Mooners and Shakers: Bitcoin and crypto market steady, but one top analyst warns against buying the dip

Pic: DKosig / iStock / Getty Images Plus via Getty Images

While the US dollar index (DXY) and stonks seem indecisive on Wall Street today, Bitcoin and crypto are pretty steady at the time of writing.

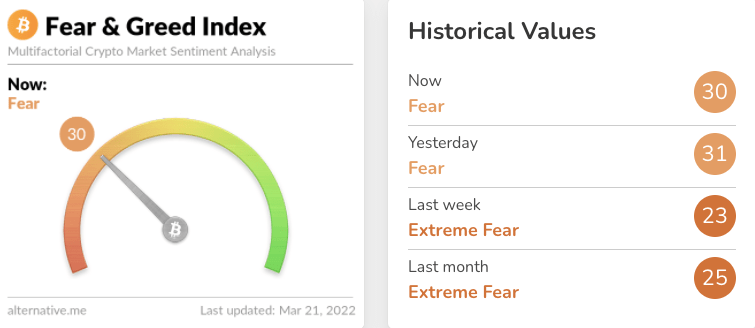

Meanwhile the crypto Fear & Greed Index has ticked up a bit over the past few days and the generally more bullish analysts around are sounding, unsurprisingly, generally bullish for the short term.

However, one prominent analyst better known as a traditional finance observer has provided some words of caution today. Bloomberg’s senior commodity strategist Mike McGlone was speaking on the Wolf of All Streets Podcast on Monday and was pointing to an over “extended” stock market that could keep all risk assets suppressed.

“So, we have the most extended stock market in 20 years relatively… most expensive stock market in terms of GDP in the history of mankind, most expensive stock market versus real estate and versus global equities ever… and part of that is that’s been driving inflation and the Fed has to push back that inflation,” said McGlone.

Lose-lose for risk assets? Unfortunately, at current levels of inflation, the #FederalReserve, by mandate, basically has to limit peoples ability to buy stuff.https://t.co/cBmj94luGs

— Mike McGlone (@mikemcglone11) March 21, 2022

“That was my warning — people that don’t get it yet — ‘Don’t buy the dip’ — that’s for the people that haven’t learned their lessons,” the Bloomberg analyst continued.

Long-term, though, McGlone still believes Bitcoin, specifically, will eventually hit US$100k. Whether or not that’s this year as he’s previously indicated it could, is another question. McGlone also thinks that BTC “might easily see US$30,000 first”.

Top 10 overview

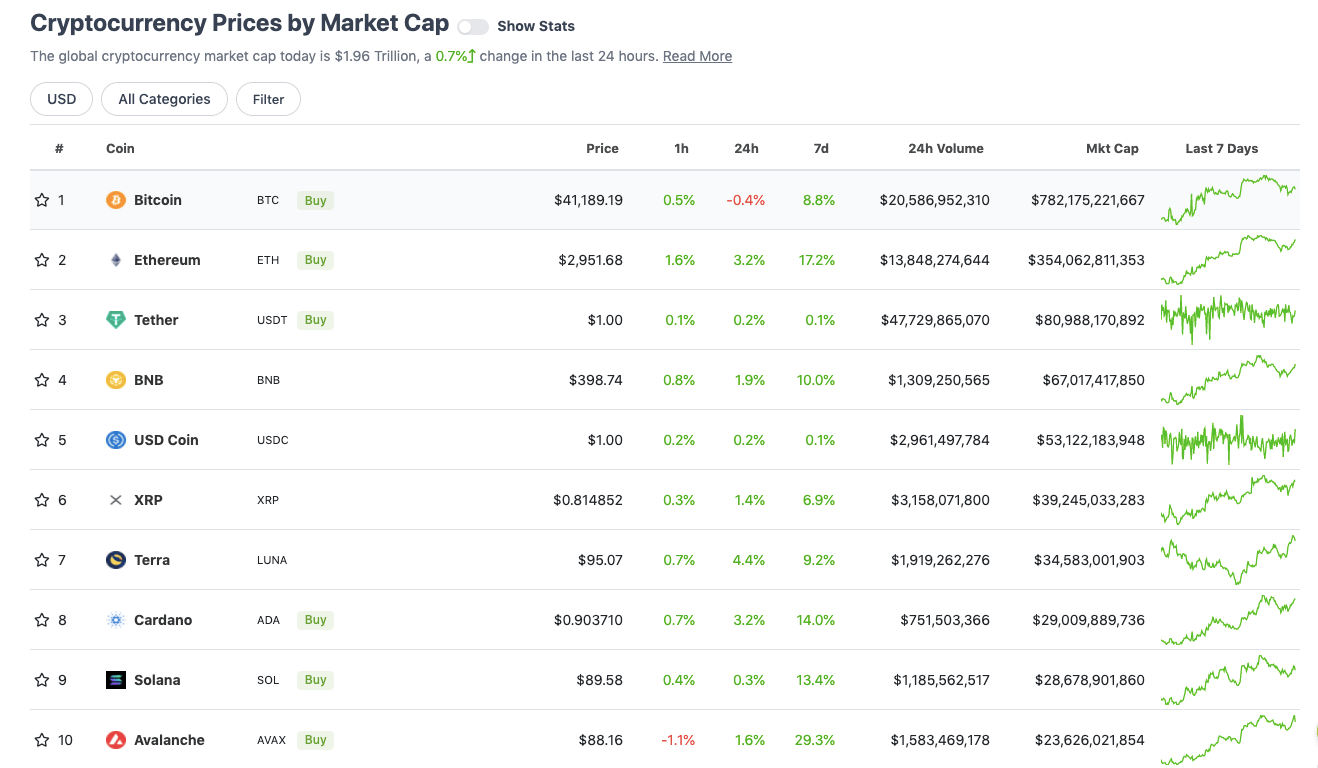

With the overall crypto market cap at about US$1.96 trillion, up roughly 0.7% from this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Layer 1s Terra (LUNA), Ethereum (ETH) and Cardano (ADA) are leading the top-10 price action over the past 24 hours, although Avalanche (AVAX) has been surging again lately, too.

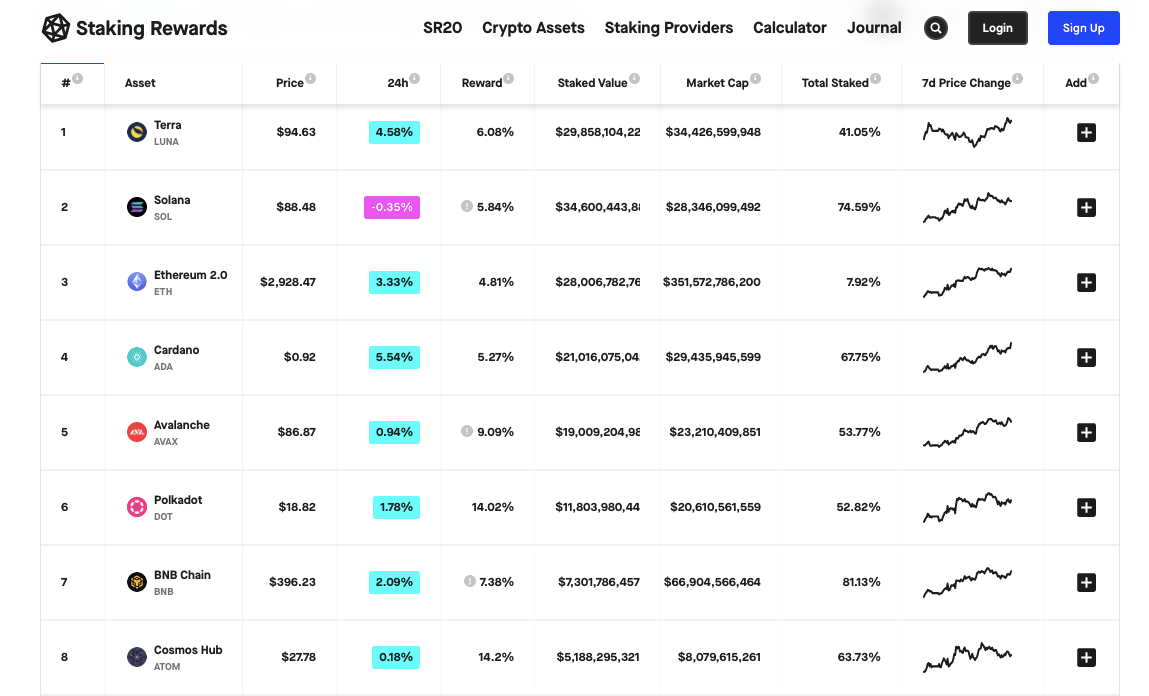

In the first week of March, according to data from Staking Rewards, LUNA flipped ETH in terms of staked value, and as you can see on the chart below, it’s maintained that placing with more than US$29.8 billion worth of LUNA locked up for passive rewards. Solana (SOL) isn’t doing too badly with that metric, either.

As for how Bitcoin (BTC) is shaping up so far this week, feelings are as mixed as ever among the Twitter-populated crypto analysts. It’s tricky to get a read on who’s the more vocal right now – bears or bulls.

@ZeroHedge, aka “John Wick”, seems to be sensing something big just around the corner, though…

This resistance has been touched 4 times. The more times a resistance is touched the more powerful the breakout eventually is.

With the volatility building, I can only imagine this breakout being that of a volatility breakout setup.

I’ve set my alerts. pic.twitter.com/GpMpWGRL42

— Wick (@ZeroHedge_) March 21, 2022

But Dutch trader Michaël van de Poppe doesn’t appear to be expecting too much from the OG crypto right now…

For #Bitcoin, I'm looking at the following levels.

Crucial to hold; $40.4K area.

If that low is lost, I'm assuming we'll test $39K and have further downwards momentum to look forward to. pic.twitter.com/LdzKqq0Oqz

— Michaël van de Poppe (@CryptoMichNL) March 21, 2022

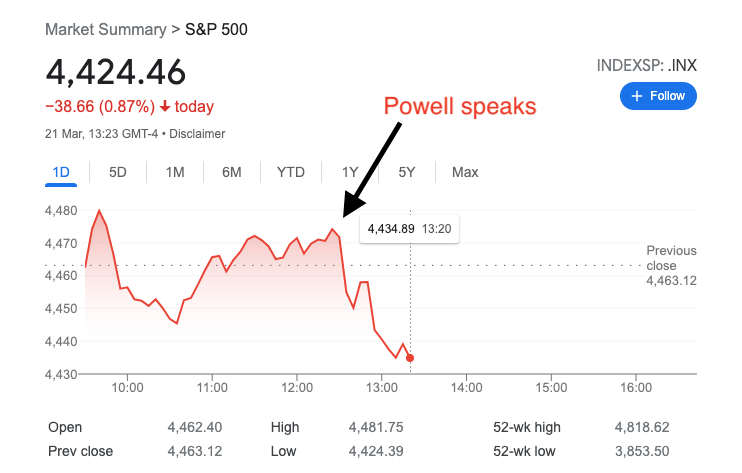

Hold the phone… news just in, US Federal Reserve boss Jerome Powell just said something…

https://twitter.com/NorthmanTrader/status/1505946580821716995

Annnd… the stock and crypto markets appears to be somewhat spooked as this is typed. Perhaps only slightly (a “transitory” kinda deal). Yep, that’s a whole lot of influence for one bloke.

Uppers and downers: 11–100

Sweeping a market-cap range of about US$20.57 billion to about US$970 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Convex Finance (CVX), (mc: US$1.14 billion) +14%

• Algorand (ALGO), (mc: US$5.3 billion) +7.5%

• Dash (DASH), (mc: US$1.29 billion) +7%

• Bitcoin SV (BSV), (mc: US$1.62 billion) +6%

• EOS (EOS), (mc: US$2.3 billion) +5.5%

DAILY SLUMPERS

• Xido Finance (XIDO), (market cap: US$970 million) -12.5%

• ECOMI (OMI), (mc: US$1.7 billion) -7%

• JUNO (JUNO), (mc: US$1.49b) -6%

• ApeCoin (APE), (mc: US$1.32b) -4%

• THORChain (RUNE), (mc: US$2.6b) -4%

Uppers and downers: lower caps

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• Biswap (BSW), (market cap: US$212m) +161%

• Spell Token (SPELL), (mc: US$423m) +32%

• Hector Finance (HEC), (mc: US$81m) +31%

• Ribbon Finance (RBN), (mc: US$67m) +28%

• Ocean Protocol (OCEAN), (mc: US$265m) +23%

DAILY SLUMPERS

• SuperRare (RARE), (market cap: US$106 million) -27%

• Addapter Token (ADP), (mc: US$39.5m) -18%

• Tranchess (CHESS), (mc: US$58m) -15%

• Epik Prime (EPIK), (mc: US$17m) -11%

• Bounce (AUCTION), (mc: US$116m) -10%

Around the blocks

The move is seen as a notable step in the development of crypto markets for institutional investors.https://t.co/uRIoHdWkpf

— Blockworks (@Blockworks_) March 21, 2022

Everyone Hates Elizabeth Warren’s Crypto Regulation Bill https://t.co/1HmBGq07uI

— Neeraj K. Agrawal (@NeerajKA) March 21, 2022

— Bitcoinproenneke – BTC 'til the wheels fall off (@Bitcoinproenne) March 20, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.