Mooners and Shakers: Bitcoin attempts to arrest slide as ‘crypto winter’ predictions circulate

Pic: Getty

Geopolitical fears and various other concerns continue to keep the crypto market on edge, even with Wall Street taking a day off from its jitters.

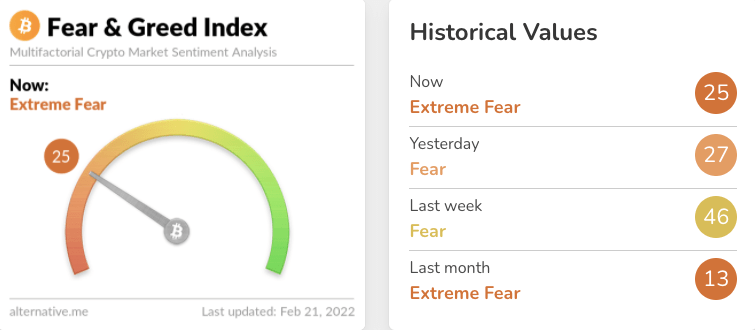

While Bitcoin is attempting another relief bounce at the time of writing, it’s still anxious times for over-positioned, serial-portfolio-checking HODLers, with the Crypto Fear & Greed Index sentiment tracker now officially back in the “Extreme Fear” zone.

And aside from the threat of war still on the table in Eastern Europe, the Fed’s rate-hike narrative and tech stocks tumbling in Asia today, it seems some prominent crypto founders aren’t doing much to allay extreme fears right now, either…

Crypto founders are prepared for a deeper bear market

Du Jun, co-founder of the Chinese-founded, Seychelles-based Huobi crypto exchange told CNBC yesterday that he thinks the next Bitcoin bull run won’t occur until mid-late 2024. This would be in line with the fourth Bitcoin “halving” event, expected in July 2024.

Referencing the “crypto winter of 2018″, which followed the second Bitcoin halving and rally in 2017, Du indicated he’s a believer in the cyclical nature of the halvings and their so-far historically correlated price action.

“If this circle continues, we are now at the early stage of a bear market,” said Du. “Following this cycle, it won’t be until the end of 2024 to the beginning of 2025 that we can welcome the next bull market on Bitcoin.”

And as Cointelegraph points out, late last year, Kraken crypto exchange CEO Jesse Powell was also expecting a looming crypto winter, calling anything under US$40k for BTC a “buying opportunity”.

Jirayut Srupsrisopa, CEO of Thailand-based crypto exchange Bitkub Capital Group Holdings, also thinks a major bull run won’t occur until 2024, with a period of corrections and volatility in between.

But Vitalik reckons there’s a silver lining…

Meanwhile, Ethereum co-founder Vitalik Buterin told Bloomberg the other day that he thinks a crypto winter wouldn’t be such a bad thing and might even help the industry to mature and strengthen.

“The winters are the time when a lot of those applications fall away and you can see which projects are actually long-term sustainable, like both in their models and in their teams and their people,” said the 28-year-old billionaire, adding:

“[Crypto builders] welcome the bear market because when there are these long periods of prices moving up by huge amounts as it does — it does obviously make a lot of people happy — but it does also tend to invite a lot of very short-term speculative attention.”

Top 10 overview

With the overall crypto market cap actually ticking up about 1% over the past 24 hours, here’s the state of play in the top 10 by market cap right now – according to CoinGecko data.

Layer 1 protocol Terra (LUNA) is the clear top-coin mover on the daily timeframe. The Terra blockchain recently injected about US$450 million worth of the network’s stablecoin UST into the Anchor yield reserve, strengthening its DeFi ecosystem.

Anchor Protocol (ANC) is a decentralised savings platform offering low-volatile yields on stablecoin deposits on the Terra network.

No turbulence ahead.

On Friday, Terraform Labs’ founder, Do Kwon, injected $450 million UST into Anchor protocol’s reserve to guarantee its lucrative rewards system of 20% per annum. https://t.co/pacMcuzxA5

— Cointelegraph (@Cointelegraph) February 19, 2022

$BTC Daily levels to watch.

Seems that we’re $2000 from potential support and $7000 from macro support.

Will we bounce at 35 or 30?#bitcoin #cryptocurrency #cryptotrading #cryptonews pic.twitter.com/Q8PKrBezf0

— Roman (@Roman_Trading) February 21, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$18.6 billion to about US$944 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Quantstamp (QNT), (market cap: US$1.58 billion) +13%

• JUNO (JUNO), (mc: US$1.3b) +7%

• Decentraland (MANA), (mc: US$4.25b) +6%

• Waves (WAVES), (mc: US$960m) +5.5%

• Shiba Inu (SHIB), (mc: US$14.7b) +5%

DAILY SLUMPERS

• Radix (XRD), (market cap: US$1.26 billion) -5%

• Ecomi (OMI), (mc: US$2.9b) -4%

• NEO (NEO), (mc: US$1.6b) -3%

• DASH (DASH), (mc: US$1b) -2%

• Convex Finance (CVX), (mc: US$1.2b) -2%

Uppers and downers: lower cap

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• Achain (ACT), (market cap: US$10.8m) +134%

• Nest Protocol (NEST), (mc: US$48.5m) +30%

• STP Network (STPT), (mc: US$143m) +19%

• Adventure Gold (AGLD), (mc: US$78m) +18.5%

• Trader Joe (JOE), (mc: US$193m) +15%

DAILY SLUMPERS

• Pegaxy Stone (PGX), (market cap: US$19.5 million) -22%

• Radicle (RAD), (mc: US$226m) -13%

• Goldfinch (GFI), (mc: US$27.6m) -13%

• API3 (API3), (mc: US$310m) -12.5%

• Maple Finance (MPL), (mc: US$84.6m) -8%

Final words

#bitcoin CANNOT BE BANNED! https://t.co/w3MvNjSdHJ

— Vincenzo Stefanini (@VincentStefanin) February 19, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.