Mooners and Shakers: Bitcoin fights to hold the line; Avalanche and NEAR surge

Getty Images

The US dollar, the most famous of all sh*tcoins, has been surging on Friday’s Wall Street open. Not exactly something to get excited about for Bitcoin and the crypto market.

The DXY (US dollar index) has made a move back above 100 for the first time in almost two years, triggering the usual inverse correlation in risk-on assets today.

So, despite all the positivity in the crypto market, particularly for Bitcoin right now, price action is largely flat to negative at the time of writing. (With outliers here and there, of course.)

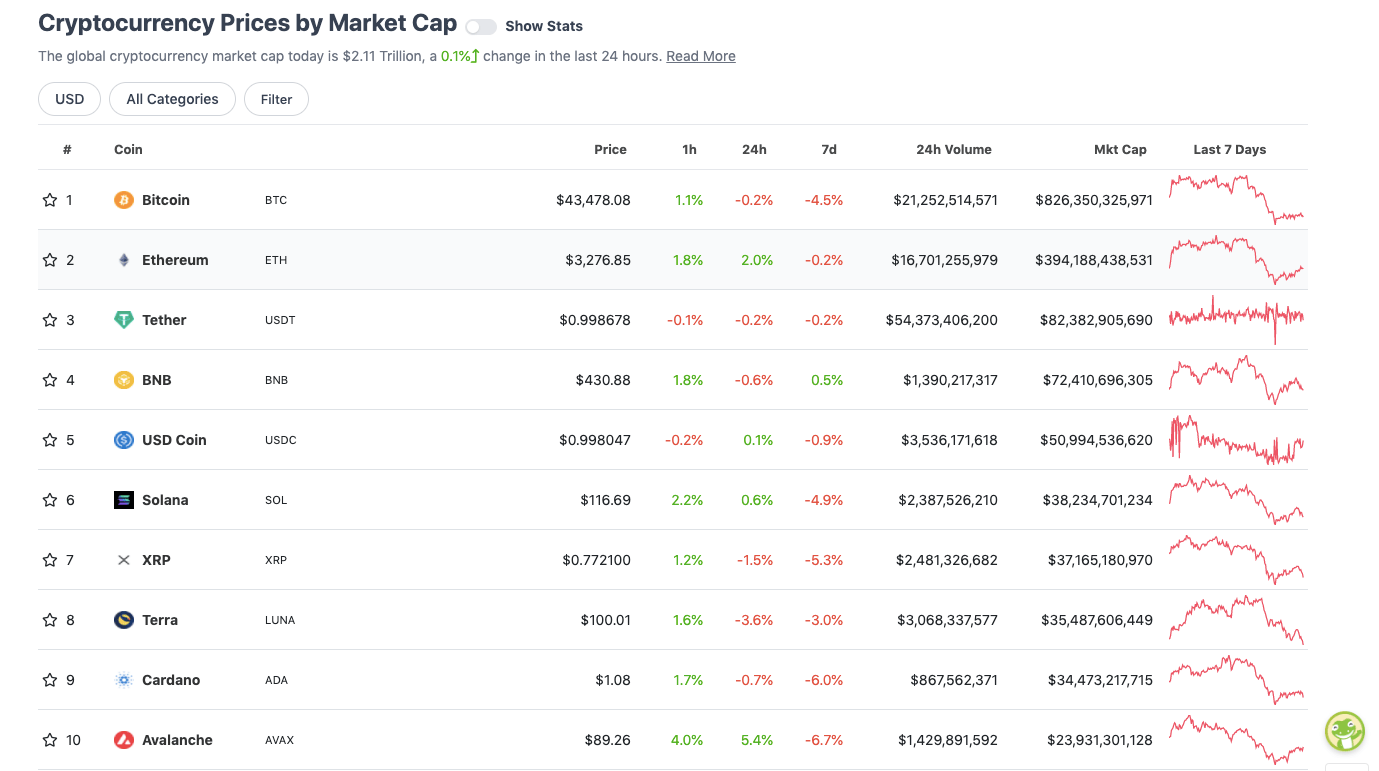

Top 10 overview

With the overall crypto market cap at about US$2.11 trillion, about where it was sitting this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Bitcoin (BTC) is still hanging in the balance presently, sitting just above the US$43k support it’s been holding onto for the better part of two days.

Familiar headwinds are still swirling for the stonks and crypto markets, and they’ll likely continue for the foreseeable. Those are, of course, related to the US Federal Reserve’s inflation-combatting measures.

Priced in? Maybe not… it depends how hard Jerome Powell and pals go on the rate-hiking, economy-tightening measures from here.

Many analysts and traders are now predicting a 50 basis-point increase to be announced when the FOMC next meets in the first week of May. According to the CME FedWatch Tool, the probability is better than 70 per cent that the Fed funds rate reaches 2.25% by the end of the year. It’s currently at 0.25%.

Markets are forecasting the fastest Fed tightening in 30 years. What’s driving the rate-hike acceleration? Presented by @CMEGroup pic.twitter.com/uiuhTVmtU2

— Bloomberg Originals (@bbgoriginals) April 6, 2022

Still, this is crypto… where bullish sentiment can usually be found no matter the macro news and no matter the chart movements…

https://twitter.com/mikealfred/status/1512439541491441671

I AM SO BULLISH ON #BITCOIN 🚀 pic.twitter.com/HRVROYX8gJ

— Crypto Rover (@rovercrc) April 8, 2022

Months from now, you won't be worrying about this #BTC dip$BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) April 8, 2022

Moving on… looking at that CoinGecko chart again for a sec, we notice the DeFi and gaming-focused layer 1 protocol Avalanche (AVAX) is proudly standing out (+5.4%) at the bottom of the top 10 pack.

Not content with buying up hundreds of millions of Bitcoin every other day, Terra’s Luna Foundation Guard (LFG) has now made the decision to acquire a decent amount of AVAX to add to its UST stablecoin reserve…

1/ The Luna Foundation Guard has announced a strategic deal with the Avalanche Foundation to acquire $100M of $AVAX to help bolster its UST Decentralized Forex Reserve. https://t.co/EJvXVwLdyt

— egs9000🔺⚔️ (@el33th4xor) April 7, 2022

Additionally, Terraform Labs, which also supports the Terra blockchain, has also bought US$100 million worth of AVAX (in a LUNA-AVAX token swap) to “strategically align ecosystem incentives”.

Uppers and downers: 11–100

Sweeping a market-cap range of about US$22.3 billion to about US$1.1 billion in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Near Protocol (NEAR), (market cap: US$12.83 billion) 27%

• Frax Share (FXS), (mc: US$1.97 billion) +13%

• JUNO (JUNO), (market cap: US$1.15 billion) +10%

• ZCash (ZEC), (market cap: US$2.2 billion) +8.5%

• Enjin (ENJ), (market cap: US$1.6 billion) +8%

The proof-of-stake layer 1 blockchain Near Protocol has been on a tear lately, rising up a few spots to number 16 on the charts on the back of some big funding news.

It’s managed to raise a whopping US$350 million from FTX Ventures, Dragonfly Capital, and others. This follows a funding raise of US$150 million only a few months ago in January.

Near Protocol thesis in 1 minute:

Algorithmic stablecoin, redeemable with $NEAR burn mechanism and 20% APR$350M additional funding in recent round led by @Tiger_Global

NFT gaming gets great support from Near Foundation, more will come over next couple of weeks

Chart good

— Krisma (@KRMA_0) April 8, 2022

DAILY SLUMPERS

• OKB (OKB), (mc: US$5.2 billion) -2%

• Quant (QNT), (mc: US$1.7 billion) -0.5%

• The Graph (GRT), (mc: US$2.8 billion) -0.3%

• Decentraland (MANA), (mc: US$3.6 billion) -0.3%

• VeChain (VET), (market cap: US$4.6 billion) -0.2%

Uppers and downers: lower caps

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• ICHI (ICHI), (market cap: US$652 million) +69%

• Aurora (AURORA), (mc: US$317m) +32%

• Kyber Network Crystal Legacy (KNCL), (mc: US$214m) +31%

• Kyber Network Crystal (KNC), (mc: US$412m) +29%

• Cult DAO (CULT), (mc: US$103m) +29%

DAILY SLUMPERS

• Savanna (SVN), (mc: US$120m) -34%

• district0x (DNT), (mc: US$101m) -16%

• Multichain (MULTI), (mc: US$271m) -19%

• DEUS Finance (DEUS), (mc: US$63.5m) -15%

• Metis Token (METIS), (mc: US$305m) -10%

Around the blocks

Ark Invest CEO Cathie Wood had a bit more to say at the Bitcoin 2022 conference in Miami today. Not like her to be so ridiculously bullish…

But what will $1 million USD be worth 🤔

— Natalie Brunell ⚡️ (@natbrunell) April 8, 2022

As for this piece of breaking news…

BREAKING: Tesla Solar PV array and Tesla Megapack to power Blockstream and Block's $12 million #Bitcoin mining facility.

— Bitcoin Magazine (@BitcoinMagazine) April 8, 2022

… hmm, nice. But what about a resumption of the Tesla BTC-payment option, Elon? Could happen. Sure, the enigmatic, tweet-happy billionaire’s been on the case about Bitcoin’s carbon footprint in the past, but perhaps that’s a shifting narrative.

And you can already buy Tesla merch with DOGE, which is basically just a Bitcoin/Litecoin code copy, so there’s that…

"To the moon indeed!" – @elonmusk at the Tesla Cyber Rodeo event. #Dogecoin @BillyM2k pic.twitter.com/6YtzGz3seI

— DogeDesigner (@cb_doge) April 8, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.