Legend of crypto: Michael Sloggett has bounced back from the worst year of his life

Pic: Getty

Four years ago Michael Sloggett was on top of the world, making hundreds of thousands of dollars trading cryptos and getting paid good money to teach others to do the same.

Then last year it all came crashing down on him. The 37-year-old Queensland father of two was arrested on accusations of money laundering, lost his business and seriously considered his own life.

But these days he’s back and looking better than ever. In a wide-ranging interview with Stockhead in early February, Sloggett addressed how he’s doing, his arrest and the new business he’s launched as chief vision officer.

Alas, we won’t be printing Sloggett’s comments regarding his legal defence, although he was eager to give his side of the story on that. Our lawyer told us that there was a chance that could be interpreted as violating Australia’s rule against “sub-judice” (interfering with pending legal proceedings).

Stockhead: So I’m curious, tell me your story from the beginning — how did you get into crypto?

Sloggett: Yeah, it was interesting. First got into crypto because we were trying to bring in from the US fat burners and stuff like that [for his Townsville supplement business, Second to None Nutrition]. FTX fees were really really high. Commbank couldn’t give us a rate… and a supplier was like, ‘we accept Bitcoin’.

He actually walked us through the process, and we started buying supplements. It’s crazy, we started buying $40,000 worth of supplements when Bitcoin was $230 a coin. If I’d just kept the Bitcoin and not bought the supplements, I’d be a lot better off! (laughs)

Stockhead: (laughs) … How long ago was this?

Sloggett: 2015.

Stockhead: Okay. And so that sort of sparked your interest …?

Sloggett: No, actually, that didn’t spark my interest in Bitcoin at all.

It wasn’t until probably about December 2016, January 2017, and Bitcoin was coming back up to A$1000. And I was like, holy shit. I checked my wallet, I still had some — and I ended up investing quite a bit of money. Well, it was a lot of money for what I had back then. I think it was $50,000?

I think I had 100+ Bitcoin spread over BTC and altcoins at the start of 2017. By July, I was sharing a lot of stuff on social media, and I discovered technical analysis; just discovered a love for trading.

Back then it was more about alternative coins. I had an account on Bitfinex, did a little bit of leverage trading — but not a lot, because to be honest, there was more money in these altcoins that were going crazy parabolic.

I started sharing a lot of my trades publicly, like Verge, Tron, Antshares … These are coins that went absolutely parabolic in 2017. Verge went from one Satt (Satoshi, the smallest denomination of Bitcoin) to 1,700. So one Bitcoin on Verge turned into 1,700.

Stockhead: Oh my gosh.

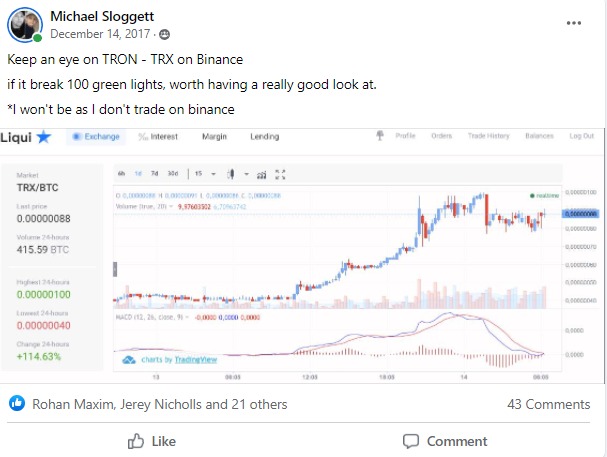

Sloggett: I told people they should be buying Tron at 88 Satts…. I said, I won’t be buying because it’s on Binance. At that time, I wasn’t using Binance, it was so new and foreign. It went to almost 2,000 Satts … people started taking notice, saying ‘how does this guy find this stuff so early on and see it before everyone else?’

So that’s when I started teaching people. Crypto Calls Australia (his Facebook group) grew to like 40,000; people were saying ‘you gotta teach us’. So that company I created ended up teaching over 15,000 people over four years.

In Neo (formerly Antshares), I was a very early investor, I put $18,000 on Neo at 48 cents – and I watched it go all the way up to US$170, I think my investment was like $4.9 million? And then watched it fall all the way back down to 40-something dollars (per token). (Laughs)

Stockhead: Isn’t that always the way?

Sloggett: I did that a couple of times. It’s actually good because it actually taught me so many valuable lessons that I now teach other people, which is really cool.

And during that whole altcoin and ICO mania, and then the horrendous bear market – I leverage traded the entire bear market from April 2018 all the way to April 2021.

Then obviously I got caught up in that whole money laundering thing [Sloggett was arrested last April by Queensland’s Major and Organised Crime Squad].

[detailed discussion redacted]

And then obviously that happened, I took nine months off social media. Also off trading. I was pretty cooked. Mentally, I went through probably some of the darkest days I’ve ever gone through.

You know, I lost my business. I lost my friends. I mean, I built a wildly successful trading company where we have 5,000 active students when I left. I mean, wildly successful – we had $10 million a year in revenue.

And you know, it broke me, it really broke me, because my friends literally just turned on me, turned their back on me and I was all alone and struggling.

[Sloggett here briefly detailed a dispute with his former partners at his old business, who ousted him after his arrest, a move he’s now contesting through his lawyer].

So it was really really hard. It was really really tough.

And then after about four months of feeling sorry for myself, a friend of mine actually reached out, said, ‘hey, like, crypto games.’

And sort of got me looking again.

I had nearly stopped looking at the charts, but I would still look at the price. And I was watching the world’s most parabolic bull run — and I wasn’t even in it!

Stockhead: Oh no.

Sloggett: That hurt more than most, because I had been telling people that this was coming for four years.

Even at $3,000, after the (Bitcoin) halvening, I was like, ‘guys, July 2020 is when this starts, pack your bags and start accumulating’.

I missed out on my Olympics — and it hurt me mentally even more, right?

A bunch of people would check in on me, and were like, ‘you taught me so much – you taught me three years ago, and I’ve made so much money, and if it wasn’t for you…’

I was like, ‘alright’.

I started sharing some charts with people, cuz they’re like, ‘oh, where’s the top where’s the top? What’s gonna happen now?’ It got me excited again.

And then all of a sudden they’re like, ‘oh, do you know about games?’ I went deep down this rabbit hole of IGOs [initial game offerings], IDOs [initial decentralised exchange offering], decentralized finance.

That got me really excited again.

And then I became a crazy investor in IGOs and IDOs.

I think I’ve got exposure to over 100 different metaverse and gaming projects. I got in early, before the marketing.

And I networked my way into all this stuff. And that was hard as well.

And regained some friends that I’d lost contact with over that period. Some of them had made a decision to build another company and get back into education, and they offered me an opportunity to be a part of it. At first I turned it down, but then in January they asked me again to come onboard. By then things had changed, so I made the call and decided to take back control of my life and do what I love again.

We had a really successful launch, we got close to 600 members by end of the first week and are now about to crack well over 1,000.

Just really excited to be teaching again.

I feel like I know more than I ever knew before.

I feel like everything that I’ve been through has kind of given me a newfound kind of perspective — not just on the markets, but on life, on people, on what’s important.

It really humbled me.

Stockhead: Uh-huh.

Sloggett: Like, as crazy as it sounds, I think it needed to happen. You know what I mean?

Because I was f***ing making six figures a month, buying crazy watches and cars, doing all this shit… I actually moved out of my home, I wasn’t living with the mother of my kids anymore. Constantly flying interstate and around the world.

And then when I got my ass humbled, I was like, ‘Oh, f***. Shit!’

I kind of lost my way there for sec.

But it actually a blessing. I had to go through this horrible process, but it brought me back down to planet Earth, taught me a bunch of stuff.

And it also let me look at the market from a completely different angle.

Now I’ll be more excited about everything else that’s happening now.

So yeah, it’s been a crazy ride. (laughs)

So the thing is that’s, that’s f***ing six years in crypto. I always say crypto is like dog years. You do four years in crypto and you’ve done 24 in the real world.

Stockhead: Wow, that’s some story. So tell me about this new business? Is this another company that teaches trading?

Sloggett: Yeah, so it’s called MTC Education.

The team wanted to do it a little bit different. So we went and developed a complete community app. So we’ve got an in-house platform that looks and feels like Facebook, it really does.

But the cool thing is, MTC owns it, so we’re not restricted by Discord rules, Facebook group rules and stuff like that.

We built something where it’s our world, it’s our universe. We can give people badges, we can host live calls, we can do anything that we want to be able to do.

We’ve got some phenomenal trainers, got really good coaches. I get to teach people everything about technical analysis, which I know a lot about.

I get to teach more about psychology, because I think what I had to develop to get out of that. I already had a pretty good trader psychology mindset, from being in the housing commission to who I am now … I’ve developed that over the years, but over the last 12 months has really solidified that — that grit, that determination and kind-of callousing of the mind.

And now I also get to teach people about DeFi, IGOs, IDOs.

You know, the only rabbit hole I haven’t jumped down is JPEG NFTs. I can’t get my head around it.

You know, it’s funny because in one of these games, Town Star, I own like $84,000 worth of NFTs, which is crazy right? But this game, you own a farm. And if I place those NFTs in my world, everyday, they actually earn me money. So those NFTs actually make sense to me. To me, they’re like an asset.

But the whole $4 million monkey? I don’t get it! (laughs)

Stockhead: Yeah, if only we’d minted them… it’s a crazy world.

So what are your favourite projects at the moment?

Sloggett: My favourite project is called Seedify, a launchpad. One of the reasons I like Seedify so much is that they offer you a 75 per cent APY on staking their asset. It gets paid out every 90 days; you can do different levels as well. But if you do it over 90 days, you get 75 per cent. So when you work that out, if you compound that out, it’s 100 per cent, every single year, and that allocation, if you’ve staked enough, it gives you allocations in their projects.

There are a lot of (launch)pads out there that are launching these weird projects that are just complete scams. Seedify is kind of like, the premiere kind of pad. It’s very expensive to get in, but their vetting process… they only bring in really, really good projects.

So I like that, because even if the market did dip another 50 per cent, the APY of 100 per cent will make up the loss and I’ll get the allocations still. So it means I can still invest in these cool projects. And as you earn more coins, you can restake to unlock higher tiers to get bigger allocations.

There was one the other day, Sidus, and I think I got a $50 allocation – and that’s worth $3,400 today. You know, $50 to $3,400 — that’s a good day.

Stockhead: Wow… I’ll have to look into that.

Sloggett: So I really really like that stuff. It means I don’t have to go out and research a million things. They’re putting really good information in front of me. I now know where to look, I know what white papers to read. I’m not trolling Reddit forums, getting weird names from Telegram channels, going down rabbit holes for days on end.

Stockhead: Sure, sure.

So, I did tell you, I wanted to mention the AusCoin situation. (AusCoin was a cryptocurrency venture Sloggett was involved in that failed in 2019, following an expose by 60 Minutes.) Can you take me through what happened with that? I know it was a number of years ago.

Sloggett: Yeah, yeah. In 2017, a buddy of mine reached out. He said, ‘I’m going to do this coin’. And he says, ‘will you come on board and market it and go on the road with me?’

And I was like, ‘are you gonna show me the roadmap?’ At the time, he didn’t have one. He said, ‘we’re just going to make it.’

And I was like, ‘it’s got do something, it’s got to have a purpose; you can’t just make it for the sake of making it.’

So we went through this whole thing; came up with a plan. And then we were like, what if we deployed a network of ATMs? The whole idea was, we would deploy this network of ATMs, and that would give people a real easy way to buy and sell that they were used to doing.

I researched a lot of companies, right? And Apple Pay — Apple Pay is phenomenal. I use it. But if you actually look at the stats for Apple Pay, the number of people that activate it, it’s about 80 per cent. The amount of people that activate it and upload their card, drops to 30 per cent. And then the number of people who actually upload their card and then use it, it’s less than seven per cent.

So that just goes to show that people are really reluctant to do things that they don’t always do. So to get your card. So to get your card out and tap, we’ve always done that. To use your phone, it’s really easy. However, getting an entire globe to adopt to a new concept and do something different to what they’ve always done (is difficult).

So my idea was, if we can get a really easy cash-in and crypto-out, or crypto-in and cash-out, that’s something that people can understand.

So we’re like, alright, we’ll raise this money, we’ll deploy this network and the deal was always going to be real simple — for the people who held AusCoin, it was going to get you cheaper rates, and also mitigate fees on the ATM network.

So that was going to give you cheaper rates, and always mitigate fees on the ATM network. So that was the whole tokeneconomics behind it. We also had all these plans for merchants and all this other stuff.

We launched under a lot of controversy. We didn’t really have a chance. A Current Affair covered it, everyone covered it. Australians f***king hated it. And I don’t know if it was because of the founder, a gentleman by the name of Sam [Sam Karagiozis, who is now facing drug charges] — I don’t know what it was, but it became cool to hate the project.

So the project never really had a chance before it even got off the ground. And when it did get off the ground, we raised half a million dollars. Like, everyone talks about AusCoin as though it was the biggest f***ing scam in Australian history. F***ing wasn’t. Havven took $76 million and never gave anyone s**t. So we took half a million, might have been about $700,000 and we deployed 43 ATMs, we did some of the biggest commercial contracts that have ever been done.

We had commercial contracts with some of the biggest shopping centres in Australia. We did a deal with one of the biggest deployers of ATMs in the world. And we did this all with no money, no support, no help.

And then what happened was, the guy who owned the company, Sam, got caught up in some s**t that happened before AusCoin even existed. And he got charged and the AFP [Australian Federal Police] seized all of his assets. Now he was the sole director of AusCoin. So when the AFP seized all of his s**t, they took the entire AusCoin network – even though AusCoin had nothing to do with something that apparently happened a year before AusCoin even launched.

So that is the f***ing story. It had a working product, everything was in development, and then because of outside circumstances, all of the assets go taken away and I was kind of left on the chopping block.

And that’s it. And that f***ing poor guy, Sam. He’s not even going to trial, I think for another four years, for the stuff that they claimed happened a year before AusCoin’s existence. So that’s a story in itself. It’s actually crazy. I don’t want to talk too much about Sam, because I don’t want to talk out of school, but that’s the story in a nutshell.

Stockhead: Got it. And so let’s see… You said you were in this dark place for awhile last year and now it seems like you’ve really bounced back.

Sloggett: I was f***ing suicidal. Oh man, I said my goodbyes, there was a night where I drove to the f***ing train tracks up the road. I was sitting there, tryng to work out what song I was gonna go out to.

Sloggett: I was f***ing suicidal. Oh man, I said my goodbyes, there was a night where I drove to the f***ing train tracks up the road. I was sitting there, tryng to work out what song I was gonna go out to.

Stockhead: Oh my gosh.

Sloggett: Yeah, it was done. I had checked out. (morbid laugh). I was getting ready to go, and then I started thinking about like, if I hit the train hard enough, I wonder if I can derail it and make the news.

I’m thinking about how do you derail it and not hurt anyone… but because it’s coal, they’re coal trains? I just want to leave and for people know I still had some f***ing power. (laughs again)

And then I was like — hold on, big fella. You’re sitting here, you don’t want to die … you just don’t want to be in pain anymore.

What are you doing?

Thank God I had this conversation with myself because it was as the train went past, because I had intended to hit the coal carriages and try and knock it off the tracks.

So people would be like, ‘Oh, he hit it with so much force, he derailed the whole thing’.

And then I thought, alright, you don’t want to die. So let’s not do that.

So yeah, I picked myself up and got on with it.

I’m so passionate about the space. I love sharing anything that I’m doing, good or bad.

I like that I’m the kind of person in the space that isn’t scared to own that f*** up and mistakes and I’ll be public, I’ll be honest about it. I’m like, hey I’m so far from perfect, it’s not funny.

However, there is a lot of good stuff there as well. I’ve helped create millionaires. I’ve set people financially free, I’ve taught people stuff that they never would have learned before. I’ve helped people who are in similar places like I was in the train. I got an abundance of messages from people saying, ‘man, if it wasn’t for you, I wouldn’t be here anymore.’

And that shit keeps me going. So you know, I had to come back. I had to come back and I had to get back into this space. And I had to rebuild what I didn’t have anymore. And so that’s how it all came about.

Stockhead: Wow… that’s some story. When was this thing with the train?

Sloggett: Let’s see … six months ago?

Stockhead: Well, you look good now. You look like you’ve lost weight, looking very buff.

Sloggett: I run a lot now. The psychological battle with running, I like that a lot more than the process of just going out and lifting weights. The mental game in running has really sparked my interest. I’m still in the gym a couple of days a week, but yeah, I’m just doing my best not to eat cheese. But thank you.

Stockhead: Any road races?

Sloggett: It was funny, a couple years ago, we set out to do a challenge, it was to run four miles every four hours for 48 hours. Yeah, I’d never f***ing run anything like that in my life.

I put it out on Facebook, and people were like, ‘you never do that’. I’m like, ‘F***, I will now.

So we put a date on it, we put a bunch of people together, from all around the world. And we had a Facebook Messenger group, and we did the stats on this thing – if we do like four by four by 52, means we would run two marathons that day. It was like, f***.

So it was a mental game that I found in that, the one o’clock run. You could get away with not doing it. Or what if I walked, who’s really gonna know? That test, to push yourself when no one else is watching. When you’re all alone and you’re in the dark, the s**t that you do when no one else is watching really f***ing matters.

And that actually, you know actually gave me another level of self-belief. It’s like, hold on, you’re a bad motherf***er, you made a choice and a decision.

And that made me reflect – hang on, you made a decision that you’re going to kill yourself.

So let’s make a different decision. We want to live. So what decision are we going to make now.

Well, let’s make the decision to never be here again. Okay, cool. Like decision made. What are going to do now? Well, we’re going to get out of this awkward funk that you’re in and we’re gonna get back to doing what you love. Well, f**k, we’re gonna do that.

Let’s do 10 charts a day. Let’s go back to f***ing exercising every day. Let’s f***ing stop drinking three litres of Pepsi Max and replace it with water every day.

It just took these little little things, but it started with that decision. But that decision was based on me remembering that I’ve been through stuff way harder than what I was going through.

I lost the business, I lost some friends, and some people on the internet were talking s**t — so f***ing what. (laughs).

In that moment, I’ve was like, I’ve lost everything, I’ve lost my fans, I’ve lost my multimillion-dollar business, I’ve lost my community.

And then, funnily enough, I’ve started to get it all back. And it all comes back to that one choice, that one decision, where I decided, f**k, I’m not gonna, wait.

Stockhead: That’s great, I’m very happy for you. I think everyone loves — what’s the word? A second chance story?

Sloggett: I think Joe Rogan said it best, he said stories of people winning are cool, but he likes stories of people who completely f**k their life up. I always say I like better too, but it’s true, right?

I don’t want to be the guy, Donald Trump’s son, who took a $2 million loan to build a f***ing hotel but it was really tough because it was hard work.

That’s cool, but show me the guy who f***ed his whole life up, was at the bottom of the barrel, had f***ing nowhere to go, and dusted himself off and became someone.

That f***ing s**t gets me, that’s the kind of story I want to hear.

The cool thing is, maybe I’m becoming that story myself. Maybe that’s why I’m keen to share that message, because you can, you can jack your whole f***ing life up.

Like, I’d left the mother of my children, I had a girlfriend in another state, I wasn’t living in the house anymore, I’d lost my f***ing business, I’m being charged by the federal f***ing police, I went from making a hundred grand a month to not making a cent…

Stockhead: Oooof.

Sloggett: And when you hit the dirt, after being that high, it hurts more. Right? Especially someone like me — I come from the housing commission, I come from the gutter. So I had all these thoughts in my head. Like, you had actually done, what most people won’t ever be doing.

And then you f*** it all up. So that weighs on you every single day as well. Right?

And then you f*** it all up. So that weighs on you every single day as well. Right?

And then, you know, I never had a dad. So I’m always thinking, f***, you’ve gone and done it. You always said that you’re going to be the best dad because your dad showed you who not to be.

Look, look at what you’ve gone and f***ing done.

You’ve become everything that you said that you hated about what you never had.

So I can be like, you know, I’ve gone through that now. And I’m at home, with my kids. We’ve got a phenomenal business again, everything’s on the up and up, I’m back doing what I love.

I’m doing what I love for a living, I’m sharing what I’m passionate about, and turning it into a powerful message to impress on other people — life is a f***ing good thing.

I think that’s a powerful message to have, and I’m kind of grateful that I got to through all this, because now this story can f***ing help someone. Because there’s someone out there that is way more f***ed up than I was. And if they hear this story, they go, ‘oh s**t, oh f*** I’m still in the fight’ — so yeah, it’s good.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

For more crypto news, follow the author on Twitter, follow Stockhead’s crypto-themed Twitter account, and its Facebook page. Sloggett’s page

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.