Internet Computer, dYdX sink to new lows amid listless crypto market

Getty Images

Two hugely hyped crypto projects, the Internet Computer and dYdX, are sinking to new lows as the overall market treads water.

ICP tokens hit an all-time nadir of US$21.04 overnight, down from around $75 in September. The coins briefly traded for as much as $750 shortly after their launch in May.

Close to lunchtime (Sydney time) the tokens were changing hands for $21.68, down 4.7 per cent from 24 hours ago.

$ICP will find new support at $0 no worries guys. pic.twitter.com/CmtNtZtcA3

— Tradecraft X (@Tradecraft_X) December 17, 2021

dYdX tokens meanwhile had sunk to an all-time low of US$7.16 overnight, down from over $25 in early October.

The coins were down 5.4 per cent to $7.39 around lunchtime.

There isn’t much in common with the two projects, but both were the subject of massive airdrops to community members that could be causing selling pressure.

The ICP airdrop vests in monthly instalments through May 2022, potentially meaning that the price could be under pressure until then.

Both projects also have a slick working product. dYdX is a decentralised derivatives exchange that offers up to 25x leverage, while the Internet Computer is a working alternative to centralised hosting services like Amazon Web Services.

Elsewhere in the crypto market, Sushi tokens have dropped out of the top 100 entirely, following reports of turmoil within the Sushi development team. Chief technical officer Joseph Delong resigned earlier this month amid the controversy.

They were trading today at $5.35, making Sushi the No. 116 crypto.

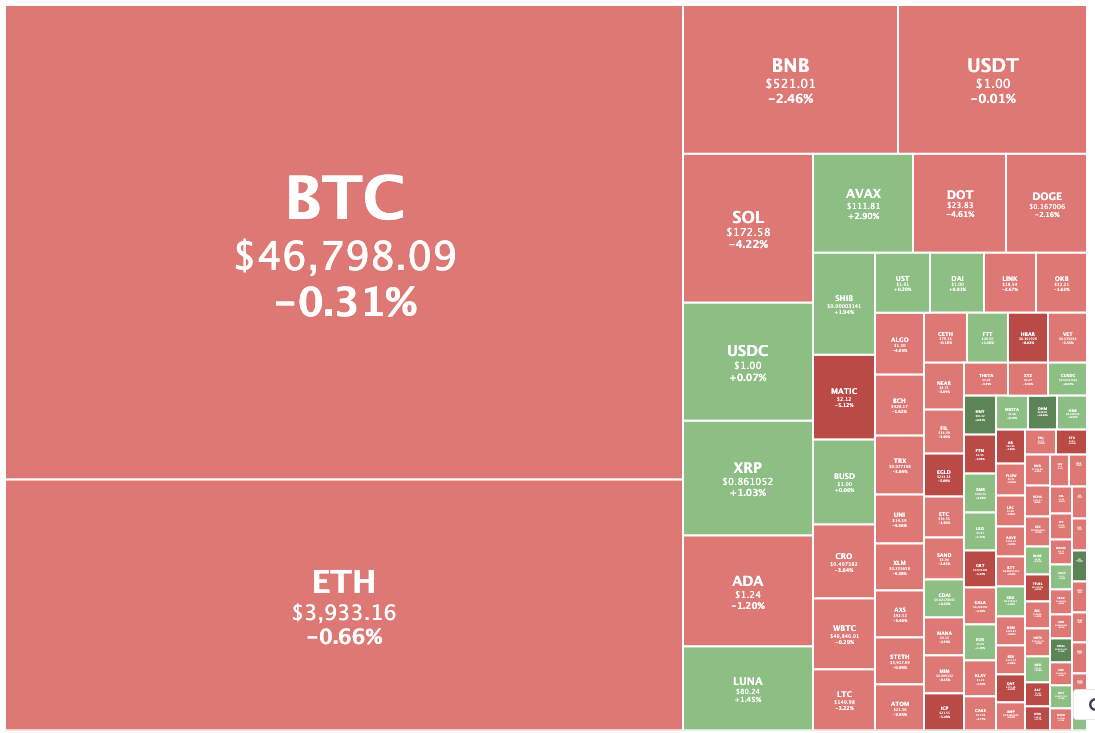

Crypto market down 1.1%

Overall the crypto market stood at US$2.18 trillion, down 1.1 per cent from yesterday.

Bitcoin was trading flat at US$46,770, while Ethereum was down 0.8 per cent to US$3,924.

Solana was the biggest mover in the top 10, falling 4.3 per cent to $171.

Terra (LUNA) was trading at $80.78, up 2.4 per cent, after hitting a fresh all-time high of $81.68 yesterday afternoon.

Revain was the biggest gainer in the top 100, rising 10.7 per cent, followed by Yearn.Finance, up 10.4 per cent.

Decred was the biggest loser in the top 100, falling 16.8 per cent to $71.75 after yesterday’s pump.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.