How cryptocurrencies are reacting to the unfolding COVID-19 crisis

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

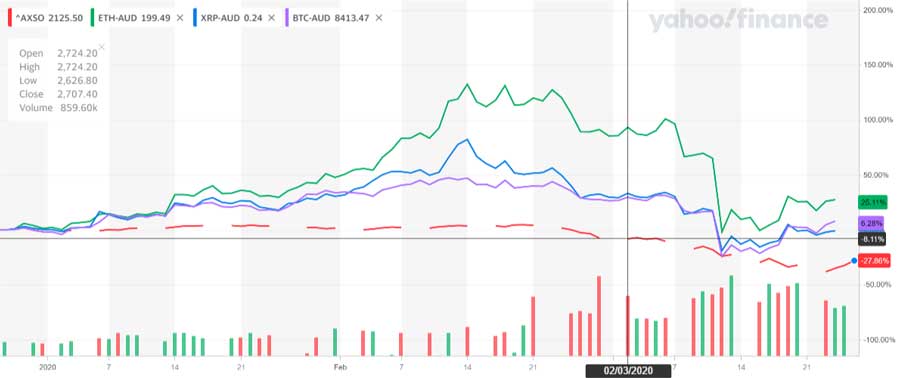

Digital assets moved in correlation with the global economy this month. Historically, the sector acts independently of traditional assets such as stocks, commodities or options. However, as market index values drop worldwide, so too has the value of Bitcoin (BTC).

BTC accounts for 70 per cent of volume traded on digital exchanges worldwide. When BTC’s price moves, other major coins such as Ethereum (ETH) and Ripple’s XRP adjust accordingly. This correlation is stronger in downward moves and weaker when prices increase.

Digital asset markets started to dip on February 24. This was mirrored by the traditional markets: the ASX All Ordinaries (XAO) and Small Ordinaries (XSO). The decline was accelerated by the economic impacts of the COVID-19 pandemic.

BTC’s price dropped 35 per cent on March 12, tied to the US announcement on the European travel ban. ETH and XRP followed suit by 41 per cent and 32 per cent respectively. On the same day, the XSO index shrank 7.29 per cent.

Since then, BTC’s price has rebounded 39 per cent, with ETH, XRP and other alt-coins (any asset made after BTC) following the upward trend.

This is in contrast to the XSO. It continued its tumble until the government announced an $84bn economic stimulus package, regaining 5 per cent that day. BTC likewise increased by 2 per cent on our market.

Overall, the XSO has dropped 27 per cent since the start of the year, with BTC gaining 10 per cent during the same period.

Volume

BTC Markets has seen a significant overall increase in trading volume throughout March. Volume remained strong as digital assets made back some of the losses from earlier in the month.

| Coin | Volume (March 9th - 15th) | Largest volume since |

|---|---|---|

| BTC | 4,011 BTC | June 2019 |

| XRP | 114.25 million XRP | January 2018 |

| ETH | 37,600 ETH | May 2019 |

| LTC | 18,081 LTC | August 2019 |

Source: BTC Markets data

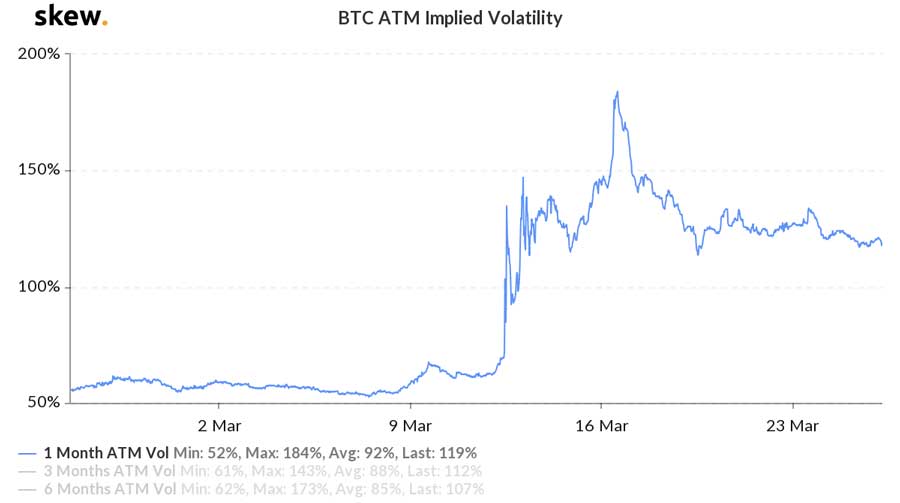

Volatility

Implied volatility is the market expectation on price movement over a given period. BTC’s volatility increased dramatically during the month, reflecting the significant price movements seen in the market.

Over the course of March, it moved from 52 per cent to a high of 184 per cent. It currently sits at 119 per cent, with large price swings expected as we move into April.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.