Mooners and Shakers: Bitcoin back above $28k as altcoins Kaspa, Conflux and Algorand surge

Getty Images

Bitcoin has bounced back strongly above US$28k over the past 24 hours, while a handful of altcoins have taken that as the sign to bust a move, too.

In fact, the OG crypto is up around 72% so far in 2023 and has made its best quarterly gain in about two years.

Which, when you consider the amount of excrement hitting the crypto industry fan this year, courtesy of the US government and its bulldog regulators, it’s a pretty remarkable show of strength.

Cathie Wood says US crypto crackdown will become an election issue

And on that topic, Bitcoin bull Cathie Wood – CEO of ARK Invest – believes the Biden government’s seemingly anti-crypto stance will likely have negative consequences for the Democrats at the next major US election.

In a recent interview with US economist Arthur Laffer (apparently Wood’s one-time mentor), the tech-loving CEO noted that some 50 million Bitcoin-owning Americans will be watching closely the actions of the US government.

“I don’t know if you saw the President’s annual economic report. It came out a couple of days ago and it went after crypto. Big time,” noted Wood.

“They saw no role for [crypto]. Well, it has to be somewhat threatening… I honestly think – and we’re seeing with young people especially – this is going to become a national election issue.”

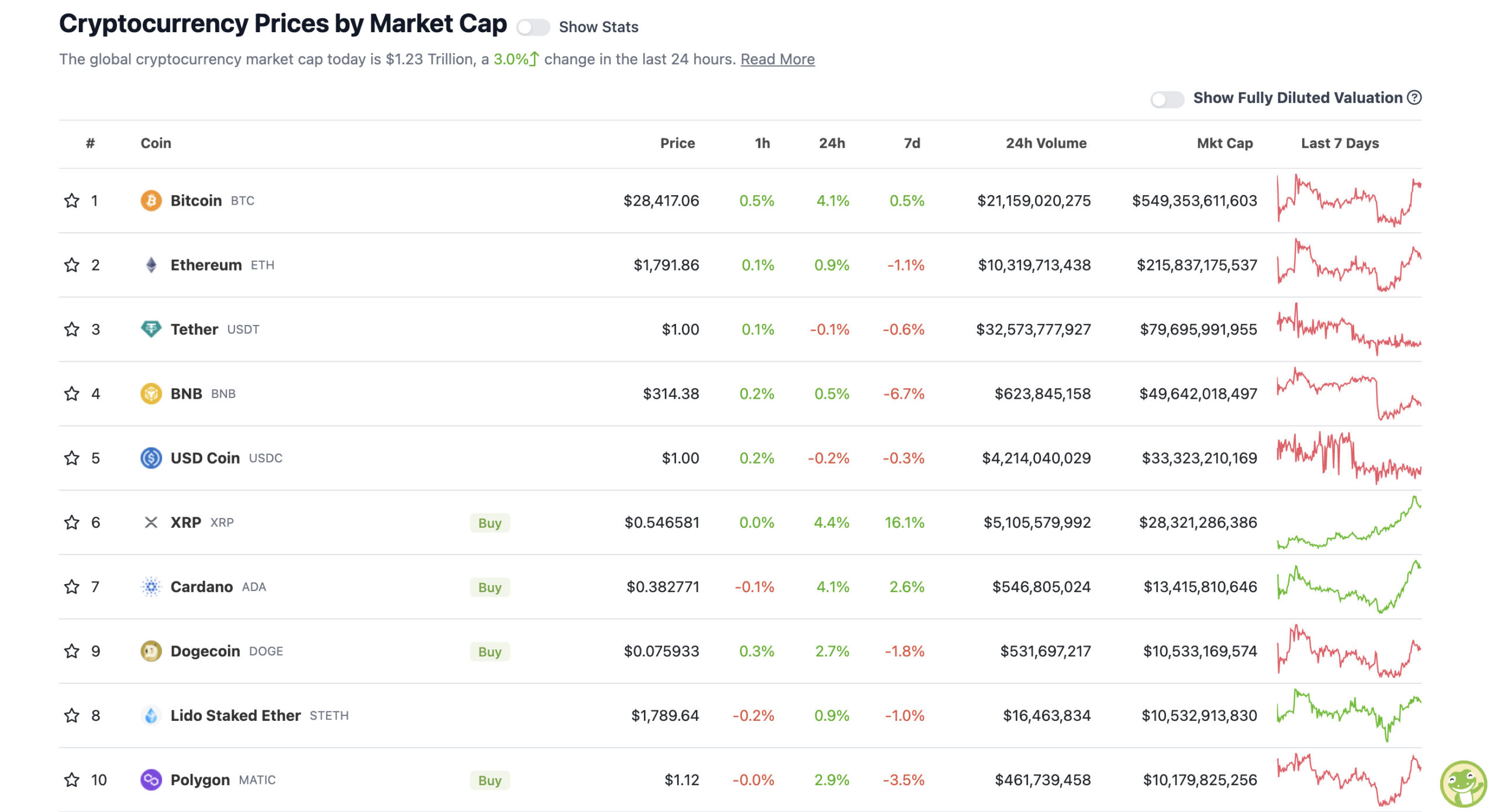

Top 10 overview

With the overall crypto market cap at US$1.23 trillion, up about 3% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

As always, it’s Bitcoin’s rally that’s the most important on this chart (sorry, Ethereum – it may not always be so), and that’s because it’s the crypto market mover in chief. That said, there are some altcoins on the move that might be worth paying attention to as well.

But, as Eddy “Market Highlights” Sunarto noted this morning, “according to a recent survey, Bitcoin remains the favourite crypto asset among Australians”.

Josh Gilbert, a market analyst over at eToro meanwhile breaks down his BTC outlook thus:

“Looking ahead, we believe the top-down macro outlook remains the main crypto driver for now, with the lower inflation and interest rate outlook supportive.

“The asset class remains one of the positive wild cards of 2023 after being the worst performing asset in 2022.

“However, there is still continued uncertainty in wider capital markets, meaning it may not all be one way for Bitcoin and crypto assets this year.”

Checking in with a prominent Crypto Twittering analyst as well, here’s Rekt Capital, who is eyeing the weekend for all the confirmation he needs that Bitcoin has reversed the macro downtrend and leapt boldly into a new bull market…

This Saturday, the #BTC Monthly Candle will have closed above the Macro Downtrend to confirm a new Bull Market$BTC #Crypto #Bitcoin pic.twitter.com/yHS6YfU91L

— Rekt Capital (@rektcapital) March 29, 2023

Uppers and downers: 11–100

Sweeping a market-cap range of about US$8.15 billion to about US$432 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS

• Kaspa (KAS), (market cap: US$506 million) +26%

• Conflux (CFX), (mc: US$898 million) +22%

XCMG (@XCMGGroup), 3rd largest construction machinery manufacturer worldwide, has teamed up with #Conflux and Zen Spark Technology.

Together, we're pushing the limits of blockchain and #Web3 technologies to explore exciting international use cases.https://t.co/1fzgYJbzH6

— Conflux Network Official (@Conflux_Network) March 28, 2023

• Algorand (ALGO), (mc: US$1.66 billion) +15%

Algorand has released some called Algokit – a collection of tools and libraries that make it easy to build applications on the Algorand chain.

Video of @JohnAlanWoods tomorrow after dropping #AlgoKit #Algorand pic.twitter.com/1ZeGksLrBd

— Poli (@ProfPoliwag) March 28, 2023

• Render (RNDR), (mc: US$472 million) +12%

• Hedera (HBAR), (mc: US$2 billion) +12%

Okay, let’s talk about Kaspa very briefly. This thing is up more than 82% over the past seven days, and that’s perhaps partly because the under-the-radar project has been listed on a couple of exchanges this week – Hotbit and BYDfi. Admittedly, not the most prominent and renowned exchanges, but still.

What is it, then? It’s a Bitcoin-inspired proof-of-work crypto, which, according to its website is “the fastest, open-source, decentralized & fully scalable Layer-1 in the world”. Bold claims.

It uses something called BlockDAG, which is apparently helps it deliver high block creation and transactional speed without the loss of security and decentralisation that other chains tend to encounter.

#Kaspa $KAS

no ceo

no board

no ico

…

everything you wrote, exactly the same as #Bitcoin

…

1.4 years old

230mn market cap

+

instant tx confirmations on layer-1.

usable stateless money pic.twitter.com/hlCL9mMYCP— Eyal Yablon𐤊a (@fishtuna) March 16, 2023

As with absolutely everything presented in Mooners & Shakers, due diligence is required on Kaspas, and absolutely nothing written here should be construed as financial advice.

SLUMPERS

• Flare (FLR), (market cap: US$479 million) -8%

• GMX (GMX), (mc: US$649 million) -2%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

BREAKING‼️ China and UAE have completed the world’s first Yuan- settled LNG trade in a blow to US Dollar dominance – Reuters

It begins… pic.twitter.com/jT74B8DgPq

— Radar🚨 (@RadarHits) March 29, 2023

#Bitcoin if $USD stops being the global reserve currency. pic.twitter.com/n5coMQserH

— Altcoin Daily (@AltcoinDailyio) March 29, 2023

Uh-oh… CNBC’s Jim “The Cooler” Cramer said something positive about Bitcoin. Time to dump everything absolutely immediately?

Jim Cramer says “They haven’t been able to do anything to damage Bitcoin, it’s a rebellion against the system”

Is Jim turning bullish on Bitcoin?! 😮 pic.twitter.com/jZb7oXocyJ

— Crypto Crib (@Crypto_Crib_) March 29, 2023

The best argument for why this is gonna giga send is that we've simply run out of bad news

We've nuked every company, every reputation, everything

The whole industry is a laughing stock, and yet price is 2x from the lows

What else do they wanna throw at us?

— DonAlt (@CryptoDonAlt) March 29, 2023

SEC chief Gary Gensler will face the Financial Services Committee to justify his recent policies and approach towards the crypto ecosystem. pic.twitter.com/VPQtI43MFQ

— Crypto Crib (@Crypto_Crib_) March 29, 2023

#Bitcoin doesn't care… 🚀 pic.twitter.com/vdC8F36dH4

— Bitcoin Archive (@BTC_Archive) March 29, 2023

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.