Mooners and Shakers: Bitcoin barely clings to $28k as Pepe leapfrogs into top 100

Getty Images

Following the performance of the US stock market overnight, Bitcoin and many of the crypto market’s altcoins have dipped quite dramatically since this time yesterday, as the US Dollar Index gets a little boost. Meanwhile, frog memecoin PEPE keeps leaping higher.

More on that in a sec. The broad prediction, though, was that this was going to be a volatile week ahead of and after the US Federal Reserve’s latest FOMC meeting, and things are going to script so far.

The latest chapter in the US banking crisis – the collapse of First Republic Bank, and its sale from the US government to JPMorgan – is also muddying the waters for investors.

Bitcoin (BTC) responded particularly well to the banking sector woes in March, but that safe-haven narrative is yet to take hold this time around. A pre-FOMC dip is nothing new, though, as Crypto Twittering chart watcher Michaël van de Poppe suggests here…

Well, well, well #Bitcoin.

Again we're getting a correction going into FOMC? pic.twitter.com/dg2tRL6Tlm

— Michaël van de Poppe (@CryptoMichNL) May 1, 2023

Top 10 overview

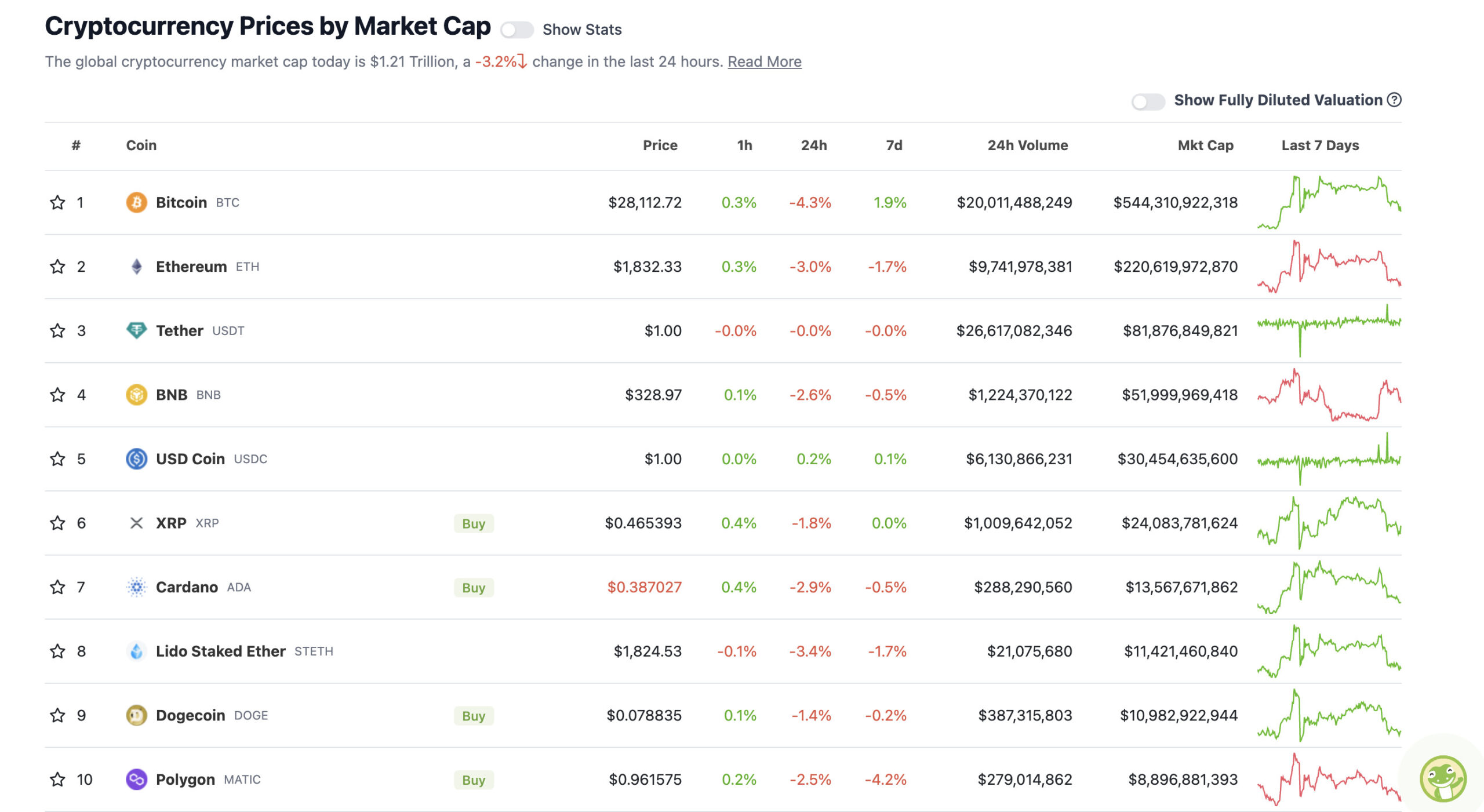

With the overall crypto market cap at US$1.21 trillion, down about 3.2% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Bitcoin has take quite a hit since we put this column together this time yesterday, when it was travelling, albeit with some turbulence, at a US$29,400 altitude. This morning (AEST), it plummeted to US$27,700, but is attempting to reclaim $28k as a level of support as we type.

The Bitcoin bulls and bears have plenty to speculate about as they analyse things of a technical nature.

“Moustache” has been pointing out a bullish monthly cross in the MACD (moving average convergence/divergence), for instance, which has played out well for Bitcoin in the past…

#Bitcoin – Update

It finally happened.

A bullish monthly cross in the MACD.

As said last time, the 2W cross has taken $BTC from 16k-30k.

A monthly cross is huge and has only happened in 2012, 2015 and 2019 (I would call the covid crash an exception). pic.twitter.com/RZAEM1G5JL

— 𝕄𝕠𝕦𝕤𝕥𝕒𝕔ⓗ𝕖 🧲 (@el_crypto_prof) May 1, 2023

But, if the US dollar somehow keeps pulling itself up off the canvas, all short-term bullish Bitcoin bets are off.

Wait, I almost forgot…

GM dollar bulls. ☕$DXY pic.twitter.com/CnJgSD1eji

— Justin Bennett (@JustinBennettFX) May 1, 2023

Let’s wait and see what happens at the Fed meeting, though. The wider investment mindset, as Tedtalksmacro points out, will likely be defensive positioning until, at least, just after Jerome Powell walks away from the lectern.

https://twitter.com/tedtalksmacro/status/1652997550431928321

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Pepe (PEPE), (market cap: US$516 million) +65%

• TRON (TRX), (market cap: US$6.12 billion) +2%

• Chiliz (CHZ), (market cap: US$688 million) +1%

• Injective (INJ), (market cap: US$630 million) +1%

Despite Bitcoin and altcoins falling in a heap around it, Pepe bounded its way into the top 100 coins by market cap overnight (AEST). In fact, all the way up to 90, where it’s taking a bit of a breather right now.

If you’re thinking something along the lines of… “WTAF… a crypto created with no intrinsic value other than it trading off the power of someone else’s meme (which may or may not end up creating a copyright issue) has made a few chancers an absolute crapload of money in two weeks?”… then you’d be right.

At least it’s not another bloody dog coin, right? Although a spate of newly spawned frog-themed garbage has definitely begun populating the lower ends of the crypto scale over the past fortnight.

You might’ve have expected PEPE to have had a pretty significant dump by this stage. That’s usually how it goes with newly released memecoins. But it hasn’t happened (yet).

In fact, $PEPE has been going from strength to strength. It looks like it was listed on the OKX exchange, which might explain some of its extra pumpage yesterday and into today.

Get it! Wen @binance @cz_binance pic.twitter.com/OmwoKhqlPJ

— MEMER (@MemerAus) May 1, 2023

If Bitcoin and the rest of the crypto market does continue to lose strength this week, it’ll be interesting to see if Pepe can hold up okay or if it gets well and truly frog stomped.

$PEPE Made overnight millionaires 🤯 as it went from a shitcoin with barely 100k in liquidity to a top #85 token 📈 💸

Here's the wallets 👛 and tools 🔧 i created to help you track wallets early to $PEPE so that you don't miss the next memecoin run again! 🤫

👇

0/6 pic.twitter.com/GmLre8ac0f— Defi_Mochi (@defi_mochi) May 1, 2023

PUMPERS (lower caps)

• Wojak (WOJAK), (market cap: US$23 million) +78%

• MXC (MXC), (market cap: US$58 million) +37%

• MATH (MATH), (market cap: US$20 million) +15%

SLUMPERS

• Internet Computer (ICP), (market cap: US$2.51 billion) -10%

• Kaspa (KAS), (mc: US$468 million) -10%

• Render (RNDR), (mc: US$807 million) -7%

• Hedera (HBAR), (mc: US$1.86 billion) -7%

• ImmutableX (IMX), (mc: US$895 million) -5%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

I threw in $5k super late into $PEPE thinking I bought the top and still up $25k in a few days

Which means some of you have made some insane cash off this meme

— Rager (@Rager) May 1, 2023

Frog money millionaire spotted in New York $pepe pic.twitter.com/FPiky8JW0I

— borovik (@3orovik) April 24, 2023

First Republic Bank was the 2nd largest bank failure in US history. Only Washington Mutual was bigger… pic.twitter.com/YnocngmGpM

— Charlie Bilello (@charliebilello) May 1, 2023

Yes, yes it is.https://t.co/e9tBLj1WfI

— Caitlin Long 🔑⚡️🟠 (@CaitlinLong_) May 1, 2023

https://twitter.com/tedtalksmacro/status/1653037902161387521

New month

Same #BTC outlook$BTC is well-positioned for a new macro uptrend over the mid- to long-term after successfully breaking beyond the macro downtrend

Question is do we get a 2015-like retest or just continue moving upwards like in 2019?#Crypto #Bitcoin pic.twitter.com/4JBpifji1x

— Rekt Capital (@rektcapital) May 1, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.