Mooners and Shakers: Argentina’s football fan token ARG dumps after World Cup shock; Bitcoin bounces

Pain: Argentina fans rue their team's shock loss to the Saudis. (Getty Images)

Bitcoin, Ethereum and the total crypto market are up a bit today, unlike Argentina and Australia’s football fans.

In one of the biggest shocks in FIFA World Cup history, powerhouse soccer nation Argentina, featuring all-time-great Lionel Messi, went down 2-1 to Saudi Arabia in Lusail, Qatar.

Crypto angle? Yep, there’s one. The Argentine Football Association’s crypto fan token ARG plummeted overnight (AEDT) from about US$7.55 down to a low of $4.96, per CoinGecko data. The token is currently down about 20% over the past 24 hours, although it is up 15% on the month.

ARG? It’s an Ethereum-based football fan token which is part of the Socios ecosystem and requires the purchase of the Chiliz (CHZ) token. CHZ can then traded for specific fan tokens, such as ARG, which give the holders the right to vote on fan-based decisions related to the associated team or sporting entity.

Anyway, it appears crypto-using fans of Argentina have either spat the dummy post loss, or, more likely, ARG was being used by speculators as a way to bet on the outcome of the match, no doubt with the anticipation of an Argentine win and a higher token price.

As for the CHZ utility/currency token itself, it’s also down and has been sinking in value over the past week in the lead up to the world’s biggest sporting tournament after building strongly earlier in the month. A buy the rumour, sell the news event based on the World Cup? Quite possibly.

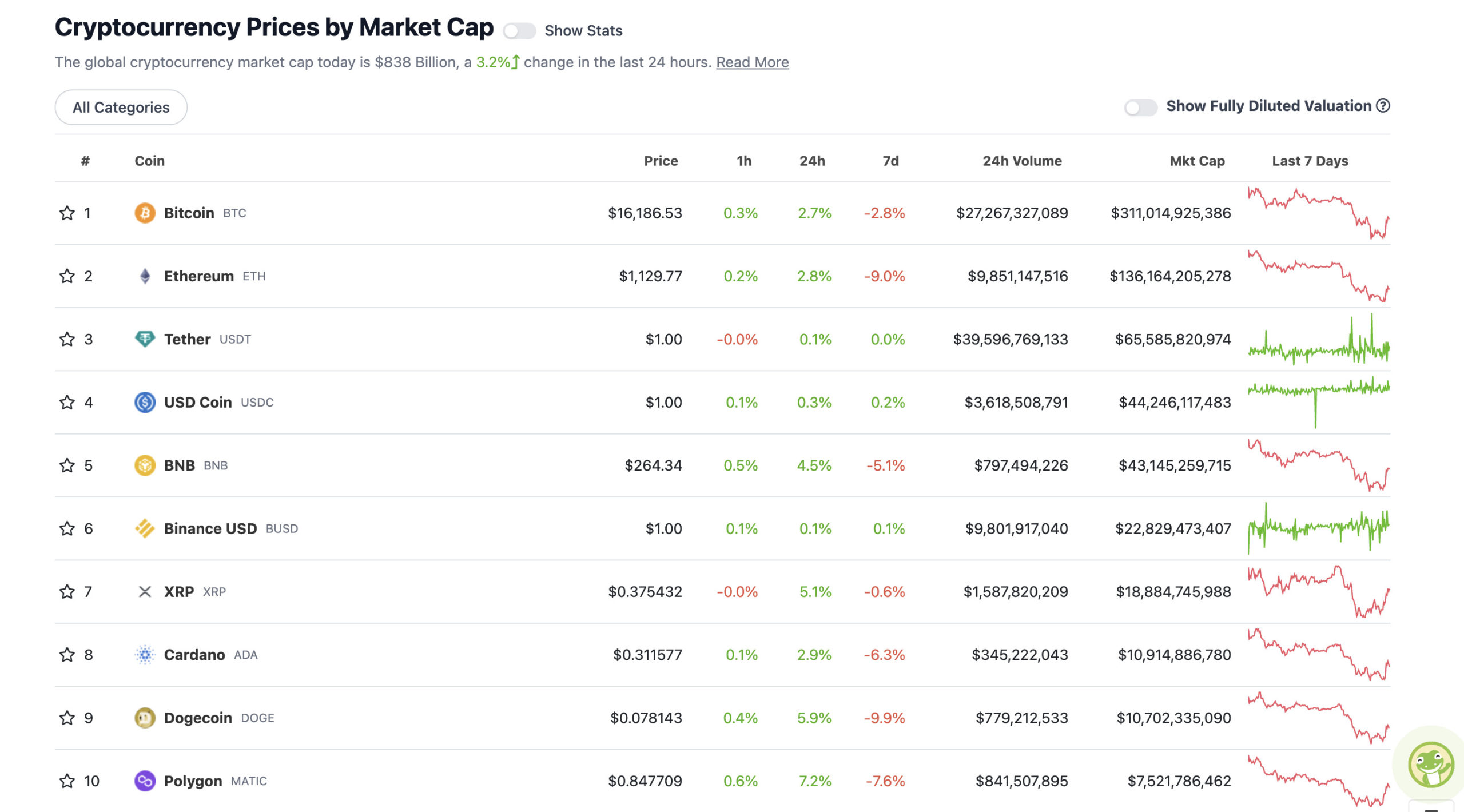

Top 10 overview

With the overall crypto market cap at US$838 billion, up 3.2% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

The total crypto market cap has found about US$20 billion down the back of the sofa since this time yesterday, with Bitcoin kicking off, passing the ball to Ethereum, which neatly offloaded to BNB. A perfect through-ball to XRP followed, cutting out Cardano, and then a one-two with Dogecoin before a cross to Polygon’s MATIC and a powerful header into the top right corner.

#Bitcoin showing some more continuation, but needs to reclaim some more levels to show serious strength. pic.twitter.com/xYKF1Ea63x

— Michaël van de Poppe (@CryptoMichNL) November 22, 2022

The crypto market was looking especially weak this time yesterday, but this little Bitcoin bounce seems to have spurred some action among other fan favourites, such as MATIC, and Dogecoin. Not to mention the likes of Litecoin, Chainlink and Axie Infinity, below.

Uppers and downers: 11–100

Sweeping a market-cap range of about US$6.18 billion to about US$315 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Curve DAO (CRV), (market cap: US$396 million) +29%

• Litecoin (LTC), (mc: US$4.96 billion) +14%

• Chainlink (LINK), (mc: US$3.15 billion) +13%

• Kava (KAVA), (mc: US$338 million) +6%

• Axie Infinity (AXS), (mc: US$767 million) +12%

DAILY SLUMPERS

• Radix (XRD), (market cap: US$371 million) -10%

• GMX (GMX), (market cap: US$331 billion) -5%

• BinaryX (BNX), (mc: US$398 million) -4%

• Evmos (EVMOS), (mc: US$341 million) -4%

• Chiliz (CHZ), (mc: US$967 million) -4%

Around the blocks

A selection of rumour, randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

And now @TheSaudisNFT floor being swept HARD 🚀🚀🚀

— Crypto Bitlord (@crypto_bitlord7) November 22, 2022

FTX's collapse is not a crypto failure. It's a failure with CeFi, @GaryGensler, and Sam Bankman-Fried. Decentralization is the point. Watch below for more thoughts 👇 pic.twitter.com/VYacafc0ZD

— Tom Emmer (@GOPMajorityWhip) November 22, 2022

📍#SBF, his parents and #FTX top executives reportedly bought 19 properties worth $121 million the Bahamas 🇧🇸 over the past 2 years

👇👇👇 pic.twitter.com/Cfu1kDNgwZ

— Crypto Rand (@crypto_rand) November 22, 2022

There are going to be a lot of awkward Thanksgiving dinners this year. Especially so if anyone bought crypto on your suggestion 🙈 pic.twitter.com/pYJnNjnrZm

— Coin Bureau (@coinbureau) November 22, 2022

I don’t think we’ve bottomed but we aren’t too far from it.

People who give up on crypto from now to the next few months are making regrettable decisions.— Eunice D Wong 🦄 (@Eunicedwong) November 22, 2022

This is historically the optimal time to allocate to Bitcoin. All prior Bitcoin cycles had bottomed by this point in the halving cycle. We have less than 100 days until all the other cycles went vertical. I am getting very excited. Not investment advice. pic.twitter.com/O7BJr5qomz

— Charles Edwards (@caprioleio) November 22, 2022

Genesis Timeline

November 8: "No material net credit exposure"

November 9: We lost $7M

November 10: Okay, we have $175M locked in FTX

November 16: Sorry, no withdrawals or new loans

November 17: Okay, we need $1BN

November 21: We'll go bankrupt without the money

👍

— Cred (@CryptoCred) November 21, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.