Mooners and Shakers: Bitcoin and crypto market retreat ahead of this week’s Fed meeting

Coinhead

Coinhead

Bitcoin and crypto took something of a battering overnight. That probably doesn’t matter too much for the moment. What might matter is the words that exit Fed boss Jerome Powell’s mouth on Wednesday 2.30pm ET (Thursday, 6.30am AEDT).

The next Federal Open Market Committee meeting is approaching at last and it could be a significant short-mid-term market mover. As per.

Well that is, for example, if Powell were to hit us harder than the 25 basis points rate hike that many a market analyst seems to be expecting. Or, for that matter, if he were to simply strike a particularly dour tone and gloomy outlook.

Here’s what Sven “Northman Trader” Henrich is expecting to happen. A status quo 25bps raise and some tough “not out of the woods” talk. Could be on the money, that.

Powell:

If I don't raise rates I lose all credibility

If I raise by 25bp financial conditions may loosen further & I lose all credibility

If I raise by 50bp all our previous guidance turns out to have been wrong & I lose all credibility.So I do 25 & talk mean & hope that works.

— Sven Henrich (@NorthmanTrader) January 30, 2023

In the meantime, concentrating on what we do know – the sharpish overnight dip Bitcoin and pals experienced is really a result of essentially copy trading nervy Wall Street’s moves. The S&P 500, for instance, closed at -1.3%, while the Nasdaq was down 1.9%.

Let’s take a closer look at the crypto majors, though, and a handful or two of slightly lower cap items.

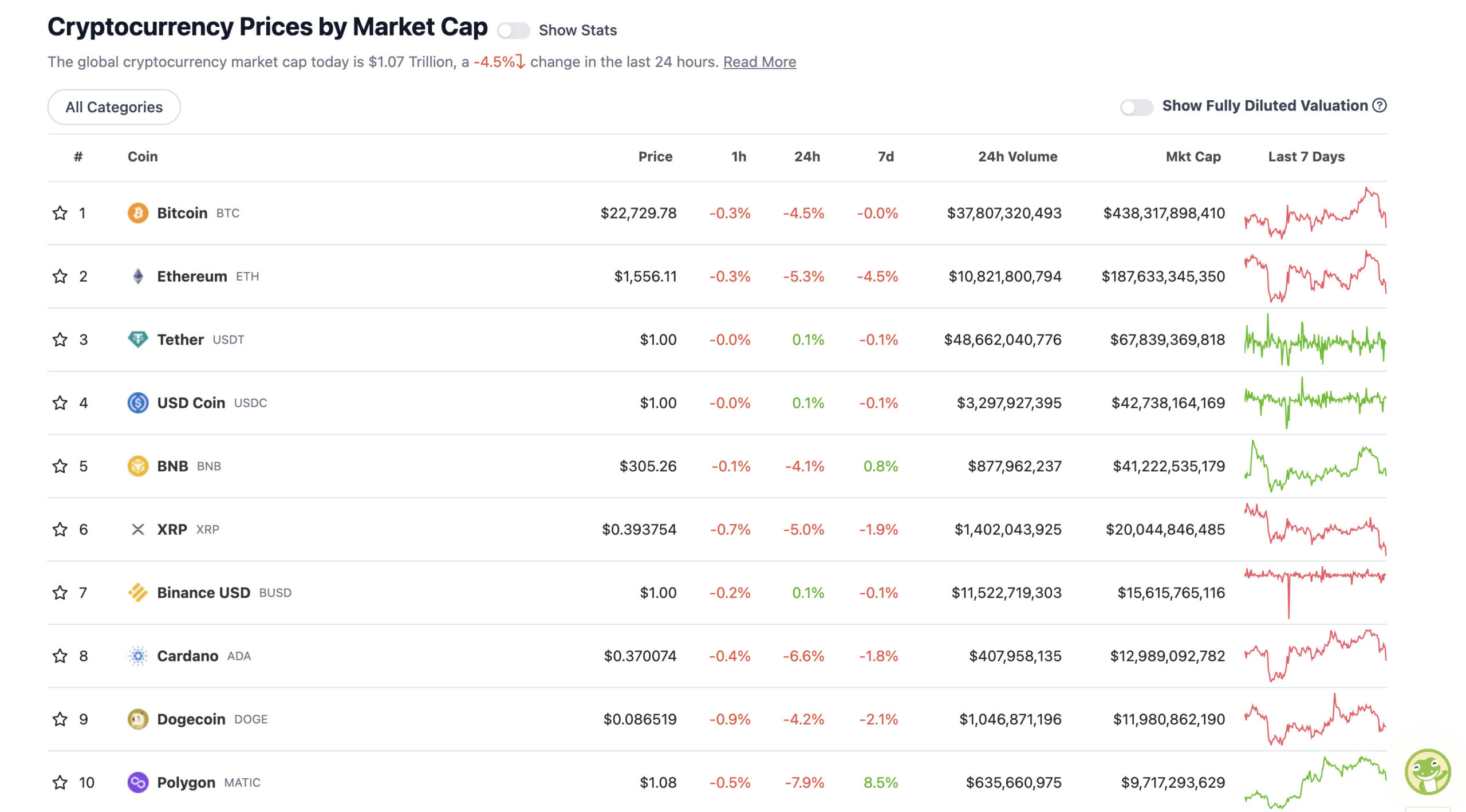

With the overall crypto market cap at US$1.07 trillion, down about 4.5% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Aside from stablecoins, we’ve got a Mick Hucknall vibe on the 24-hour price action, with recent surger Polygon (MATIC) the reddest of the daily reds.

Let’s try to find some positivity, though, before this thing gets any bloodier, which it actually seems to be by the minute as we type.

Here’s something. Citing a Beincrypto report, eToro analyst Simon Peters passed on the following to us in an email this morning: “Amid high-profile ether price rises of 2023, Ethereum is sending other signals that the network is in rude health.

“Metrics such as the number of addresses on the network have hit record highs, while the numbers of daily traded tokens has steadily increased back to levels last seen in July 2021,” added Peters.

This ties in well with the latest report from CoinShares, which indicated its big-money investors are increasing their exposure to Ethereum (ETH) and are expecting the asset to outperform Bitcoin (BTC).

Regarding Bitcoin, though, Goldman Sachs is positive, ranking it the best-performing asset of 2023 so far.

₿REAKING: #Bitcoin is the best performing asset in the world this year, according to latest data by Goldman Sachs pic.twitter.com/vh7f7UIloi

— Documenting ₿itcoin 📄 (@DocumentingBTC) January 23, 2023

Sweeping a market-cap range of about US$9.8 billion to about US$443 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Dash (DASH), (market cap: US$651 million) +1.5%

And that’s all, folks. Hardly a “pumper”, is it.

Why is privacy coin Dash holding up when other’s aren’t? Can’t see a lot of news, really. Just a quick reminder about what it is, though.

Forked from Bitcoin’s code in 2014, Dash is one of a group of cryptos (including Monero and Zcash) that focus on cryptographic technology that helps them increase anonymity and privacy by hiding user addresses and transaction details, making transactions harder to trace.

Unlike most other privacy coins, Dash offers its privacy feature as an option to users and also pitches itself as a rapid-transaction digital currency.

DAILY SLUMPERS

• Optimism (OP), (market cap: US$454 million) -13%

• Axie infinity (AXS), (market cap: US$1.23 billion) -13%

• Flow (FLOW), (mc: US$1 billion) -12%

• Near (NEAR), (mc: US$1.94 billion) -12%

• The Graph (GRT), (mc: US$762 million) -11%

Optimism is down quite a bit today. Which kinda sums up the sudden crypto mood swing overnight. But OP is touted as one of the major Layer 2 blockchains to watch – a narrative that ETH heads believe will scale the Ethereum ecosystem to a new heights of network-effect dominance.

If you’d been looking around for crypto airdrops last year, you might’ve been lucky, or aware, enough to have bagged yourself some “free” OP tokens, simply by connecting to, and participating with, the Optimism network in a fairly small way.

Some heavy early adopters did pretty well for themselves from OP. We’re talking US$50k worth in some cases. No guarantees, but here then, are some other crypto airdrop opportunities that you just might want to consider.

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Are you suggesting we need a fixed supply? If only there were something like that…

— Benjamin Cowen (@intocryptoverse) January 30, 2023

Take notes of all the stupid ideas considered by most because among that list will be hidden gems. Remember that NFTs last cycle were discarded when CryptoKitties clogged the Ethereum network. Most of the time the issue isn’t the idea but the infrastructure required to support it

— Santiago R Santos | #9159 (@santiagoroel) January 30, 2023

My best piece of advice for #crypto newbies is this: When you're in profit and happy, take partial profit. If you don't take profit you won't make profit.

What's your advice 👇

— Lady of Crypto (@LadyofCrypto1) January 30, 2023

What’s our advice? To give no financial advice.

the boomers are giving each other crypto awards again https://t.co/2PIl3x3tH5

— Vance Spencer (@pythianism) January 30, 2023

Lastly, we’ll just leave this here…

JUST IN: $10 trillion BlackRock, $2.55 trillion Goldman Sachs and $1.8 trillion BNY Mellon "hoping to expand" #Bitcoin and crypto offerings – Bloomberg.

Probably nothing

— Bitcoin Magazine (@BitcoinMagazine) January 30, 2023