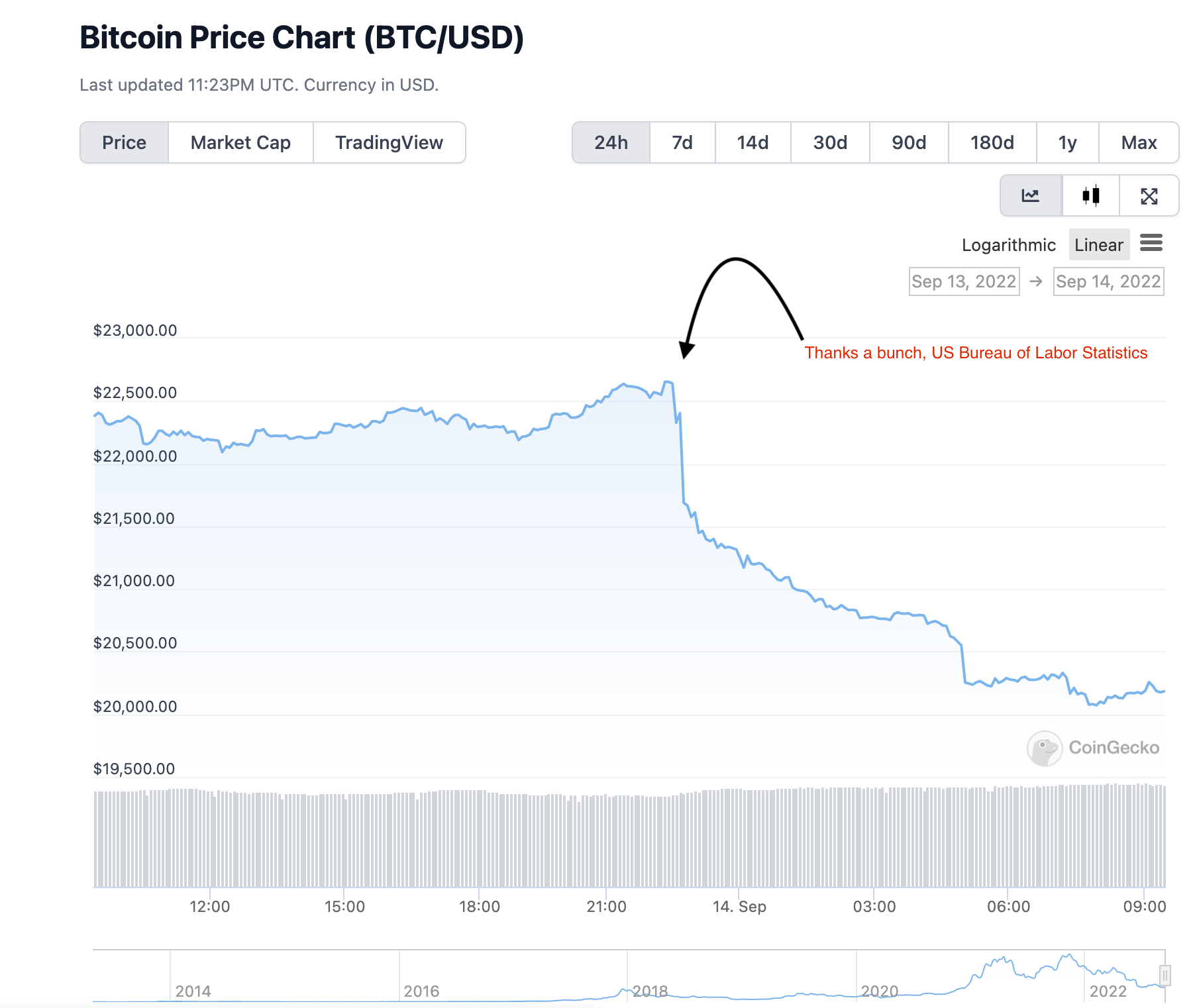

Mooners and Shakers: Bitcoin, Ethereum and crypto market deflate after hot CPI inflation data release

A Bitcoin metaphor, as of about 8.30am (EST).

It’s that time of the month for crypto and indeed all markets. America’s CPI (Consumer Price Index) inflation figures are in, and the news ain’t particularly crash hot.

Actually, the figure is a little hot and it’s caused a bit of a crash here and there. Definitely here and there within the crypto market.

Take a look at what it did to the price of Bitcoin at pretty much bang on the nose of 8.30am EST, which was about 10.30pm last night in Sydney…

But Bitcoin wasn’t alone in this daily brutalisation, most top cryptos are copping it, as is basically anything that isn’t the US dollar right now.

#DXY with a massive spike. No bueno. pic.twitter.com/FEp9jzznWT

— Dom's Crypto (@Doms_Crypto) September 13, 2022

As for the CPI figure itself, at 8.3%, it’s gone up by 0.1% month on month from July. Many traders, investors, analysts and fans of Kenny Rogers song The Gambler, were expecting a lower figure of 8.1%.

Well, we knew this week was going to be a volatile one based around this fateful data set, so here we are, and where do we go from here?

Let’s take a look at the crypto majors…

Top 10 overview

With the overall crypto market cap at US$1.03 trillion and down about 7% since yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

So that’s more than a US$80 billion dollar seepage from the entire crypto market since this time yesterday. But hey, it’s still poking its nose above 1 trill. And, for the moment at least, Bitcoin seems to have pulled an emergency handbrake stop just above the US$20k mark.

Meanwhile US crypto analyst and macro economist Alex Krüger seems to be viewing all this with at least some short-term lining that is silver in colour… Well, any time the word “bottom” is mentioned, it always makes crypto heads turn…

Today is one of those trend days were prices are likely to end close to the bottom, pointless to bid any levels.

The post Jun/10 CPI crash took five week days to bottom. Don't know how many days it will take this time, but doubt it will be over today.

— Alex Krüger (@krugermacro) September 13, 2022

https://twitter.com/krugermacro/status/1569784172146999299

Speaking of things related to bottoms of perhaps a more saggy nature, eyes will be on the US Federal Reserve and what Jerome B Powell delivers us trembling plebs next week in terms of the next American interest-rate hiking play.

“John Wick” has taken time off from killing bad people with a pencil to give his thoughts on that very matter. He seems to be suggesting here that another 75 basis-points hike would be about right and expected… but there’s also a chance now the Fed could turn up the heat to… duh-duh-daaaaaaah… ONE HUNDRED basis points.

Sea of red for S&P 500. 🩸

This is bc of uncertainty now.

.75 bps hike would be perfect. But 1 full point would be too much, and .5 would be too little. Inflation numbers say fed hike of either .75 or 1. pic.twitter.com/B59gxXglWU

— Wick (@ZeroHedge_) September 13, 2022

Bitcoin, as it’s wont to do, tends to grab most of the crypto market spotlight when things are pumpin’ or dumpin’. It’s down big time over the past 24 hours with a 9.6% bleed at the time of writing.

Ethereum, meanwhile, has also Jack and Jill’ed it, but not as hard as crown-busting Jack (and yeah, that’s an extemely tenuous metaphor for BTC).

And not as hard as their mate Solana (SOL), for that matter – once again proving that the coins pumping hardest into what turns out to be a bearish event, often dump the hardest the next day.

Ethereum, as any crypto head worth their salt will know, has its monumental, mythical Merge upgrade due in roughly 24 hours. Christian “I’ll be Your Crypto Wingman Any Time” Edwards has a good take on it, actually – one that talks about it in the context of risk management… with a risk-management expert, sensibly.

Uppers and downers: 11–100

Sweeping a market-cap range of about US$7.9 billion to about US$421 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Terra Luna Classic (LUNC), (market cap: US$2.46 billion) +15%

• Terra (LUNA), (mc: US$709 million) +5%

• Celsius (CEL), (mc: US$620 million) +2%

You know it’s a bad day in the market when the only coins pumping in the top 100 are “crypto contagion” coins you’d probably be pretty nuts to dabble in, unless you like a side of extra extreme risk with your generally already extremely risky asset class.

DAILY SLUMPERS

• The Graph (GRT), (market cap: US$808 million) -13%

• Helium (HNT), (mc: US$585 million) -12%

• NEAR Protocol (NEAR), (mc: US$3.46 billion) -11%

• EOS (EOS), (mc: US$1.47 billion) -11%

• Monero (XMR), (mc: US$2.6 billion) -10%

Around the blocks

A selection of randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

But lower than last month. So, could be worse.

— Dom's Crypto (@Doms_Crypto) September 13, 2022

Markets now thinking 38% chance the #Fed raises rates by 100 bps pic.twitter.com/x3keSZXTQv

— Benjamin Cowen (@intocryptoverse) September 14, 2022

No bull: If a 14x forward multiple is the correct valuation, then simple math will tell us that the fair value for the S&P 500 is 3200-3400 at an EPS of $230. This suggests that this bear market is not yet over. pic.twitter.com/HTGqQbTcOq

— Jurrien Timmer (@TimmerFidelity) September 14, 2022

Bitcoin is down on the news that inflation for August came in higher than expected (8.3% instead of 8.1%). Bitcoin should be up today. Its properties dictate that it should be inversely correlated to inflation. The fact that it is down shows just how early it is.

— Tyler Winklevoss (@tyler) September 13, 2022

Tyler is confusing monetary inflation with CPI.

BTC is a monetary inflation hedge, not a cpi (consumer price increase) hedge.

Common misconception. Monetary conditions began to contract in ‘22.

Inflation was 2020-21’s story. Monetary contraction is 2022’s story. pic.twitter.com/pKyy68xqCN

— ᛉ 𝓣𝓸𝓪𝓭 𝓞𝓯 𝓦𝓪𝓻 🇺🇸 (@BTC_i_Hodl) September 13, 2022

🐳🦈 The amount of #Bitcoin addresses with 10 or more $BTC has risen dramatically since mid-February. Over these past 7 months, the amount of these shark and whale addresses is up 3.6% on the network, and is back to its highest level in 19 months. 👍 https://t.co/7bFgEh1QMh pic.twitter.com/2CwEUCMgZ3

— Santiment (@santimentfeed) September 13, 2022

King Charles III on #Bitcoin: It's a "very interesting development." pic.twitter.com/sW9xtStLY4

— Bitcoin Magazine (@BitcoinMagazine) September 12, 2022

https://twitter.com/PubityIG/status/1569228620647768064

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.