Mooners and Shakers: Bitcoin claws its way up; Mastercard plans crypto trading for banks

Getty Images

Is this the old crypto calm before another damaging storm? Or are “moonbois” and girls strapping in for an explosive ride out of Sideways City? Volatility is expected one way or another. Meanwhile, Mastercard has crypto-related news.

We’ll look at the payments giant’s announcement further below, but first, let’s talk Bitcoin and altcoins.

The leading crypto asset has been crabbing it in a reasonably tight range for about four months now – averaging around its current price somewhere near or below US$20k. Something’s got to give very soon, according to those who pore over the charts most hours of every day.

And it’s not just Bitcoin, of course. Here, US crypto analyst and forex trader Justin Bennett shows the overall altcoin pattern wedging itself into a super tight corner. In the mystical land of technical analysis, that often means one thing – an explosive move is about to ensue.

This terminal pattern for #altcoins is insane. 👀

Can't recall the last time I saw a market take a terminal pattern this far.

Something has to give soon. ⌛️ https://t.co/VOMgunsLb1 pic.twitter.com/Ar4t8sT0Ot

— Justin Bennett (@JustinBennettFX) October 17, 2022

Are we seeing the beginnings of a risk-markets rally with this little US$300 or so Bitcoin pump today? The S&P 500 and Nasdaq closed US trading in reasonable shape after a surge, so something like that could be on the cards. Although we still have a nagging feeling the Fed could utterly snuff out any short-term hopium come November 2 when they next meet to discuss fun stuff, such as interest-rate hikes.

But… according to Morgan Stanley’s CIO Michael J. Wilson, the US stock market might see a short-term rally of as much as 16%, provided a recession isn’t officially declared in the States. If he’s right, the crypto market would surge accordingly as well.

Morgan Stanley’s long-time equities bear Michael Wilson says US stocks are ripe for a short-term rally in the absence of an earnings capitulation or an official recession https://t.co/lFrCxOJk0I

— Bloomberg (@business) October 17, 2022

Stock Market forming some kind of low point that could result in a recession rally

In most recessions there exists rebounds that maintain higher levels for hundreds of days before retesting the lows

I’m bullish in the medium term. Long term it’s unclear if the worst is over

— Kevin Svenson (@KevinSvenson_) October 17, 2022

Bitcoiners be like pic.twitter.com/tKroXcZSCd

— Jameson Lopp (@lopp) October 17, 2022

Onto some daily price action.

Top 10 overview

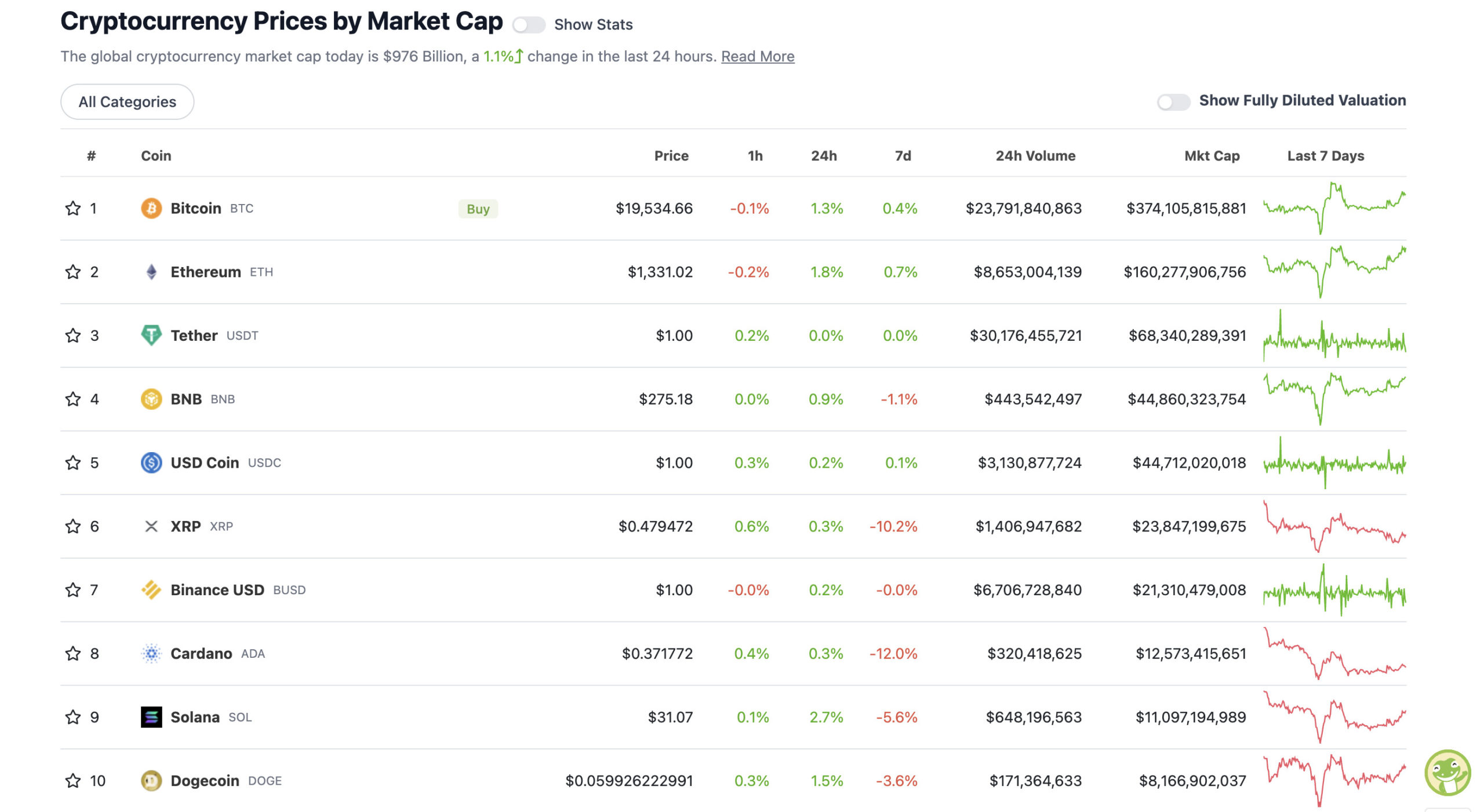

With the overall crypto market cap at US$976 billion, up about 1% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

It’s a pleasant sea of green for the daily price movements in the crypto majors, although Cardano and XRP continue to show double-digit downturns over the past seven days.

As far as XRP is concerned, is there any update on Ripple Labs’ legal battle with the SEC? No major developments beyond what we’ve recently covered.

However, here’s Ripple Labs CEO Brad Garlinghouse expressing his growing disdain for the SEC’s actions in a recent chat on the topic:

“Most ppl outside the United States don’t really care that the SEC is suing us.”

~@bgarlinghouse at DC Fintech 2022“No one gives a shit.”#XRPArmy #XRP pic.twitter.com/YIH1pzcDJw

— Cowboy.X (@cowboycrypto313) October 14, 2022

My outrage has grown as the litigation has unfolded.

There is no recourse, there is no consequence to those that brought this lawsuit. The SEC’s pursuit of a policy objective isn’t about “a faithful allegiance to the law”. It’s about power.

— Brad Garlinghouse (@bgarlinghouse) October 15, 2022

Mastercard aims to help banks move into crypto

More big crypto-adoption news? Yep. Mastercard has revealed it’s launching a program to let financial institutions offer crypto trading to their clients.

According to an announcement from the mainstream payments titan, Mastercard will act as a “bridge” between Paxos – a crypto trading platform already used by PayPal, and banks.

Mastercard’s program, dubbed Crypto Source, will handle regulatory compliance and security, which the payments firm confirms are the main reasons banks cite for their hesitancy in delving into crypto.

“There’s a lot of consumers out there that are really interested in this, and intrigued by crypto, but would feel a lot more confident if those services were offered by their financial institutions,” said Jorn Lambert, Mastercard’s chief digital officer.

According to a CNBC report, Mastercard will pilot the product in the first quarter of next year, presumably in the US, before expanding it out to “more geographies”.

https://twitter.com/BarrySilbert/status/1582107222460747778

Uppers and downers: 11–100

Sweeping a market-cap range of about US$8.2 billion to about US$407 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Huobi (HT),(market cap: US$1.04 billion) +17%

• Lido DAO (LDO), (mc: US$1.06 billion) +14%

• Maker (MKR), (mc: US$986 million) +10%

• Curve DAO (CRV), (mc: US$486 million) +9%

• Evmos (EVMOS), (mc: US$556 million) +8%

DAILY SLUMPERS

• Casper (CSPR), (market cap: US$482 million) -6%

• Celsius (CEL), (mc: US$411 million) -4%

• Radix (RDX), (mc: US$539 million) -2%

• Ethereum Name Service (ENS), (mc: US$500 million) -2%

• Chain (XCN), (mc: US$1.36 billion) -1%

Around the blocks

A selection of randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

https://twitter.com/BitcoinMagazine/status/1582059550793834496

https://twitter.com/LilMoonLambo/status/1581823047547244544

There's around 10 or so NFT projects that I think will appreciate tremendously in the coming decade.

Lasting through many bear or bull markets,

I might do a thread on this later.

— MattyVerse (@DCLBlogger) October 17, 2022

Meanwhile, prePO, an Aussie-founded “decentralised trading platform allowing anyone, anywhere, to gain exposure to any pre-IPO company or pre-token project”, is conducting its public sale of its PPO token at the time of writing.

We covered this unique project recently with David Angliss from Apollo Capital.

https://twitter.com/prepo_io/status/1582159525720621057

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.