JP Morgan says Bitcoin could hit $73K, $146K, or $30K; crypto market cools off a bit

Not a JP Morgan analyst, it's England's Steve Beaton playing darts in Frimley Green, 1998. (Getty Images)

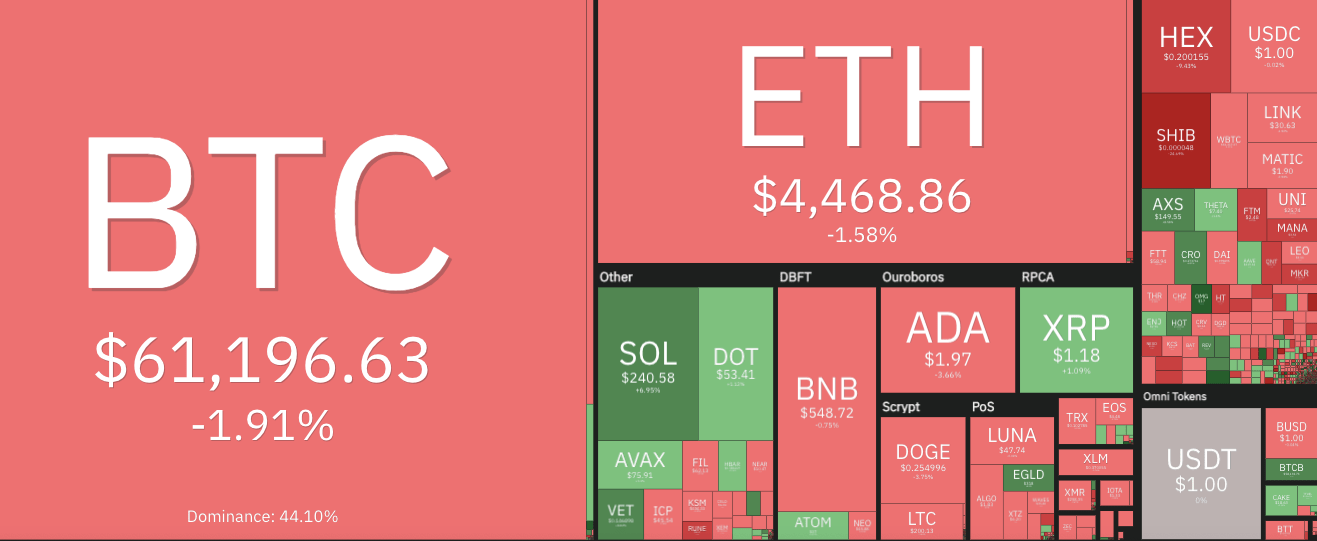

Bitcoin, Ethereum and the crypto market in general have cooled off just slightly today. Meanwhile, JP Morgan has provided a variety of Bitcoin price predictions for investors to choose from.

At the time of writing, the crypto market as a single, broad entity is down a percentage point today, but still sitting just above US$2.81 trillion, give or take a billion dollars or two.

Pack leaders Bitcoin (BTC) and Ethereum (ETH) are both down a fraction at press time, and Cardano (ADA) is lagging behind most in the top 10 right now, about 3.5 per cent to the negative and losing its US$2 psychological support once more.

Its smart-contract rival Solana (SOL), on the other hand, is easily the best top-10 performer today, up about nine per cent since this time yesterday, and hitting another all-time high of US$245 several hours ago.

Shiba Inu (SHIB), however, is in the dog house, falling out of the top-10 spot again for now, and down 23 per cent in the past 24 hours.

Things could get much, much worse for the dog-meme coin’s HODLers if one massive “whale” (holder of a large amount of the token) decides to dump his or her Shiba Inu bag.

As has been reported widely now, a crypto wallet holding US$2.3 billion worth of SHIB, which had been inactive for a long time, has moved as many as 40 trillion tokens elsewhere.

Moving crypto of this magnitude out of a wallet to, for example, an exchange wallet, might only mean one thing for the whale this week… Lambos for the family, rock-star mansions and ‘SHIB happens’ tattoos all round.

JP Morgan provides some searing Bitcoin price analysis

In a report this week written for its investors, the US investment banking giant JP Morgan has offered a veritable box of chocolates selection of price predictions for Bitcoin.

The bank’s main thesis, at least for the short term, was that it thinks Bitcoin can “continue to outperform into 2022”.

But it also believes the OG crypto’s “fair value” is about US$35K, based on its own pricing model – so about 43 per cent lower than where it’s currently trading, around US$61,200.

That said, the investment bank’s analysts reckon US$73K could be on the cards…

“This challenges the idea that a price target of $100K or above, which appears to be the current consensus for 2022, is a sustainable Bitcoin target in the absence of a significant decline in Bitcoin volatility,” the report reads.

Not done throwing a few darts around, though, the bankers also suggested a surge to US$146K was “entirely possible”, but a plunge back to US$30K wasn’t off the table, either.

JP Morgan " Bitcoins fair price is $35k, but it could go to $73k soon, however it's unpredictable so it might go to $146k but it could also go to $30k"

Incredible that boomers pay you for this @jpmorgan pic.twitter.com/LI2QZiSnl8

— Steven Lubka ☀️ (@DzambhalaHODL) November 4, 2021

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.