Mooners and Shakers: A disturbance in the Force as BlackRock files for spot Bitcoin ETF

Pic via Getty Images

Are you listening, Crypto Rebellion? A dark force is stirring to alter your galaxy. And it’s the owner, pretty much, of America and large parts of the planet more broadly.

Yep – BlackRock has filed for a spot Bitcoin ETF.

Amid the SEC’s pincer-formation attack on prominent crypto outposts Coinbase and Binance. Amid freshly baked Tether (USDT) stablecoin FUD. Amid the lowest Bitcoin and crypto levels in three months. And amid Darth Gensler and Grand Moff Warren’s all-out assault on the Rebel alliance.

And it comes after dozens of Separatist asset managers have tried and failed dismally to pass their own spot BTC ETFs past the SEC over the past couple of years.

Here’s the filing:https://t.co/3H0xfPDGqm pic.twitter.com/q8mJCqIlib

— Swan (@Swan) June 15, 2023

Wait, could this actually be a good thing for the price of Bitcoin (BTC)?

Absolutely it could be if approved, but that would also come with an uneasy, sinister undercurrent of “tradfi” control for many a true crypto believer. Case in point…

Blackrock Bitcoin Spot ETF filed

This makes sense as to why all crypto exchanges and crypto assets are under attack

Blackrock is affiliated with ~99% of American goods and now they will control your money 100%

Great job everyone https://t.co/HJedRKXoGl

— Wendy O (@CryptoWendyO) June 15, 2023

That said, it’s highly likely most of the market really couldn’t give two hoots about who pumps their bags. Nevertheless, the timing of it all is certainly a major chin scratcher.

“The shares are intended to constitute a simple means of making an investment similar to an investment in Bitcoin rather than by acquiring, holding and trading Bitcoin directly on a peer-to-peer or other basis or via a digital asset exchange,” reads the BlackRock filing.

BlackRock manages 9 TRILLION USD worth of assets across Earth, and perhaps several squillion more across Coruscant. As some crypto analysts and observers are saying, if the SEC is going to approve anyone for a spot BTC ETF, it’s probably going to be BlackRock.

Hang on, back in a sec… just reaching for the space hookah here, because you know, crypto rebellions are built on hopium…

Nice. Okay, so the real questions here are… Is Emperor Larry Fink building a Bitcoin Death Star, and did he plant Darth Gensler into the SEC role to specifically knacker the crypto industry in the US and bring down the prices of Bitcoin and pals so that trillionaire institutions that missed the last big crypto wave could jump in and essentially take control?

Yeah, that hit’s worn off already, but it’s still kinda fun to think about. The Outer Rim Social Network, aka Crypto Twitter, is certainly lapping it all up today…

Gary finally did his overlords bidding .. 'yo we need just one more discount and kill some competition here.. then we'll enter cheap for the next cycle, and you get a sweet position once you retire'

— XPAPI (@1MrPapi) June 15, 2023

It's obvious to everyone here that the SEC's incompetence in the US opens the door for Hong Kong & emerging markets to establish themselves as crypto hubs.

America's regulatory crackdown doesn't stop crypto.

It just means other countries capture the upside. pic.twitter.com/g81Gv31cUi

— Luke Martin (@VentureCoinist) June 15, 2023

Of course, I didn't say this wasn't bullish or they shouldn't get approved. I'm all for it. The point was the SEC is weaponized against crypto companies to slow them down to allow TradFi incumbents to come in and lead the market, that is not the free market

— Tony Edward (Thinking Crypto Podcast) (@ThinkingCrypto1) June 15, 2023

There’s one added point of interest, however, which may throw a spanner in the works regarding the speculation of SEC approval on this. And that’s the fact BlackRock notes it intends to use Coinbase custody for the ETF, and the crypto exchange’s spot-market data for pricing.

What with Coinbase being sued by the SEC last week for securities violations, perhaps it seems unlikely the SEC would even consider rubber stamping this latest filing any time soon.

“And then we psyoped them into selling their Bitcoin to us” pic.twitter.com/SetLFeYoTq

— Will (@WClementeIII) June 15, 2023

Top 10 overview

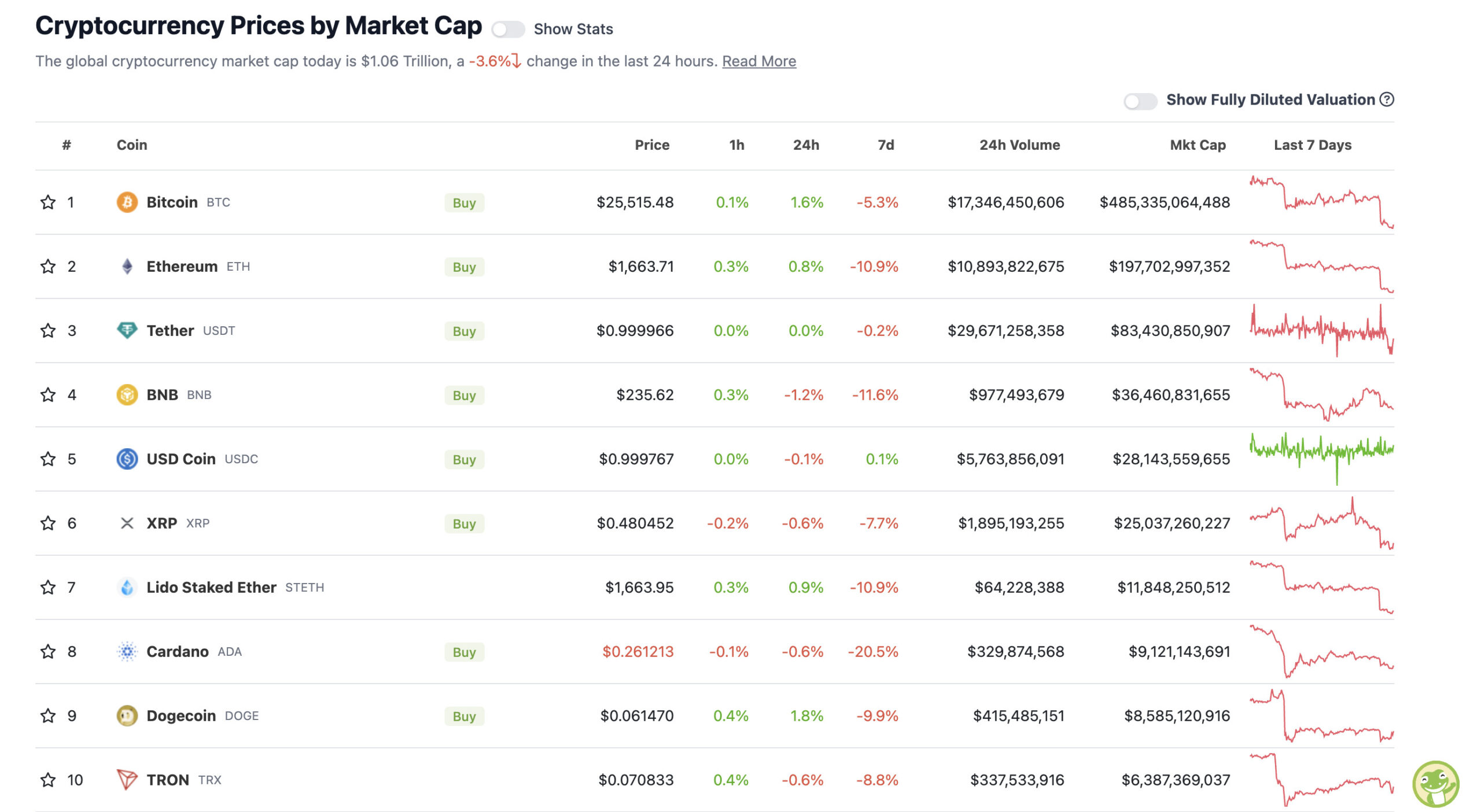

With the overall crypto market cap at US$1.06 trillion, down 3.6% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

So then, yes the overall crypto market is down again, although at least Bitcoin has seen some stabilisation and movement back up, probably in reaction to this BlackRock news.

There’s also been a rally on Wall Street overnight, however, which our very own non-fungible Eddy Sunarto over at the busy Market Highlights desk is partly putting down to the fact “the Chinese government has slashed its cash rate and is reportedly mulling a big stimulus package to prop up key sectors”.

However, what’s also interesting about this, is that the crypto market, for so long tightly correlated to the movement of the US stock markets, in particular the tech-tastic Nasdaq, is not currently riding that wake. Then again, perhaps the crypto bleed would be worse right now if not for the current stonks push.

$BTC 1D

Price sitting in support with low volume. Generally implies a reversal is coming.

Will short if volume validates a breakdown but looking for reversal to long for now.

Itching to make a trade, been in cash a while.#bitcoin #cryptocurrency #cryptotrading #cryptonews pic.twitter.com/3FRMOnl5GN

— Roman (@Roman_Trading) June 15, 2023

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Kaspa (KAS), (market cap: US$348 million) +15%

• KuCoin (KCS), (market cap: US$637 million) +13%

SLUMPERS

• Aave (AAVE), (market cap: US$718 million) -6%

• Hedera (HBAR), (mc: US$1.36 billion) -6%

• Polygon (MATIC), (mc: US$5.5 billion) -5%

• Polkadot (DOT), (mc: US$5.4 billion) -5%

• Stellar (XLM), (mc: US$2.07 billion) -4%

Around the blocks: Tether FUD rears ugly head

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Tether FUD brewing for the 917th time. Sigh…

— Lark Davis (@TheCryptoLark) June 15, 2023

There has been some fresh fear, uncertainty and doubt flying around over the past 24 hours regarding the stability of stablecoin Tether (USDT), after large amounts of the coin was suddenly sold off on decentralised exchanges Curve and Uniswap, spooking traders.

This saw the asset briefly, slightly depeg from its near US$1 level. It has since, however, recovered.

Fun Fact: Stablecoin FUD often marks local bottoms. pic.twitter.com/puLT7wun7E

— Miles Deutscher (@milesdeutscher) June 15, 2023

Markets are edgy in these days, so it's easy for attackers to capitalize on this general sentiment.

But at Tether we're ready as always. Let them come.

We're ready to redeem any amount.— Paolo Ardoino 🤖🍐 (@paoloardoino) June 15, 2023

One green candle and everyone is going to forget about this Tether FUD pic.twitter.com/qUHaplmoyd

— Ninja (@Ninjascalp) June 15, 2023

IMO, #FED Chair #JPow was all bark and no bite. He telegraphed super hawkish to tame markets, but executed a super dovish pause.

Pick your targets.#BTC #TradFi #Crypto #FUD #MissionAccomplished pic.twitter.com/NRYEceMeZW

— Keith Alan (@KAProductions) June 14, 2023

A hidden gem in the BlackRock ETF filing.#GetForked https://t.co/tER6xxZPui pic.twitter.com/Qdt8BZ2OEZ

— Anil ⚡ (@anilsaidso) June 15, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.