Mooners and Shakers: Bitcoin fails breakout attempt but not all is lost; Quant surges; Celsius CEO resigns

Getty Images

Bitcoin and crypto’s classic volatility was at play overnight (AEST), with BTC making a break back above US$20k again, only to come tumbling back down a few short hours later.

Despite this quickly fizzing exuberance, and the unwelcome return of Bart Simpson to the charts, Bitcoin and cryptos at large are still ranging in familiar territory and holding up perhaps better than expected when compared with other markets.

He's back….#Bitcoin $BTC #BTC pic.twitter.com/aV3aI44Urh

— Crypto Zombie (@TheCryptoZombie) September 27, 2022

According to a report from the New York Times, Bitcoin has been trading “slightly in the green”, while the world’s currencies, particularly the British pound, and stock market indices take an absolute beating.

And if you want a side of hope with your main course of carved portfolio lavished in a jus of disappointment, then the on-chain analytics firm Glassnode has been bringing it to tables this week.

Its latest report shows a metric called the “Revived Supply 1+ Years”, which is indicating that long-term Bitcoin holders largely appear unwilling to sell in the current price range around and below US$20k.

“Revived Supply 1+ Years provides confirmation that the volume of latent supply re-entering the active supply is extremely low,” reads the Glassnode report.

Using clearer language, the analytics firm explained that “it appears increasingly likely that the Bitcoin HODLers who remain, are strapped in, and willing to go wherever the Bitcoin ship takes them”.

Onto some daily price action and other happenings.

Top 10 overview

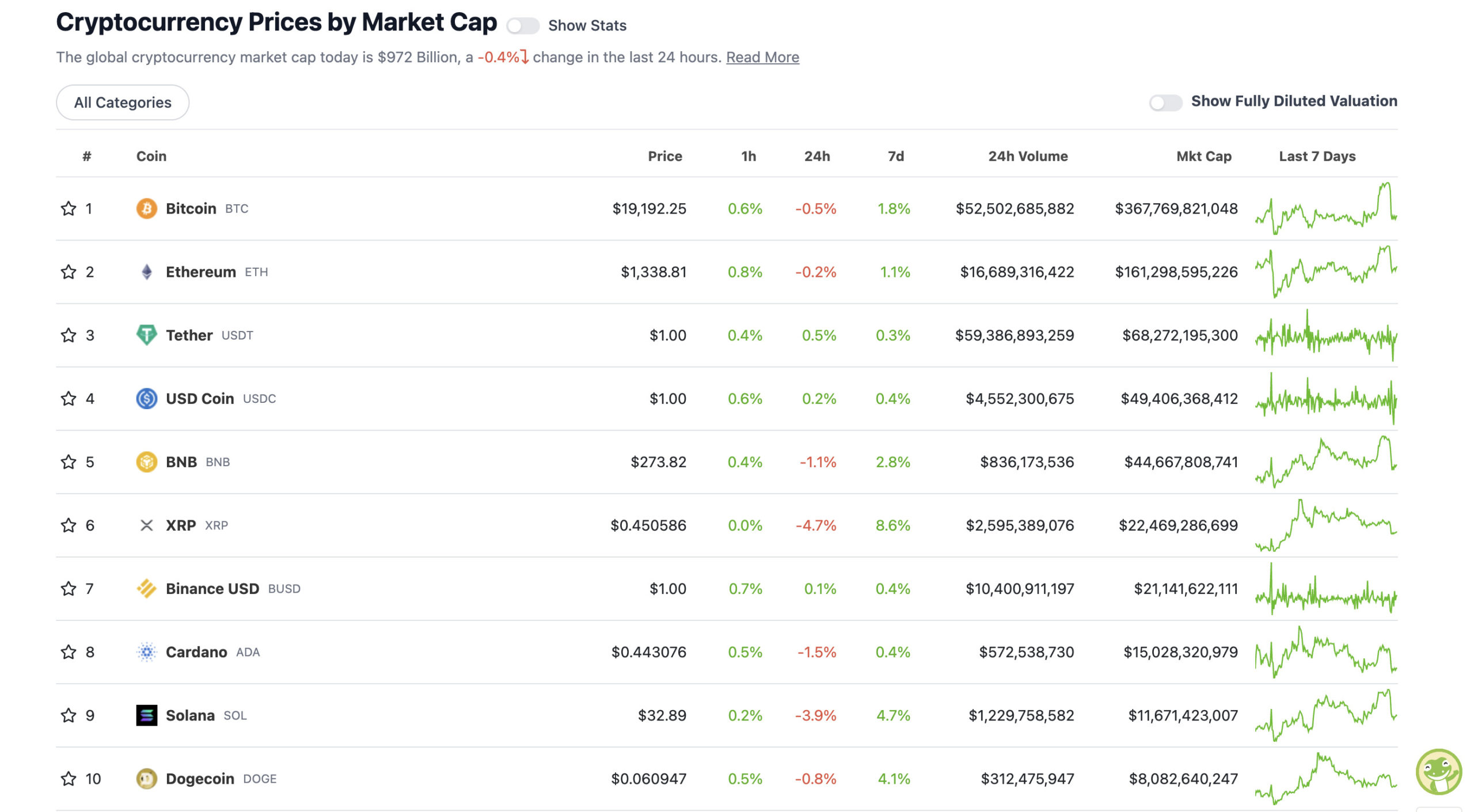

With the overall crypto market cap at US$972 billion and down about 0.4% since yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

If you’re only just clocking into the crypto league ladder now since this time yesterday, you’d probably be thinking not much has changed.

And you’d be right, although you might, however, be aware that crypto surged before the stock markets opened and tanked, taking crypto back down with them.

Thankfully, Bitcoin, Ethereum and pals grabbed back onto a well-used tree branch or two on the way back down.

What’s now looming as the next important deadline for dedicated chart watchers, though, is Bitcoin’s monthly close. Judging by Rekt Capital’s Twitter-housed analysis, it would seem that pretty much about the US$19,800 level would be a decent place to hold come midnight, September 30 UTC.

There’s some work to do again to get back up there.

Worth repeating that #BTC performing a Monthly Close below the green level could confirm a breakdown from the Monthly range$BTC #Crypto #Bitcoin https://t.co/pOTzAP6HAC pic.twitter.com/ztjWOoR09c

— Rekt Capital (@rektcapital) September 27, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$7.4 billion to about US$397 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Quant (QNT), (market cap: US$1.81 billion) +18%

• STEPN (GMT), (mc: US$421 million) +7%

• Uniswap (UNI), (mc: US$4.8 billion) +7%

• NEO (NEO), (mc: US$629 million) +5%

• Chainlink (LINK), (mc: US$4 billion) +4%

Quant (QNT) is an ERC-20 token that’s a smart interoperability play aiming to connect public blockchains and private networks. And it’s pumping right now.

Why? It’s hard to pinpoint, although several investors seem to be looking into it…

nothing to see. just quant the most searched crypto on @coingecko pic.twitter.com/orPTc47cac

— Comfy In Conviction ⭕️ (@RenderMami) September 27, 2022

The project’s “Overledger” system that facilitates the aforementioned private/public blockchain interoperability is pitched as a top enterprise-grade solution for the business world, which could potentially see demand for the crypto as an investment as it further develops.

#QUANT THREAD🔥

Here is why $QNT's OVERLEDGER Revolutionise the world of business 👇 pic.twitter.com/oCyvIR2DSv

— TheBlockchainMedia (@TheChainMedia) September 23, 2022

DAILY SLUMPERS

• Terra (LUNA), (market cap: US$418 million) -6%

• Terra Luna Classic (LUNC), (mc: US$1.95 billion) -6%

• Chiliz (CHZ), (mc: US$1.33 million) -4%

• Synthetix Network (SNX), (mc: US$539 million) -4%

• Algorand (ALGO), (mc: US$2.47 billion) -4%

Around the blocks: Celsius CEO Alex Mashinsky resigns

A selection of randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

Perhaps the biggest crypto news of the past handful of hours is the news that embattled “CeFi” crypto lender Celsius is currently without a CEO, with its figurehead Alex Mashinsky reportedly resigning from the post.

Mashinsky submitted his resignation letter on Tuesday apologising for the “difficult financial circumstances” members of the Celsius community are facing.

He added that he still plans to help the firm “achieve a successful reorganisation”.

Celsius Network Co-Founder and CEO Alex Mashinsky reportedly resigns from the crypto lending company amid its bankruptcy filings. pic.twitter.com/bjEgXDALY8

— Yahoo Finance (@YahooFinance) September 27, 2022

A quick scan of Crypto Twitter reveals plenty of responses unfit for print. But perhaps this Altcoin Daily post best sums up the sentiment.

Alex Mashinsky says he is “very sorry” about the financial struggles #Celsius customers are facing in the fallout from its collapse. pic.twitter.com/J0AhNmOJC5

— Altcoin Daily (@AltcoinDailyio) September 27, 2022

Mashinsky’s resignation is actually the latest in a string of prominent crypto-firm resignations, including most recently Kraken CEO Jesse Powell and FTX US president Brett Harrison. Michael Saylor stepped down from CEO of his MicroStrategy firm in August but remains its executive chairman (with a 100% Bitcoin-focus remit!).

Note: there’s absolutely no suggestion any of the other crypto companies mentioned by Will Clemente in the following tweet here are embroiled in the kind of financial mess Celsius has found itself in due to the Terra Luna-sparked “crypto contagion”.

Kraken CEO stepped down

FTX US President stepped down

Alameda co-CEO stepped down

Microstrategy CEO stepped down

Celsius CEO stepped downWho's next?

— Will (@WClementeIII) September 27, 2022

the crypto ceo exodus is now serving as an excuse for this guy to shoot his shot 😂 pic.twitter.com/Ry3jaMUnwN

— Jacquelyn Melinek (@jacqmelinek) September 27, 2022

JUST IN – 🇺🇸 Fed Chair Powell: The Central Bank will always be the main source of trust in money.#Bitcoin: Hahahahahaha

— Bitcoin Magazine (@BitcoinMagazine) September 27, 2022

Told you @bankofengland! https://t.co/DpeEdRUqNX

— Nayib Bukele (@nayibbukele) September 26, 2022

made it to bitcoin beach #btc pic.twitter.com/rNSrqM59bO

— Sheikh Roberto (@roberto_saudi) September 26, 2022

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.