Mooners and Shakers: Bitcoin and Ethereum slip further, but RSI tells us it’s oversold

Repetitive Slouch Injury? Or maybe something else. (Pic via Getty Images)

Bitcoin and Ethereum (and, because most of them are total sheep, the altcoins) dipped again overnight, while the bears lick their prehensile lips. But let’s look for silver linings, shall we? The RSI provides one.

That stands for the Repetitive Strain Injury that Bitcoin’s clearly suffered banging its fist and head against the US$29k door for a good month or so.

It also stands for Relative Strength Index, which, to cut a long story short (or actually make it slightly longer), is essentially a technically analytical indicator that shows when a market is overbought or oversold.

A number above 70 quite often indicates the market or a particular asset is overbought, and below 30 tends to mean that it’s oversold. Bitcoin’s is currently sitting around 20 on its daily RSI.

Bitcoin daily RSI is the most oversold that it's been since the March 2020 covid crash pic.twitter.com/MPUfmQagcu

— Will (@WClementeIII) August 22, 2023

Excuse us for a sec while we look backstage for one of yesterday’s Bitcoin-analysis stars to back up that tweet from young Bitcoin analyst Will Clemente above…

Ah here he is. Welcome to the stage, former Wall Street trader bloke and financial media (Real Vision) CEO Raoul Pal…

“Hello…”

Actually, Pal, we’ll take it from here. We can just quote what you said in your most recent blog.

The one-time Goldman exec-turned-crypto-enthusiast predicts institutional buyers will move in to buy the dip – in stocks first of all – establishing a market bottom on the S&P 500.

“At this pace of sell-off, we’ll be back to oversold conditions for S&P 500 either this week or next,” he noted, adding:

“Bitcoin also came down over the week to retest key support levels at around $25,200. We just triggered a new DeMark daily 9 setup today.

“These have worked well in the past in signaling a reversal in price. Additionally, with a current RSI of 20 (yes, 20!), Bitcoin is the most oversold since June of last year.”

And that there, is our hopium-reaching kicker for today.

Pal thinks this “DeMark sequential indicator” he speaks of, along with the RSI, suggests that we’ll soon BTC flip bullish once more.

But… the bears

In the spirit of some sort of attempt at balance here, we’d best give some bearish voices some airtime, because there are a lot of them about.

It’s probably completely unfair to label the always astute, brainiac crypto analyst Ben “Into the Cryptoverse” Cowen a bear (or a bull) but here’s his latest take – or at least “a scenario to consider”.

#Bitcoin – A scenario to consider

This potential scenario is a lower low.

Of course, a case could be made for a double bottom (2015) or higher low (2018-2020), but I would at least keep the 2019 high in mind ($13k-$14k). pic.twitter.com/Wl7LliTLmO

— Benjamin Cowen (@intocryptoverse) August 22, 2023

We shouldn’t be lumping pseudonymous analyst and trader extraordinaire Bluntz into the ‘bear’ category, either. He’s only calling it as he sees it right now, and he seems long-term bullish. Here’s what he has to say about the total crypto market right now…

“Looking at TOTAL paints the clearest picture of them all, far more than looking at either ETH or BTC on their own imo.

“Based off of TOTAL, I do believe the June lows still need to be swept before calling bottoms, but it will probably be the last GOOD buying opportunity of the next few years.”

looking at $TOTAL paints the clearest picture of them all, far more than looking at either $eth or #btc on their own imo.

based off of total i do believe the june lows still need to be swept before calling bottoms but it will be probably the last GOOD buying opp of the next few… pic.twitter.com/sAEQI6iHSf

— Bluntz (@Bluntz_Capital) August 21, 2023

The June lows he’s looking at appear to be somewhere around a total US$900 billion market cap. Currently the broader crypto market is chopping around US$1.09 trillion.

Lastly, popular crypto YouTuber Nicholas “DataDash” Merten has been on the more bearish side of the ledger for a while now. In his latest video, he notes:

“The bulls did not show up as expected, and now we must brace ourselves for significant upcoming challenges.

“This pain won’t only affect Bitcoin but also the entire altcoin space, including Ethereum. There are warning signs indicating Ethereum’s potential collapse in the next few weeks, with its ascending support line at risk.”

Merten says he wouldn’t be surprised to see Ethereum, in particular, lose some levels of support and sink back below US$1,000 again in the short term.

Grain of salt and all that. As usual, it’s bloody hard to know who’s going to be right and who’s going to be dead wrong in the world of crypto price-movement predictions.

Keep an open mind, manage risk, play the long game if you’re a true believer, and train one eye on the macro environment, we say. (Without being even remotely qualified in any way to offer anything that should be even remotely construed as advice of the financial kind or otherwise. Of course.)

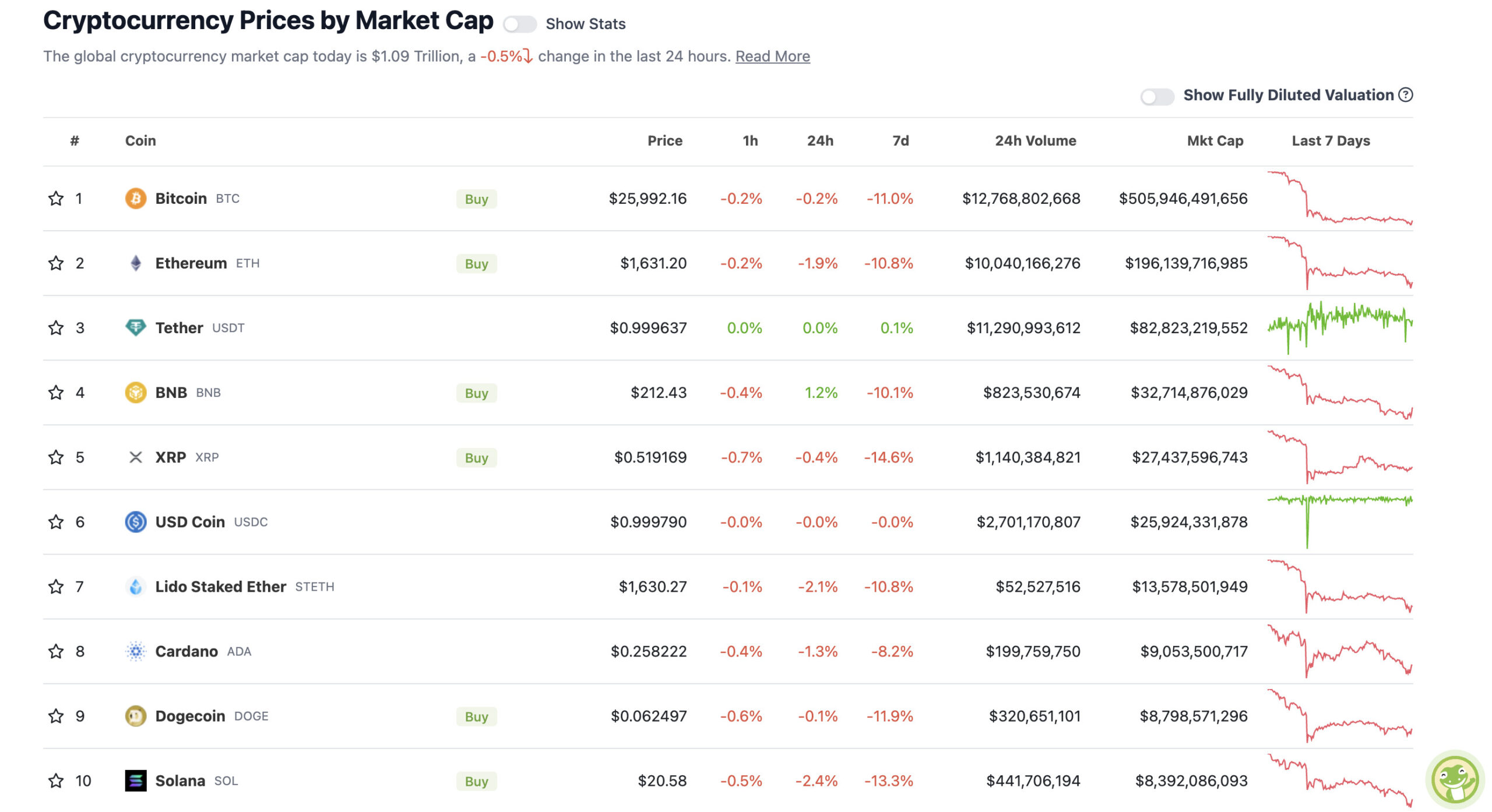

Top 10 overview

With the overall crypto market cap at US$1.09 trillion, pretty flat since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Sui (SUI), (market cap: US$389 million) +4%

• Optimism (OP), (market cap: US$1.13 billion) +3%

• NEAR Protocol (NEAR), (market cap: US$1.1 billion) +2%

• Radix (XRD), (market cap: US$562 million) +2%

• Decentraland (MANA), (market cap: US$561 million) +1%

SLUMPERS

• THORChain (RUNE), (market cap: US$473 million) -10%

• Frax Share (FXS), (market cap: US$416 million) -7%

• FLEX Coin (FLEX), (market cap: US$530 million) -5%

• Maker (MKR), (market cap: US$939 million) -5%

• ImmutableX (IMX), (market cap: US$649 million) -5%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Watch @CaitlinLong_ lay down FACTS. Ask yourself why the hell did @SBF_FTX aka SBFraud get a One Hour meeting with Chair Powell and get to avoid the rules, while @custodiabank’s application to become a member of the Federal Reserve System is denied (which is against the clear… https://t.co/vj0eVmY6PF

— John E Deaton (@JohnEDeaton1) August 22, 2023

https://twitter.com/mikealfred/status/1694024641973833760

The market really gave us a 1-day volatility fix, only to return to boring death chop once again.

Great, #Bitcoin. Great. pic.twitter.com/2WJyFVIBmW

— Jelle (@CryptoJelleNL) August 22, 2023

This is the first time since the LUNA/3AC collapse that #Bitcoin has broken below both the weekly + daily 200-day SMA.

And only the 3rd time in $BTC's history.

Last time, it was fuelled by an unprecedented liquidation cascade. This time, it only took a general market sell-off. pic.twitter.com/TqObcoiOBo

— Miles Deutscher (@milesdeutscher) August 22, 2023

I still believe we see $BTC a bit lower before a potential bounce. This falls in line with major horizontal support levels around 25k & RSI being the most oversold since Covid-19.

Looking for swing shorts here has higher risk than reward in my opinion.#bitcoin #cryptocurrency

— Roman (@Roman_Trading) August 22, 2023

JUST IN: 🇺🇸 Fed should raise inflation target above 2% – WSJ

Here we go…

Not so transitory after all. 🤨— Bitcoin Archive (@BTC_Archive) August 21, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.