain halt” outage on the NEM blockchain, however! Also not exactly pump-worthy, that.

PSA: The client team is currently investigating a chain halt that occurred at block height 4129631. We have advised all exchanges to halt withdrawals and deposits.

— NEM (@nemofficial) February 27, 2023

Be careful out there.

DAILY SLUMPERS

• Klaytn (KLAY), (market cap: US$903 million) -6%

• WEMIX (WEMIX), (mc: US$568 million) -5%

• Conflux (CFX), (mc: US$473 million) -4%

• Quant (QNT), (mc: US$1.8 billion) -4%

• Optimism (OP), (mc: US$622 million) -4%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

The US anti-crypto posture is baffling.

I’ve never seen such a self own.

The US has the talent, the entrepreneurs, and the capital to lead.

Yet it’s telling the builders to “go build somewhere else”

America forgot it has to outbuild the world in order stay competitive.

— RYAN SΞAN ADAMS – rsa.eth 🦄 (@RyanSAdams) February 27, 2023

Crypto lawyer PSA: Chair Gensler has again proclaimed that every cryptocurrency, except BTC, is an unregistered security. He now must recuse himself from voting on any enforcement case that raises that issue since he has prejudged the outcome. Antoniu v. SEC (8th Cir. 1989)

— Stuart Alderoty (@s_alderoty) February 27, 2023

Beware the ides of March?

https://twitter.com/VailshireCap/status/1630306724375658501

Or are we going to follow a risk on, risk off, risk on monthly pattern this year…? Not sure the US trader Roman is so confident on that thought…

Seeing as all the people who missed the 60% move upwards are now bullish, the move is most likely over.

I’m not a “sentiment trader” but when the herd turns bullish, it’s time to look for exit indications in the chart.#bitcoin #cryptocurrency #cryptotrading

— Roman (@Roman_Trading) February 27, 2023

Charles Edwards, founder of the crypto-focused Capriole Fund, however, has pinpointed NINE reasons why he thinks Bitcoin is at the beginning of a bull market. He’s basing it on a combo of on-chain metrics, resilience beyond black swan events, positive historical timing regarding previous Bitcoin halvings, a shift in sentiment, and an approaching “macroeconomic regime change”.

January was massive for Bitcoin, not just because price went up a lot. I believe it was the start of the bull market for Bitcoin for these 9 reasons:

— Charles Edwards (@caprioleio) February 28, 2023

9. We are approaching a macroeconomic regime change. 2023 will likely see a Fed rate pause and change of policy. Rates have trended down every time inflation has dropped as fast as it is today in the last half century.

— Charles Edwards (@caprioleio) February 28, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.