Mooners and Shakers: ApeCoin and Dogecoin surge 30% over past week; KuCoin’s yield offerings slammed

Getty Images

Bitcoin and Ethereum might be in ranging mode, but ApeCoin and Dogecoin are at least two coins seeing some significant action over the past seven days.

Animals, eh? Bullish? We’ll look at why APE and DOGE have some investors frothing in a sec, although someone needs to make a ROO token to bounce around in this volatile market. (Checks CoinGecko… yep, they already did – it’s a gambling-based thing.)

But meanwhile, speaking of gambling, what’s going on with reasonably large exchange KuCoin and the cryptocurrencies some punters have entrusted it to hold? Stupendous levels of yield, on Bitcoin, Ethereum and other tokens, seemingly.

KuCoin’s insanely high yield offerings

Various entities on Crypto Twitter have expressed their disbelief at the fact the Seychelles-based KuCoin crypto exchange appears to be offering nearly 300% APR on Bitcoin (BTC), 200% on Ethereum (ETH) and 200% APR on the stablecoin Tether (USDT).

It certainly seems… generous, especially in this climate of fear, uncertainty and doubt regarding centralised crypto exchanges in the wake of the FTX collapse.

Kucoin giving off this energy right now…

Don't chase that sweet yield my friends. It's not worth it! pic.twitter.com/675wVnBykF

— Alex Valaitis (@alex_valaitis) November 29, 2022

This looks like the moment before the exchange goes down to sucker in as much money as possible and then lock withdrawals. You heard it here first

— Kevin Svenson (@KevinSvenson_) November 29, 2022

The fear is real, and that’s partly because KuCoin, like Binance, is one of the largest exchanges by trading volume. According to Investopedia, it has more than 10 million users and a presence in more than 200 countries.

To be fair, it’s also an exchange that’s long been known for its high yield, low fees and extremely wide selection of cryptocurrencies on offer for trading.

With yields this high, though, it does beg the question how an exchange can make such offers in the midst of a crippling bear market, and whether it could be running low on certain assets. Does it need to cover liabilities to “sucker in as much money as possible” as Kevin Svenson puts it above?

It’s all speculation at this stage, to which KuCoin has since responded in a reply to a tweet from Web3 advocate Alex Valaitis. The exchange says the high yields relate to their “Dual Investment” products and not their main earn product.

Apparently in this system, the amount earned depends on the staked asset performance at maturity.

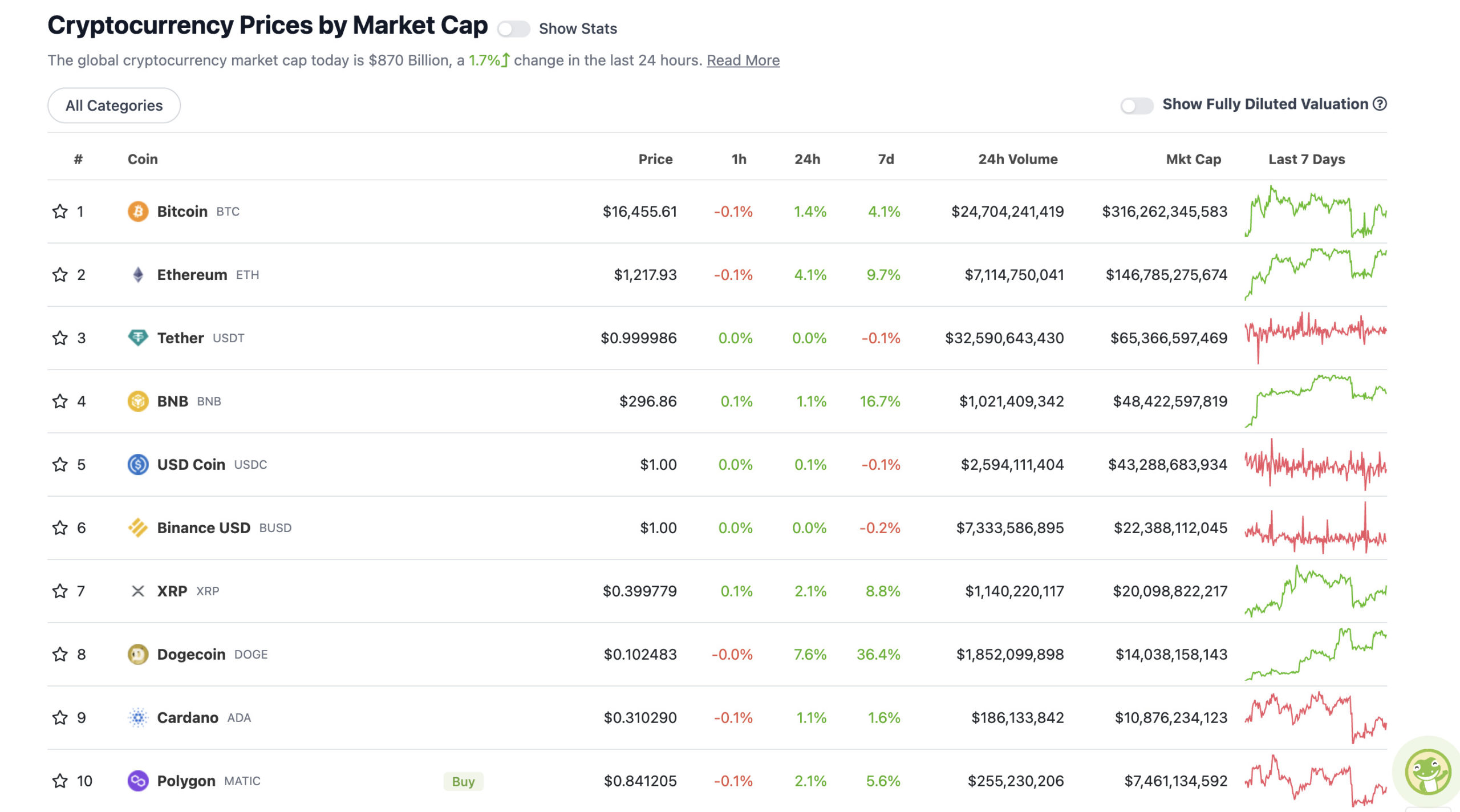

Top 10 overview

With the overall crypto market cap at US$870 billion, up almost 2% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

A little bit of relief for the crypto market overnight then, finding about 30 billion USD since this time yesterday.

A reasonable slice of that has gone into Dogecoin (DOGE), which is up another 7.6% overnight, since cooling off a bit yesterday. Overall, though, it’s been surging over the past seven days (+36%) and seems to be forming some momentum based on the following factors:

• Elon Musk’s apparent desire to build a “Tesla Phone” if Twitter were to be delisted from Apple’s App Store and other application stores on mobile devices.

• Tied to that, the speculation is that cryptos (including Musk fave DOGE) might be added inside a potential Tesla phone app as payments options.

• The likelihood of DOGE being a favoured payments option for Twitter as Musk expands and changes the social-media platform’s roadmap.

Imagine a @tesla phone with built in Starlink via @SpaceX enabling $DOGE @dogecoin payments with @twitter. No carrier charges, no BS roaming or dead spots.

The Tesla has a pretty good UI and touch screen design. I don’t see it being that hard transitioning to a phone.

— Umbrella (@umbrella_uni) November 28, 2022

ApeCoin goes APE

ApeCoin (APE) – the governance and currency token for the Bored Ape Yacht Club (BAYC) ecosystem – has gone a bit bananas (had to do it) over the past 14 days. Similar to DOGE, it’s up around 30% over the past week, and actually closer to 40% over the past fortnight.

Why? Two words: staking rewards.

Excitement is starting to build for APE holders as this long-anticipated rewards system will reportedly be implemented in December. Announced by Horizen Labs, the staking protocol will provide APE holders, along with Bored Ape and Mutant Ape NFT owners, token-based rewards for staking the tokens they hold.

Not everyone’s happy, though, as several jurisdictions, including the US, will be blocked from using the staking function due to regulatory concerns.

This isn’t okay @yugalabs, the comms around this have been horrible and the lede is buried here

We need more information about the US being geo-blocked

Will the only way people from US can participate in is trying to illegally use a VPN or stake directly from contract? https://t.co/OaEPGv1SgB

— Ben Jammin (@xBenJamminx) November 24, 2022

The Ape Foundation has since suggested possible workarounds for affected countries and regions.

Uppers and downers: 11–100

Sweeping a market-cap range of about US$6.25 billion to about US$322 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Huobi (HT), (market cap: US$913 million) +10%

• Dash (DASH), (mc: US$477 million) +8%

• Rocket Pool (RPL), (mc: US$345 million) +7%

• Fantom (FTM), (mc: US$566 million) +6%

• THORChain (RUNE), (mc: US$370 million) +5%

DAILY SLUMPERS

• BinaryX (BNX), (market cap: US$369 million) -3%

• NEXO (NEXO), (market cap: US$362 million) -2%

• KuCoin (KCS), (mc: US$641 million) -2%

• Synthetix (SNX), (mc: US$395 million) -1%

Around the blocks

A selection of rumour, randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

Uh-oh, another one bites the dust in the FTX crypto contagion?

NEW: Crypto exchange Bitfront has shut down – Reuters

Another one…🤨

— Bitcoin Archive (@BTC_Archive) November 29, 2022

The notion of "governance rights" as a narrative for why a token should be valuable is pathological. You're literally saying "I'm buying $X because later on someone might buy it from me and a bunch of other people to twist the protocol toward their special interests"

— vitalik.eth (@VitalikButerin) November 29, 2022

!FUNNY NEWS!

You are degens, people! 😂

Vitalik said smth like: "Imagine I buy X token blah blah blah…"

Then, $X pumped over 40%

🙃

— Satoshi Stacker (@StackerSatoshi) November 29, 2022

According BlockFi's bankruptcy filing, the company estimates that they have between $1 billion & $10 billion in assets and liabilities.

Great to see that they have narrowed it down to a reasonable range 👍

— Coin Bureau (@coinbureau) November 29, 2022

LATEST: $FTM is up 17.2% today following Andre Cronje's latest article revealing @FantomFDN's $340M worth of assets and annual earnings of more than $10M.

Other tokens from platforms within its ecosystem such as $SCREAM and $GEIST are also up 14.3% and 43.5% respectively. pic.twitter.com/Op2iKHnjDE

— CoinGecko (@coingecko) November 29, 2022

Post FTX, crypto markets have settled into a new range – wrapped around $16,500 BTC and $1,200 ETH. While we could easily trade sideways through a quiet holiday period, there are a number of catalysts in either direction 🧵👇

— Cumberland (@CumberlandSays) November 29, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.