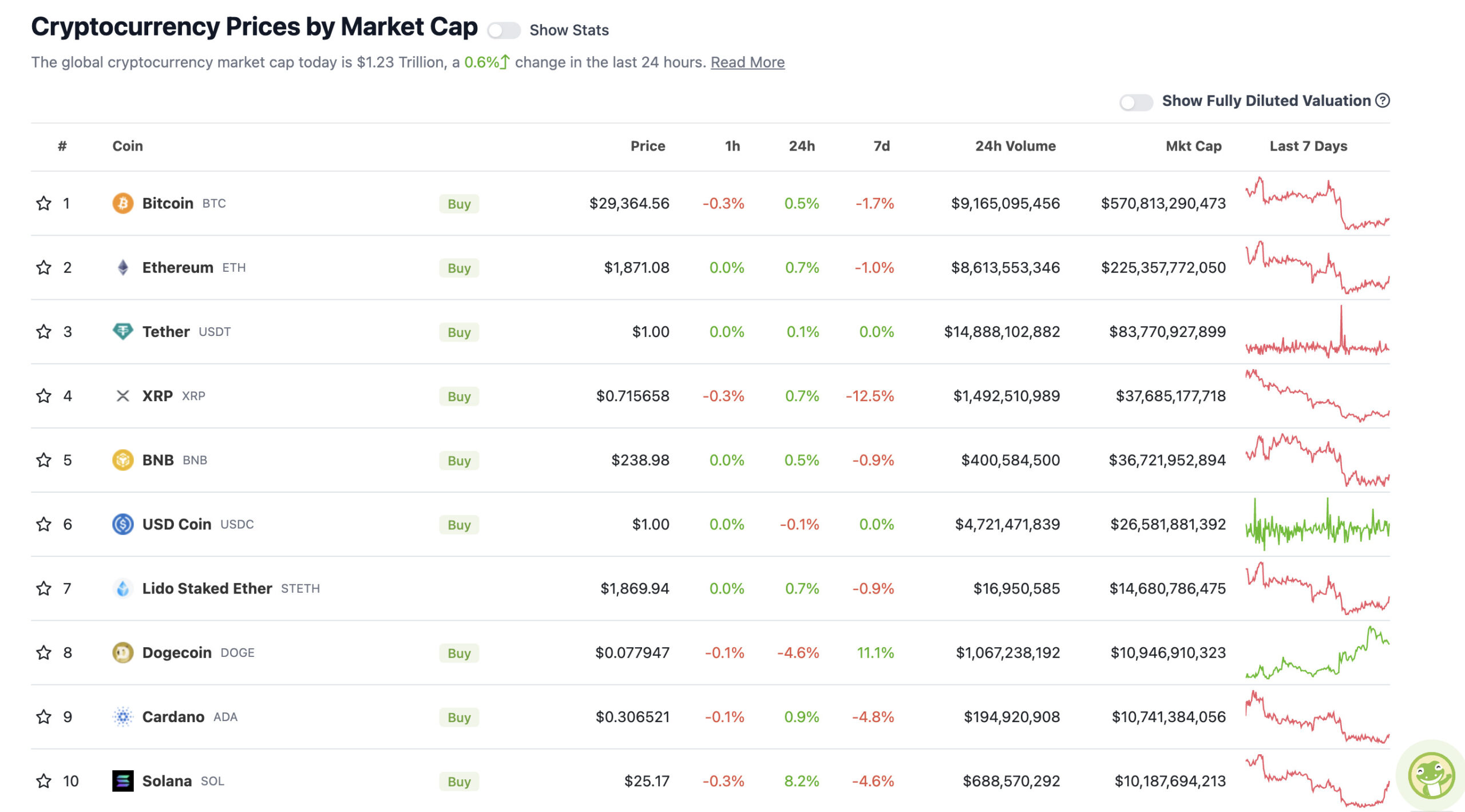

With the overall crypto market cap at US$1.23 trillion, up 0.6% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Mooners and Shakers: Bitcoin dusts itself off after Fed hike; Solana pumps

Not the one in the room. (Getty Images)

It was the most important FOMC meeting of our life and times. Until the next one.

After the Fed’s latest rate-hike announcement, Bitcoin lifted itself off the US$29k canvas for another groggy air swing, which was mildly encouraging. But it looks like it’s already run out of puff again.

Wall Street was a real mixed bag after Jerome Powell delivered the latest FOMC deliberations, including the broadly expected 25bps interest-rates hike from the Federal Reserve.

And you can throw Bitcoin and the crypto market into that mixed bag and shake it up for some extra spice, too.

These are the voyages of the Federal Reserve

Our ongoing mission

To screw the middle class

To seek out new ways

and new methods

to boldly make the rich richer from cycle to cycle https://t.co/9VMI2LorkU— Sven Henrich (@NorthmanTrader) July 26, 2023

As our very own non-fungible Eddy Sunarto noted earlier in his Market Highlights roundup, “Chair Powell gave nothing away regarding future decisions” from the Fed.

“Instead, he repeatedly reiterated the data dependency of the Fed’s next few meetings, simply noting that the FOMC is prepared to tighten policy further, if appropriate.”

The Fed trying to hold the economy together pic.twitter.com/GHe5COhjVY

— Not Jerome Powell (@alifarhat79) July 26, 2023

The Fed is meeting currently to decide the next move on how they get out of this mess.

A decision is expected soon …

— Wall Street Mav (@WallStreetMav) July 26, 2023

Hot take: the Fed doesn’t look like it’ll be cutting interest rates this year, then. Probably. Actually, we don’t know and it very much seems like Jay Powell doesn’t, either. Right then, as you were, carry on…

Top 10 overview

While Bitcoin, Ethereum and most of the others in the majors are doing okay, today (bar DOGE, which is taking a nap after an energetic walk yesterday), Solana (SOL) has actually surged.

Why? Good question. It’s been making a bit of a comeback just lately, hence its regular presence in the top 10 once more. We’ve been noticing a bit of VC positivity surrounding the Ethereum rival (which copped an absolute beating amid and in the aftermath of the FTX debacle).

For instance, Chris Burniske, a former ARK Invest analyst, now partner at the prominent Placeholder VC firm, told the Unchained podcast this week that he/they are now focusing on accumulating and supporting Solana.

“We [invested in] Ethereum in 2018-19, and it worked out for us, and we’re doing the same thing with SOL in this bear market,” said Burinske. “Centralization was a point of focus for us, we’ve been in crypto for a long time, we want the benefits of these systems to be maximally distributed and I think our view is [that] last year was a majorly redistributing event for Solana.

“I would say that Ethereum still has a very core place in our beings,” he added, “but we also want to help support other ecosystems of merit that have differentiated approaches that we see as appealing to differentiated developers that will build products that bring in different types of users, and so to us, Solana has merit in that regard.”

Meanwhile, regarding Bitcoin and crypto more broadly, for what it’s worth, here’s another popular crypto analyst’s take…

Most likely no more rate hikes.

However, the FED is not projecting a recession is a concern. Most likely one will come.

Have a terrible GDP tomorrow and sweep the lows on #Bitcoin before we continue the party up.

Buy the dip season. pic.twitter.com/KdhnNOz6kC

— Michaël van de Poppe (@CryptoMichNL) July 26, 2023

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Flex Coin (FLEX), (market cap: US$460 million) +24%

• Compound (COMP), (market cap: US$486 million) +14%

• XDC Network (XDC), (market cap: US$822 million) +11%

• Kaspa (KAS), (market cap: US$767 million) +7%

• Stellar (XLM), (market cap: US$4.2 billion) +6%

• Chainlink (LINK), (market cap: US$4.17 billion) +5%

SLUMPERS (11-100 market cap position)

• Toncoin (TON), (market cap: US$4.6 billion) -5%

• Theta Network (THETA), (market cap: US$820 million) -4%

• GALA (GALA), (market cap: US$582 million) -3%

• Filecoin (FIL), (market cap: US$1.89 billion) -2%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Apparently Sartoshi Nagamoto wasn’t innovative. Ah well, at least inventor of Bitcoin Satoshi Nakamoto was. (Whoever that actually is or was, of course.)

JUST IN: 🇺🇸 US Congressman says #Bitcoin creator "Saratoshi Nagamoto" was not innovative. pic.twitter.com/3i0AhKOcSN

— Watcher.Guru (@WatcherGuru) July 26, 2023

Meanwhile, OpenAI creator Sam Altman’s Worldcoin UBI (Universal Basic Income) retina-scanning, data-capturing project continues to gather attention. And we’re really not sure if that’s a kinda meh thing (WLD is down 2.5% in the past 24 hours) or a very bad thing. Writers of dystopian novels have some fresh fodder, though.

day 3 of @worldcoin launch, crazy lines around the world. one person getting verified every 8 seconds now. pic.twitter.com/vHRu1sWMT3

— Sam Altman (@sama) July 26, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.