‘Massive’ 51pc attack targets Craig Wright’s Bitcoin SV; crypto market down 1.1%

Getty Images

A fork of Bitcoin founded by a controversial Australian entrepreneur has been the subject of a “massive” attack aimed at reorganising its blockchain.

Bitcoin SV, the No. 40 crypto, began suffering the 51 per cent attack at 1.45am AEST today, CoinMetrics tweeted.

FARUM has identified a 51% attack today on the BSV network at around 11:45AM EDT.https://t.co/Oy19UDw53t https://t.co/T3MMRHqPe8

— CoinMetrics.io (@coinmetrics) August 3, 2021

A 51 per cent attack occurs when a group of miners manage to control the majority of the hashpower (computing power) devoted to mining blocks on a blockchain, allowing them to censor transactions and reverse transactions that occur while they’re in control of the network. This could lead to the parties behind the attack double-spending their coins, by presenting them for trading or payment and then later reversing that transaction.

Bitcoin itself has never been the subject of a successful 51 per cent attack but a number of smaller cryptos have, the largest being Ethereum Classic, currently the No. 18 crypto.

This latest attack involved reversing 100 blocks, meaning 570,000 transactions were wiped out, one researcher wrote. With a block being mined roughly every 10 minutes, that’s more than 16.5 hours of transactions.

Correction: the reorg was 100 (!) blocks deep wiping out 570k transactions. It was just our alert system that didn’t expect someone trying to revert the whole blockchain and stopped at 18. Oh well, there are some risks associated with transacting on low-hashrate blockchains.

— Nikita Zhavoronkov (@nikzh) August 3, 2021

Bitcoin SV emerged from a November 2018 split with Bitcoin Cash – which itself was forked from Bitcoin in August 2017. (There’s a lot of drama in the crypto space.) It was created by Craig Steven Wright, the Aussie developer who claims to be Bitcoin’s pseudonymous creator Satoshi Nakamoto.

While the various Bitcoin forks have their supporters, it’s fair to say that many in the community hate them, regarding them as pretenders to Bitcoin’s throne.

Sydney-based exchange the Independent Reserve delisted Bitcoin SV in January, “in light of recent events and community feedback,” after Wright served take-down legal claims on various sites hosting the original Bitcoin white paper.

The Bitcoin Association behind Bitcoin SV was urging node operators to take steps to invalidate the “fraudulent” chain — an action that some were blasting as hypocritical and counter to cryptocurrency’s decentralised ethos.

If what you call the ‘fraudulent’ chain is the longest, then it isn’t fraudulent; it’s the only valid chain

Where did I get this wisdom from? Well the white paper of course

— Snake ₿itken (@SnakeBitken) August 3, 2021

The attack was first reported by Coin Telegraph.

At 12.08pm AEST, Bitcoin SV had dropped 4.2 per cent to US$137.89.

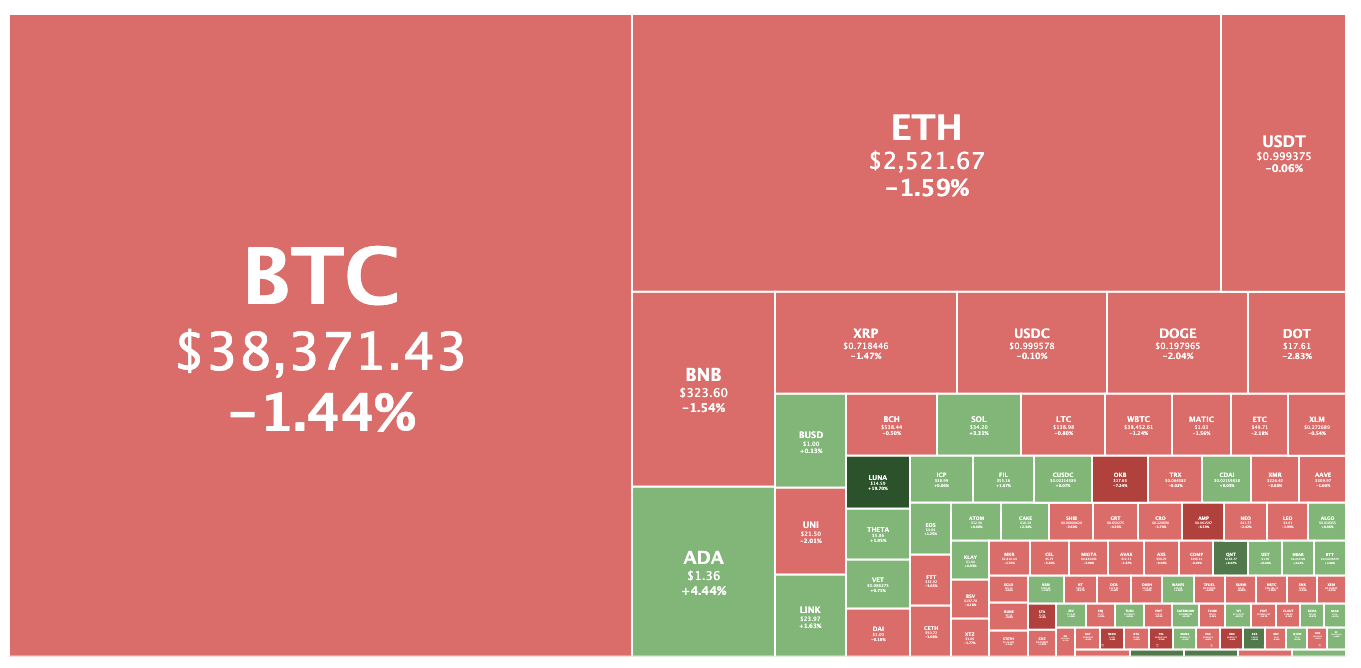

Crypto market down 1.1%

Overall the crypto market had dropped 1.1 per cent to US$1.62 trillion, with Bitcoin falling 1.5 per cent to US$38,452.

Regulatory uncertainty may be dragging on the market, with a contentious crypto-reporting provision advancing in a US$1 billion infrastructure bill being debated in the US Senate. The measure would require US crypto “brokers” to report crypto transactions to the IRS, but there’s some lack of clarity as to what would constitute a crypto broker or whether it could include miners.

Ethereum meanwhile was changing hands at US$2,525, down 1.5 per cent from yesterday, ahead of its London hard fork tomorrow night (Australian time).

Terra (LUNA) was the best performer in the top 100, rising 20.2 per cent. The No. 20 crypto, Luna is used to maintain the stability of Terra stablecoins.

Perpetual Protocol was the second-best gainer with a 10.9 per cent rise to move into the top 100, at 97. (Stockhead wrote about the decentralised derivatives exchange in late May, when it was the No. 248 crypto, as a “coin to watch” in our column with Apollo Capital.)

On the flipside, Stacks was the worst performer, falling 14.4 per cent. The No. 70 crypto, Stacks is a platform for writing smart contracts on the Bitcoin blockchain.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.