Mooners and Shakers: Bitcoin flat again, but XRP makes gains after SEC denied appeal in Ripple case

Insert hopium pipe here. (Pic: SEC chair Gary Gensler, via Getty Images)

Okay, so perhaps this wasn’t quite the chosen one. The Bitcoin rally to lead us all from dark meh-ness and bring balance to the Farce. Guess it just didn’t have the supporting volume.

Or maybe it just didn’t have the Mabo, the vibe. In any case, Bitcoin has fallen back down a tad since its early ‘Uptober’ spurt. But not off a cliff, mind.

Hang on a sec… (puts hand to ear, TV reporter style) I’m just receiving word that… Gary Gensler and his US Securities and Exchange Commission have been denied again in their mission to nail Ripple for securities violations.

According to several reports and several foaming-at-mouth ‘XRP Army’ types on TwitterX, a federal judge in the US has rejected the SEC’s bid to appeal its recent loss against Ripple, which is the crypto company that built the XRP protocol and issues the XRP token.

BREAKING: Judge denies SEC motion to appeal the Ripple case! $XRP

The SEC just keeps losing!!! pic.twitter.com/KVpaCAJwa1

— Altcoin Daily (@AltcoinDailyio) October 3, 2023

The judge, one Analisa Torres, ruled in July that the retail sales of XRP by Ripple did not meet the criteria required to classify them as securities sales, and therefore do not fall under the purview of the SEC. The judge did find, though, that Ripple had breached securities laws by selling XRP tokens to institutional investors.

But it is the retail sales point that the SEC has been trying to contest and appeal.

“The SEC’s motion for certification of interlocutory appeal is denied, and the SEC’s request for a stay is denied as moot,” wrote Torres in a conclusionary statement.

This is another win for Ripple in its long-standing battle with the SEC but sadly, it’s not the end of it. The judge has now set an April 2024 trial date for other issues in the case that need resolving. And the SEC still has another chance to appeal the entire case once that point is reached.

Never. Ending. Story.

Still, the good news for XRP holders today, is that the token price jumped a good 5% on the news.

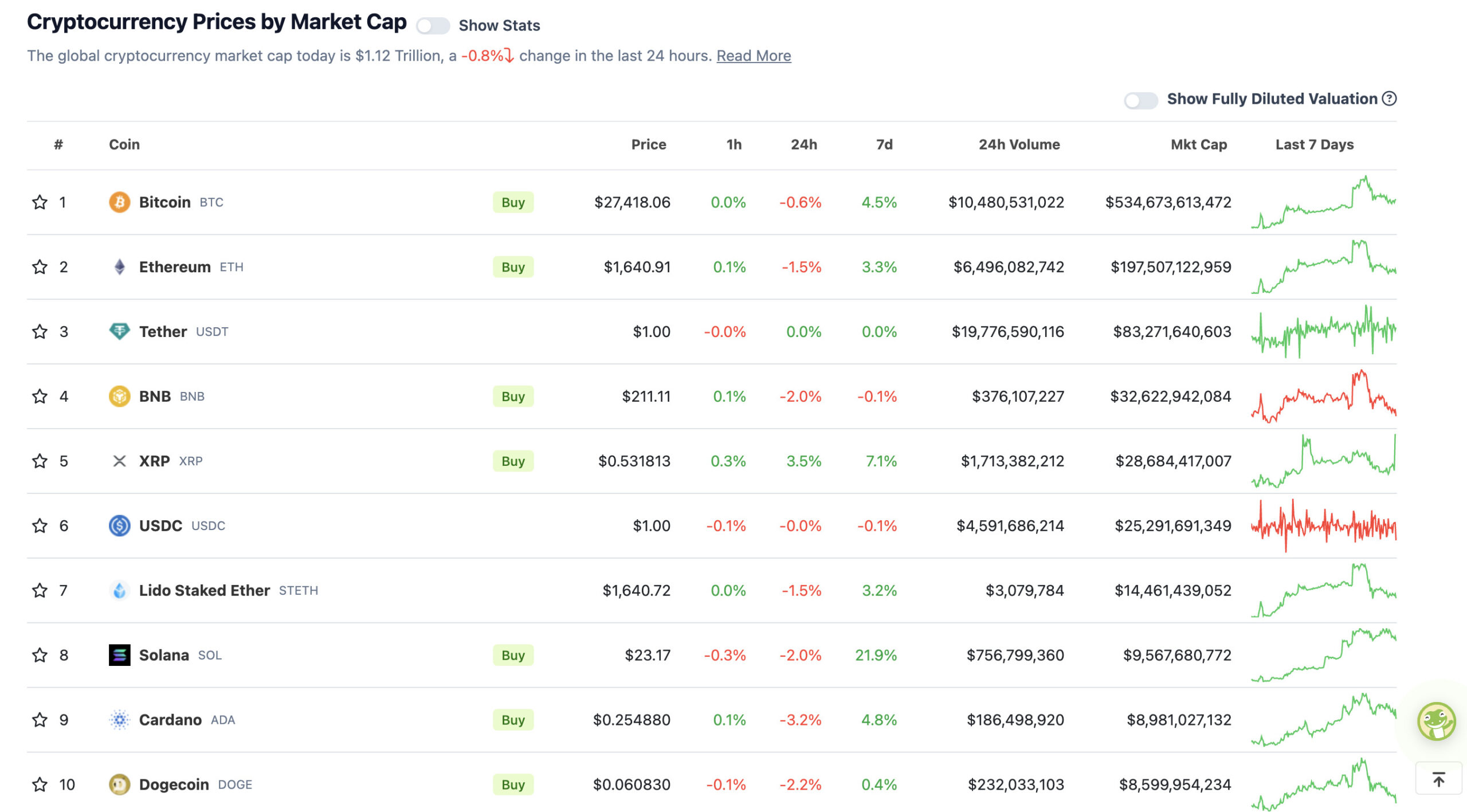

Top 10 overview

With the overall crypto market cap at US$1.12 trillion, down a fraction since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

One thing I’ve noticed is how well $BTC & #alts have held up against the $DXY moving upwards parabolically and the $SPX correction downwards.

If the $DXY corrects downwards, risk assets are going to sky rocket.

Even most alt coins have been moving upwards with the $DXY.

— Roman (@Roman_Trading) October 3, 2023

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Rollbit Coin (RLB), (market cap: US$503 million) +12%

• Leo Token (LEO), (market cap: US$3.5 billion) +3%

• GALA (GALA), (market cap: US$410 million) +2%

SLUMPERS

• Bitcoin SV (BSV), (market cap: US$715 million) -6%

• eCash (XEC), (market cap: US$480 million) -6%

• Aave (AAVE), (market cap: US$940 million) -6%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Hmm, full-time Bitcoin hater and gold bug Peter Schiff is talking up the prospect of QE and more money printing from the Fed. Which, of course would help gold, but would absolutely fire up BTC, too.

If bond yields keep rising at the current pace we are weeks away from a second, far larger wave of bank failures. That would result in the biggest QE program yet to finance the biggest bank bailout. The only way to avert this crisis is for the Fed to take action before it starts.

— Peter Schiff (@PeterSchiff) October 3, 2023

Other economist/analysts are on the same tack here.

Soaring yields, partially driven by insatiable debt issuance by the US Treasury, are tightening conditions so fast that, before you know it, the Fed may either be forced to pause QT or outright start become a buyer of US debt again. 😂🤦♂️ pic.twitter.com/ZOtcrb1Elb

— Sven Henrich (@NorthmanTrader) October 3, 2023

Meanwhile, “Jay” Powell is looking super chill here. Must’ve been filmed on the Federal Reserve’s ‘Thank Fed it’s Friday’ mufti day.

The Federal Reserve has joined Instagram.

Jerome Powell, going by “Jay” to keep it hip, is popping his collar to teach the zoomers that debasing the money by ~2% every year is necessary to make the world go around.

Late-stage empire, credibility running on fumes.

It's so over. pic.twitter.com/4Q7j8CoKwr

— Joe Consorti ⚡️ (@JoeConsorti) October 3, 2023

I keep pinching myself that it's happened again https://t.co/qRYjKcRut7

— Chris Burniske (@cburniske) October 4, 2023

The Affirmative Uptober Token Watchlist🗒

——————————————$ARB – Arbitrum Short Term Incentive Program (STIP). 50m ARB to be allocated to protocols in the ecosystem. This could act as a large ecosystem boost by attracting significant liquidity.

(The… pic.twitter.com/D3VgAVVGfM— Thor Hartvigsen (@ThorHartvigsen) October 2, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.