Last-minute Bitcoin pump gives bulls some hope after bearish weekend

Getty Images

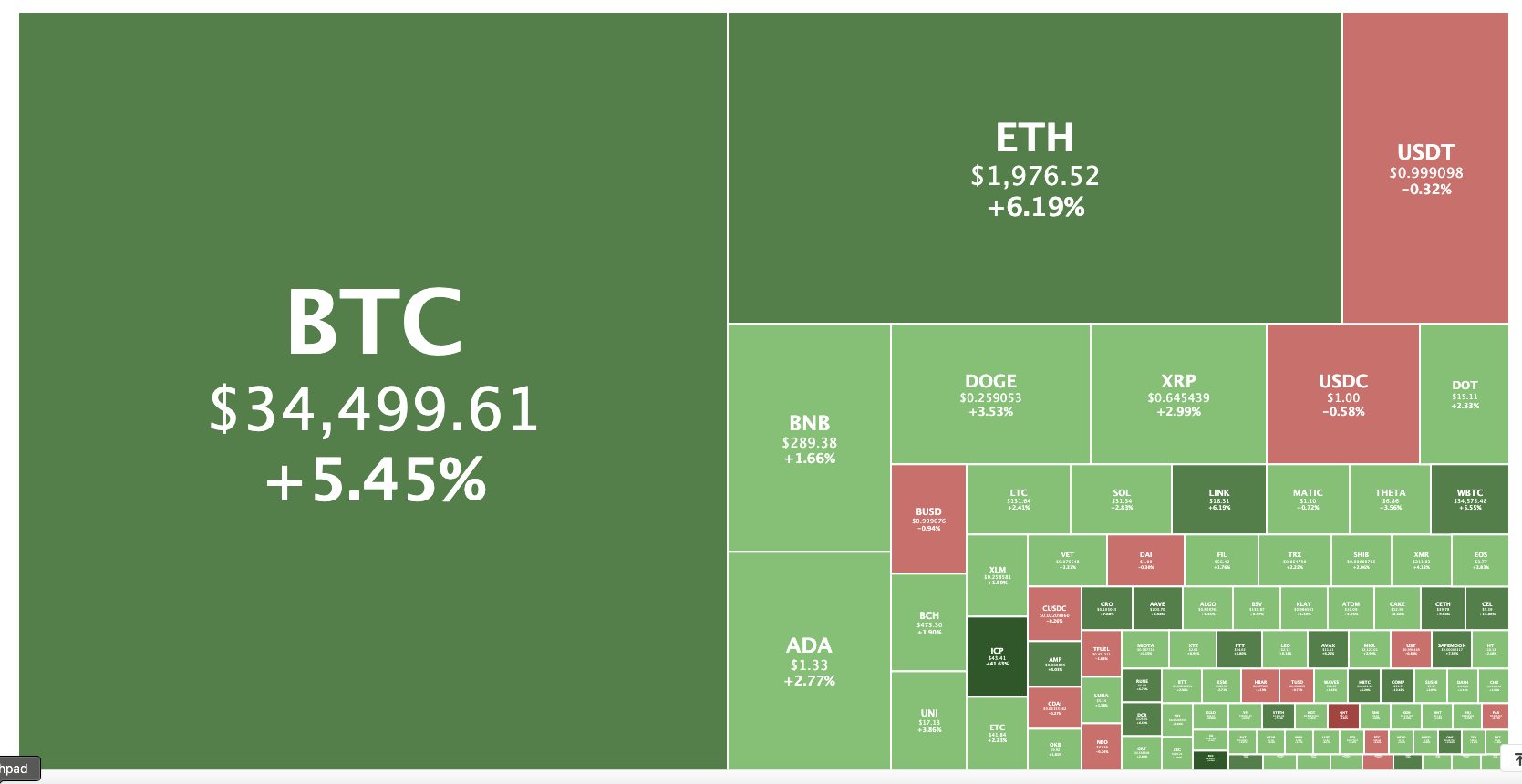

Crypto markets are recovering from a weekend dip, with a pump this morning just hours before the weekly close giving some hope to the bulls.

After falling as low as just above US$30,000 on Saturday evening (Sydney time), Bitcoin jumped 6.1 per cent in the space of an hour Monday morning, going from $32,530 at 7.34am AEST to $34,515 at 8.35am.

The weekly close came 85 minutes later, at 10am AEST/midnight UTC.

Very nice weekly close on #Bitcoin. Very, very nice in fact. pic.twitter.com/8Frmn4N7TU

— Tyler (@TylerDurden) June 28, 2021

Yesterday (when BTC was trading for around $33,250) influential crypto trader Rekt Capital had tweeted it was important for Bitcoin to rally above ~$34,000 “and turn the Higher Low into new support before the Weekly Close for this early-stage bullish momentum to be preserved”.

At noon Sydney time, Bitcoin was trading at US$34,440, up 4.4 per cent from Sunday, and just $400 under where it was Friday.

“We are still trading at resistance without a decisive move up,” tweeted another Bitcoin analyst, who goes by Bitcoin Charts. “Please be ware of that. If we can decisively make a move up and break 35k with volume, then I would be feeling a bit more bullish than bearish. This was a very nice move up! Let’s see what happens next.”

Among other tokens, Ethereum was trading at US$1,971, up 4.7 per cent, and all but a handful of the top 100 altcoin were in the green.

Internet Computer was the biggest gainer, rising 50 per cent to US$46.50 after a horrific few weeks, price-action wise.

Bitcoin Cash ABC, XDC Network and Compound had also posted double-digit gains.

Amp and Quant were the biggest losers, both down a little under four per cent after a strong run recently.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.