Mooners and Shakers: Crypto bleeds as UST remains unpegged and Terra’s terrible few days continues

A UST stablecoin metaphor, earlier (Getty Images)

Bitcoin and its moody friends seemed to be a half chance for half a recovery earlier. But that proved about as short lived as an unnamed character in Squid Game, as Terra’s UST stablecoin drifted further away from its dollar peg.

Wouldn’t count on it, but maybe tomorrow, Eastern Daylight Time, will bring something different. One thing that mainstream financial analysts and at least some of the Crypto Twitterati are looking out for is Wednesday’s fresh US Consumer Price Index (CPI) inflation data.

Expectations from the likes of Forbes, MarketWatch and others seem to be that the US annual inflation rate might actually have peaked in March. According to Forbes, a drop from 8.5%, potentially down to about 8.1% or lower could be on the cards.

This outcome might reflect at least a neutral to positive reaction from markets, potentially offering some sort of reprieve from the blood-letting. Is that too much to hopium for? Probably. This time tomorrow, we might know.

In the meantime, here’s the visual and statistical representation of the crypto market sentiment over the past 24 hours. Starting to turn an ominous shade of crimson there. Something about buying when there’s blood in the streets? Some strong conviction is required for that play at this stage…

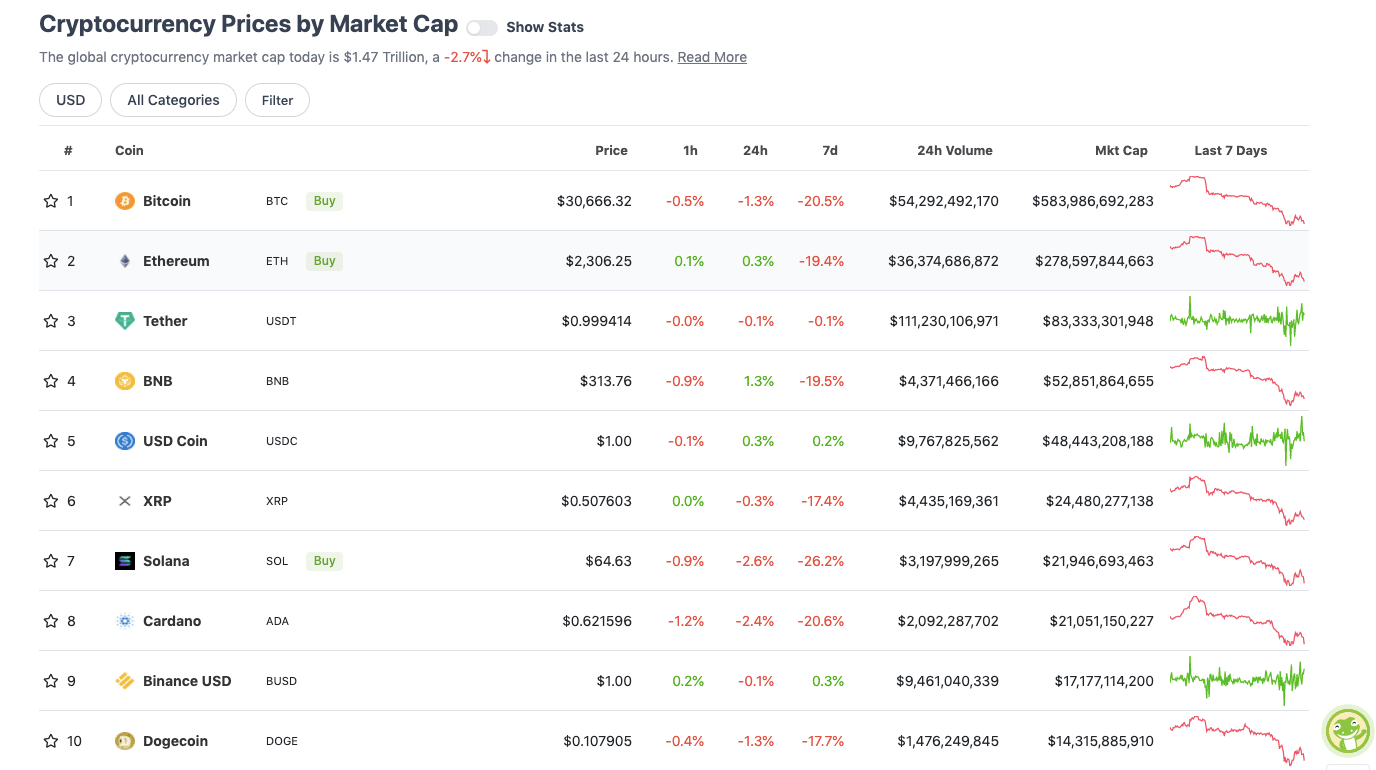

Top 10 overview

With the overall crypto market cap at roughly US$1.47 trillion, down about 2.7% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

This table is more notable right now for what’s not in it, than what is, with both Terra (LUNA) and its UST stablecoin dropping out of sight and into our next category. We’ll get into that a little more, further below.

After a rebound this morning, the UST peg is dropping again. Down to 0.77 pic.twitter.com/AUGL9VPaIF

— Will (@WClementeIII) May 10, 2022

Meanwhile, even the generally pretty bullish analyst Rekt Capital seems to be more readily building in bearish possibilities for the months ahead. But here’s hoping for that “V-shaped generational bottom”, eh?

What happens if #BTC loses the $28K-$30K support?$BTC would probably enter a multi-month downtrend

Unless a fundamental catalyst like in March 2020 assists in accelerating the drawdown to reach a volatile V-Shaped generational bottom within just a few weeks#Crypto #Bitcoin

— Rekt Capital (@rektcapital) May 10, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$17.2 billion to about US$775 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Chain (XCN), (market cap: US$1.42 billion) 9%

• Shiba Inu (SHIB), (mc: US$8.7 billion) +6%

• Maker (MKR), (mc: US$1 billion) +5%

• Cronos (CRO), (mc: US$5.7 billion) +5%

• FTX Token (FTT), (mc: US$4.5 billion) +4%

DAILY SLUMPERS

• Terra (LUNA), (mc: US$5.7 billion) -63%

• TerraUSD (UST), (mc: US$12.65b) -20%

• STEPN (GMT), (mc: US$1b) -20%

• Monero (XMR), (mc: US$2.85b) -13%

• Waves (WAVES), (mc: US$1.18b) -12%

Despite his assurances of a recovery plan, Terra founder Do Kwon is copping plenty of heat right now, while the UST stablecoin dollar “depegging” gets some unwanted attention in Washington. Attention from those with the power to potentially go a bit nuts on regulatory overreach, such as US Treasury Secretary Janet Yellen…

They are watching you…

FED/US GOV talking about $UST https://t.co/9qbhAanNUm

— Crypto94 – Owner of Infinity Gainz (@CryptoExpert101) May 10, 2022

So then, just a very simple quick recap of what’s occurred…

• Over the weekend, a whale dumped US$84 million worth of the algorithmic stablecoin UST.

• Do Kwon later acknowledged a removal of a good deal of liquidity from Curve took place – one of the largest liquidity pools for UST. He assured all via Twitter with: “Obviously Terraform Labs has no incentive to depeg UST”.

• A plan fromTerra’s Luna Foundation Guard (LFG) to lend US$1.5 billion worth of Bitcoin to help TerraUSD regain its dollar parity was enacted. It seemed to be briefly working, with more capital apparently ready to be deployed by Kwon.

• But things escalated, and amid the dump worsening (right down to $0.62 on some exchanges), some say the damage has been done and the trust has been lost in UST, Terra and its governance/staking token LUNA, which is designed to absorb the protocol’s volatility.

No doubt this drama has a few more twists and turns to come, but for the sake of the market, particularly the perception of it, many will be hoping the Terra ecosystem can recover asap.

https://twitter.com/Pentosh1/status/1524103272260423683

Uppers and downers: lower caps

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• WeWay (WWY), (market cap: US$183 million) +30%

• Bifrost (BFC), (mc: US$106m) +20%

• MXC (MXC), (mc: US$204m) +15%

• Bitkub Coin (KUB), (mc: US$338m) +14%

• Persistence (XPRT), (mc: US$190m) +13%

DAILY SLUMPERS

• Anchor Protocol (ANC), (mc: US$162m) -50%

• Astroport (ASTRO), (mc: US$99m) -42%

• Orion Money (ORION), (mc: US$8m) -41%

• Ampleforth Governance Token (FORTH), (mc: US$35m) -22%

• Quantstamp (QSP), (mc: US$26m) -19%

Around the blocks

A result of the LUNA fiasco yesterday:

The largest day of net inflows of #bitcoin on exchanges in 4.5 years, with 53.2k BTC of net deposits. pic.twitter.com/t9tvajCzqX

— Dylan LeClair 🟠 (@DylanLeClair_) May 10, 2022

Not fully in the loop regarding the markets, but we are heads down working on the #Ethereum merge and beyond. This is one of the most exciting years in the Ethereum project's history and sentiment has not changed for us working on this

— rauljordan.eth(💙,🧡) (@rauljordaneth) May 9, 2022

— Dan Held (@danheld) May 10, 2022

Bored Ape #1725 just sold for 250 $ETH / $587,500 🚀

NFTs are dead 😅#BAYC 🦍 pic.twitter.com/E3HcuD8eJy

— APE G4NG (@ape_g4ng) May 10, 2022

#Bitcoin is volatile?

I feel nothing…— Bitcoin Archive (@BTC_Archive) May 10, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.