Mooners and Shakers: Christmas bear market or bear trap? Bitcoin and alts bleed into new week

Getty Images

With the US stock market well in the red to start this Christmassy/Coviddy week, cryptocurrencies were already ahead on that negative sentiment, bleeding out in anticipation and then further following suit.

At the time of writing, the entire crypto market cap has just fallen under US$2.27 trillion, and is down another 3% since this time yesterday.

Is there any hope left for a last-minute Santa rally? It can’t be ruled out. A number of analysts on social media have been eyeing the US$42k territory for a potential Bitcoin bottom as a potential base to bounce off.

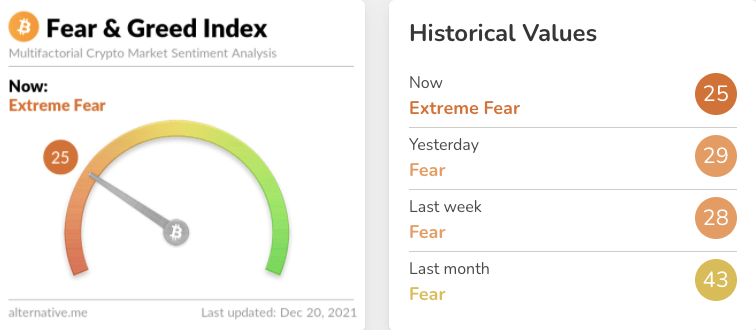

One thing’s for sure, though, overall market sentiment isn’t exactly high right now and hasn’t been particularly positive for at least a month.

Bears are making some of the loudest noises across Crypto Twitter at present. However, despite Bitcoin (BTC) continuing to trade under its 200-day moving average on the charts, there are positive voices to be found among those studying the data.

Young on-chain analyst Will Clemente, for instance, is spotting potential for another dramatic Bitcoin short squeeze…

https://twitter.com/WClementeIII/status/1472759512855629827

… While chartists Dr. Jeff Ross and Rekt Capital are both seeing just enough sign of life in the bull market for those of us still reaching for the hopium bong…

https://twitter.com/VailshireCap/status/1472942941115088896

Recent #BTC Weekly close suggests a confirmed loss of red as support$BTC has reached the orange demand area which is approx. confluent with the blue 50-week EMA

In the past, 3 times out of 4 BTC would wick deeply into orange before reversing to the upside#Crypto #Bitcoin pic.twitter.com/x0I8kUxdPb

— Rekt Capital (@rektcapital) December 20, 2021

Important couple of weeks coming up for $BTC ⌛️

We are within touching distance of the 50 EMA & it could dictate which direction this market is heading..

Watch out for..

✅ Low holiday volumes will cause volatility

🐻 Possible Bear Trap

📉 Break down below 50 EMA#bitcoin pic.twitter.com/uglM8WWGHa— DREAD BONGO (@DreadBong0) December 20, 2021

Top 10 overview

Here’s the state of play in the top 10 by market cap at press time, according to CoinGecko data. (Of course, the usual caveat: this could be quite different by the time you read this.)

As you can see from the chart above, layer 1 platforms Solana (SOL) (-7.2%) and Polkadot (DOT) (-5.8%) are faring the worst in the top 10 right now, while their rival Terra (LUNA) has actually been travelling okay over the past 24 hours (+2.9%).

Winners and losers: 11–100

Sweeping a market-cap range of about US$25.1 billion to US$1.1 billion in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• yearn.finance (YFI), (market cap: US$1.3b) +16%

• Olympus (OHM), (mc: US$2.5b) +6%

• Leo Token (LEO), (mc: US$3.4b) +3%

• Terra (LUNA), (mc: US$28.5b) +2.8%

• Monero (XMR), (mc: US$3.4b) +2%

DAILY SLUMPERS

• Near (NEAR), (market cap: US$5b) -12%

• Kadena (KDA), (mc: US$1.6b) -11.8%

• Spell Token (SPELL), (mc: US$1.25b) -11.6%

• Radix (XRD), (mc: US$2.3b) -10.5%

• Curve (CRV), (mc: US$1.5b) -10.4%

Lower-cap winners and losers

Moving below the crypto unicorns (in some cases well below), here’s just a small selection catching our eye…

DAILY PUMPERS

• Fancy Games (FNC), (market cap: US$19m) +45%

• AnySwap (ANY), (mc: US$439m) +25%

• Bondly (BONDLY), (mc: US$23m) +16%

Fancy Games is a new play-to-earn platform that’s placed its focus on the casual mobile-gaming market, which is the most dominant sector of gaming in terms of downloads. The $FNC token launched just the other day, and the first game created by the studio is being released in January. You can check out our interview with its founders here.

Are you ready to join the Fancy Birds treehouse?

Game Launch end of January.

Genesis Early Bird whitelist spots still remain!

5 WL Spots to those that Like, Retweet, and Tag a friend you want to play with🐦

Join for more WL giveaways:https://t.co/I0Ho8tmIH7

Be Ready$FNC pic.twitter.com/gICmSbfgQM

— Fancy Birds Official (@Fancybirdsio) December 20, 2021

DAILY SLUMPERS

• Raiden (RDN), (market cap: US$20m) -27%

• UFO Gaming (UFO), (mc: US$560m) -19%

• Audius (AUDIO), (mc: US$712m) -15%

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.