Mooners and Shakers: Axie Infinity suffers US$600 MILLION exploit; meanwhile Bitcoin hits 2022 high

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

Leading GameFi project Axie Infinity has suffered a sickeningly humongous exploit today. And yet the crypto market is still moving in a positive direction overall as noted Bitcoin “whales” MicroStrategy and Do Kwon keep buying.

The mega Axie exploit – largest in DeFi history

This piece of shocking news has just occurred as we were putting this article to bed and is a developing story, but here are the key details in brief:

• Ronin (RON), an Ethereum-linked sidechain developed by Axie Infinity creator Sky Mavis, has confirmed a security breach in a blog post today.

• This looks like being the largest exploit in DeFi history to date, with reportedly about US$600 million (173,600 ETH tokens and 25.5 million USDC) stolen after Sky Mavis’s Ronin validator nodes and Axie DAO validator nodes were compromised.

• The funds were apparently drained by a malicious actor some six days ago.

• The attacker or attackers “used hacked private keys in order to forge fake withdrawals” from the Ronin bridge across two transactions, as shown on Ethereum block explorer Etherscan.

• “We are working directly with various government agencies to ensure the criminals get brought to justice,” the blog notes.

• The price of RON is currently down 19% on the news, according to CoinGecko.

Axie Infinity's Ronin bridge lost about $600 million as five validator private keys got compromised.

Ronin is a custodial sidechain bridge governed by a multisig wallet used by Axie to communicate with Ethereum.

The multisig requires 5 private keys to sign/execute transactions. https://t.co/mOACiYSM6M

— Alex Krüger (@krugermacro) March 29, 2022

Someone executed a $600,000,000 exploit on the Ronin network (what Axie runs on)

Here's his wallet.

Holy literal what… pic.twitter.com/67DpJgIFl8

— Alex Becker 🍊🏆🥇 (@ZssBecker) March 29, 2022

Meanwhile MicroStrategy buys another US$205 million BTC

In actual fact, it’s MacroStrategy a subsidiary of the American business intelligence and software company MicroStrategy in charge of that particular Bitcoin buy – through a collateralised loan from US crypto payments provider Silvergate.

But whatevz, really, it’s probably just easier to think of it as yet another purchase led by the mega Bitcoin bull Michael Saylor.

Both he, and MicroStrategy, have become more widely known for Bitcoin-championing and investment narratives than anything else over the past year or so. As per a company earnings call in February, MicroStrategy now owns more than 125,000 BTC making it the biggest corporate Bitcoin whale around.

Proof that you never have to sell your #bitcoin. You can just borrow against it.

— Eric Weiss ⚡️ (@Eric_BIGfund) March 29, 2022

Do Kwon’s LFG keeps splashing out on Bitcoin, too

And then there’s Terra founder Do Kwon. His Luna Foundation Guard (LFG) has reportedly been making daily batch buys of at least US$125 worth of BTC as part of its strategy to increase its stablecoin-backing Bitcoin reserves to US$3 billion – with an ultimate US$10 billion fund in mind.

In fact, as Crypto Briefing noted today, on-chain data shows that LFG purchased another 2,830 BTC worth around US$135 million on Monday, bringing its reserves to 27,785 Bitcoin.

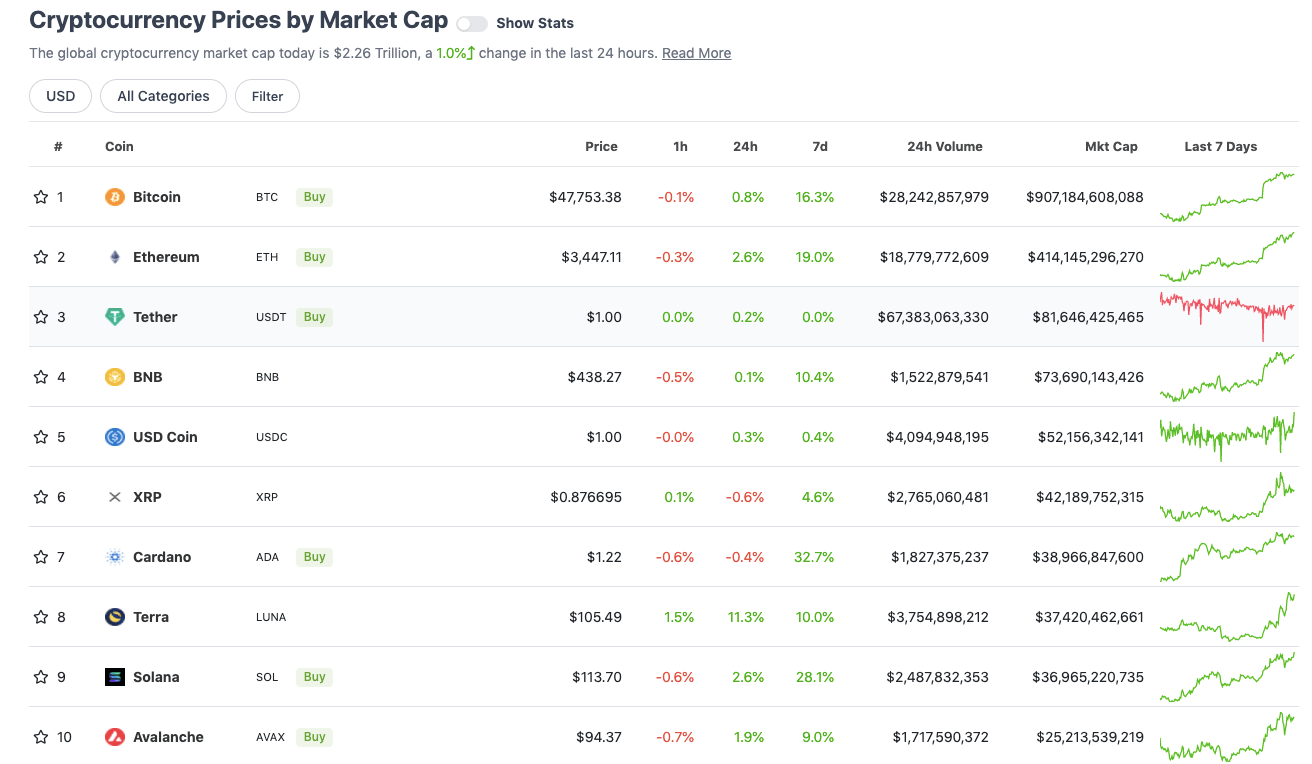

Top 10 overview

With the overall crypto market cap at about US$2.26 trillion, up roughly 1% from this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Bitcoin (BTC) has dropped back into the US$47ks again now, but several hours ago it managed to briefly breach US$48k – the first time it’s been up there since December 28.

Terra (LUNA) meanwhile has been in fine fettle over the past 24 hours. In fact, the layer 1 protocol’s native token hit an all-time high of US$107 about an hour or so ago.

Does that have anything to do with the Luna Foundation Guard buying Bitcoin as a reserve for Terra’s stablecoins? We’ll go out on a pretty sturdy limb here and say… yes, yes it does.

Daily US$125 million purchases for a mega BTC reserve fund is surely feeding the positive sentiment and growing confidence building for the Terra blockchain – a project that was already thriving anyway this year with a growing DeFi ecosystem.

What comes after #Bitcoin Season?

Altcoin Season#BTC #ALTSEASON #Crypto

— Rekt Capital (@rektcapital) March 29, 2022

Brace yourselves for the biggest crypto bull market in the history of mankind

— Crypto Bitlord (@crypto_bitlord7) March 29, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$24.3 billion to about US$1.1 billion in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Waves (WAVES), (mc: US$4.9 billion) +36%

• THORChain (RUNE), (mc: US$3.7 billion) +20%

• Aave (AAVE), (mc: US$2.8 billion) +17%

• KuCoin Token (KCS), (mc: US$1.6 billion) +8%

• Chiliz (CHZ), (mc: US$1.5 billion) +5%

DAILY SLUMPERS

• Zilliqa (ZIL), (market cap: US$1.38 billion) -9%

• ApeCoin (APE), (mc: US$2.3 billion) -7.5%

• Axie Infinity (AXS), (mc: US$6.65 billion) -6%

• Helium (HNT), (mc: US$2.4 billion) -6%

• Zcash (ZEC), (mc: US$2.35 billion) -5%

Uppers and downers: lower caps

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• Cult DAO (CULT), (mc: US$37.5m) +138%

• DEUS Finance (DEUS), (market cap: US$137 million) +47%

• Silo Finance (SILO), (mc: US$66.5m) +40%

• Rarible (RARI), (mc: US$66m) +35%

• Guild of Guardians (GOG), (mc: US$24m) +27%

DAILY SLUMPERS

• Hegic (HEGIC), (market cap: US$33 million) -20%

• Ronin (RON), (mc: US$274.5m) -19%

• Unibright (UBT), (mc: US$205m) -18%

• Universe.XYZ (XYZ), (mc: US$40m) -14%

• Redacted Cartel (BTRFLY), (mc: US$166.5m) -14%

Around the blocks: Greenpeace’s Bitcoin-changing campaign

Global activists Greenpeace and other climate-focused groups, along with Chris Larsen – co-founder of Ripple – are campaigning to get the Bitcoin network changed to a more environmentally friendly consensus model.

As reported by Cointelegraph and others, the “Change the code, not the climate” campaign wants to see Bitcoin switch from its proof-of-work mining-based protocol to something more akin to proof-of-stake, which uses far less energy.

The campaign aims to pressure Bitcoin miners, as well as key industry figures such as Elon Musk and Jack Dorsey, to succumb and initiate the protocol’s consensus-mechanism change.

So, how do you think Bitcoin fans are taking the news?

No, we are not changing the code, @Greenpeace. I am a climate activist and climate change researcher, bitcoin stays on PoW. DM if you want a serious conversation about this.

— Margot Paez (@jyn_urso) March 29, 2022

Greenpeace, with funding from Ripple's Chris Larsen, is launching a full-on propaganda attack on Bitcoin.

Long-debunked BS like BTC-will-warm-the-planet-by-2-degrees are presented as facts.

Every journalist who falls for this isn't doing his/her job.https://t.co/X4KfOuo8Ap

— raphael @ relai.app (@raphschoen) March 29, 2022

— mart.joy • CKBird++↾⇃ (@Emman_Mart) March 29, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.