Mooners and Shakers: Bitcoin fights to hold $40k as fear grips market again

Pic: Getty

As we swerve all over the road and into the weekend, Bitcoin, the most dominant crypto by market share, is yet again following the most dominant exchanges – the US stock markets.

And currently, they’re up and down and all over the shop, reacting and overreacting to the same news topics (Russia/Ukraine, Fed, inflation) that have been spooking investors all week. Get used to it, I guess.

At the time of writing, Bitcoin has managed to recover the US$40k level after dipping to about US$39,700 upon a bloody opening of trad-market trading in New York. A few more hours will tell if it that longterm level of support can hold into the weekend.

Some unreliable weekend trading activity will ensue, and then what? Maybe crypto needs another major bullish catalyst or two. Joe Biden’s “executive order” on crypto is set to hit next week – maybe that’ll spur the market one way or another?

Wouldn’t count on it. It sounds like it’s merely a mandate for various government agencies to “study” cryptocurrencies and produce a report three to six months later. Let’s hope some solid crypto-industry players help them with their homework.

https://twitter.com/CryptoWhale/status/1494374922264719363

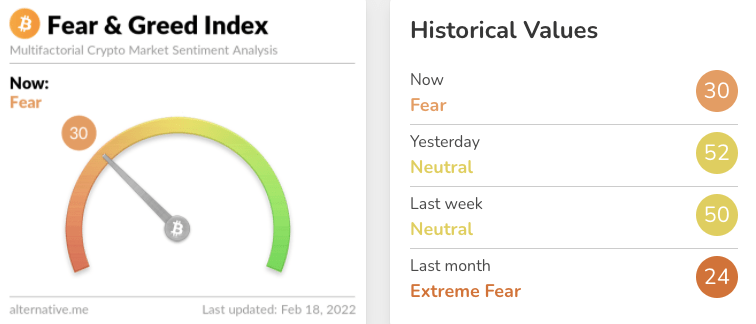

How ’bout a quick check on the leading crypto market sentiment indicator? It’s been pretty neutral just lately, but yep… there we go – we’re back in pencil-snapping, fingernail-chewing territory once again.

If Bitcoin can’t hold its $40k line in the sand, or maybe the US$39.5k level City Index analyst Tony Sycamore mentioned to Stockhead yesterday, then we could be seeing our old buddy “Extreme Fear” pretty soon.

And the bold, blood-on-streets-buying traders will be loving that catch-up.

Top 10 overview

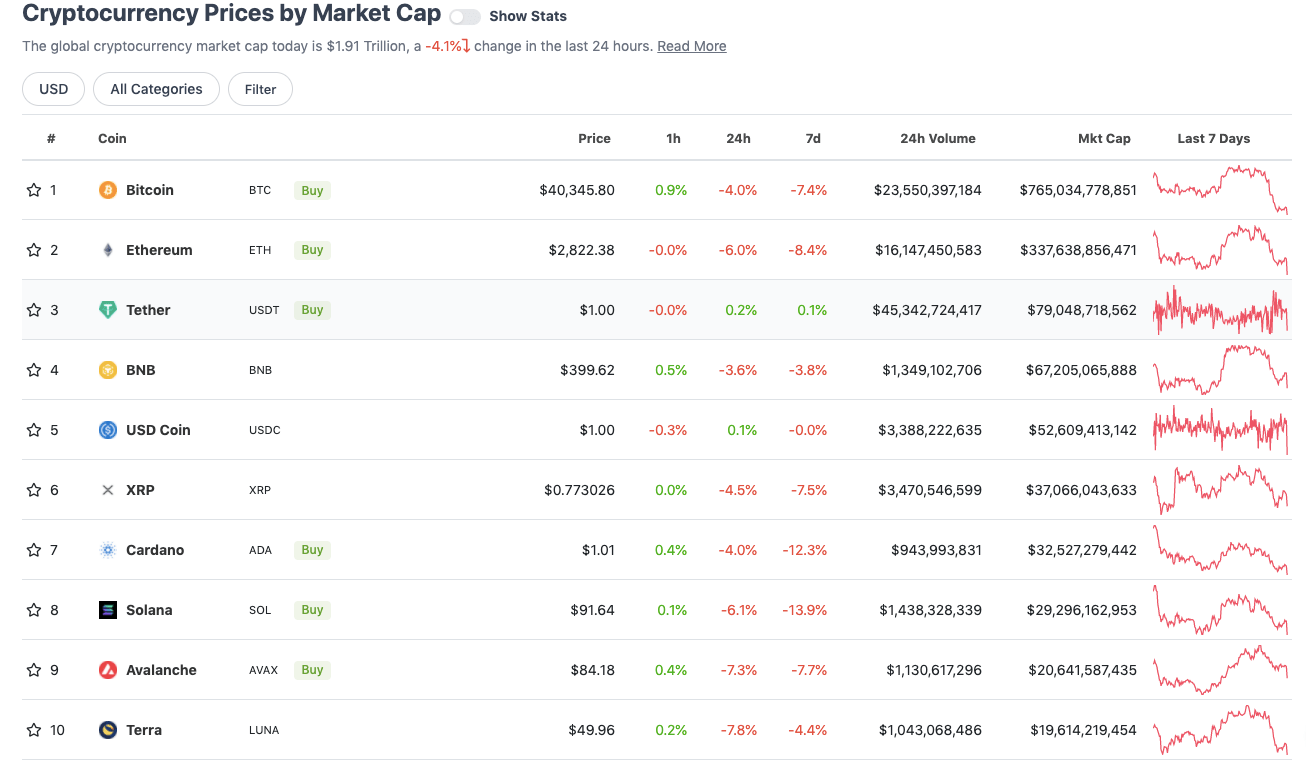

With the overall crypto market cap down about 4% over the past 24 hours, here’s the state of play in the top 10 by market cap right now – according to CoinGecko data.

Aside from stablecoins (naturally) everything’s being hit pretty hard in the top 10 right now, but particularly layer 1 protocols Terra (LUNA) and Avalanche (AVAX). Both those coins are faring a bit better than most others on the weekly timeframe, however.

Uppers and downers: 11–100

Sweeping a market-cap range of about US$19.4 billion to about US$962 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• NEO (NEO), (market cap: US$1.86 billion) +7%

• Humans.ai (HEART), (mc: US$1.26b) +2.5%

• Klaytn (KLAY), (mc: US$3.35b) +1%

(Okay, so not actually a lot of pumpage here at the moment.)

DAILY SLUMPERS

• Decentraland (MANA), (market cap: US$4.5 billion) -11%

• Kadena (KDA), (mc: US$1.17b) -9%

• Aave (AAVE), (mc: US$1.99b) -9%

• Enjin (ENJ), (mc: US$1.57b) -8.5%

• Arweave (AR), (mc: US$1.45b) -8.5%

Uppers and downers: lower cap

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• Baby Doge Coin (BABYDOGE), (market cap: US$663m) +26%

• Dia (DIA), (mc: US$72.5m) +26%

• LORDS (LORDS), (mc: US$27m) +19%

• Alpaca Finance (ALPACA), (mc: US$71.4m) +18%

• Astar (ASTR), (mc: US$223m) +12%

DAILY SLUMPERS

• PlotX (PLOT), (market cap: US$10.8 million) -30%

• Crabada (CRA), (mc: US$110m) -19%

• Venus (XVS), (mc: US$132m) -17.5%

• Feg Token (FEG), (mc: US$181m) -17%

• Vader Protocol (VADER), (mc: US$136m) -16%

Final words

This is why I'm claiming that 29k-34k area (might be) the possible final bottom. It's hard to tell for sure but, it will be more clear once we get down there. #btc #Bitcoin https://t.co/OWN8KDrPsj

— PROFIT BLUE (@profit8lue) February 17, 2022

ETH dipped 8% today bcuz of this

pic.twitter.com/prLf9SG9Hh— Tim Connors (@itstimconnors) February 18, 2022

Yeah, things are a bit shaky at the moment. But let’s sign-off with a hopium hit from the co-founder of hedge fund Three Arrows Capital, shall we? Have a good weekend.

90% of my bottom signal list that I wrote down before is now hit

We may go lower from here due to headlines or w/e but I think the bull case for #Bitcoin has never been stronger and I think 2x ath within a few months is well within reach https://t.co/Klo7wQhUGI

— 朱溯 (3/AC) (@zhusu) February 18, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.