India’s crypto industry builds amid hopes for positive regulations

Getty Images

India’s crypto industry has been treading on eggshells the past few years as it tiptoes around regulators imposing bans one minute and sitting uncomfortably on the fence the next. Meanwhile, investors are investing, traders are trading and projects are building.

It’s no secret that, with its reputation for technological innovation and its massive population of 1.39 billion people, India has the potential to become one of the world’s most significant crypto markets. India’s population demographic, too, is much younger than those of the United States and China.

As it stands, India is already among the global leaders for crypto adoption, according to a recent study conducted by market research firm Finder. The study showed that India ranked third, behind Vietnam and Indonesia, with 30 per cent of citizens surveyed saying they own cryptocurrency.

“Interest in crypto has also grown exponentially among retail investors,” Gajesh Naik told Stockhead via a Telegram chat.

Naik is the founder of Gaj.Finance, an Indian-based multi-chain DeFi and NFT platform, and StableGaj, a decentralised stablecoin exchange.

“And with that, comes the rapid rise of budding Indian developers building on web3,” he added. “India has already contributed key innovations to the sector, such as the scaling solution Polygon Network.”

Also speaking with Stockhead today was Pratik Gandhi, Head of Marketing and Growth at Covalent, a decentralised, “unified API” blockchain data-querying project.

“The number of smart contract developers in India has quadrupled in the last two years,” said Gandhi. “It started with the developers working as contractors for projects based primarily in North America and Europe, [but we’re] now witnessing world-class projects like Polygon, InstaDapp, and Frontier coming out of India.

“The total value locked in Indian crypto projects has already crossed US$2 billion+ cumulatively as they keep adding value to the tech ecosystem,” he added. “Crypto breakout categories like DeFi and NFTs are also gaining attention as we see India-specific hackathons taking place across different layer 1 blockchain protocols, from Ethereum to Tezos to Solana.”

Is government sentiment shifting on crypto?

India’s government and its central bank, the Reserve Bank of India (RBI), has in the past shown to be cautious of, and even downright hostile to, crypto in the influential nation. In fact, in 2018, the RBI issued an order barring all financial institutions in the country from doing business with anyone involved with crypto.

This blanket ban was quashed by India’s Supreme Court in March, bringing fresh hope of an innovation-friendly, regulated crypto landscape.

After the ban was lifted, a surge of retail investing in the country ensued. For instance, CoinSwitch Kuber – the largest cryptocurrency platform in India – has now onboarded about 10 million investors and traders over the past 12 months.

While the regulatory situation in India remains murky, earlier this month the Indian government announced it was working on a draft bill to define cryptocurrencies as taxable commodities. The law, if passed, would not allow cryptos to be used for payments, but would instead allow them to be traded and invested in as assets.

This would at least be some regulatory progress. Once a government realises how much it can gain from taxing an asset class, and goes about doing it, it could prove to be a boon for the sustained future of a surrounding industry.

“The crypto community and tech leaders have contributed greatly to the more positive sentiments about crypto coming from Indian lawmakers,” Naik told Stockhead, adding:

“While the finer details of crypto-centric legislation have yet to be outlined, this still presents a positive outlook for the sector in contrast to an outright ban. With positive government support, India is poised to become a key innovation driver in the crypto space.”

Pratik Gandhi, meanwhile, believes that “the government needs to consider all the groundbreaking projects and initiatives in the space and take the right steps to foster innovation and growth in India.”

Ex RBI official pushes crypto adoption

Some of the more positive lawmaker sentiment Naik is referring to might be attributed to recent comments made by the former RBI deputy governor Rama Subramaniam Gandhi.

As reported by Cointelegraph, Gandhi was speaking at the Hodl 2021 virtual conference on September 7, and said he believes that while crypto can be used for payments, he views them as an asset class.

This at least partly reflects the crypto-tax draft bill currently waiting to be considered by Indian politicians.

Gandhi hopes that the development of a clear regulatory framework will allow Indians to invest and hold digital assets. Mined assets, as opposed to purchased ones, should be subject to capital gains tax, he added.

“Cryptocurrencies should be paid for through normal payment channels,” said the former RBI deputy. “If they are not, it should be deemed mined, and capital gains tax must be levied. That is like voluntary disclosure.”

Meanwhile, the current RBI governor, Shaktikanta Das, has been maintaining a cautious tone, expressing his concerns about the nascent industry at an event organised by The Indian Express and the Financial Times.

As the government waits to deliberate over the crypto-tax bill, Das chimed in with:

“We have serious, major concerns on cryptocurrency with respect to financial stability, [and] have conveyed the same to government of India.”

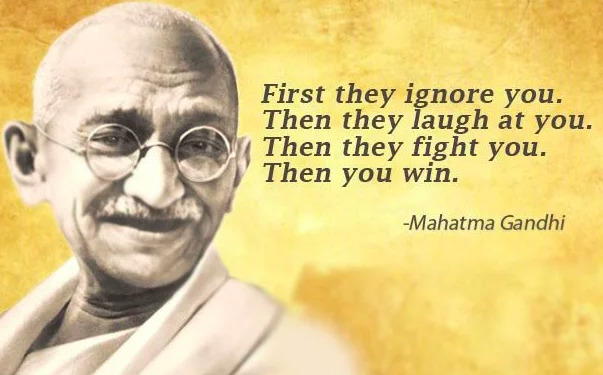

RBI concerns aside, we’ll give the final words to another, more famous Gandhi – a highly recognisable quote within crypto circles…

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.