Mooners and Shakers: Bitcoin crawls out of weekend as analysts expect dip lower

Getty Images

Morning, Coinheads and welcome to a short working week in this part of the world, with ANZAC Day tomorrow. Meanwhile, perhaps there are a few more going short on Bitcoin just at the moment.

The OG crypto has managed to stem its bleed into the weekend and is holding onto the mid-$27k level as we type. That said, there doesn’t appear to be oodles of confidence floating about from bullish types that it won’t head further south in the short term.

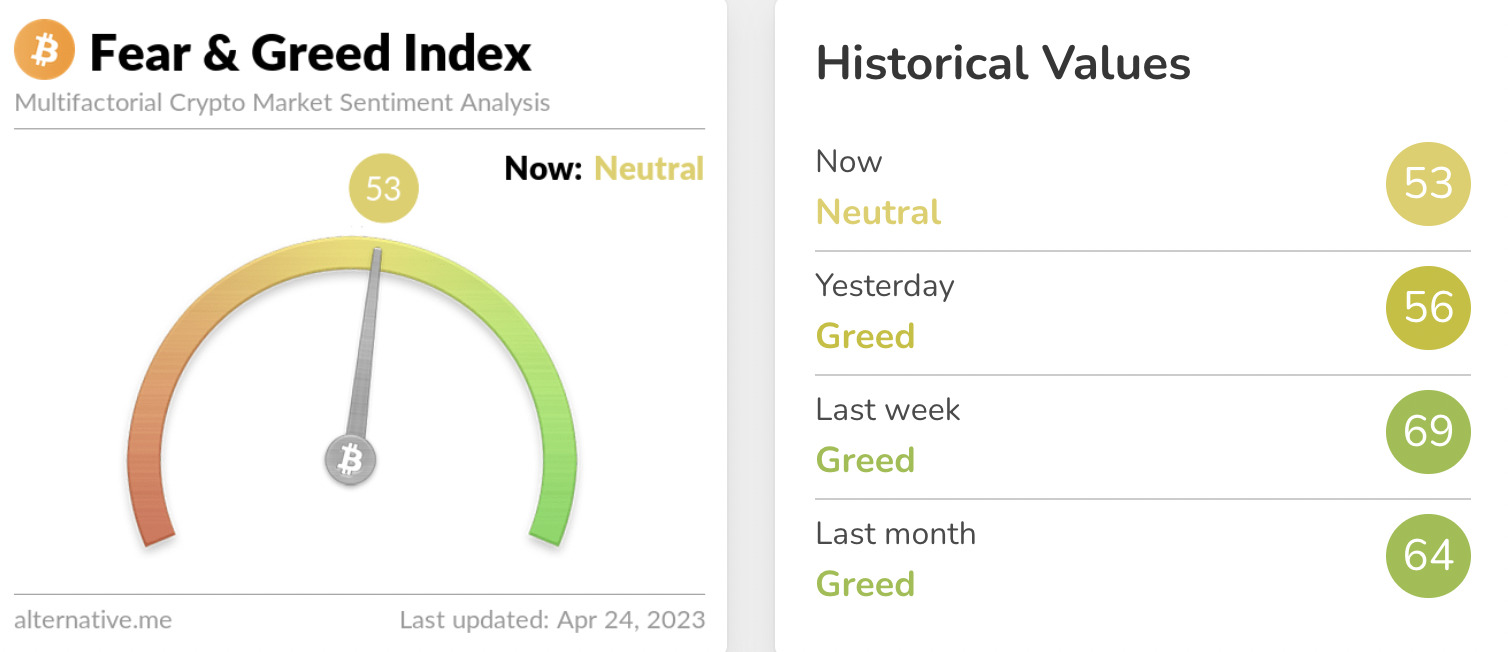

That’s reflected somewhat by a bit of a dip in market sentiment over the past few days, if the Crypto Fear & Greed Index is anything to seriously go by.

Top 10 overview

With the overall crypto market cap at US$1.21 trillion, down about 1% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

It’s not exactly the most inspiring-looking top 10 chart this morning, is it. Although you probably shouldn’t give much credence to weekend crypto price movements, it was as stagnant as we’ve seen in quite some time. The seven-day price action in the chart above speaks more to the cool-off narrative.

Still, as Binance’s founder and global CEO “CZ” says…

Less FUD on weekends…

— CZ 🔶 BNB (@cz_binance) April 23, 2023

Checking in with the odd crypto-twittering and YouTubing analyst, we’ll try to find a half decent cross section of slightly bearish, slightly bullish opinion…

This tweet from widely followed crypto analyst Benjamin “Into the Cryptoverse” Cowen, referencing BlackRock CEO Larry Fink selling some of his stocks position last week, might make more than a few people “following the money” a little wary.

CEOs don’t normally sell at bottoms https://t.co/5ia9NBYErc

— Benjamin Cowen (@intocryptoverse) April 22, 2023

Cowen, in one of his most recent YouTube videos, put forward the idea that Bitcoin (BTC) could be in for a “summer lull”, meaning the northern hemisphere/US summer, naturally.

“I would generally argue that there is a good chance that this will be a summer lull 2.0, where we come back in and come back down to these lower levels before ultimately putting on our rally caps going into the halving year. That is my general expectation,” said Cowen, adding that he tends to believe that for the rest of this year, “we will likely see prices fall back in”.

Meanwhile, Crypto Tony told his 287k+ Twitter followers that he’s been eyeing a US$26.6k short-term BTC target…

$26,600 is my target in my short position right now, and being the weekend it may take a bit longer to get there 💯

It is the most logical target and we also have bids popped up down there too now, so i am expecting a reaction once tested pic.twitter.com/7ZwRGYWvQQ

— Crypto Tony (@CryptoTony__) April 23, 2023

… while Dutch trader Michaël van de Poppe also thinks the OG crypto will “test a bit lower”, however, is still seeing the potential for a continuation of the bullish trend crypto has so far seen this year.

#Altcoins dropping towards new lows with the potential of having a bullish divergence on multiple timeframes.

Looking at #Bitcoin, we're still holding up.

Rejection at $27,800 resulted into a sweep lower, which I think we'll still test a bit lower before reversing up. pic.twitter.com/jzU6bm0goq

— Michaël van de Poppe (@CryptoMichNL) April 23, 2023

US chart watcher Roman Trading, another we regularly clock into, has his eye on the US Dollar Index, which has been flagging lower, as well as a potential “head and shoulders” pattern for Bitcoin dominance. What’s that mean? It essentially means there’s still a chance at present, in his view, for a risk-on market for crypto in the short term.

I still believe the $DXY will not confirm it’s DB and is rather bear flagging for lower. Lots of confluence on risk assets.

101.6 is the level to watch this week. if it breaks it’ll bust and risk will pump hard due to the HS forming on $BTC.D.#bitcoin #cryptocurrency pic.twitter.com/sW8yaiCj4m

— Roman (@Roman_Trading) April 23, 2023

This thesis could easily be invalidated, so we’ll have to wait and see how the week begins to pan out.

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• BitGet Token (BGB), (market cap: US$526 million) +9%

• Curve DAO (CRV), (market cap: US$756 million) +1%

• Kaspa (KAS), (market cap: US$435 million) +1%

• ApeCoin (APE), (market cap: US$1.45 billion) +1%

PUMPERS (lower caps)

• Evmos (EVMOS), (market cap: US$174 million) +9%

• Pepe (PEPE), (market cap: US$135 million) +7%

• Lukso (LYXE), (market cap: US$218 million) +3%

SLUMPERS

• Injective (INJ), (market cap: US$542 million) -9%

• Arbitrum (ARB), (mc: US$1.68 billion) -8%

• Zilliqa (ZIL), (mc: US$520 million) -7%

• Baby Doge Coin (BABYDOGE), (mc: US$449 million) -6%

• Optimism (OP), (mc: US$686 million) -4%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

There is no house in bitcoin, no counterparty risk, thus a commodity, like gold. Munger lies to help his banking investments. https://t.co/imI0AWe5Yf

— PlanB (@100trillionUSD) April 23, 2023

— Benjamin Cowen (@intocryptoverse) April 23, 2023

Twelve years ago #Satoshi left Bitcoin in good hands. pic.twitter.com/D5SKrz4129

— Michael Saylor⚡️ (@saylor) April 23, 2023

Technically I think we'll be having the classic Monday drop and then we'll reverse.

GDP & FED coming up.

Markets are pricing in reality in which 25bps is a likelihood.

Waiting for a clear reclaim of $27,800 or bull. divs in $26,800 area for longs on #Bitcoin.

— Michaël van de Poppe (@CryptoMichNL) April 23, 2023

670 days since John's "suicide".

670 days & his remains have still not been released.

670 days & his autopsy report has still not been released.

670 days is an absurd amount of time to wait to bury your loved one.

What are they hiding?#JohnMcAfeeDidNotKillHimself pic.twitter.com/WAcx4fywXb

— Janice Elizabeth McAfee (@theemrsmcafee) April 23, 2023

NEW‼️🇺🇸 President Biden's comms director holds $50,001-$100,000 in #Bitcoin – Cointelegraph

— Bitcoin Archive (@BTC_Archive) April 23, 2023

Hilarious how the moment she sees the cameras she tries to hide behind people.

— Coin Bureau (@coinbureau) April 23, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.