Is Kazakhstan becoming a Bitcoin mining powerhouse? BIT Mining moves in

Borat approves. Probably. Picture: Getty Images

Chinese crypto mining firm BIT Mining is set to purchase a further 2,500 Bitcoin-mining rigs for operation in Kazakhstan, in addition to the company’s 7,850 either already there or in transit.

For the time being at least, it seems like the mining exodus from China is set to “make benefit glorious nation of Kazakhstan”.

A new law being introduced by the Kazakhstan President will reportedly introduce hefty extra taxes for crypto miners, starting in 2022. So it certainly could all benefit the Central Asian nation if foreign miners hang around long enough.

BIT Mining owns BTC.com, currently the sixth-largest Bitcoin mining pool by hashrate distribution, validating 9.4% of blocks on the Bitcoin blockchain.

The Shenzhen-based company is just one of several mining operations finding it necessary to redeploy elsewhere due to the mining crackdown taking place in China, as decreed by the CCP (Crypto Cancelling Partypoopers).

In a press release on Wednesday, and as reported by Coin Telegraph, BIT Mining said it had entered a US$6.6 million agreement to buy 2,500 Bitcoin mining rigs, which should, in theory, greatly increase the company’s hashrate capacity.

Hashrate is the total combined computational power used to mine and process transactions on a Proof-of-Work (POW) blockchain.

Kazakhstan welcoming crypto with open arms

While Kazakhstan is not the only country experiencing an influx of new mining activity, it’s certainly fast becoming a hotspot for the Chinese mining migration to rival the US. BIT Mining’s fellow major players Bitmain and Canaan have also both been making moves there over the course of the past month.

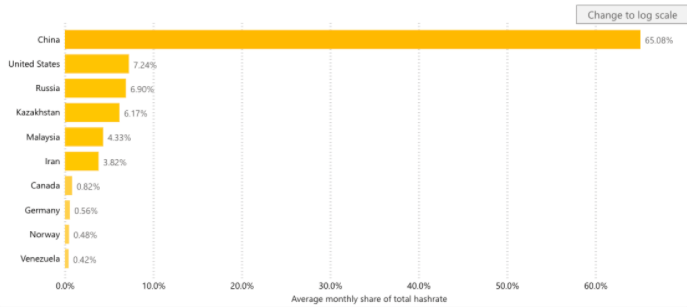

Kazakhstan is the fourth-largest country in the world in terms of its total Bitcoin hashrate share – after China, the US and Russia. This is according to data from the Cambridge Bitcoin Electricity Consumption Index.

And the nation has made clear moves to welcome new crypto-based opportunities, recently making its banking institutions open to cryptocurrency activity and transactions.

According to Coin Telegraph, which cited local Kazakhstan reports, several Kazakh banks will soon be approved to service companies and businesses providing access to Bitcoin, Ethereum and several altcoins. In other words, crypto exchanges.

Environmental concerns?

The increasing Kazakhstan mining activity won’t please those concerned about how Bitcoin affects the environment, as the country pulls in more than 90 per cent of its electricity from fossil fuels, including coal.

It remains to be seen, however, what the environmental implications of the mining migration to Kazakhstan will actually be.

In fact, as reported by CNBC, some analysts think the Chinese mining migration will only be taking a temporary stopover in Kazakhstan before finding greener, more renewable pastures elsewhere.

‘Kazakhstan is not a clear solution’

Varit Bulakul, head of Digital Asset Division and International Business Finance Advisory at The Brooker Group, spoke to Stockhead this week about Bitcoin mining movements more generally.

“Miners are looking for alternatives but Kazakhstan is still not a clear solution,” said Bulakul.

“During the past few months, Chinese miner migration has been hit with policy changes, energy-contract cancellations, and confiscation of equipment in foreign countries. These restrictions have put fear into miners in China, with some also turning to local illegal mining to avoid these foreign risks.”

Bulakul suggested that regardless of what’s happened in China, the Bitcoin mining industry “has always been positively valued”.

There definitely seems to be no shortage of those who view it as a screaming opportunity.

“Mining companies in the USA and Canada are getting valuations in multiples over the book value,” Bulakul told Stockhead.

“With the current BTC price range of US$30k to US$40k, energy cost is becoming less important as the overall margin is very attractive to miners.

“China being out of the picture will only provide short-term benefits to the existing miners, giving more BTC rewards until all the mining tools migrate to operate outside of China.

“Looking ahead, I think there will be top-tier companies attracting these miners with sustainable solutions in accelerating a healthier ecosystem. However, the operating cost remains high as well as the opportunity cost, so [more] miner decisions should be made in the coming months.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.