‘Lazarus-like recovery’ – Bitcoin soars by US$6k as case for aggressive rate hikes fade

Getty Images

Bitcoin has soared to a 12-day high while the Russian ruble has plunged to a record low as the West tightens sanctions on Moscow over its invasion of Ukraine.

At lunchtime (Sydney time), BTC was up 15.7 per cent to US$43,550, having spiked from US$38,100 to $40,600 around 1am AEDT and from $41,900 to US$44,200 at 9.40am.

The intrinsic value of #Bitcoin is now in full display on the whole world.

— Nayib Bukele (@nayibbukele) March 1, 2022

Today Bitcoin had the largest daily candle in percentage terms in over a year

— Will Clemente (@WClementeIII) March 1, 2022

Sydney-based City Index analyst Tony Sycamore said that crypto was staging a “Lazarus-like recovery,” supported by two factors.

“The first is the sanctions imposed by the west on Russia over the weekend have prompted strong inflows into Bitcoin and other digital assets as Russians look for ways to get their money out of the country, and their rapidly tumbling currency,” he told Stockhead.

“The second factor is the market’s dovish reassessment of the Federal Reserve’s hiking cycle. US yields fell 12-15bp across the curve overnight, all but pricing out the possibility of a 50bp hike from the Federal Reserve in March which is supportive of risk assets in general including equities and digital assets.”

The ASX200 was up 1.4 per cent at lunchtime with tech stocks the best performing sector, rising 5.5 per cent, supporting Sycamore’s idea that it was a risk-on day. The Nikkei was up 1.6 per cent and US stock futures were up in the overnight hours there.

The US Federal Reserve is still widely expected to hike rates by 25 basis points at its mid-March meeting but the case for an aggressive 50 basis point hike appears to have vanished.

again, the economy is now hardly anything real at all, it’s all just money supply growth

Increased expectations of that growth is bullish for stocks and every asset except fiat currency for that matter. It’s that simple

— TheHappyHawaiian (@ThHappyHawaiian) February 28, 2022

Crypto market up 12.1%

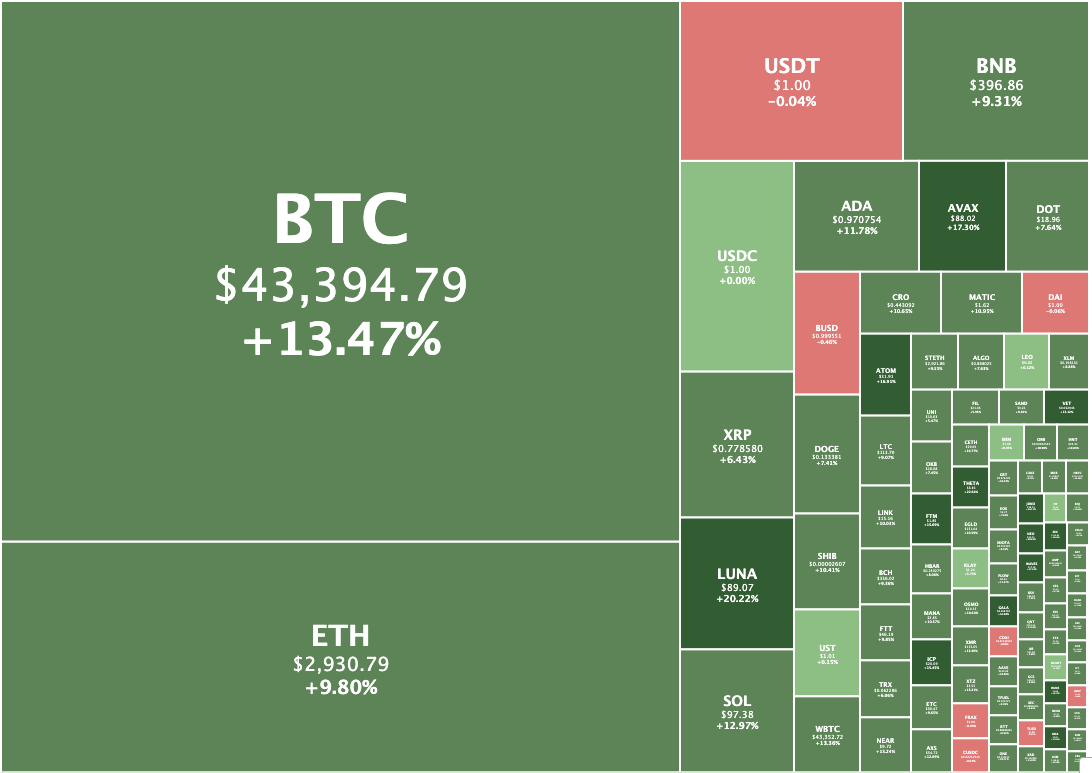

Overall the crypto market was back at US$2 trillion, up 12.1 per cent in the past 24 hours, according to Coingecko.

Trading View, which uses a different methodology, pegged the total crypto market at US$1.88 trillion, its highest level since February 18.

Ethereum was up 9.8 per cent to US$2,930, and had traded as high as $2,972, an 11-day high.

Among top 10 coins, Terra (LUNA) was up 20 per cent $89, and Avalanche was up 17.5 per cent to $88.

Waves was the biggest gainer in the top 100, rising 45 per cent to $17.

Theta Network, Neo and Kadena were all also having a strong day, rising between 23 and 18 per cent.

The only top 100 cryptos in the red were stablecoins, which sometimes edge lower when the rest of the market rallies.

Looking forward, it’s important that Bitcoin close above $42,000, Sycamore said. (While Bitcoin trades around the clock, its “close” is said to take place at midnight UTC/ 11am AEDT).

“Want to see it consolidate the break,” he said.

“Should Bitcoin post a daily close above $42,000, it would likely trigger a stronger recovery towards the 200-day moving average at $49,000 and reinforce the idea that a tradable low is in place at $33,000.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.