Mooners and Shakers: Bitcoin and Ethereum steady as altcoins look ready to move

Getty Images

Bitcoin is cruising along around US$30k, Ethereum just rose above $2,100 and several altcoins look like they’re shaking on the launchpad, ready to blast off. Welcome to a hopium-filled start to the crypto week.

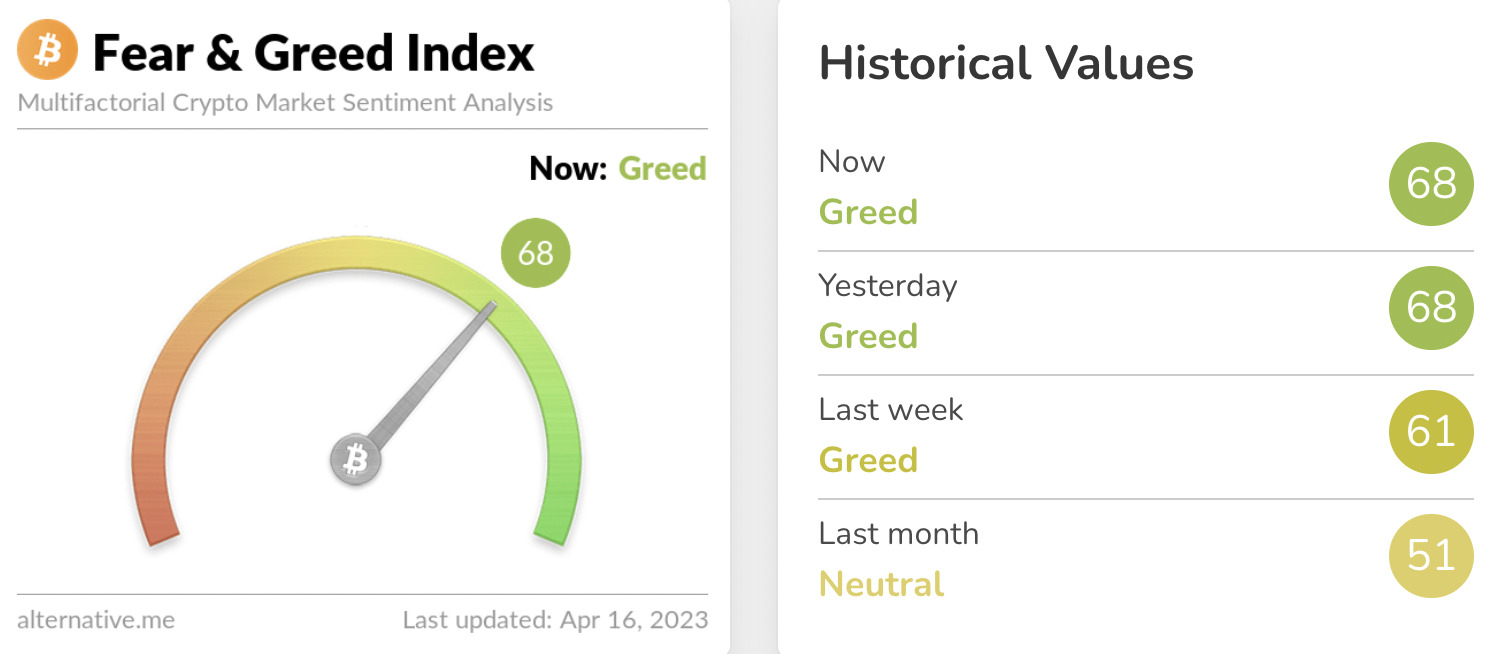

Before we go any further, lets’s get some visual confirmation on said hopium, in the form of a greedy Crypto Fear & Greed Index…

Yep, just as we thought, not much has changed there. It’s a very vague level of science, of course, but if the needle moves into Extreme Greed territory, that’s when things tend to become overheated and it might be time to heed the good old Warren Buffett pearl of wisdom. You know the one.

Some breaking/broken news

• Hong Kong has confirmed its commitment to crypto at a major Web3 conference held in the region. In case you had any doubts that the major Asian financial hub is shaping to become a crypto powerhouse, government officials there all but confirmed the plans.

Speaking at the Hong Kong Web3 Festival late last week, Financial Secretary Paul Chan Mo-po said, regarding the regulation of the industry:

“I believe that everybody has learned from recent events that appropriate regulations are a must to create a sustainable development environment and a more ideal space for development.”

• US Congress will host two major crypto hearings later this week. Firstly, SEC boss Garry Gensler is due to be grilled by the US House Committee on Financial Services on the subject of “Oversight of the Securities and Exchange Commission.” Gensler is well known for his strict stance on the industry and believes all, or most altcoins are unregistered securities.

The other hearing is related to draft legislation pertaining to stablecoins.

Draft US Digital Dollar / Payment Stablecoin Bill Enters Congress

1/ A product of bi-partisan efforts, the first comprehensive proposed law for Payment Stablecoins has arrived in Congress. Some thoughts below:

https://t.co/SD0x2oQMmk— Jeremy Allaire – jda.eth / jdallaire.sol (@jerallaire) April 15, 2023

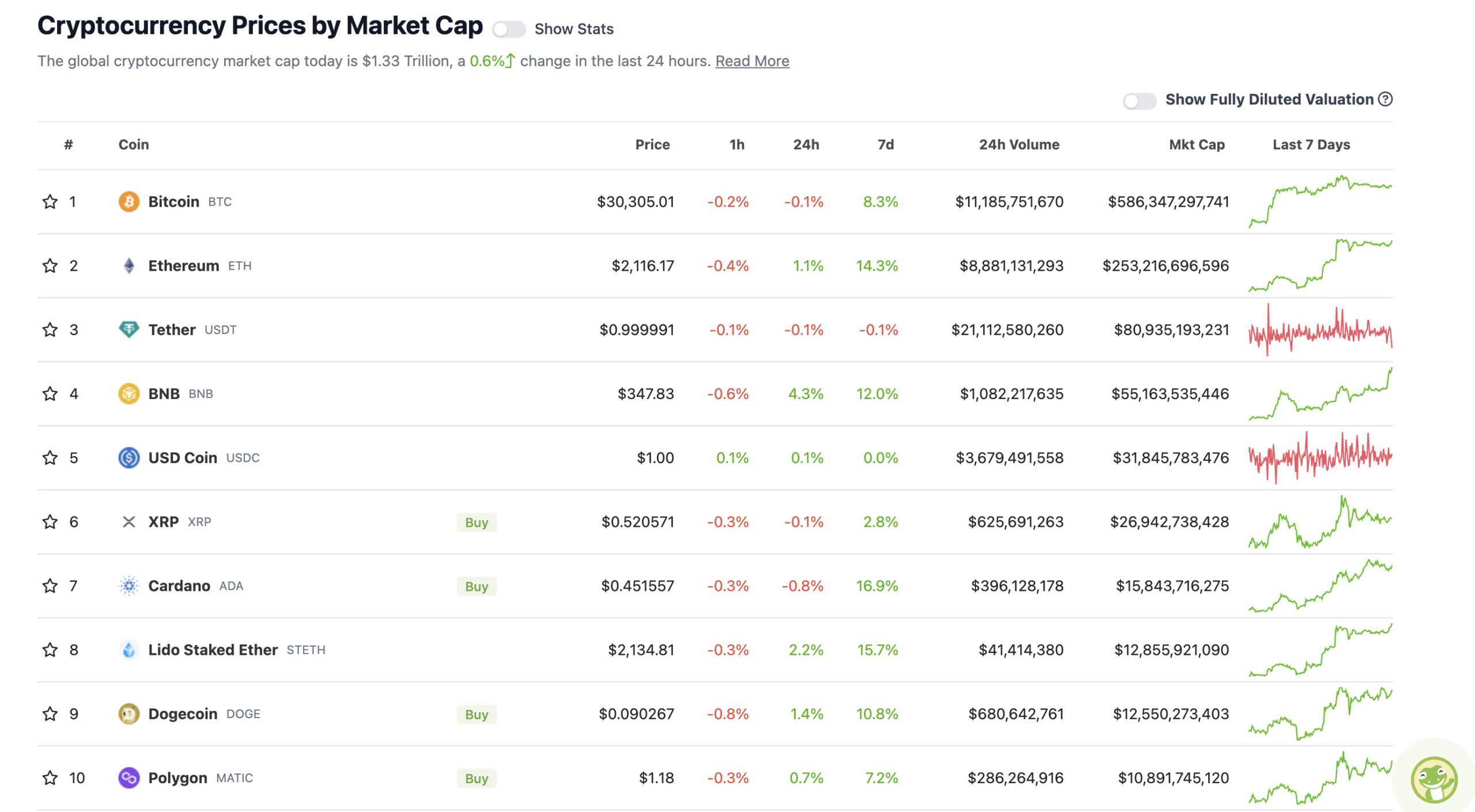

Top 10 overview

With the overall crypto market cap at US$1.33 trillion, up 0.6% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Layer 1 blockchains Ethereum and Cardano have been leading this latest rally over the past few days, ever since the former successfully implemented its Shanghai and Capella network upgrades last week.

Staking has become a hot topic again, and although those two chains are in direct competition with one another, both are increasingly relying heavily on the narrative – for validation and securing their proof-of-stake networks and also for increasing decentralisation.

Meanwhile, just to prove the point, the liquid staking derivative token STETH is still, erm, staking its recent claim for a long-term top 10 berth in the crypto market cap stakes.

And meanwhile meanwhile… look out, Crypto Twitter-housed chart watchers are seemingly swinging altcoin-bullish…

https://twitter.com/Pentosh1/status/1647705921483595776

$Link is a sleeping giant.#cryptocurrency #cryptotrading pic.twitter.com/qRy3pOkMAv

— Roman (@Roman_Trading) April 16, 2023

The more #Bitcoin stabilizes, the more momentum we’ll see on altcoins.

There’s more confidence now through #Ethereum and Q2 was also a great quarter in 2019.

— Michaël van de Poppe (@CryptoMichNL) April 16, 2023

Uppers and downers: 11–100

Sweeping a market-cap range of about US$9.55 billion to about US$439 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS

• Radix (XRD), (market cap: US$906 million) +16%

• Casper Network (CSPR), (mc: US$625 million) +15%

• Rocket Pool (RPL), (mc: US$1.14 billion) +14%

• Injective (INJ), (mc: US$744 million) +13%

• Baby Doge Coin (BABYDOGE), (mc: US$573 million) +8%

SLUMPERS

• OKB (OKB), (market cap: US$3.18 billion) -4%

• WOO Network (WOO), (mc: US$545 million) -3%

• Stacks (STX), (mc: US$1.18 billion) -1%

• MultiversX (EGLD), (mc: US$1.09 billion) -1%

• Optimism (OP), (mc: US$847 million) -1%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Yep, this pretty much sums up the current sentiment we were talking about earlier…

https://twitter.com/Pentosh1/status/1647738708957839360

‼️ Brazil’s Nubank holds #Bitcoin with 1% of its treasury.

Guess who is a major shareholder?

Warren Buffett. 😂 👏 pic.twitter.com/jbgWBPt9dG— Bitcoin Archive (@BTC_Archive) April 16, 2023

World’s most insane Bitcoin bet ever 🤯#Bitcoin #BTC #crypto pic.twitter.com/G9kh72dKKt

— Lark Davis (@TheCryptoLark) April 16, 2023

Spotted in London by a member of the team.

We say no #CBDC because we want our financial privacy. pic.twitter.com/nn8nOKq0ya

— Coin Bureau (@coinbureau) April 16, 2023

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.